Foundations Of Financial Management

17th Edition

ISBN: 9781260013917

Author: BLOCK, Stanley B., HIRT, Geoffrey A., Danielsen, Bartley R.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 18P

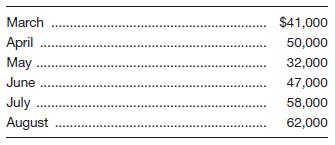

Simpson Glove Company has made the following sales projections for the next six months. All sales are credit sales.

Sales in January and February were

Prepare a monthly cash receipts schedule for the firm for March through August.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Vikrambhai

jagdish

Marlin Company projects the follwoing sales for the first thre months of the year: $11500 in January; $10100 in February and $10400 in March. the company expects 60% of the sales to be cash and the remainder on accounts. Sales on account are collected 50% in the month of the sale and 50% in the following month. The Account Receivable account has a zero on January.

1. Prepare a schedule of cash receipts for Marlin for January, February and March. What is the balance in Accounts Receivable on March 31?

2. Prepare a revised schedule of cash receipts if receipts from sales on account are 70% in the month of the sale, 20% in the following month of the sale and 10% in the second month of the sale. What is the balance in Accounts Receivable on March 31?

Chapter 4 Solutions

Foundations Of Financial Management

Ch. 4 - What are the basic benefits and purposes of...Ch. 4 - Explain how the collections and purchases...Ch. 4 - With inflation, what are the implications of using...Ch. 4 - Explain the relationship between inventory...Ch. 4 - Prob. 5DQCh. 4 - Discuss the advantage and disadvantage of level...Ch. 4 - What conditions would help make a percent-of-sales...Ch. 4 - Prob. 1PCh. 4 - Philip Morris expects the sales for his clothing...Ch. 4 - Galehouse Gas Stations Inc. expects sales to...

Ch. 4 - The Alliance Corp. expects to sell the following...Ch. 4 - Prob. 5PCh. 4 - Cyber Security Systems had sales of 3,500 units at...Ch. 4 - Dodge Ball Bearings had sales of 15,000 units at...Ch. 4 - Sales for Ross Pro’s Sports Equipment are expected...Ch. 4 - Vitale Hair Spray had sales of 13,000 units in...Ch. 4 - Delsing Plumbing Company has beginning inventory...Ch. 4 - On December 31 of last year, Wolfson Corporation...Ch. 4 - At the end of January, Higgins Data Systems had an...Ch. 4 - At the end of January, Mineral Labs had an...Ch. 4 - Convex Mechanical Supplies produces a product with...Ch. 4 - The Bradley Corporation produces a product with...Ch. 4 - Sprint Shoes Inc. had a beginning inventory of...Ch. 4 - J. Lo’s Clothiers has forecast credit sales for...Ch. 4 - Simpson Glove Company has made the following sales...Ch. 4 - Watt’s Lighting Stores made the following sales...Ch. 4 - Ultravision Inc. anticipates sales of $290,000...Ch. 4 - The Denver Corporation has forecast the following...Ch. 4 - Wright Lighting Fixtures forecasts its sales in...Ch. 4 - The Volt Battery Company has forecast its sales in...Ch. 4 - Graham Potato Company has projected sales of...Ch. 4 - Harry’s Carryout Stores has eight locations. The...Ch. 4 - Archer Electronics Company’s actual sales and...Ch. 4 - Prob. 27PCh. 4 - The Manning Company has financial statements as...Ch. 4 - Conn Man’s Shops, a national clothing chain, had...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Cash collections for Renew Lights found that 65% of sales were collected in the month of sale, 25% was collected the month after the sale, and 10% was collected the second month after the sale. Given the sales shown, how much cash will be collected in March and April?arrow_forwardEarthies Shoes has 55% of its sales in cash and the remainder on credit. Of the credit sales, 70% is collected in the month of sale, 15% is collected the month after the sale, and 10% is collected the second month after the sale. How much cash will be collected in June if sales are estimated as $75,000 in April, $65,000 in May, and $90,000 in June?arrow_forwardCash collections for Wax On Candles found that 60% of sales were collected in the month of the sale, 30% was collected the month after the sale, and 10% was collected the second month after the sale. Given the sales shown, how much cash will be collected in January and February?arrow_forward

- My Aunts Closet Store collects 60% of its accounts receivable in the month of sale and 35% in the month after the sale. Given the following sales, how much cash will be collected in March?arrow_forwardOne Device makes universal remote controls and expects to sell 500 units in January, 800 in February, 450 in March, 550 in April, and 600 in May. The required ending inventory is 20% of the next months sales. Prepare a production budget for the first four months of the year.arrow_forwardAll Temps has a policy of always paying within the discount period, and each of its suppliers provides a discount of 2% if paid within 10 days of purchase. Because of the purchase policy, 80% of its payments are made in the month of purchase and 20% are made the following month. The direct materials budget provides for purchases of $23,812 in February, $23,127 in March, $21,836 in April, and $28,173 in May.What is the balance in accounts payable for April 30, and May 31?arrow_forward

- A companys sales for the coming months are as follows: About 20 percent of sales are cash sales, and the remainder are credit sales. The company finds that typically 10 percent of a months credit sales are paid in the month of sale, 70 percent are paid the next month, and 15 percent are paid in the second month after sale. Expected cash receipts in July are budgeted at what amount? a. 114,520 b. 143,150 c. 145,720 d. 156,000arrow_forwardThe following data were obtained from the financial records of Sonicbrush, Inc., for March: Sales are expected to increase each month by 15%. Prepare a budgeted income statement.arrow_forwardJane MacDonald, Carroll Financial Analyst, prepared the following sales and cash disbursement estimates for the February-June period of this year. Month Sales Cash Disbursements February 500 400 March 600 300 April 400 600 May 200 500 June 200 200 MacDonald indicates that 30% of sales have been, historically, in cash. 70% of credit sales are collected one month after the sale, and the remaining 30% are collected two months after the sale. The company wants to keep a minimum final balance in its $ 25 cash account. Balances in excess of this amount will be invested in short-term government securities (marketable securities), while any deficits will be financed through short-term bank borrowing (payable securities). The cash balance initially on April 1 is $ 115. Prepare cash budgets for April, May, and June. How much, if any, of the maximum funding would Carroll require to meet its obligations within this three-month period?…arrow_forward

- Avery Company projects the following sales for the first three months of the year: $13,500 in January; $15,900 in February; and $15,800 in March. The company expects 80% of the sales to be cash and the remainder on account. Sales on account are collected 50% in the month of the sale and 50% in the following month. The Accounts Receivable account has a zero balance on January 1. Round to the nearest dollar. Prepare a schedule of cash receipts for Avery for January, February, and March. What is the balance in Accounts Receivable on March 31?arrow_forwardGraham Potato Company has projected sales of $16,200 in September, $18,500 in October, $26,200 in November, and $22,200 in December. Of the company's sales, 25 percent are paid for by cash and 75 percent are sold on credit. Experience shows that 40 percent of accounts receivable are paid in the month after the sale, while the remaining 60 percent are paid two months after. Determine collections for November and December. Also assume Graham's cash payments for November and December are $22,000 and $14,500, respectively. The beginning cash balance in November is $5,000, which is the desired minimum balance. a. Prepare a cash receipts schedule for November and December. Sales Credit sales Cash sales One month after sale Two months after sale Total cash receipts Graham Potato Company Cash Receipts Schedule September October November $ $ December 6,550 $ 19,650 6,550 $ $ 22,200 16,650 5,550 5,550arrow_forwardGraham Potato Company has projected sales of $11,400 in September, $14,500 in October, $21,400 in November, and $17,400 in December. Of the company's sales, 30 percent are paid for by cash and 70 percent are sold on credit. Experience shows that 40 percent of accounts receivable are paid in the month after the sale, while the remaining 60 percent are paid two months after. Determine collections for November and December. Also assume Graham’s cash payments for November and December are $18,000 and $10,500, respectively. The beginning cash balance in November is $5,000, which is the desired minimum balance. a. Prepare a cash receipts schedule for November and December. b. Prepare a cash budget with borrowing needed or repayments for November and December. (Negative amounts should be indicated by a minus sign. Assume the November beginning loan balance is $0.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY