Concept explainers

Transaction Analysis L03-5

Dixon Company is a manufacturer that completed numerous transactions the month, some of which are shown below.

a. Raw materials purchased on account, S 100.000.

b. Raw materials used in $78,000 direct materials, and $16,000 indirect materials.

c. Sales commissions paid in cash, $45,000.

d.

e. Sales for the month. $4S0.000 (70% cash sales and the remainder were sales on account).

f. Factory utilities paid in cash. $12, 000.

g. Applied $138,000 of manufacturing

h. Various

i. Cash receipts from customers who had previously purchased on credit. $115,000.

j.Various completed jobs costing a total of $220.000 were sold to customers.

k. Cash paid to raw material suppliers, $90,000.

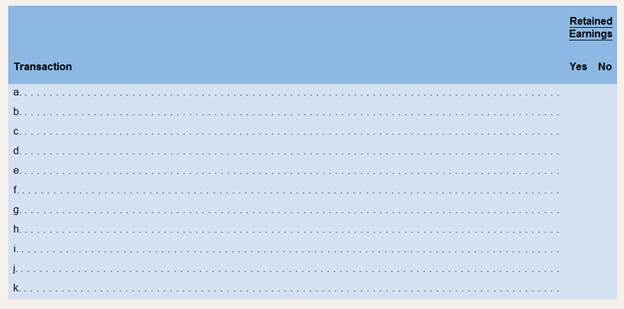

Required:

The table shown below includes only one account from Dixon Company’s balance sheet-

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

INTRO MGRL ACCT LL W CONNECT

- A company paid $12,000 for a one-year insurance policy on October 1. What amount should be reported as Prepaid Insurance on the December 31 balance sheet? A. $3,000B. $9,000C. $12,000D. $0arrow_forwardNo chatgpt 9. In a perpetual inventory system, what happens when goods are sold?A. Only sales revenue is recordedB. Inventory and cost of goods sold are updated immediatelyC. Inventory is updated at the end of the accounting periodD. Only cost of goods sold is recordedAnswer: Barrow_forward9. In a perpetual inventory system, what happens when goods are sold?A. Only sales revenue is recordedB. Inventory and cost of goods sold are updated immediatelyC. Inventory is updated at the end of the accounting periodD. Only cost of goods sold is recordedneed helparrow_forward

- Can you demonstrate the accurate method for solving this financial accounting question?arrow_forwardWhat effect does recording depreciation expense have on the accounting equation?A. Increases assets and increases equityB. Decreases assets and decreases equityC. Increases liabilities and decreases equityD. No effect on assets or equity No AIarrow_forwardNo ai 9. In a perpetual inventory system, what happens when goods are sold?A. Only sales revenue is recordedB. Inventory and cost of goods sold are updated immediatelyC. Inventory is updated at the end of the accounting periodD. Only cost of goods sold is recordedAnswer: Barrow_forward

- Solve this question with accounting questionarrow_forwardHello tutor solve this situation with accounting questionarrow_forwardWhat effect does recording depreciation expense have on the accounting equation?A. Increases assets and increases equityB. Decreases assets and decreases equityC. Increases liabilities and decreases equityD. No effect on assets or equity helparrow_forward

- What effect does recording depreciation expense have on the accounting equation?A. Increases assets and increases equityB. Decreases assets and decreases equityC. Increases liabilities and decreases equityD. No effect on assets or equityarrow_forwardFinancial accounting questionarrow_forwardCan you demonstrate the proper approach for solving this financial accounting question with valid techniques?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College