FOUNDATIONS OF FINANCE- MYFINANCELAB

10th Edition

ISBN: 9780135160572

Author: KEOWN

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 10SP

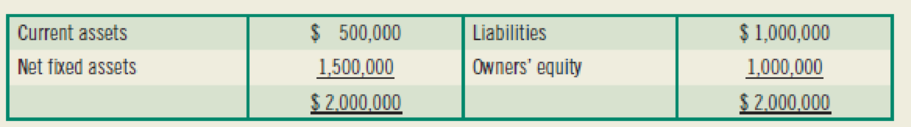

(Evaluating current and proforma profitability) (Financial ratios—investment analysis) The annual sales for Salco Inc. were $4.5 million last year. All sales are on credit. The firm’s end-of-year balance sheet was as follows:

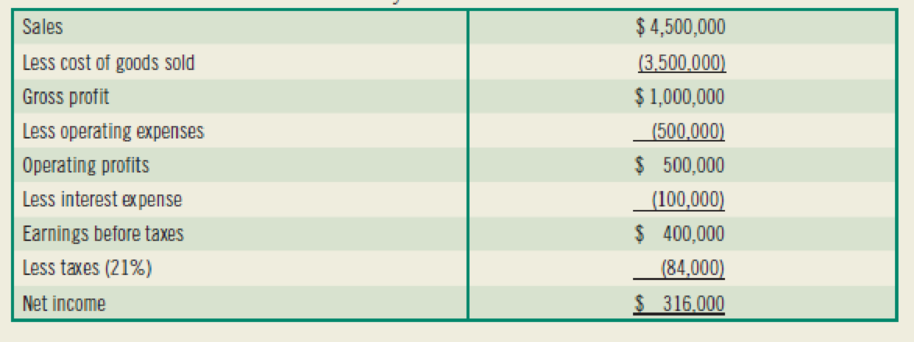

The firm’s income statement for the year was as follows:

- a. Calculate Salco’s total asset turnover, operating profit margin, and operating

return on assets . - b. Salco plans to renovate one of its plants, which will require an added investment in plant and equipment of $1 million. The firm will maintain its present debt ratio of 0.5 when financing the new investment and expects sales to remain constant. The operating profit margin will rise to 13 percent. What will be the new operating return on assets for Salco after the plant’s renovation?

- c. Given that the plant renovation in part (b) occurs and Salco’s interest expense rises by $50,000 per year, what will be the return earned on the common stockholders’ investment? Compare this

rate of return with that earned before the renovation.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Given the solution with financial accounting question

Please provide contact solution with financial accounting question

Please provide problem with financial accounting question

Chapter 4 Solutions

FOUNDATIONS OF FINANCE- MYFINANCELAB

Ch. 4 - Describe the five-question approach to using...Ch. 4 - What are the limitations of industry average...Ch. 4 - What is the difference between a firms gross...Ch. 4 - Prob. 9RQCh. 4 - Prob. 1SPCh. 4 - Prob. 2SPCh. 4 - Prob. 3SPCh. 4 - (Price/ book) Chang, Inc.s balance sheet shows a...Ch. 4 - Prob. 5SPCh. 4 - (Ratio analysis) The balance sheet and income...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Consider the sales data for Computer Success given in Problem 7. Use a 3-month weighted moving average to forec...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

1.10 Brown’s, a local bakery, is worried about increased costs—particularly energy. Last year’s records can pro...

Operations Management

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

13. Indicate how each of these accounts should be classified in the stockholders’ equity section of the balance...

Financial Accounting: Tools for Business Decision Making, 8th Edition

4. JC Manufacturing purchase d inventory for $ 5,300 and al so paid a $260 freight bill. JC Manufacturing retur...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

E8-16 Understanding internal control, components, procedures, and laws

Learning Objectives 1, 2, 3

Match ...

Horngren's Accounting (12th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- I need help finding the accurate solution with financial accounting questionarrow_forwardI am looking for help with financial accounting questionarrow_forwardAssume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. In addition, the taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. Keisha Sanders, a divorced single taxpayer and practicing attorney, lives at 9551 Oak Lane in Boise, ID 83709. Her social security number is 412-34-5670 (date of birth 2/27/1979). Her W-2 contained the following information: Wages (box 1) = $ 84,601.55 Federal W/H (box 2) = $ 8,278.51 Social Security wages (box 3) = $ 84,601.55 Social Security W/H (box 4) = $ 5,245.30 Medicare wages (box 5) = $ 84,601.55 Medicare W/H (box 6) = $ 1,226.72 In addition, Keisha made alimony payments totaling $11,100 for the year to her former husband Alex, an unemployed mine worker, whose Social Security number is 412-34-5671. This was in regards to a divorce decree that was completed prior to November 2017 and had not…arrow_forward

- Tyrone and Akira, who are married, incurred and paid the following amounts of interest during 2024: Home acquisition debt interest Credit card interest Home equity loan interest (used for home improvement) Investment interest expense Mortgage insurance premiums (PMI) Required: $ 10,250 3,100 5,105 8,200 1,000 With 2024 net investment income of $1,025, calculate (a) the amount of their allowable deduction for investment interest expense and, (b) their total deduction for allowable interest. Home acquisition principal and the home equity loan principal combined are less than $750,000. Deduction for investment interest expense Total deduction for allowable interest Amountsarrow_forwardReggie, who is 55, had AGI of $36,400 in 2024. During the year, he paid the following medical expenses: Drugs (prescribed by physicians) Marijuana (prescribed by physicians) Health insurance premiums-after taxes. Doctors' fees Eyeglasses Over-the-counter drugs Required: $ 585 1,485 1,300 1,335 460 285 Reggie received $585 in 2024 for a portion of the doctors' fees from his insurance. What is Reggie's medical expense deduction? Medical expense deductionarrow_forwardWhat is the difference between a bond's coupon rate and its yield to maturity (YTM)?no AIarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License