Concept explainers

Analyzing, Recording, and Summarizing Business Activities and Adjustments

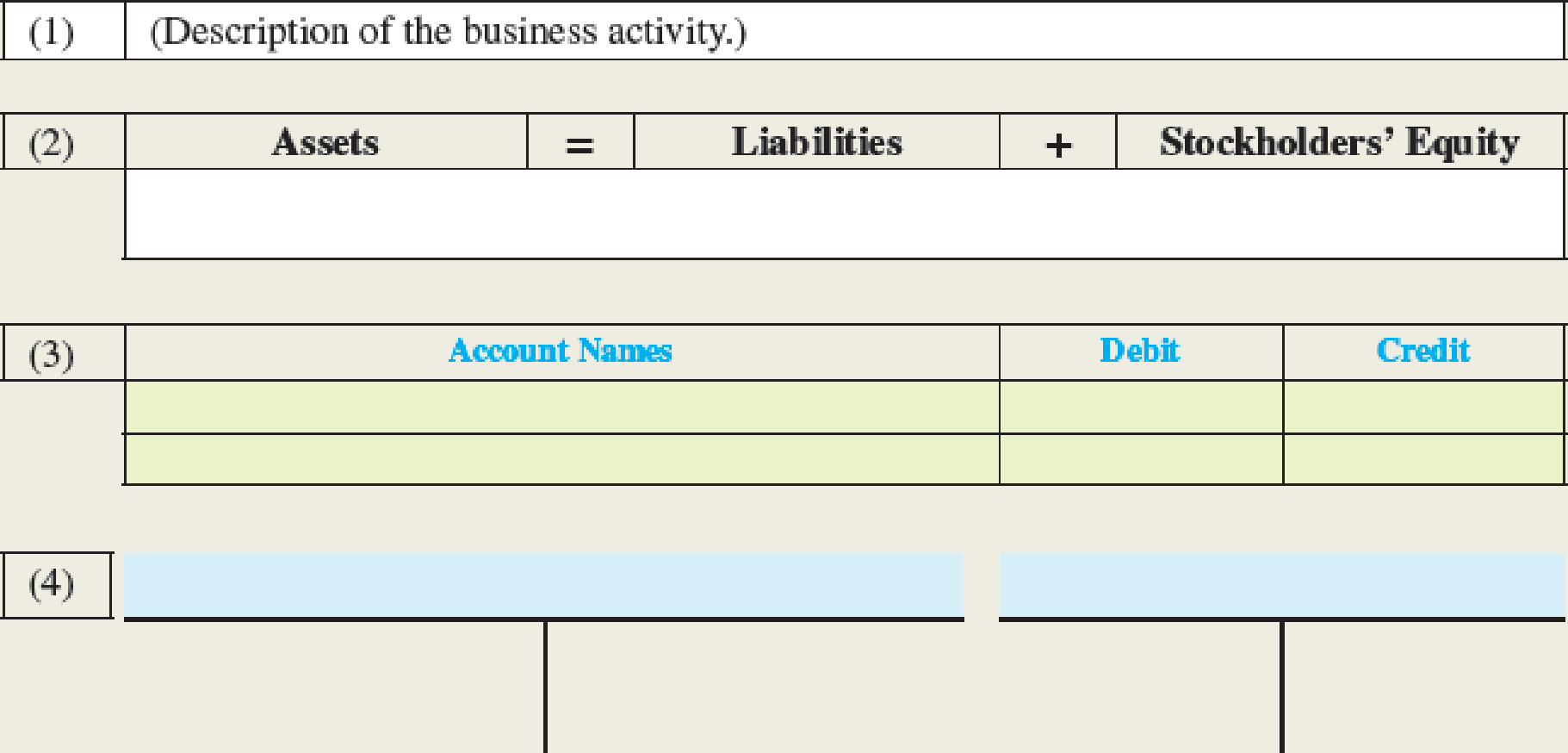

The following relates to a magazine company called My Style Mag (MSM). You will use your understanding of the relationships among (1) business activities, (2)

Required:

For each item (a)–(f) listed below, use the information provided to prepare and complete a four-part table similar to that shown above. Items (a)–(f) are independent of one another.

a.

Prepare a four part table by using the given information.

Explanation of Solution

Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by creating a relation between resources or assets of a business and claims on the resources by the creditors, and the owners.

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

T-account: The condensed form of a ledger is referred to as T-account. The left-hand side of this account is known as debit, and the right hand side is known as credit.

Prepare a four part table by using the given information as follows:

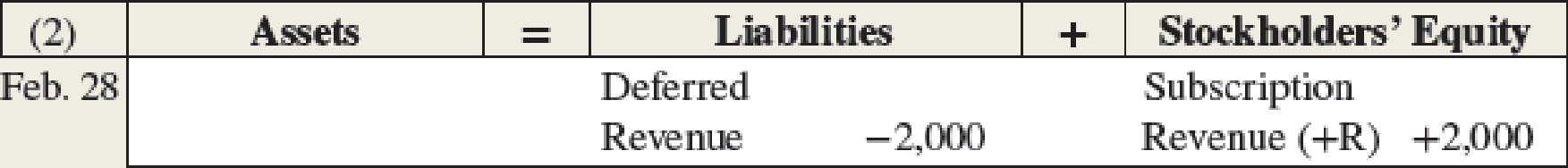

| (1) | On January 22, 2018, MSM received $24,000 cash from customers for one–year subscriptions to the magazine for February 2018 – January 2019. | ||||||||||

| (2) | Assets | = | Liabilities | + | Stockholders’ Equity | ||||||

| Cash +$24,000 |

Deferred Revenue +$24,000 | ||||||||||

| (3) | Account Names | Debit ($) | Credit ($) | ||||||||

| Cash (+A) | 24,000 | ||||||||||

| Deferred revenue (+R, +SE) | 24,000 | ||||||||||

| (To record the deferred revenue) | |||||||||||

| (4) | Cash account | Deferred revenue account | |||||||||

| $24,000 | $24,000 | ||||||||||

Table (1)

b.

Prepare a four part table by using the given information.

Explanation of Solution

Prepare a four part table by using the given information as follows:

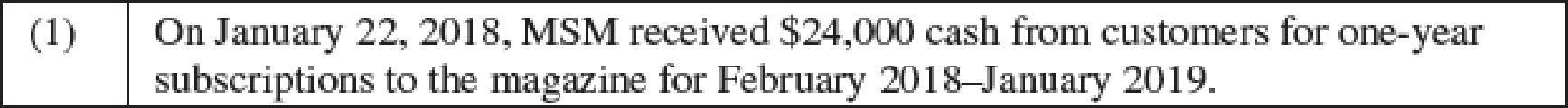

| (1) | Company MSM received utilities services on account at a cost of $3,000. | ||||||||||

| (2) | Assets | = | Liabilities | + | Stockholders’ Equity | ||||||

|

Accounts payable +$3,000 | Utilities expense (+E) -$3,000 | ||||||||||

| (3) | Account Names | Debit ($) | Credit ($) | ||||||||

| Utilities expense(+E, -SE) | 3,000 | ||||||||||

| Accounts payable (+L) | 3,000 | ||||||||||

| (To record the utilities expense) | |||||||||||

| (4) | Accounts payable account | Utilities expense account | |||||||||

| $3,000 | $3,000 | ||||||||||

Table (2)

c.

Prepare a four part table by using the given information.

Explanation of Solution

Prepare a four part table by using the given information as follows:

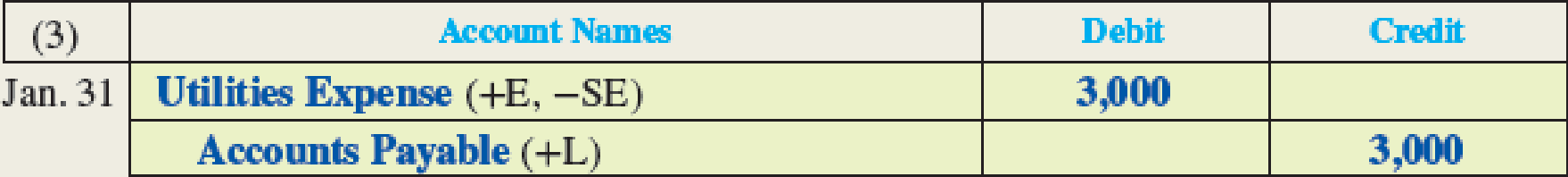

| (1) | Company MSM provided $2,000 of subscriptions for which it had been received the payment previously. | ||||||||||

| (2) | Assets | = | Liabilities | + | Stockholders’ Equity | ||||||

|

Deferred Revenue -$2,000 | Subscription revenue (+R) +$2,000 | ||||||||||

| (3) | Account Names | Debit ($) | Credit ($) | ||||||||

| Deferred revenue (-L) | 2,000 | ||||||||||

| Subscription Revenue (+R, +SE) | 2,000 | ||||||||||

| (To record the subscription revenue) | |||||||||||

| (4) | Deferred revenue account | Subscription revenue account | |||||||||

| $2,000 | $2,000 | ||||||||||

Table (3)

d.

Prepare a four part table by using the given information.

Explanation of Solution

Prepare a four part table by using the given information as follows:

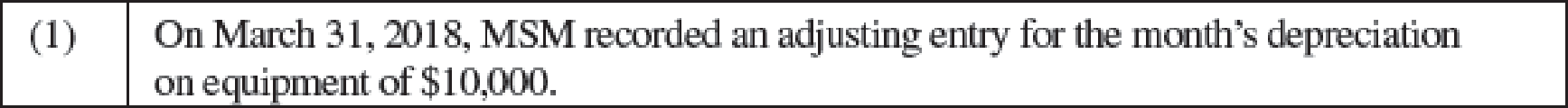

| (1) | On March 31, 2018, Company MSM recorded an adjusting entry for the month’s depreciation of $10,000. | ||||||||||||

| (2) | Assets | = | Liabilities | + | Stockholders’ Equity | ||||||||

| Accumulated | Depreciation | ||||||||||||

| Depreciation–Equipment (+xA) –$10,000 | Expense (+E) –$10,000 | ||||||||||||

| (3) | Account Names | Debit ($) | Credit ($) | ||||||||||

| Depreciation Expense (+E, –SE) | 10,000 | ||||||||||||

| Accumulated Depreciation–Equipment (+xA, –A) | 10,000 | ||||||||||||

| (To record accumulated depreciation) | |||||||||||||

| (4) | Accumulated Depreciation–Equipment account | Depreciation Expense account | |||||||||||

| $10,000 | $10,000 | ||||||||||||

Table (4)

e.

Prepare a four part table by using the given information.

Explanation of Solution

Prepare a four part table by using the given information as follows:

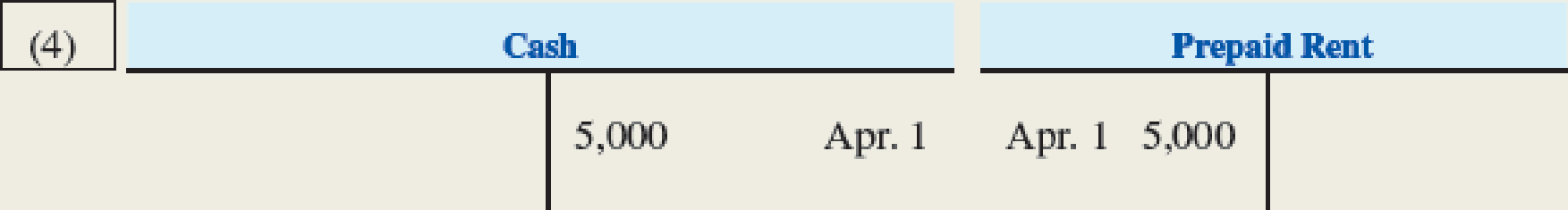

| (1) | On April 1, Company MSM paid $5,000 rent in advance of obtaining its benefits. | ||||||||||

| (2) | Assets | = | Liabilities | + | Stockholders’ Equity | ||||||

| Cash –$5,000 | |||||||||||

| Prepaid Rent +$5,000 | |||||||||||

| (3) | Account Names | Debit ($) | Credit($) | ||||||||

| Prepaid Rent (+A) | 5,000 | ||||||||||

| Cash (–A) | 5,000 | ||||||||||

| (To record prepaid rent) | |||||||||||

| (4) | Cash account | Prepaid Rent account | |||||||||

| $5,000 | $5,000 | ||||||||||

Table (5)

f.

Prepare a four part table by using the given information.

Explanation of Solution

Prepare a four part table by using the given information as follows:

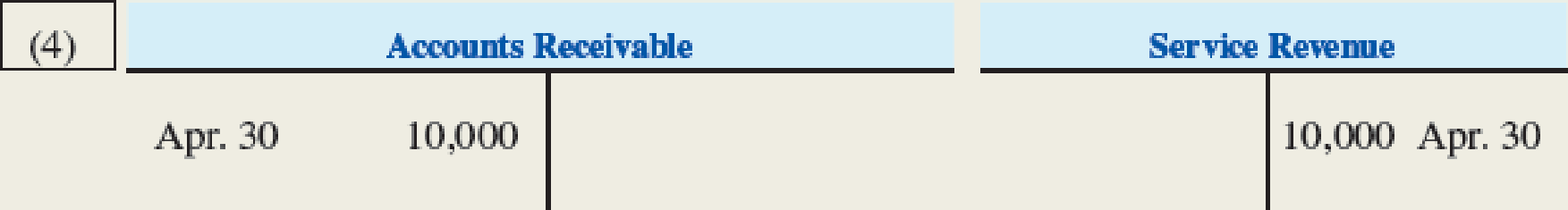

| (1) | On April 30, 2018, Company MSM billed customers for $10,000 of advertising services provided on account. | |||||||||

| (2) | Assets | = | Liabilities | + | Stockholders’ Equity | |||||

| Accounts | Service | |||||||||

| Receivable +$10,000 | Revenue (+R) +$10,000 | |||||||||

| (3) | Account Names | Debit ($) | Credit ($) | |||||||

| Accounts Receivable (+A) | 10,000 | |||||||||

| Service Revenue (+R, +SE) | 10,000 | |||||||||

| (To record service revenue recognized on account) | ||||||||||

| (4) | Accounts Receivable account | Service Revenue account | ||||||||

| $10,000 | $10,000 | |||||||||

Table (6)

Want to see more full solutions like this?

Chapter 4 Solutions

FUNDAMENTALS OF FINANCIAL ACCOUNTING

- A contingent liability should be recorded only when:A. It is possible and the amount is estimableB. It is probable and the amount is estimableC. It is certain to occurD. Management decides it’s importantarrow_forwardNo chatgpt 6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Landarrow_forwardNeed help hi 6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Landarrow_forward

- 6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Land i need helparrow_forward6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Landneed helparrow_forward6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Landarrow_forward

- Which basis of accounting recognizes revenues and expenses when cash is exchanged?A. AccrualB. Modified AccrualC. Cash BasisD. Matchingneedarrow_forwardWhich basis of accounting recognizes revenues and expenses when cash is exchanged?A. AccrualB. Modified AccrualC. Cash BasisD. Matchingneed helparrow_forwardWhich basis of accounting recognizes revenues and expenses when cash is exchanged?A. AccrualB. Modified AccrualC. Cash BasisD. Matchingarrow_forward

- 9. Which of the following best describes deferred revenue?A. Cash received before revenue is earnedB. Cash paid after expense is incurredC. Revenue earned but not yet receivedD. Expense incurred but not paidarrow_forwardNeed help. 2. What does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forwardDont use AI 2. What does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,