FUNDAMENTALS OF FINANCIAL ACCOUNTING

6th Edition

ISBN: 9781260823875

Author: PHILLIPS

Publisher: MCGRAW-HILL CUSTOM PUBLISHING

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 14E

Reporting an Adjusted Income Statement

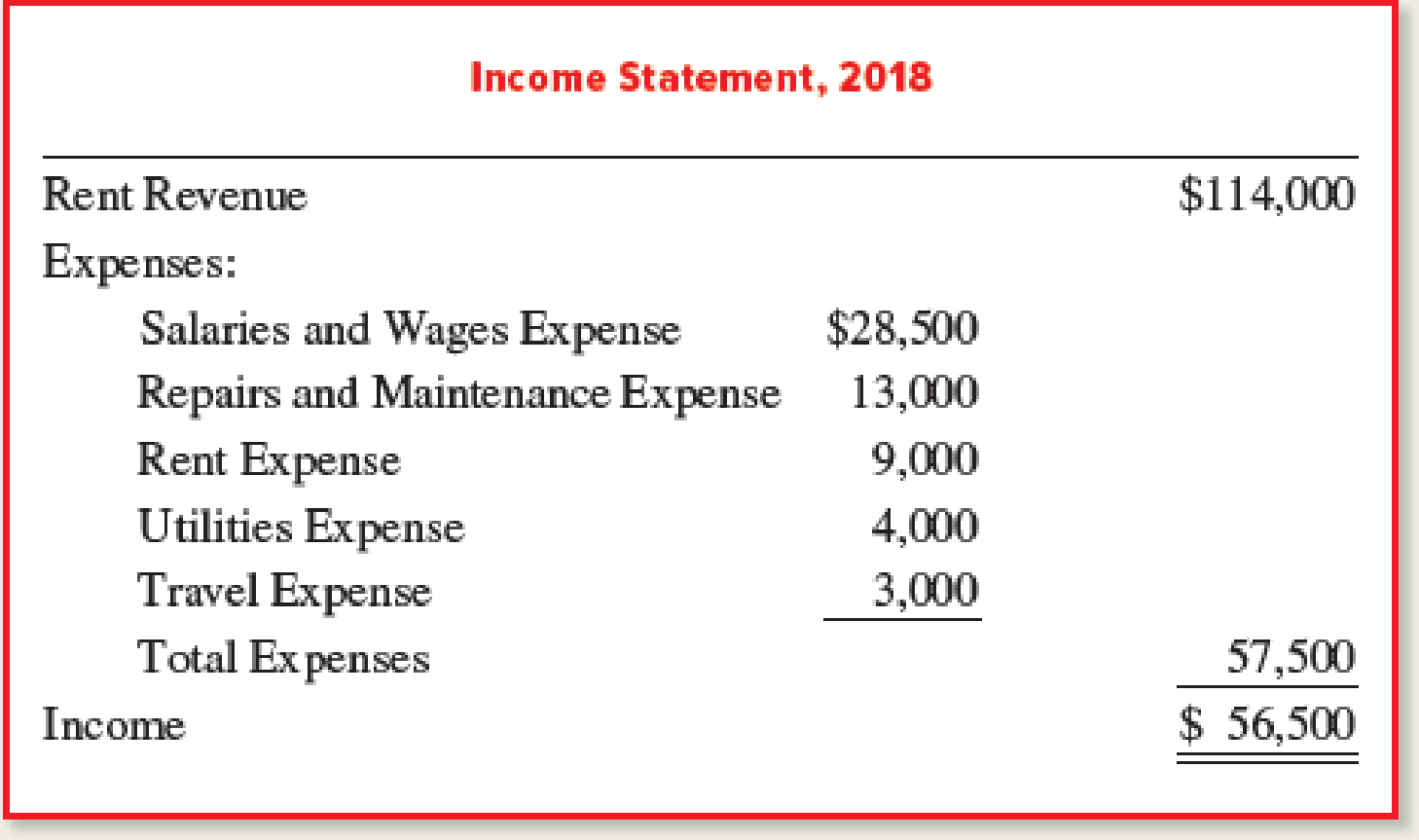

Dyer, Inc., completed its first year of operations on December 31, 2018. Because this is the end of the annual accounting period, the company bookkeeper prepared the following preliminary income statement:

You are an independent CPA hired by the company to audit the firm’s accounting systems and financial statements. In your audit, you developed additional data as follows:

- a. Wages for the last three days of December amounting to $310 were not recorded or paid.

- b. The $400 telephone bill for December 2018 has not been recorded or paid.

- c.

Depreciation of equipment amounting to $23,000 for 2018 was not recorded. - d. Interest of $500 was not recorded on the notes payable by Dyer, Inc.

- e. The Rental Revenue account includes $4,000 of revenue to be earned in January 2019.

- f. Supplies costing $600 were used during 2018, but this has not yet been recorded.

- g. The income tax expense for 2018 is $7,000, but it won’t actually be paid until 2019.

Required:

- 1. What

adjusting journal entry for each item (a) through (g) should be recorded at December 31, 2018? If none is required, explain why. - 2. Prepare, in proper form, an adjusted income statement for 2018.

- 3. Did the adjustments have a significant overall effect on the company’s net income? By what dollar amount did net income change as a result of the adjustments?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you help me solve this general accounting question using the correct accounting procedures?

Can you help me solve this financial accounting problem with the correct methodology?

Papyrus Industries was started on April 15, 2019, when it issued common stock for $50,000 cash. Also on April 15, 2019, the company purchased production machinery that cost $42,000 cash. The machinery was delivered under terms of FOB shipping point, and the transportation cost was $3,200. The machinery had a ten-year useful life and a $4,500 expected salvage value. Using straight-line depreciation, determine the amount of depreciation expense and the amount of accumulated depreciation that would appear on the December 31, 2022, financial statements. a) $4,070 / $15,092.78 b) $4,070 / $15,059.17 c) $3,890 / $14,398.33 d) $4,220 / $15,613.33

Chapter 4 Solutions

FUNDAMENTALS OF FINANCIAL ACCOUNTING

Ch. 4 - Prob. 1QCh. 4 - Explain the relationships between adjustments and...Ch. 4 - Prob. 3QCh. 4 - Prob. 4QCh. 4 - What is a contra-asset? Give an example of one.Ch. 4 - Explain the differences between depreciation...Ch. 4 - What is an adjusted trial balance? What is its...Ch. 4 - On December 31, a company makes a 59,000 payment...Ch. 4 - Using the information in question 8, determine the...Ch. 4 - Using the information in question 8, prepare the...

Ch. 4 - What is the equation for each of the following...Ch. 4 - Prob. 12QCh. 4 - What is the purpose of closing journal entries?Ch. 4 - Prob. 14QCh. 4 - Prob. 15QCh. 4 - What is a post-closing trial balance? Is it a...Ch. 4 - The owner of a local business complains that the...Ch. 4 - Which of the following accounts would not appear...Ch. 4 - Which account is least likely to appear in an...Ch. 4 - When a concert promotions company collects cash...Ch. 4 - On December 31, an adjustments made to reduce...Ch. 4 - An adjusting journal entry to recognize accrued...Ch. 4 - Prob. 6MCCh. 4 - Company A has owned a building for several years....Ch. 4 - Which of the following trial balances is used as a...Ch. 4 - Assume the balance in Prepaid Insurance is 2,500...Ch. 4 - Assume a company receives a bill for 10,000 for...Ch. 4 - Prob. 1MECh. 4 - Understanding Concepts Related to Adjustments...Ch. 4 - Matching Transactions with Type of Adjustment...Ch. 4 - Recording Adjusting Journal Entries Using the...Ch. 4 - Determine Accounting Equation Effects of Deferral...Ch. 4 - Prob. 6MECh. 4 - Determining Accounting Equation Effects of Accrual...Ch. 4 - Recording Adjusting Journal Entries Using be...Ch. 4 - Preparing Journal Entries for Deferral...Ch. 4 - Preparing Journal Entries for Deferral...Ch. 4 - Preparing Journal Entries for Deferral and Accrual...Ch. 4 - Reporting Adjusted Account Balances Indicate...Ch. 4 - Preparing an Adjusted Trial Balance Macro Company...Ch. 4 - Reporting an Income Statement The Sky Blue...Ch. 4 - Reporting a Statement of Retained Earnings Refer...Ch. 4 - Prob. 16MECh. 4 - Recording Closing Journal Entries Refer to the...Ch. 4 - Preparing and Posting Adjusting Journal Entries At...Ch. 4 - Preparing and Posting Adjusting Journal Entries At...Ch. 4 - Prob. 20MECh. 4 - Prob. 21MECh. 4 - Prob. 22MECh. 4 - Prob. 23MECh. 4 - Prob. 24MECh. 4 - Prob. 25MECh. 4 - Prob. 26MECh. 4 - Prob. 1ECh. 4 - Identifying Adjustments and Preparing Financial...Ch. 4 - Prob. 3ECh. 4 - Determining Adjustments and Accounting Equation...Ch. 4 - Determining Adjustments and Accounting Equation...Ch. 4 - Determining Adjustments and Accounting Equation...Ch. 4 - Recording Adjusting Journal Entries Refer to E4-6....Ch. 4 - Recording Typical Adjusting Journal Entries...Ch. 4 - Determining Accounting Equation Effects of Typical...Ch. 4 - Determining Adjusted Income Statement Account...Ch. 4 - Reporting Depreciation The adjusted trial balance...Ch. 4 - Recording Transactions Including Adjusting and...Ch. 4 - Analyzing the Effects of Adjusting Journal Entries...Ch. 4 - Reporting an Adjusted Income Statement Dyer, Inc.,...Ch. 4 - Recording Adjusting Entries and Preparing an...Ch. 4 - Recording Four Adjusting Journal Entries and...Ch. 4 - Recording Four Adjusting Journal Entries and...Ch. 4 - Prob. 18ECh. 4 - Analyzing, Recording, and Summarizing Business...Ch. 4 - Preparing Adjusting Entries, an Adjusted Trial...Ch. 4 - Preparing an Adjusted Trial Balance, Closing...Ch. 4 - Analyzing and Recording Adjusting Journal Entries...Ch. 4 - Prob. 3CPCh. 4 - Identifying and Preparing Adjusting Journal...Ch. 4 - Preparing a Trial Balance, Closing Journal Entry,...Ch. 4 - Analyzing and Recording Adjusting Journal Entries...Ch. 4 - Prob. 3PACh. 4 - Identifying and Preparing Adjusting Journal...Ch. 4 - Preparing a Trial Balance, Closing Journal Entry,...Ch. 4 - Recording Adjusting Journal Entries Cactus...Ch. 4 - Determining Accounting Equation Effects of...Ch. 4 - Identifying and Preparing Adjusting Journal...Ch. 4 - From Recording Transactions to Preparing Accrual...Ch. 4 - Prob. 2COPCh. 4 - Recording Transactions (Including Adjusting...Ch. 4 - From Recording Transactions (Including Adjusting...Ch. 4 - From Recording Transactions to Preparing Accrual...Ch. 4 - Prob. 6COPCh. 4 - Finding Financial Information Refer to the...Ch. 4 - Prob. 2SDCCh. 4 - Ethical Decision Making: A Mini-Case Assume you...Ch. 4 - Adjusting the Accounting Records Assume it is now...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the answer to this general accounting question with proper steps.arrow_forwardShaan Manufacturing is planning to sell 320 electronic toys and to produce 300 electronic toys in November. Each electronic toy requires 85 grams of plastic and 1.25 hours of direct labor. The cost of the plastic used in each electronic toy is $4.50 per 85 grams. Employees of the company are paid at a rate of $22.50 per hour. Manufacturing overhead is applied at a rate of 125% of direct labor costs. Shaan Manufacturing has 75,000 grams of plastic in its beginning inventory and wants to have 65,000 grams in its ending inventory. What is the amount of budgeted direct labor cost for the month of November?arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY