Corporate Finance Plus MyLab Finance with Pearson eText -- Access Card Package (4th Edition) (Berk, DeMarzo & Harford, The Corporate Finance Series)

4th Edition

ISBN: 9780134408897

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 30, Problem 12P

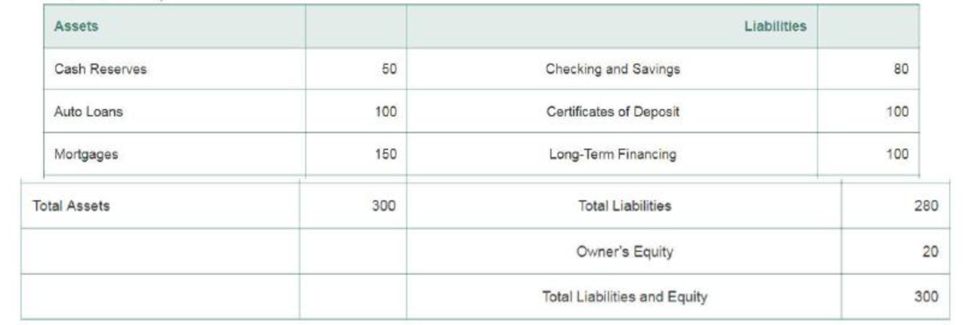

You have been hired as a risk manager for Acorn Savings and Loan. Currently, Acorn’s

When you analyze the duration of loans, you find that the duration of the auto loans is two years, while the mortgages have a duration of seven years. Both the cash reserves and the checking and savings accounts have a zero duration. The CDs have a duration of two years and the long-term financing has a 10-year duration.

- a. What is the duration of Acorn’s equity?

- b. Suppose Acorn experiences a rash of mortgage prepayments, reducing the size of the mortgage portfolio from $150 million to $100 million, and increasing cash reserves to $100 million. What is the duration of Acorn's equity now? If interest rates are currently 4% but fall to 3%, estimate the approximate change in the value of Acorn’s equity.

- c. Suppose that after the prepayments in part (b), but before a change in interest rates, Acorn considers managing its risk by selling mortgages and/or buying 10-year Treasury STRIPS (zero-coupon bonds). How many should the firm buy or sell to eliminate its current interest rate risk?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Commissions are usually charged when a right is exercised. a warrant is exercised. a right is sold. all of the above will have commissions A and B are correct, C is not correct

What is Exploratory Research Case Study?

What is the main purpose of Exploratory Research?

please help with how to solve this thank you.

Chapter 30 Solutions

Corporate Finance Plus MyLab Finance with Pearson eText -- Access Card Package (4th Edition) (Berk, DeMarzo & Harford, The Corporate Finance Series)

Ch. 30.1 - How can insurance add value to a firm?Ch. 30.1 - Prob. 2CCCh. 30.2 - Prob. 1CCCh. 30.2 - What are the potential risks associated with...Ch. 30.3 - How can firms hedge exchange rate risk?Ch. 30.3 - Prob. 2CCCh. 30.4 - How do we calculate the duration of a portfolio?Ch. 30.4 - How do firms manage interest rate risk?Ch. 30 - The William Companies (WMB) owns and operates...Ch. 30 - Genentechs main facility is located in South San...

Ch. 30 - Prob. 3PCh. 30 - Your firm faces a 9% chance of a potential loss of...Ch. 30 - BHP Billiton is the worlds largest mining firm....Ch. 30 - Prob. 6PCh. 30 - Prob. 7PCh. 30 - Prob. 9PCh. 30 - Prob. 10PCh. 30 - Prob. 11PCh. 30 - You have been hired as a risk manager for Acorn...Ch. 30 - Prob. 13PCh. 30 - Prob. 14P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Question 25 Jasmine bought a house for $225 000. She already knows that for the first $200 000, the land transfer tax will cost $1650. Calculate the total land transfer tax. (2 marks) Land Transfer Tax Table Value of Property Rate On the first $30 000 0% On the next $60 000 0.5% (i.e., $30 001 to $90 000) On the next $60 000 1.0% (i.e., $90 001 to $150 000) On the next $50 000 1.5% (i.e., $150 001 to $200 000) On amounts in excess of $200 000 2.0% 22 5000–200 000. 10 825000 2.5000.00 2 x 25000 =8500 2 maarrow_forwardQuestion 25 Jasmine bought a house for $225 000. She already knows that for the first $200 000, the land transfer tax will cost $1650. Calculate the total land transfer tax. (2 marks) Land Transfer Tax Table Value of Property Rate On the first $30 000 0% On the next $60 000 0.5% (i.e., $30 001 to $90 000) On the next $60 000 1.0% (i.e., $90 001 to $150 000) On the next $50 000 1.5% (i.e., $150 001 to $200 000) On amounts in excess of $200 000 2.0% 225000–200 000 = 825000 25000.002 × 25000 1= 8500 16 50+ 500 2 marksarrow_forwardSuppose you deposit $1,000 today (t = 0) in a bank account that pays an interest rate of 7% per year. If you keep the account for 5 years before you withdraw all the money, how much will you be able to withdraw after 5 years? Calculate using formula. Calculate using year-by-year approach. Find the present value of a security that will pay $2,500 in 4 years. The opportunity cost (interest rate that you could earn from alternative investments) is 5%. Calculate using the formula. Calculate using year-by-year discounting approach. Solve for the unknown in each of the following: Present value Years Interest rate Future value $50,000 12 ? $152,184 $21,400 30 ? $575,000 $16,500 ? 14% $238,830 $21,400 ? 9% $213,000 Suppose you enter into a monthly deposit scheme with Chase, where you have your salary account. The bank will deduct $25 from your salary account every month and the first payment (deduction) will be made…arrow_forward

- PowerPoint presentation of a financial analysis that includes the balance sheet, income statement, and statement of cash flows for Nike and Adidas. Your analysis should also accomplish the following: Include the last three years of data, and evaluate the trends in the data. Summarize the footnotes on each of the statements. Compute the earnings per share for the three years. Compare the two companies and determine the insights gathered from the trend analysis.arrow_forwardIn addition to the customer affairs department of the insurance company the insurance policy must identify which other following on the policy Name of the producer Current director of insurance Policyholder satisfaction rating for paying claims 4. Financial rating from a recognized financial rating servicearrow_forwardIn addition to the customer affairs department of the insurance company the insurance policy must identify which other following on the policy Name of the producer Current director of insurance Policyholder satisfaction rating for paying claims D. Financial rating from a recognized financial rating servicearrow_forward

- Unearned premium refunds for insurance policies cancelled when an insurance company is covered by the Illinois Insurance guaranty fund is subject to a MAXIMUM premium refund of what amount? A.$ 100.00 B.$ 1000.00 C.$10,000.00 D.$ 100,000.00arrow_forwardBefore the department of insurance can issue an order charging an insurance company with improper claims practices, they must first: Review the company's financial statement on file with the department Determine that the practice has been done with such frequency as to indicate a business practice Contact the company's competitors to determine if they know how the company operates Contact the NAIC to determine if the company is on the watch listarrow_forwardthe last three (3) years of the EPS and a summary of the footnotes for Nike and Adidas.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

What is a mortgage; Author: Kris Krohn;https://www.youtube.com/watch?v=CFjY-58ooi0;License: Standard YouTube License, CC-BY

Topic 10 Accounting for Liabilities Mortgage Payable; Author: Accounting Thinker;https://www.youtube.com/watch?v=EPJOphrbArM;License: Standard YouTube License, CC-BY