RATIO ANALYSIS Data for Barry Computer Co. and its industry averages follow.

- a. Calculate the indicated ratios for Barry.

- b. Construct the DuPont equation for both Barry and the industry.

- c. Outline Barry’s strengths and weaknesses as revealed by your analysis.

- d. Suppose Barry had doubled its sales as well as its inventories, accounts receivable, and common equity during 2016. How would that information affect the validity of your ratio analysis? (Hint: Think about averages and the effects of rapid growth on ratios if averages are not used. No calculations are needed.)

| Ratio | Barry | Industry Average |

| Current | ----- | 2.0× |

| Quick | ----- | 13× |

| Days sales outstandinga | ----- | 35 days |

| Inventory turnover | ----- | 6.7× |

| Total assets turnover | ----- | 3.0× |

| Profit margin | ----- | 1.2% |

| ------ | 3.6% | |

| ----- | 9.0% | |

| ----- | 73% | |

| TIE | ----- | 3.0× |

| Debt/Total capital | ----- | 47.0% |

aCalculation is based on a 365-day year.

(a)

To determine: The indicated ratios.

Ratio Analysis

Ratio is used to compare two arithmetical figures. In case of the ratio analysis of the company the financial ratios are calculated. The financial ratios examine the performance of the company and is used in comparing with other same business. It indicates the relationship of two or more parts of financial statements.

Current Ratio

Current ratio is a part of liquidity ratio which reflects the capability of the company to payback its short term debts. It is calculated based on the current assets and current liabilities that a company possesses in an accounting period.

Explanation of Solution

Given,

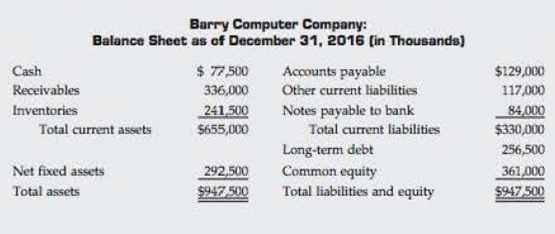

Current asset is$655,000.

Current liabilities is $330,000.

The formula to calculate present current ratio is,

Substitute $655,000 for current asset and $330,000 for current liabilities.

Thus, current ratio is 1.98 times.

Quick Ratio

It is also known as the acid-test ratio which is used to determine the company’s capability to satisfy the dues using only liquid assets. The excluding of less liquid assets inventory shows the liquidity of a company in a better manner.

Given,

Current asset is $655,000.

Inventory is $241,500.

The formula of quick ratio is,

Substitute $655,000 for current assets, $330,000 for current liabilities and $241,500 for inventory.

Thus, quick ratio is 1.25 times.

Days sales Outstanding

Days sales outstanding is used to measure days that a business usually requires to collects its receivable in average. It indicates account receivable of the firm and the firm’s efficiency in collecting the account receivable.

Given,

Receivables are $336,000.

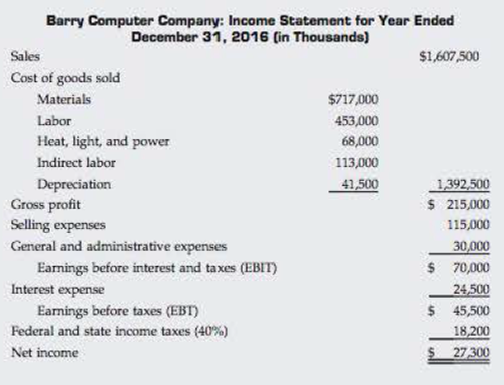

Annual sale is $1,607,500.

The formula to calculate Days sales outstanding is,

Substitute $336,000 for account receivables and $1,607,500 for annual sales.

Thus, Days sales outstanding is 76.29 days.

Inventory Turnover Ratio

Inventory turnover reflects the number of times an average inventory is converted into sales during a period. It is used to measure the efficiency of business operations.

Given,

Total sale is $1,607,500.

Total inventory $241,500.

The formula of inventory turnover ratio is,

Substitute $1,607,500 for total sales and $241,500 for total inventory.

Thus, inventory turnover ratio is 6.66 times.

Total Assets Turnover Ratio

It indicates how effectively the asset of the company is utilized. Total asset is the sum of current assets and fixed assets.

Given,

Total sales are $1,607,500.

Total assets are $947,500.

The formula of total assets turnover is,

Substitute $1,607,500 for total sales and $947,500 for total assets.

Thus, total assets turnover is 1.70 times.

Return on Assets

It is a profitability ratio. This ratio shows profit earning capability on per dollar of assets. It shows the percentage of net income on total assets. Higher the returns on assets better the profitability. Total assets include fixed as well as current assets.

Given,

Net income is$27,300.

Total assets are $947,500.

The formula of return on asset is,

Substitute $27,300 for net income and $947,500 for total value of assets.

Thus, return on assets is 2.88%.

Return on Equity

Return on equity is the return from the equity. It is the ratio of net income and shareholders’ equity. This ratio measures the performance of the company and tells how well the company is performing. This ratio is used to compare a firm with their competitors.

Given,

Net income is $27,300.

Common equity is $361,000.

The formula of return on equity is,

Substitute $27,300 for net income and $361,000 for common equity in above formula.

Thus, return on equity is 7.56%.

Return on Invested Capital (ROIC)

It represent the amount of return earned by all investors and can be calculated by dividing total earnings available for investors to total invested capital.

Given,

Earnings before interest and tax (EBIT) are $70,000.

Tax rate is 40%.

Total debt is $340,500 (working note).

Total equity is $361,000.

The formula of ROIC is,

Substitute $70,000 for EBIT, $340,500 for debt, 40% for tax and $361,000 for equity in above formula.

Thus, Return on invested capital is 5.99%.

Working note:

Compute total debt.

Long term debt is $256,500.

Notes payable to bank is $84,000.

The total debt of the company is:

Times-Interest Earned Ratio

It is the type of solvency ratio which indicates the capability of business to repay interest and provide debt related services. It shows the relation between EBIT and long-term debt. It determines the debt servicing capacity of a business keeping in view of the fixed interest on long-term debt.

Given,

EBIT is $70,000.

Interest expense is $24,500.

The formula to calculate times interest earned is,

Substitute $70,000 for EBIT and $24,500 for interest expense.

Thus, the Times Interest Earned ratio is 2.86%.

Debt/Total Capital

It is percentage of total capital which is financed by borrowed fund. Borrowed fund includes short and long term debts. Operating debt like account payable, accrual are not considered.

Given,

Total debt is $340,500 (working note).

Equity is $361,000

The formula of Debt/Total capital is,

Substitute $340,500 for total debt and $361,000 for equity.

Thus, debt/total capital ratio is 48.54%.

Working notes:

Compute total debt.

Given,

Long term debt is $256,500.

Notes payable to bank is $84,000.

Calculation of total debt,

Thus, total debt is $340,500.

(b)

To construct: The Du Pont equation for both Company B and Industry.

Du Pont Equation

Among all ratios, return on equity is very common. It shows the value of the firm. Improvement in the ROE is considered as valued addition to the firm. ROE can be linked with other ratios. Analysis of such ratios will indicate proper reason for a change in ROE. The combination is known as Du Pont equation which is shown below,

Explanation of Solution

Company B

Given,

Net income of the company is$27,300.

Sales of the company is $1,607,500.

Total asset is $947,500.

Total common equity is $361,000.

The Du point relation of the company’s ratios is shown below:

Substitute $27,300 for the net income, $1,607,500 for sales, and $947,000 for total assets and $361,000 for the total common equity.

Thus, the Du Pont equation of company is

Industry

Given,

ROE of industry is 9%.

Profit margin is1.20%.

Total assets turnover is 3.0 times.

Equity multiplier is 2.5 times(working note).

The DU Pont equation is,

Substitute 9% for ROE, 1.20 % for the profit margin, 3.0 times for the total assets turnover and 2.5 times for the equity multiplier in above formula.

Thus the Du Pont equation of Industry is

Working notes:

In case of industry, there is no equity multiplier. So, calculate equity multiplier.

Given,

Profit margin of the industry is1.2%.

Return on equity is 9.0%.

Total assets turnover ratio is 3.0 times.

Calculation of equity multiplier,

Thus, equity multiplier is 2.50 times.

Therefore, the Du Pont equation of Company B and Industry is outlined.

(c)

To outline: The strength and weakness of the company revealed by the analysis.

Answer to Problem 23P

The analysis shows the following data about the company.

| Ratios | Company | Industry |

| (a) Liquidity Ratio: | ||

| Current | 1.98x | 2.0x |

| Quick | 1.25x | 1.3x |

| (b) Assets Management: | ||

| Days sales outstanding | 76.29days | 35 days |

| Inventory turnover | 6.66x | 6.7x |

| Total assets turnover | 1.70x | 3.0x |

| (c) Debt Management: | ||

| Total debt to capital | 48.54% | 47.0% |

| TIE | 2.86% | 3.0x |

| (d) Profitability: | ||

| Profit margin | 1.70% | 1.20% |

| ROA | 2.88% | 3.60% |

| ROE | 7.56% | 9.0% |

| ROIC | 5.99% | 7.50% |

Table (1)

Explanation of Solution

- Liquidity ratio shows the ability to pay back short term dues. The figures of the company are almost at par with industry’s average. The liquidity seems strong.

- Assets management is the ability to utilize assets. Total assets turnover is low. The inventory turnover of the company is half of the industry but the day’s sales outstanding of the company is very high. Thus the company should improve the collection from account receivables.

- Debt management is the capability of the company to pay back its debts. Total debt/total capital of the company is higher than industry but times-interest-earned ratio (TIE) of the company is lower than industry.

- Profit margin of the company is higher as compared to industry. ROA,ROE and ROIC are below the industry’s average.

Therefore, based on above given points it can be said that the company liquidity is strong, assets management seems weak, the debt management is average and profitability can be considered strong.

(d)

To identify: The affect in the ratio analysis of the company supposing the company had doubled its sales as well as inventories, account receivables and common equity during 2016.

Answer to Problem 23P

If the company had doubled its sales, account receivables and inventory. The ratio analysis will be affected in the given way:

- Liquidity Ratios: When the inventory and account receivables are doubled, the current assets will increase. But there will be no change in the current liability. The current assets will be improved and it will also improve the quick ratio. Thus it can be said the liquidity ratio will be improved.

- Assets Management: There will be no change in days sales outstanding since both the numerator and denominators are doubled. Inventory ratio will remain unchanged because both the numerator and denominators are doubled. The assets turnover will be little improved as the sales will be doubled. The assets increase by a little amount.

- Total debt to capital: The equity will be doubled but debt will remain same. The proportion of debt to capital will be decreased. The solvency position of the company will be improved.

- Profitability: Company already has better profit margin than industry. If there is an increase in sales, the profit will also increase.

Explanation of Solution

If the account receivables and inventory are doubled, the total assets of the company will be increased and it will affect the asset turnover ratio slightly because the sales are also being doubled. So, it can be said there will be a little change in total assets ratio or can be unchanged also.

Therefore, if the sales, receivables, inventories and equities will be doubled, the liquidity, profitability and solvency will be improved but the assets utilization will remain same.

Want to see more full solutions like this?

Chapter 4 Solutions

Bundle: Fundamentals of Financial Management, Concise Edition, Loose-leaf Version, 9th + Aplia, 1 term Printed Access Card

- Mary decides to buy a Treasury note futures contract for delivery of $100,000 face amount in September, at a price of 120′24.0. At the same time, Eric decides to sell a Treasury note futures contract if he can get a price of 120′24.0 or higher. The exchange, in turn, agrees to sell one Treasury note contract to Mary at 120′24.0 and to buy one contract from Eric at 120′24.0. The price of the Treasury note decreases to 120′10.5. Calculate Eric's balance on margin account. Assume that initial margin is $1,890. Please note that loss should be entered with minus sign. Round the answer to two decimal places.arrow_forwardDon't used hand raiting and don't used Ai solutionarrow_forward(2x76m A = + S) Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow?arrow_forward

- Expected Standard Stock Return Beta Deviation A B 12% 16 0.75 1.25 28% 37 The market index has a standard deviation of 22% and the risk-free rate is 9%. Required: a. What are the standard deviations of stocks A and B? b. Suppose that we were to construct a portfolio with proportions: Stock A Stock B T-bills 0.25 0.50 0.25 Compute the expected return, beta, nonsystematic standard deviation, and standard deviation of the portfolio. Complete this question by entering your answers in the tabs below. Required A Required B What are the standard deviations of stocks A and B? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Stock A 0.33 % Stock B 0.46 %arrow_forwardDon't used hand raiting and don't used Ai solutionarrow_forwardCould you explain what are the Biblical principles researchers that can follow to mitigate researcher bias? How to use of Biblical ethics to synthesize the literature to avoid misrepresentation of the literature? How researchers can demonstrate Biblical ethics when collecting and analyzing data?arrow_forward

- The manager of company A is thinking about adding an air conditioner to the office. The AC will cost $1630 to buy and install. The manager plans to use the AC for 5 years and each year's depreciation rate is 18% of the purchase price. The manager expects to sell the AC in 5 years for $880.The tax rate is 15% and the company's WACC is 15%. If the manager considers this purchase of AC as an investment, what is the NPV (keep two decimal places and assume that the AC will not affect the operations of the company)?arrow_forwardProblem 5-5 Calculating IRR A firm has a project with the following cash flows: Year Cash Flow 0 -$27,700 1 23 11,700 14,700 10,700 The appropriate discount rate is 18 percent. What is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) IRR %arrow_forwardCould you help to explain: How researchers can demonstrate Biblical ethics when conducting a literature review? How researchers can demonstrate Biblical ethics when communicating with a research team or university committee? How researchers can demonstrate Biblical ethics when recruiting participants. Provide Biblical and/or scholarly support for all assertions?arrow_forward

- Could you please help explain what is the Biblical ethics in research? How do they establish a firm ethical foundation based on Biblical principles? What should they do to reduce the researcher bias as well as misrepresenting the literature and study findings? How Christians would like to ensure of being obedient to God in the research and study conduct?arrow_forwardI need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.arrow_forward< When you purchased your car, you took out a 5-year annual-payment loan with an interest rate of 5% per year. The annual payment on the car is $5,200. You have just made a payment and have now decided to pay off the loan by repaying the outstanding balance. What is the payoff amount for the following scenarios? a. You have owned the car for 1 year (so there are 4 years left on the loan)? b. You have owned the car for 4 years (so there is 1 year left on the loan)? a. You have owned the car for 1 year (so there are 4 years left on the loan)? The payoff if there are 4 years left on the loan is $ (Round to the nearest cent.) b. You have owned the car for 4 years (so there is 1 year left on the loan)? The payoff if there is 1 year left on the loan is $ (Round to the nearest cent.)arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning