Cash flows:

Inflow and outflow movement of cash is known as Cash flows. Cash flows are the expected cash to be generated by an asset, investment or business. There are two types of cash flows, namely

Present Value:

Present value is that value of money which measures the worth of a future amount in today’s value adjusted for interest and inflation. It is used in finance for the valuation of

To Explain:

The calculation of the present value of cash flow stream.

Answer to Problem 1CC

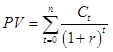

There is a formula which is used to calculate the present value of cash flow stream and that,

Where,

is the present value of the cash flow stream.

is the present value of the cash flow stream. is the cash flow which occurs at the end of the year t1.

is the cash flow which occurs at the end of the year t1. is the discount rate.

is the discount rate. is the year, which ranges from 0 to n.

is the year, which ranges from 0 to n. is the last year in which a cash flow occurs.

is the last year in which a cash flow occurs.

Explanation of Solution

- Cash flow is the value of the various inflows and outflows. Some investments have a specific period of time or some are for the perpetuity basis.

- For the calculation of present value of various cash flows, it is required to know about the components like, the total future cash flows from the investment, interest rate at which interest amount will be calculated and time period.

- Discount rate is the rate which prevails in the open market at which the future values are discounted to get the value as on today.

The calculation of the present value depends upon the various factors (cash flow, discount rate, and time period).

Want to see more full solutions like this?

Chapter 4 Solutions

Fundamentals of Corporate Finance (3rd Edition) (Pearson Series in Finance)

- Ends Apr 27 Explain why we start with Sales forecasts when we do our financial forecasting. What are the limitations of the Percent of Sales Forecasting method?arrow_forwardDescribe in detail what exactly is the Cash Conversion Cycle, how is it computed and what is the purpose of this calculation (how is it used).arrow_forwardExplain what Interest Rate Parity is, how it is calculated, and why it is important to a company operating internationally.arrow_forward

- Compare and contrast the three core means of adding shareholder wealth; Cash Dividends, Stock Dividends and Stock Splits, and Stock Repurchases. Include the various advantages and disadvantages of each one.arrow_forwardHow to calculate the future value?arrow_forwardhow to caculate the future value?arrow_forward

- what are some of the question can i asek my prinsiple of finance teache?arrow_forwardA critical discussion of the hockey stick model of start-up financing should be presented, supported by recent in-text citations. Provide a detailed explanation of the model. Describe each of the three stages of the hockey stick model of start-up financing, including a detailed characterisation of each stage. The characterisation of each stage should detail the growth, risk, and funding expectations. Present a critical evaluation and an insightful conclu sion.arrow_forwardQuestion Workspace Check My Work New-Project Analysis The president of your company, MorChuck Enterprises, has asked you to evaluate the proposed acquisition of a new chromatograph for the firm's R&D department. The equipment's basic price is $64,000, and it would cost another $18,000 to modify it for special use by your firm. The chromatograph, which falls into the MACRS 3-year class, would be sold after 3 years for $28,400. The MACRS rates for the first three years are 0.3333, 0.4445 and 0.1481. (Ignore the half-year convention for the straight-line method.) Use of the equipment would require an increase in net working capital (spare parts inventory) of $3,000. The machine would have no effect on revenues, but it is expected to save the firm $24,760 per year in before-tax operating costs, mainly labor. The firm's marginal federal-plus-state tax rate is 25%. Cash outflows and negative NPV value, if any, should be indicated by a minus sign. Do not round intermediate…arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education