Concept explainers

Magness Delivery Service completed the f<blowing tranuttions during De< ;mbei 2016:

Dec. 1 Magness Dp!' i, >ei ' < "' 'lions by receiving $10,000 cash and a truck with a fair value of $20,000 horn Robert Mugness The business gave Magness capital in exchange for this contribution

1 Paid $ 1,000 cash for a tour-month insurance policy The policy begins December 1 4 Paid $500 cash for office supplies.

12 Performed delivery services for a customer and received $2,000 cash

15 Completed a large delivery job, billed the customer, $2,500, and received a promise to collect the $2,500 within one week.

18 Paid employee salary, $1,000,

20 Received $15,000 cash for performing delivery services.

22 Collected $800 in advance for delivery service to be performed later.

25 Collected $2,500 cash from customer on account.

27 Purchased fuel for the truck, paying $300 on account (Credit Accounts Payable)

28 Performed delivery services on account, $700.

29 Paid office rent, $1,600, for the month of December.

30 Paid $300 on account.

31 Magness withdrew cash of $3,000.

Requirements

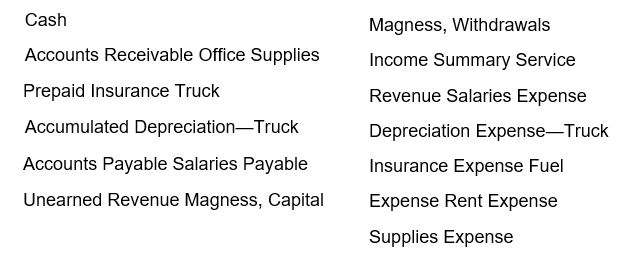

- jRecord each transaction in the journal using the following chart of accounts. Explanations are not required.

Adjustment data:

- Accrued Salaries Expense, $ 1,000.

Depreciation was recorded on the truck using the straight-line me' ul. Asstn^ a useful life of five years and a salvage value ol $5,000.- Prepaid Insurance for the month has expired.

- Office Supplies on hand, $100.

- Unearned Revenue earned during the month. $300.

- Accrued Service Revenue, $650.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

ACCOUNTING PRINCIPLES 122 5/16 >C<

- On January 1, 20X2, Mace, which uses the straight-line method, purchases a machine for $72,000 that it expects to last for 8 years; Mace expects the machine to have a residual value of $10,000. What is the machine's book value at the end of 20X4? i. $48,750 ii. $42,010 iii. $35,550 iv. $50,400 I want answerarrow_forwardJenson Ltd. recently reported a net income of $5,320 and depreciation of $970. How much was its net cash flow, assuming it had no amortization expense and sold none of its fixed assets?arrow_forwardAbcarrow_forward

- On January 1, 20X2, Mace, which uses the straight-line method, purchases a machine for $72,000 that it expects to last for 8 years; Mace expects the machine to have a residual value of $10,000. What is the machine's book value at the end of 20X4? i. $48,750 ii. $42,010 iii. $35,550 iv. $50,400 Tutor need your helparrow_forwardDo fast answer of this accounting questionsarrow_forwardOn January 1, 20X2, Mace, which uses the straight-line method, purchases a machine for $72,000 that it expects to last for 8 years; Mace expects the machine to have a residual value of $10,000. What is the machine's book value at the end of 20X4? i. $48,750 ii. $42,010 iii. $35,550 iv. $50,400arrow_forward

- can you please solve this questionsarrow_forwardXUV Industries manufactures premium-quality glassware. The standard materials cost is 3 pounds of raw glass at $2.00 per pound. During October, 15,000 pounds of raw glass costing $2.10 per pound were used to produce 6,000 glassware items. Determine the materials price variance and materials quantity variance.helparrow_forwardOn January 1, 20X2, Mace, which uses the straight-line method, purchases a machine for $72,000 that it expects to last for 8 years; Mace expects the machine to have a residual value of $10,000. What is the machine's book value at the end of 20X4? i. $48,750 ii. $42,010 iii. $35,550 iv. $50,400 Answerarrow_forward

- How many units must be sold to break even?arrow_forwardXUV Industries manufactures premium-quality glassware. The standard materials cost is 3 pounds of raw glass at $2.00 per pound. During October, 15,000 pounds of raw glass costing $2.10 per pound were used to produce 6,000 glassware items. Determine the materials price variance and materials quantity variance.arrow_forwardDon't use ai given answer accounting questionsarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning