Concept explainers

Magness Delivery Service completed the f<blowing tranuttions during De< ;mbei 2016:

Dec. 1 Magness Dp!' i, >ei ' < "' 'lions by receiving $10,000 cash and a truck with a fair value of $20,000 horn Robert Mugness The business gave Magness capital in exchange for this contribution

1 Paid $ 1,000 cash for a tour-month insurance policy The policy begins December 1 4 Paid $500 cash for office supplies.

12 Performed delivery services for a customer and received $2,000 cash

15 Completed a large delivery job, billed the customer, $2,500, and received a promise to collect the $2,500 within one week.

18 Paid employee salary, $1,000,

20 Received $15,000 cash for performing delivery services.

22 Collected $800 in advance for delivery service to be performed later.

25 Collected $2,500 cash from customer on account.

27 Purchased fuel for the truck, paying $300 on account (Credit Accounts Payable)

28 Performed delivery services on account, $700.

29 Paid office rent, $1,600, for the month of December.

30 Paid $300 on account.

31 Magness withdrew cash of $3,000.

Requirements

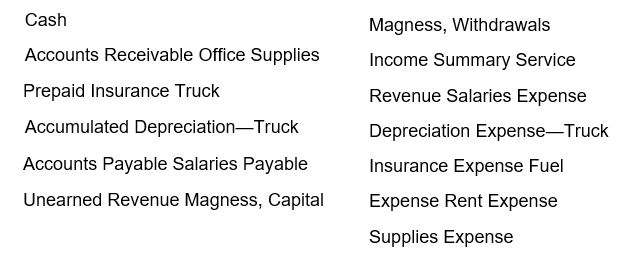

- jRecord each transaction in the journal using the following chart of accounts. Explanations are not required.

Adjustment data:

- Accrued Salaries Expense, $ 1,000.

Depreciation was recorded on the truck using the straight-line me' ul. Asstn^ a useful life of five years and a salvage value ol $5,000.- Prepaid Insurance for the month has expired.

- Office Supplies on hand, $100.

- Unearned Revenue earned during the month. $300.

- Accrued Service Revenue, $650.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Horngren's Accounting, The Financial Chapters, Student Value Edition (11th Edition)

- Give this question general accounting answerarrow_forwardThe Rolling Department of Kama Steel Company had 2,000 tons in beginning work in process inventory (80% complete) on October 1. During October, 30,660 tons were completed. The ending work in process inventory on October 31 was 1,928 tons (80% complete). What are the total equivalent units for direct materials for October if materials are added at the beginning of the process?arrow_forwardSub. General accountingarrow_forward

- Grayson corporation partial income statement is as followsarrow_forwardElectric Zero produces relay units for generators. Each relay has a standard cost of $67. Standards call for two relays per generator. In July, the company purchased 120 relays for $7,560. The company used 104 relays in the production of 50 generators, with four relays damaged in the installation process. The standard quantity of labor is 20 hours per generator, with a standard wage rate of $24.10. In July, the company incurred 1,150 labor hours at a cost of $24,350. How much is the labor rate variance?arrow_forwardexpert of general account answerarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning