Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

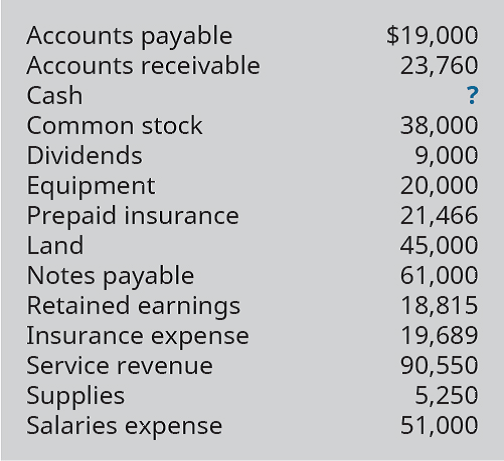

Chapter 4, Problem 14PA

Prepare an adjusted

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

General accounting question

provide correct answer

Hi expert please give me answer general accounting question

Chapter 4 Solutions

Principles of Accounting Volume 1

Ch. 4 - Which of the following is any reporting period...Ch. 4 - Which of the following is the federal, independent...Ch. 4 - Revenues and expenses must be recorded in the...Ch. 4 - Which of the following breaks down company...Ch. 4 - Which of the following is a twelve-month reporting...Ch. 4 - Which type of adjustment occurs when cash is...Ch. 4 - Which type of adjustment occurs when cash is not...Ch. 4 - If an adjustment includes an entry to a payable or...Ch. 4 - If an adjustment includes an entry to Accumulated...Ch. 4 - Rent collected in advance is an example of which...

Ch. 4 - Rent paid in advance is an example of which of the...Ch. 4 - Salaries owed but not yet paid is an example of...Ch. 4 - Revenue earned but not yet collected is an example...Ch. 4 - What adjusting journal entry is needed to record...Ch. 4 - Which of these transactions requires an adjusting...Ch. 4 - What critical purpose does the adjusted trial...Ch. 4 - Which of the following accounts balance would be a...Ch. 4 - On which financial statement would the Supplies...Ch. 4 - On which financial statement would the Dividends...Ch. 4 - On which financial statement would the Accumulated...Ch. 4 - On which two financial statements would the...Ch. 4 - Describe the revenue recognition principle. Give...Ch. 4 - Describe the expense recognition principle...Ch. 4 - What parts of the accounting cycle require...Ch. 4 - Why is the adjusting process needed?Ch. 4 - Name two types of adjusting journal entries that...Ch. 4 - Are there any accounts that would never have an...Ch. 4 - Why do adjusting entries always include both...Ch. 4 - Why are adjusting journal entries needed?Ch. 4 - If the Supplies account had an ending balance of...Ch. 4 - When a company collects cash from customers before...Ch. 4 - If the Prepaid Insurance account had a balance of...Ch. 4 - If adjusting entries include these listed...Ch. 4 - What is the difference between the trial balance...Ch. 4 - Why is the adjusted trial balance trusted as a...Ch. 4 - Indicate on which financial statement the...Ch. 4 - Identify whether each of the following...Ch. 4 - Identify whether each of the following...Ch. 4 - Identify which type of adjustment is indicated by...Ch. 4 - The following accounts were used to make year-end...Ch. 4 - Reviewing insurance policies revealed that a...Ch. 4 - On July 1, a client paid an advance payment...Ch. 4 - Reviewing payroll records indicates that employee...Ch. 4 - Supplies were purchased on January 1, to be used...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Prepare adjusting journal entries, as needed,...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - From the following Company A adjusted trial...Ch. 4 - Identify whether each of the following...Ch. 4 - Identify whether each of the following...Ch. 4 - Indicate what impact the following adjustments...Ch. 4 - What two accounts are affected by the needed...Ch. 4 - Reviewing insurance policies revealed that a...Ch. 4 - On September 1, a company received an advance...Ch. 4 - Reviewing payroll records indicates that one-fifth...Ch. 4 - On July 1, a client paid an advance payment...Ch. 4 - Prepare journal entries to record the business...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Prepare adjusting journal entries, as needed,...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - From the following Company B adjusted trial...Ch. 4 - Identify whether each of the following...Ch. 4 - To demonstrate the difference between cash account...Ch. 4 - Identify which type of adjustment is indicated by...Ch. 4 - Identify which type of adjustment is associated...Ch. 4 - Indicate what impact the following adjustments...Ch. 4 - What two accounts are affected by each of these...Ch. 4 - Using the following information: A. make the...Ch. 4 - Use the following account T-balances (assume...Ch. 4 - Use the following account T-balances (assume...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Determine the amount of cash expended for Salaries...Ch. 4 - Prepare adjusting journal entries, as needed,...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Using the following Company W information, prepare...Ch. 4 - From the following Company Y adjusted trial...Ch. 4 - Identify whether each of the following...Ch. 4 - To demonstrate the difference between cash account...Ch. 4 - Identify which type of adjustment is indicated by...Ch. 4 - Identify which type of adjustment is associated...Ch. 4 - Indicate what impact the following adjustments...Ch. 4 - What two accounts are affected by each of these...Ch. 4 - Using the following information, A. Make the...Ch. 4 - Use the following account T-balances (assume...Ch. 4 - Use the following account T-balances (assume...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Determine the amount of cash expended for...Ch. 4 - Prepare adjusting journal entries, as needed,...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Using the following Company X information, prepare...Ch. 4 - From the following Company Z adjusted trial...Ch. 4 - Assume you are the controller of a large...Ch. 4 - Assume you are employed as the chief financial...

Additional Business Textbook Solutions

Find more solutions based on key concepts

(Record inventory transactions in the periodic system) Wexton Technologies began the year with inventory of 560...

Financial Accounting (12th Edition) (What's New in Accounting)

Communication Activity 9-1

In 150 words or fewer, explain the different methods that can be used to calculate d...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

The new value of the portfolio. Introduction: Portfolio refers to a set of financial investments owned by an in...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

1-13. Identify a product, either a good or a service, that will take advantage of this opportunity. Although yo...

Business Essentials (12th Edition) (What's New in Intro to Business)

Horizontal analysis(Learning Objective 2)15-20 min. What were the dollar and percentage changes in Fesslers Fin...

Financial Accounting, Student Value Edition (5th Edition)

Tennessee Tool Works (TTW) is considering investment in five independent projects, Any profitable combination o...

Engineering Economy (17th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY