Concept explainers

a.

Find the population standard deviation for each type of investment.

Find the riskiest and least risky investments.

a.

Answer to Problem 38E

- The standard deviation for Stocks, bills and bonds are 15.821, 1.99, and 9.35 respectively.

- The risk is highest for stock investment and the risk is lowest for bill investment.

Explanation of Solution

Calculation:

The annual percentage returns for the years 1993-2012, for the three categories of investments, stock, Treasure bills and Treasure bonds are given. The measure of risk of the investment can be expressed by standard deviation.

Standard deviation:

Let

Finding mean:

Software procedure:

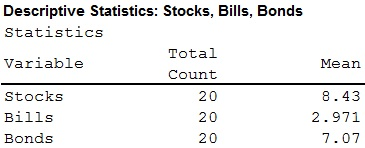

Step-by-step procedure to find mean using the MINITAB software:

- Choose Stat > Basic Statistics > Display

Descriptive Statistics . - In Variables enter the columns Stocks, Bills, Bonds.

- Choose option statistics, and select N total, Mean.

- Click OK.

Output using the MINITAB software is given below:

- From the MINITAB output the mean of Stocks, Bills and Bonds are 8.43, 2.971 and 7.07 respectively.

Standard deviation for Stocks:

The deviation, deviation’s squares are calculated below:

| x | ||

| 13.72 | 5.29 | 27.9841 |

| 2.14 | –6.29 | 39.5641 |

| 33.45 | 25.02 | 626.0004 |

| 26.01 | 17.58 | 309.0564 |

| 22.64 | 14.21 | 201.9241 |

| 16.1 | 7.67 | 58.8289 |

| 25.22 | 16.79 | 281.9041 |

| –6.18 | –14.61 | 213.4521 |

| –7.1 | –15.53 | 241.1809 |

| –16.76 | –25.19 | 634.5361 |

| 25.32 | 16.89 | 285.2721 |

| 3.15 | –5.28 | 27.8784 |

| –0.61 | –9.04 | 81.7216 |

| 16.29 | 7.86 | 61.7796 |

| 6.43 | –2 | 4 |

| –33.84 | –42.27 | 1,786.753 |

| 18.82 | 10.39 | 107.9521 |

| 11.02 | 2.59 | 6.7081 |

| 5.53 | –2.9 | 8.41 |

| 7.26 | –1.17 | 1.3689 |

| Total |

Substitute

Thus, the standard deviation for stocks is 15.821.

Standard deviation for Bills:

The deviation, deviation’s squares are calculated below:

| x | ||

| 2.98 | 0.009 | 0.0001 |

| 3.99 | 1.019 | 1.0384 |

| 5.52 | 2.549 | 6.4974 |

| 5.02 | 2.049 | 4.1984 |

| 5.05 | 2.079 | 4.3222 |

| 4.73 | 1.759 | 3.0941 |

| 4.51 | 1.539 | 2.3685 |

| 5.76 | 2.789 | 7.7785 |

| 3.67 | 0.699 | 0.4886 |

| 1.66 | –1.311 | 1.7187 |

| 1.03 | –1.941 | 3.7675 |

| 1.23 | –1.741 | 3.0311 |

| 3.01 | 0.039 | 0.0015 |

| 4.68 | 1.709 | 2.9207 |

| 4.64 | 1.669 | 2.7856 |

| 1.59 | –1.381 | 1.9072 |

| 0.14 | –2.831 | 8.0146 |

| 0.13 | –2.841 | 8.0713 |

| 0.03 | –2.941 | 8.6495 |

| 0.05 | –2.921 | 8.5322 |

| Total |

Substitute

Thus, the standard deviation for stocks is 1.99.

Standard deviation for Bonds:

The deviation, deviation’s squares are calculated below:

| x | ||

| 14.21 | 7.14 | 50.9796 |

| –8.04 | –15.11 | 228.3121 |

| 23.48 | 16.41 | 269.2881 |

| 1.43 | –5.64 | 31.8096 |

| 9.94 | 2.87 | 8.2369 |

| 14.92 | 7.85 | 61.6225 |

| –8.25 | –15.32 | 234.7024 |

| 16.66 | 9.59 | 91.9681 |

| 5.57 | –1.5 | 2.2500 |

| 15.12 | 8.05 | 64.8025 |

| 0.38 | –6.69 | 44.7561 |

| 4.49 | –2.58 | 6.6564 |

| 2.87 | –4.2 | 17.6400 |

| 1.96 | –5.11 | 26.1121 |

| 10.21 | 3.14 | 9.8596 |

| 20.1 | 13.03 | 169.7809 |

| –11.12 | –18.19 | 330.8761 |

| 8.46 | 1.39 | 1.9321 |

| 16.04 | 8.97 | 80.4609 |

| 2.97 | –4.1 | 16.8100 |

| Total |

Substitute

Thus, the standard deviation for bonds is 9.35.

- Hence, the standard deviation for Stocks, bills and bonds are 15.821, 1.99 9.35 respectively.

- If the standard deviation is high, the risk is also higher.

- Here, the standard deviation for Stocks is highest, therefore the risk is also highest in stock investment.

- The standard deviation for bills is lowest, therefore the risk is also lowest in bill investment.

b.

Explain whether the result is same as the theory or not.

b.

Answer to Problem 38E

The result is same as the theory.

Explanation of Solution

It is given that the long term loans are riskier than short-term loans. The treasure bills are short term loans and the treasure bonds are long term loans.

- From part (a), the standard deviation for Stocks, bills and bonds are 15.821, 1.99 9.35 respectively.

It is known that the higher standard deviation implies the higher risk.

The standard deviation for the treasure bonds (long term) is more than the standard deviation for the treasure bills (short-term). That is,

Therefore, long term loans are riskier than short-term loans.

Hence, the result is same as the theory.

c.

Find the mean return for each class of the investment.

c.

Answer to Problem 38E

The result follows the theory.

Explanation of Solution

- It is given that if any investment has more risk the mean return will also be more.

- From part (a), the mean of Stocks, Bills and Bonds are 8.43, 2.971 and 7.07 respectively.

The mean for the treasure bonds (long term) is more than the mean for the treasure bills (short-term). That is,

Therefore, long term loans has more mean.

Hence, the result follows the theory.

Want to see more full solutions like this?

Chapter 3 Solutions

ALEKS 360 ESSENT. STAT ACCESS CARD

- What is one sample T-test? Give an example of business application of this test? What is Two-Sample T-Test. Give an example of business application of this test? .What is paired T-test. Give an example of business application of this test? What is one way ANOVA test. Give an example of business application of this test? 1. One Sample T-Test: Determine whether the average satisfaction rating of customers for a product is significantly different from a hypothetical mean of 75. (Hints: The null can be about maintaining status-quo or no difference; If your alternative hypothesis is non-directional (e.g., μ≠75), you should use the two-tailed p-value from excel file to make a decision about rejecting or not rejecting null. If alternative is directional (e.g., μ < 75), you should use the lower-tailed p-value. For alternative hypothesis μ > 75, you should use the upper-tailed p-value.) H0 = H1= Conclusion: The p value from one sample t-test is _______. Since the two-tailed p-value…arrow_forwardUsing the accompanying Accounting Professionals data to answer the following questions. a. Find and interpret a 90% confidence interval for the mean years of service. b. Find and interpret a 90% confidence interval for the proportion of employees who have a graduate degree. view the Accounting Professionals data. Employee Years of Service Graduate Degree?1 26 Y2 8 N3 10 N4 6 N5 23 N6 5 N7 8 Y8 5 N9 26 N10 14 Y11 10 N12 8 Y13 7 Y14 27 N15 16 Y16 17 N17 21 N18 9 Y19 9 N20 9 N Question content area bottom Part 1 a. A 90% confidence interval for the mean years of service is (Use ascending order. Round to two decimal places as needed.)arrow_forwardIf, based on a sample size of 900,a political candidate finds that 509people would vote for him in a two-person race, what is the 95%confidence interval for his expected proportion of the vote? Would he be confident of winning based on this poll? Question content area bottom Part 1 A 9595% confidence interval for his expected proportion of the vote is (Use ascending order. Round to four decimal places as needed.)arrow_forward

- Questions An insurance company's cumulative incurred claims for the last 5 accident years are given in the following table: Development Year Accident Year 0 2018 1 2 3 4 245 267 274 289 292 2019 255 276 288 294 2020 265 283 292 2021 263 278 2022 271 It can be assumed that claims are fully run off after 4 years. The premiums received for each year are: Accident Year Premium 2018 306 2019 312 2020 318 2021 326 2022 330 You do not need to make any allowance for inflation. 1. (a) Calculate the reserve at the end of 2022 using the basic chain ladder method. (b) Calculate the reserve at the end of 2022 using the Bornhuetter-Ferguson method. 2. Comment on the differences in the reserves produced by the methods in Part 1.arrow_forwardA population that is uniformly distributed between a=0and b=10 is given in sample sizes 50( ), 100( ), 250( ), and 500( ). Find the sample mean and the sample standard deviations for the given data. Compare your results to the average of means for a sample of size 10, and use the empirical rules to analyze the sampling error. For each sample, also find the standard error of the mean using formula given below. Standard Error of the Mean =sigma/Root Complete the following table with the results from the sampling experiment. (Round to four decimal places as needed.) Sample Size Average of 8 Sample Means Standard Deviation of 8 Sample Means Standard Error 50 100 250 500arrow_forwardA survey of 250250 young professionals found that two dash thirdstwo-thirds of them use their cell phones primarily for e-mail. Can you conclude statistically that the population proportion who use cell phones primarily for e-mail is less than 0.720.72? Use a 95% confidence interval. Question content area bottom Part 1 The 95% confidence interval is left bracket nothing comma nothing right bracket0.60820.6082, 0.72510.7251. As 0.720.72 is within the limits of the confidence interval, we cannot conclude that the population proportion is less than 0.720.72. (Use ascending order. Round to four decimal places as needed.)arrow_forward

- I need help with this problem and an explanation of the solution for the image described below. (Statistics: Engineering Probabilities)arrow_forwardA survey of 250 young professionals found that two-thirds of them use their cell phones primarily for e-mail. Can you conclude statistically that the population proportion who use cell phones primarily for e-mail is less than 0.72? Use a 95% confidence interval. Question content area bottom Part 1 The 95% confidence interval is [ ], [ ] As 0.72 is ▼ above the upper limit within the limits below the lower limit of the confidence interval, we ▼ can cannot conclude that the population proportion is less than 0.72. (Use ascending order. Round to four decimal places as needed.)arrow_forwardI need help with this problem and an explanation of the solution for the image described below. (Statistics: Engineering Probabilities)arrow_forward

- I need help with this problem and an explanation of the solution for the image described below. (Statistics: Engineering Probabilities)arrow_forwardI need help with this problem and an explanation of the solution for the image described below. (Statistics: Engineering Probabilities)arrow_forwardQuestions An insurance company's cumulative incurred claims for the last 5 accident years are given in the following table: Development Year Accident Year 0 2018 1 2 3 4 245 267 274 289 292 2019 255 276 288 294 2020 265 283 292 2021 263 278 2022 271 It can be assumed that claims are fully run off after 4 years. The premiums received for each year are: Accident Year Premium 2018 306 2019 312 2020 318 2021 326 2022 330 You do not need to make any allowance for inflation. 1. (a) Calculate the reserve at the end of 2022 using the basic chain ladder method. (b) Calculate the reserve at the end of 2022 using the Bornhuetter-Ferguson method. 2. Comment on the differences in the reserves produced by the methods in Part 1.arrow_forward

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman