Wixis Cabinets makes custom wooden cabinets for high-end stereo systems from specialty woods. The company uses a

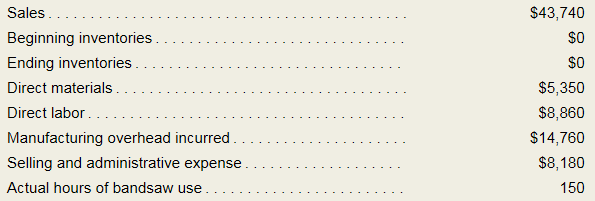

The results of a recent month’s operations appear below:

Required:

- Prepare an income statement following the example in Exhibit 3B—1 that records the cost of unused capacity on the income statement as a period expense.

- Why do unused capacity costs arise when the predetermined overhead rate is based on capacity?

1.

Introduction: Job costing is a technique of determine the cost of a manufacturing job rather than the process of the job. Manufacturing overhead is applied to product or job order is determined as predetermined overhead. Absorption costing is used to calculate the cost of product while taking indirect and direct expense into account. Activity based costing assign the cost of all the activity of the organization according to their actual consumption

To prepare: The income statement that record the cost of unused capacity.

Answer to Problem 3B.1E

Income statement given shown below:

Explanation of Solution

Cost of goods manufactured and under applied overhead

| Particular | Amount $ |

| Direct material | 5,350 |

| Direct labor | 8,860 |

| Manufacturing overhead applied | 12,300 |

| Total manufacturing cost charged to jobs | 26,510 |

| Add: Beginning work in process inventory | 0 |

| 26,510 | |

| Deduct: Ending work in process inventory | 0 |

| Cost of goods manufactured | 26,510 |

The manufacturing overhead incurred was $14200 and the applied manufacturing overhead was $12,300. Thus, under applied overhead is:

Income statement:

| Particular | Amount $ | Amount $ |

| Sales | 43,740 | |

| Cost of goods | 26,510 | |

| Gross margin | 17,230 | |

| Under applied manufacturing overhead | 1920 | |

| Selling and manufacturing expense | 8180 | 10,100 |

| Net operating income | 7,130 |

2.

Introduction: Job costing is a technique of determine the cost of a manufacturing job rather than the process of the job. Manufacturing overhead is applied to product or job order is determined as predetermined overhead. Absorption costing is used to calculate the cost of product while taking indirect and direct expense into account. Activity based costing assign the cost of all the activity of the organization according to their actual consumption

The reason for unused capacity cost arises when the predetermined overhead rate is based on capacity.

Answer to Problem 3B.1E

Manufacturing overhead typically includes a significant amount of fixed cost that results in overhead being under applied when the predetermined overhead rate is based on capacity.

Explanation of Solution

Manufacturing overhead typically includes a significant amount of fixed cost that results in overhead being under applied when the predetermined overhead rate is based on capacity. If the plant never operates at full capacity, an amount less than the total fixed cost will actually be applied to each job. However, since fixed costs remain fixed the amount overhead applied to each job will typically be underapplied.

Want to see more full solutions like this?

Chapter 3B Solutions

MANAGERIAL ACCOUNTING F/MGRS.

- Plata Company has identified the following overhead activities, costs, and activity drivers for the coming year: Plata produces two models of microwave ovens with the following activity demands: The companys normal activity is 21,000 machine hours. Calculate the total overhead cost that would be assigned to Model X using an activity-based costing system: a. 230,000 b. 240,000 c. 280,000 d. 190,000arrow_forwardCaseys Kitchens makes two types of food smokers: Gas and Electric. The company expects to manufacture 20,000 units of Gas smokers, which have a per-unit direct material cost of $15 and a per-unit direct labor cost of $25. k also expects to manufacture 50,000 units of Electric smokers, which have a per-unit material cost of $20 and a per-unit direct labor cost of $45. Historically, it has used the traditional allocation method and applied overhead at a rate of $125 per machine hour. It was determined that there were three cost pools, and the overhead for each cost pool is as follows: The cost driver for each cost pool and its expected activity is as follows: A. What is the per-unit cost for each product under the traditional allocation method? B. What is the per-unit cost for each product under ABC costing? C. Compared to ABC costing, was each products overhead under- or over applied? D. How much was overhead under- or over applied for each product?arrow_forwardCarltons Kitchens makes two types of pasta makers: Strands and Shapes. The company expects to manufacture 70,000 units of Strands, which has a per-unit direct material cost of $10 and a per-unit direct labor cost of $60. It also expects to manufacture 30.000 units of Shapes, which has a per-unit material cost of $15 and a per-unit direct labor cost of $40. It is estimated that Strands will use 140,000 machine hours and Shapes will require 60,000 machine hours. Historically, the company has used the traditional allocation method and applied overhead at a rate of $21 per machine hour. It was determined that there were three cost pools, and the overhead for each cost pool is shown: The cost driver for each cost pool and its expected activity is shown: A. What is the per-unit cost for each product under the traditional allocation method? B. What is the per-unit cost for each product under ABC costing?arrow_forward

- Cozy, Inc., manufactures small and large blankets. It estimates $950,000 in overhead during the manufacturing of 360,000 small blankets and 120,000 large blankets. What is the predetermined overhead rate if a small blanket takes 2 hours of direct labor and a large blanket takes 3 hours of direct labor?arrow_forwardTechno Incorporated manufactures two models of cameras that can be used as cell phones, MPX, and digital camcorders. Model Annual Sales in Units High F 11,100 Great P 17,100 Techno uses a volume-based costing system to apply factory overhead based on direct labor dollars. The unit prime costs of each product were as follows: High F Great P Direct materials $ 39.10 $ 26.50 Direct labor $ 18.70 $ 14.30 Budget factory overhead: Engineering and Design 2,620 engineering hours $ 445,400 Quality Control 13,050 inspection hours 336,700 Machinery 33,930 machine hours 608,940 Miscellaneous Overhead 26,610 direct labor hours 132,550 Total $ 1,523,590 Techno's controller had been researching activity-based costing and decided to switch to it. A special study determined Techno's two products have the following budgeted activities: High F Great P…arrow_forwardRequired information [The following information applies to the questions displayed below.] Performance Products Corporation makes two products, titanium Rims and Posts. Data regarding the two products follow: Rims Posts Direct Labor- Hours per unit 0.70 0.80 Annual Production Additional information about the company follows: a. Rims require $14 in direct materials per unit, and Posts require $10. b. The direct labor wage rate is $20 per hour. Activity Cost Pool Machine setups Special processing General factory 26,000 units 90,000 units c. Rims are more complex to manufacture than Posts and they require special equipment. d. The ABC system has the following activity cost pools: Unit product cost of Rims Unit product cost of Posts Activity Measure Number of setups Machine-hours Direct labor-hours Estimated Overhead Cost $ 33,300 $ 172,800 $ 858,000 Estimated Activity Rims 70 3,000 18,200 Posts 230 0 72,000 Total 300 3,000 90,200 2. Determine the unit product cost of each product…arrow_forward

- Multiple Versus Single Overhead Rates, Activity Drivers Deoro Company has identified the following overhead activities, costs, and activity drivers for the coming year: Activity Expected Cost Activity Driver Activity Capacity Setting up equipment Ordering costs Machine costs Direct materials Direct labor Units completed Direct labor hours Number of setups Number of orders Machine hours Machine hours Receiving Receiving hours Deoro produces two models of dishwashers with the following expected prime costs and activity demands: Model A Model B $754,000 473,000 7,800 2,400 Receiving hours Model A $407,490 374,000 952,200 6,500 360 6,100 12,600 24,400 17,000 2,600 6,400 The company's normal activity is 8,900 direct labor hours. Model B 405,000 Model A $593,000 478,000 Model B Number of setups Number of orders 16,800 Required: 1. Determine the unit cost for each model using direct labor hours to apply overhead. Round intermediate calculations and final answers to nearest cent. Unit Cost 150…arrow_forwardTechno Incorporated manufactures two models of cameras that can be used as cell phones, MPX, and digital camcorders. Model Annual Sales in Units High F 11,300 Great P 17,300 Techno uses a volume-based costing system to apply factory overhead based on direct labor dollars. The unit prime costs of each product were as follows: High F Great P Direct materials $ 39.30 $ 26.70 Direct labor $ 18.90 $ 14.50 Budget factory overhead: Engineering and Design 2,660 engineering hours $ 425,600 Quality Control 13,090 inspection hours 350,190 Machinery 33,970 machine hours 541,600 Miscellaneous Overhead 26,650 direct labor hours 132,650 Total $ 1,450,040 Techno's controller had been researching activity-based costing and decided to switch to it. A special study determined Techno's two products have the following budgeted activities: High F Great P…arrow_forwardTechno Incorporated manufactures two models of cameras that can be used as cell phones, MPX, and digital camcorders. Model High F Great P Annual Sales in Units 10,700 16,700 Techno uses a volume-based costing system to apply factory overhead based on direct labor dollars. The unit prime costs of each product were as follows: Direct materials Direct labor Budget factory overhead: Engineering and Design Quality Control Machinery Miscellaneous Overhead Total High F $38.70 $18.30 Great P $26.10 $ 13.90 Engineering and design hours Quality control inspection hours Machine hours Labor hours 2,540 12,970 33,850 26,530 engineering hours inspection hours machine hours direct labor hours Techno's controller had been researching activity-based costing and decided to switch to it. A special study determined Techno's two products have the following budgeted activities: High F 1,030 5,710 20,350 12,070 Prev Great P 1,510 7,260 13,500 14,460 Using the firm's volume-based costing, applied factory…arrow_forward

- National Inc. manufactures two models of CMD that can be used as cell phones, MPX, and digital camcorders. Model Annual Salesin Units High F 12,000 Great P 17,000 National uses a volume-based costing system to apply factory overhead based on direct labor dollars. The unit prime costs of each product were as follows: High F Great P Direct materials $ 40.00 $ 27.40 Direct labor $ 19.60 $ 15.20 Budget factory overhead: Engineering and Design 2,800 engineering hours $ 420,000 Quality Control 13,230 inspection hours 326,000 Machinery 34,110 machine hours 610,560 Miscellaneous Overhead 26,790 direct labor hours 133,000 Total $ 1,489,560 National's controller had been researching activity-based costing and decided to switch to it. A special study determined National's two products have the following budgeted activities: High F Great P Engineering and design hours 1,160 1,640 Quality…arrow_forwardBergeron's Fine Furnishings manufactures upscale custom furniture. attached inss below thanks for hlp whlh wwarrow_forwardResource Constraint Fairy Godmother Inc. (FGI) makes two products: Glass Slippers and Crystal Balls. FGI estimates they can sell 30,000 Glass Slippers and 20,000 Crystal Balls. Both products must be processed by the glass sanding machine, which has a capacity of 25,000 machine hours. Fairy Godmother Inc Production Information Per Unit Information Glass Slippers Crystal Balls Selling Price 25 15 Direct Materials 8 5 Direct Labor 8 4 Variable Overhead 2 2 Variable Selling 1 1 Machine Hours 4 .75 What is the contribution margin per unit for Crystal Balls? Group of answer choices 1.50 3 6 4arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning