Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 4, Problem 13EA

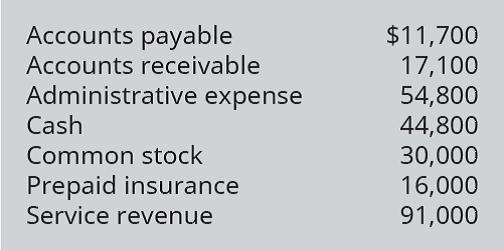

Prepare an adjusted

Adjustments needed:

Salaries due to administrative employees, but unpaid at period end, $2,000

Insurance still unexpired at end of the period, $12,000

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Walter's Rides, Inc. reported a debt-to-equity ratio of 0.75 times at the end of 2022. If the firm's total debt at year-end was $6 million, how much equity does Walter's Rides have? a. $6 million b. $8 million c. $4.50 million d. $0.75 million. want answer

Calculate the contribution margin per unit

F. Acc prblm

Chapter 4 Solutions

Principles of Accounting Volume 1

Ch. 4 - Which of the following is any reporting period...Ch. 4 - Which of the following is the federal, independent...Ch. 4 - Revenues and expenses must be recorded in the...Ch. 4 - Which of the following breaks down company...Ch. 4 - Which of the following is a twelve-month reporting...Ch. 4 - Which type of adjustment occurs when cash is...Ch. 4 - Which type of adjustment occurs when cash is not...Ch. 4 - If an adjustment includes an entry to a payable or...Ch. 4 - If an adjustment includes an entry to Accumulated...Ch. 4 - Rent collected in advance is an example of which...

Ch. 4 - Rent paid in advance is an example of which of the...Ch. 4 - Salaries owed but not yet paid is an example of...Ch. 4 - Revenue earned but not yet collected is an example...Ch. 4 - What adjusting journal entry is needed to record...Ch. 4 - Which of these transactions requires an adjusting...Ch. 4 - What critical purpose does the adjusted trial...Ch. 4 - Which of the following accounts balance would be a...Ch. 4 - On which financial statement would the Supplies...Ch. 4 - On which financial statement would the Dividends...Ch. 4 - On which financial statement would the Accumulated...Ch. 4 - On which two financial statements would the...Ch. 4 - Describe the revenue recognition principle. Give...Ch. 4 - Describe the expense recognition principle...Ch. 4 - What parts of the accounting cycle require...Ch. 4 - Why is the adjusting process needed?Ch. 4 - Name two types of adjusting journal entries that...Ch. 4 - Are there any accounts that would never have an...Ch. 4 - Why do adjusting entries always include both...Ch. 4 - Why are adjusting journal entries needed?Ch. 4 - If the Supplies account had an ending balance of...Ch. 4 - When a company collects cash from customers before...Ch. 4 - If the Prepaid Insurance account had a balance of...Ch. 4 - If adjusting entries include these listed...Ch. 4 - What is the difference between the trial balance...Ch. 4 - Why is the adjusted trial balance trusted as a...Ch. 4 - Indicate on which financial statement the...Ch. 4 - Identify whether each of the following...Ch. 4 - Identify whether each of the following...Ch. 4 - Identify which type of adjustment is indicated by...Ch. 4 - The following accounts were used to make year-end...Ch. 4 - Reviewing insurance policies revealed that a...Ch. 4 - On July 1, a client paid an advance payment...Ch. 4 - Reviewing payroll records indicates that employee...Ch. 4 - Supplies were purchased on January 1, to be used...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Prepare adjusting journal entries, as needed,...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - From the following Company A adjusted trial...Ch. 4 - Identify whether each of the following...Ch. 4 - Identify whether each of the following...Ch. 4 - Indicate what impact the following adjustments...Ch. 4 - What two accounts are affected by the needed...Ch. 4 - Reviewing insurance policies revealed that a...Ch. 4 - On September 1, a company received an advance...Ch. 4 - Reviewing payroll records indicates that one-fifth...Ch. 4 - On July 1, a client paid an advance payment...Ch. 4 - Prepare journal entries to record the business...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Prepare adjusting journal entries, as needed,...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - From the following Company B adjusted trial...Ch. 4 - Identify whether each of the following...Ch. 4 - To demonstrate the difference between cash account...Ch. 4 - Identify which type of adjustment is indicated by...Ch. 4 - Identify which type of adjustment is associated...Ch. 4 - Indicate what impact the following adjustments...Ch. 4 - What two accounts are affected by each of these...Ch. 4 - Using the following information: A. make the...Ch. 4 - Use the following account T-balances (assume...Ch. 4 - Use the following account T-balances (assume...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Determine the amount of cash expended for Salaries...Ch. 4 - Prepare adjusting journal entries, as needed,...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Using the following Company W information, prepare...Ch. 4 - From the following Company Y adjusted trial...Ch. 4 - Identify whether each of the following...Ch. 4 - To demonstrate the difference between cash account...Ch. 4 - Identify which type of adjustment is indicated by...Ch. 4 - Identify which type of adjustment is associated...Ch. 4 - Indicate what impact the following adjustments...Ch. 4 - What two accounts are affected by each of these...Ch. 4 - Using the following information, A. Make the...Ch. 4 - Use the following account T-balances (assume...Ch. 4 - Use the following account T-balances (assume...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Determine the amount of cash expended for...Ch. 4 - Prepare adjusting journal entries, as needed,...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Using the following Company X information, prepare...Ch. 4 - From the following Company Z adjusted trial...Ch. 4 - Assume you are the controller of a large...Ch. 4 - Assume you are employed as the chief financial...

Additional Business Textbook Solutions

Find more solutions based on key concepts

What are the four elements of the budgeting cycle?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

The new value of the portfolio. Introduction: Portfolio refers to a set of financial investments owned by an in...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Depreciation Methods, Disposal. Kurtis Koal Company, Inc. purchased a new mining machine at a total cost of 900...

Intermediate Accounting (2nd Edition)

The cost of debt, equity and the weighted average capital cost are the financial leverages of the firm. The opt...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

An experimental composite engine block for an automobile will trim 20 pounds of weight compared with a traditio...

Engineering Economy (17th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question : Rainbowbird Mfg. has received a special one-time order for 15,000 bird feeders at $3 per unit. Rainbowbird currently produces and sells 75,000 units at $7.00 each. This level represents 80% of its capacity. Production costs for these units are $3.50 per unit, which includes a $2.25 variable cost and $1.25 fixed cost. If Rainbowbird accepts this additional business, the effect on net income will be?arrow_forwardcan you help me with this General accounting questionarrow_forwardFinancial accountingarrow_forward

- Not Ai solutionarrow_forwardDuring its first year of operations, Peter's Plumbing Supply Co. had sales of $370,000, wrote off $5,900 of accounts as uncollectible using the direct write-off method, and reported net income of $40,700. Determine what the net income would have been if the allowance method had been used, and the company estimated that 1.75% of sales would be uncollectible. ??arrow_forwardWhat is the answer?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY