Applications and Investigations in Earth Science (9th Edition)

9th Edition

ISBN: 9780134746241

Author: Edward J. Tarbuck, Frederick K. Lutgens, Dennis G. Tasa

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3.1, Problem 2A

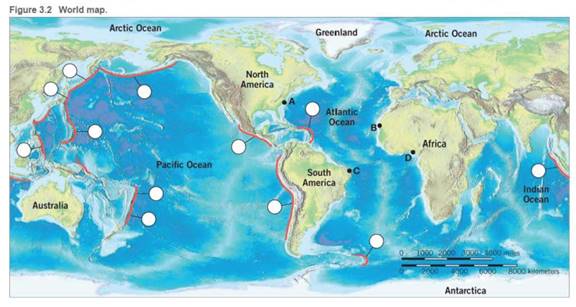

Use an atlas or your textbook to label the deep-ocean trenches on Figure 3.21. using the letter associated with each of the following trenches:

| A. | Puerto Rico | E. | Mariana | I. | Tonga |

| B. | Aleutian | F. | South Sandwich | J. | Java(Sunda) |

| C. | Peru-Chile | G. | Kuril | K. | Philippine |

| D. | Middle American | H. | Japan | L. | Kermadec |

Expert Solution & Answer

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

schedule09:03

Students have asked these similar questions

what are your thoughts on the critical importance of soil management and its impact on agricultural productivity and environmental health, and role of conservation tillage. write in first person

Five arguments that the Water Bottle Bill was passed as a means of "revenue" enhancement

In developing your arguments you should start at the website of the Connecticut State Library which contains the history of all legislation passed by the Connecticut

Legislature http://ctstatelibrary.org/leghistory_ to gather the information for your arguments.

use references

Describe the importance of recycling household solid wastes

Chapter 3 Solutions

Applications and Investigations in Earth Science (9th Edition)

Ch. 3.1 - Using an atlas or Figure 3.11 for reference, draw...Ch. 3.1 - Use an atlas or your textbook to label the...Ch. 3.2 - Does Figure 3.3A represent a convergent or...Ch. 3.2 - Does Figure 3.38 represent a convergent,...Ch. 3.2 - Does Figure 3.3e represent a convergent,...Ch. 3.3A - Examine the east coast of South America and the...Ch. 3.3A - Examine the east coast of South America and the...Ch. 3.3A - On separate pieces of tracing paper, sketch the...Ch. 3.3B - Using the same two pieces of tracing paper you...Ch. 3.3B - Reassemble the two continents as you did in...

Ch. 3.5 - Figure 3.8 illustrates an idealized distribution...Ch. 3.5 - Figure 3.8 illustrates an idealized distribution...Ch. 3.5 - On Figure 3.8, outline the zone of earthquakes.Ch. 3.5 - Draw a line on Figure 3.8 at a depth of 100...Ch. 3.5 - The elastic rebound theory predicts that...Ch. 3.6 - How many intervals3, 5, or 7of reverse polarity...Ch. 3.6 - Approximately how many years ago did the current...Ch. 3.6 - Did Earth experience normal or reverse polarity...Ch. 3.6 - Did the period of normal polarity, C, bigin 1, 2,...Ch. 3.6 - During the past 4 million years, has each interval...Ch. 3.6 - Based on the pattern of magnetic reversals shown...Ch. 3.7A - On Figure 3.10, identify and mark the periods of...Ch. 3.7A - Using the South Atlantic as an example, label the...Ch. 3.7A - Using the distance scale at the bottom of Figure...Ch. 3.7A - The distances you obtained in Question 3 are for...Ch. 3.7B - North Atlantic: distance =km100,000cm/km=cm Rate...Ch. 3.7B - Pacific: distance =km100,000cm/km=cm Rate of...Ch. 3.7C - Using Figure 3.2, measure the distance from Point...Ch. 3.7C - Divide the distance in centimeters separating the...Ch. 3.7C - Repeat the procedure above to determine the age of...Ch. 3.7C - Based on your answers to Questions 2 and 3, which...Ch. 3.8 - What are the minimum and maximum ages of the...Ch. 3.8 - What is the approximate distance in kilometers...Ch. 3.8 - Using the data in Questions 1 and 2, calculate the...Ch. 3 - The distribution of earthquakes defines the...Ch. 3 - Prob. 2LRCh. 3 - Prob. 3LRCh. 3 - Prob. 4LRCh. 3 - Prob. 5LRCh. 3 - Prob. 6LRCh. 3 - Prob. 7LRCh. 3 - Prob. 8LRCh. 3 - Complete the block: diagrams in Figure 3.12 to...Ch. 3 - Prob. 10LRCh. 3 - List and explain two lines of evidence from this...

Additional Science Textbook Solutions

Find more solutions based on key concepts

5. When the phenotype of heterozygotes is intermediate between the phenotypes of the two homozygotes, this patt...

Biology: Life on Earth (11th Edition)

58. Is each compound soluble or insoluble? For the soluble compounds, identify the ions present in solution.

a....

Introductory Chemistry (6th Edition)

Choose the best answer to each of the following. Explain your reasoning. Two stars that are in the same constel...

Cosmic Perspective Fundamentals

10. FIGURE EX1.10 shows two dots of a motion diagram and vector1. Copy this figure, then add dot 3 and the next...

Physics for Scientists and Engineers: A Strategic Approach, Vol. 1 (Chs 1-21) (4th Edition)

Two culture media were inoculated with four different bacteria. After incubation, the following results were ob...

Microbiology: An Introduction

Arrange the following atoms and ions in order of increasing ionic radius: F, S2-, Cl, and Se2-.

F < S2- < Cl <...

Chemistry: The Central Science (14th Edition)

Knowledge Booster

Similar questions

- Why is food waste a growing concern? Describe how some communities are addressing the food waste issue.arrow_forwardDescribe examples of source reductionarrow_forwardIncineration of solid waste is controversial. Do you support solid waste incineration in general?Would you support an incineration facility in your neighborhood?arrow_forward

- Describe why electronic waste is becoming a major problem.arrow_forwardHow does Gateway Community College or Norwalk, CT deal with solid waste? Can solid waste production be limited at your institution or city? How? What barriers exist that might make it difficult to limit solid waste production?arrow_forwardIt is possible to have a high standard of living, as in North America and Western Europe, and not produce large amounts of solid waste. How?arrow_forward

- IM 4G III. > Homework 1 ۲:۱۱ ٢ من ٣ Contouring (EXERCISES) Contour the following data and complete the two profiles .0 3 16 25 2117 12 2 .° 15 O 25 35 5 11 .41 20 18 31 43 16 15 4342 19 21 29 40 .30 13 12 .0 5 29 12 19 2 22 +4 15 2 110 9 D .º B' Turtle Island 0arrow_forward1. What is the contour interval of this map?Contour interval: ____ feet 2. What is the difference in elevation from one index contour to the next?Difference in elevation:____feet 3. On most quadrangles, each section is numbered in red and outlined in red or, occasionally, dashed black lines. Find Section 9, located near the center of the map, and measure its width and length in milesusing the bar scale provided.Sections are _____ miles(s) wide and ____mile(s) long 4. Locate the small intermittent stream (blue dashed line) just below the red number 9 that denotes Section 9. Toward what general direction does the stream flow? Explain how you arrived at your answer.Direction of stream flow: ____Explain: ______ 5. What is the approximate elevation of the point marked with an X in Section 8?Elevation of X _____ feet 6. What is the approximate relief between point X and the surface of Turquoise Lake?Relief:____feet 7. Which of the following phrases best describes the topography of Tennessee…arrow_forward1. The difference in elevation between adjacent contour lines is called the contour interval. Look at the bottom of this map to identify the contour interval.Contour interval: ________ 2. What is the difference in elevation between Points A and B?Difference in elevation: _____ feet 3. Notice that every fifth contour line, called an index contour, is printed as a bold brown line, and the elevation of that line is provided (in feet). List the elevations for each index contour shown on this map._____________ feet, ___________ feet,___________feet 4. Closely spaced contours indicate steep slopes. Which of the four slopes shown with red arrows labeled 1-4 is the steepest? Which is the least steep?Steepest: _______Least steep: _____ 5. One or more roughly circular closed contours indicate a hill. Which of the landforms labeled B-E are hills?Hill landforms: ______ 6. Closed contours with hachures (short lines) that point downslope indicate depressions (basins without outlets). Which of the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Applications and Investigations in Earth Science ...Earth ScienceISBN:9780134746241Author:Edward J. Tarbuck, Frederick K. Lutgens, Dennis G. TasaPublisher:PEARSON

Applications and Investigations in Earth Science ...Earth ScienceISBN:9780134746241Author:Edward J. Tarbuck, Frederick K. Lutgens, Dennis G. TasaPublisher:PEARSON Exercises for Weather & Climate (9th Edition)Earth ScienceISBN:9780134041360Author:Greg CarbonePublisher:PEARSON

Exercises for Weather & Climate (9th Edition)Earth ScienceISBN:9780134041360Author:Greg CarbonePublisher:PEARSON Environmental ScienceEarth ScienceISBN:9781260153125Author:William P Cunningham Prof., Mary Ann Cunningham ProfessorPublisher:McGraw-Hill Education

Environmental ScienceEarth ScienceISBN:9781260153125Author:William P Cunningham Prof., Mary Ann Cunningham ProfessorPublisher:McGraw-Hill Education Earth Science (15th Edition)Earth ScienceISBN:9780134543536Author:Edward J. Tarbuck, Frederick K. Lutgens, Dennis G. TasaPublisher:PEARSON

Earth Science (15th Edition)Earth ScienceISBN:9780134543536Author:Edward J. Tarbuck, Frederick K. Lutgens, Dennis G. TasaPublisher:PEARSON Environmental Science (MindTap Course List)Earth ScienceISBN:9781337569613Author:G. Tyler Miller, Scott SpoolmanPublisher:Cengage Learning

Environmental Science (MindTap Course List)Earth ScienceISBN:9781337569613Author:G. Tyler Miller, Scott SpoolmanPublisher:Cengage Learning Physical GeologyEarth ScienceISBN:9781259916823Author:Plummer, Charles C., CARLSON, Diane H., Hammersley, LisaPublisher:Mcgraw-hill Education,

Physical GeologyEarth ScienceISBN:9781259916823Author:Plummer, Charles C., CARLSON, Diane H., Hammersley, LisaPublisher:Mcgraw-hill Education,

Applications and Investigations in Earth Science ...

Earth Science

ISBN:9780134746241

Author:Edward J. Tarbuck, Frederick K. Lutgens, Dennis G. Tasa

Publisher:PEARSON

Exercises for Weather & Climate (9th Edition)

Earth Science

ISBN:9780134041360

Author:Greg Carbone

Publisher:PEARSON

Environmental Science

Earth Science

ISBN:9781260153125

Author:William P Cunningham Prof., Mary Ann Cunningham Professor

Publisher:McGraw-Hill Education

Earth Science (15th Edition)

Earth Science

ISBN:9780134543536

Author:Edward J. Tarbuck, Frederick K. Lutgens, Dennis G. Tasa

Publisher:PEARSON

Environmental Science (MindTap Course List)

Earth Science

ISBN:9781337569613

Author:G. Tyler Miller, Scott Spoolman

Publisher:Cengage Learning

Physical Geology

Earth Science

ISBN:9781259916823

Author:Plummer, Charles C., CARLSON, Diane H., Hammersley, Lisa

Publisher:Mcgraw-hill Education,