Bundle: Financial Management: Theory and Practice, Loose-leaf Version, 15th + Aplia, 1 term Printed Access Card

15th Edition

ISBN: 9781337130295

Author: Eugene F. Brigham, Michael C. Ehrhardt

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 8P

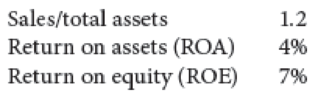

Assume you are given the following relationships for the Haslam Corporation:

Calculate Haslam’s profit margin and liabilities-to-assets ratio. Suppose half its liabilities are in the form of debt. Calculate the debt-to-assets ratio.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What do the following ratios reveal about the financial health of a company? And how do I calculate them?

Long-Term Debt-paying Ability

Debt Ratio

Debt-equity Ratio

Times Interest Earned

Which of the following shows the percentage of profit remaining after deducting cost of sales?( On ur own pls)

Horizontal Analysis

Debt-to-Equity Ratio

Gross Profit Margin

Net Profit Margin

Write the formula for the following ratios and what each ratio measures:

Debt-to-assets ratio

Asset to Shareholders’ Equity (also called “equity multiplier” )

Interest coverage ratio (also called “times interest earned”)

Chapter 3 Solutions

Bundle: Financial Management: Theory and Practice, Loose-leaf Version, 15th + Aplia, 1 term Printed Access Card

Ch. 3 - Define each of the following terms:

Liquidity...Ch. 3 - Financial ratio analysis is conducted by managers,...Ch. 3 - Over the past year, M. D. Ryngaert Co. has...Ch. 3 - Profit margins and turnover ratios vary from one...Ch. 3 - How might (a) seasonal factors and (b) different...Ch. 3 - Why is it sometimes misleading to compare a...Ch. 3 - Greene Sisters has a DSO of 20 days. The company’s...Ch. 3 - Vigo Vacations has $200 million in total assets,...Ch. 3 - Winston Watchs stock price is 75 per share....Ch. 3 - Reno Revolvers has an EPS of $1.50, a free cash...

Ch. 3 - Needham Pharmaceuticals has a profit margin of 3%...Ch. 3 - Gardial Son has an ROA of 12%, a 5% profit...Ch. 3 - Ace Industries has current assets equal to 3...Ch. 3 - Assume you are given the following relationships...Ch. 3 - Prob. 9PCh. 3 - Prob. 10PCh. 3 - Complete the balance sheet and sales information...Ch. 3 - The Kretovich Company had a quick ratio of 1.4, a...Ch. 3 - Prob. 13PCh. 3 - Prob. 14PCh. 3 - Prob. 1MCCh. 3 - Prob. 2MCCh. 3 - Prob. 3MCCh. 3 - Prob. 5MCCh. 3 - Prob. 6MCCh. 3 - Prob. 8MCCh. 3 - Prob. 9MCCh. 3 - Prob. 10MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following statement is correct? Select one: O a. Return on assets is the ratio of net income after interest expense to total assets O b. All options are correct statement C. Average collection period is the average number of times it takes for the company's customers to pay their bills o d. Increase in the debt ratio indicate more reliance on debt as a source of financingarrow_forwardI’m trying to do the debt to equity ratio. I understand that is total liabilities divided by stockholders equity. What would be my liability for the equation? Accounts receivable Inventory Net sales Cost of goods sold Total assets Total stockholders equity Net income arrow_forwardProfit volume ratio is similar to which of the following ratios? Debtors' turnover ratio Operating Ratio Current ratio Net profit ratioarrow_forward

- Using the statements provided Calculate the following liquidity ratios: Current ratio Quick ratio Calculate the following asset management ratios: Average collection period Inventory turnover Fixed asset turnover Total asset turnover Calculate the following financial leverage ratios Debt to equity ratio Long-term debt to equity Calculate the following profitability ratios: Gross profit margin Net profit margin Return on assets Return on stockholders’ equity For example: you should present it like the text, or as:Gross margin = 1,933 divided by 8,689 = 22.2% A competitor of ACME has for the same time period reported the following three ratios: Current ratio 1.52Long-term debt to equity .25 or 25%Net profit margin .08 or 8% Given these three ratios only which company is performing better on each ratio? Also overall who would you say has the best financial performance and position. Support your answer.arrow_forwardWhat are two ratios indicating how well the company manages its debt ?.arrow_forwardIt indicates the proportion of debt in relation to resources provided by the owners, a. Debt -to-equity ratio b. Debt ratio c. Equity ratio d. Operating profit marginarrow_forward

- Which one of the following is the best indicator of long-term debt paying ability? A)Working capital turnover. B)Asset turnover. C)Current ratio. D)Debt to total assets ratio.arrow_forwardCalculate the projected debt ratio, debt-to-equity ratio, liabilities-to-assets ratio, times-interest-earned ratio, and EBITDA coverage ratios. How does Computron compare with the industry with respect to financial leverage? What can you conclude from these ratios?arrow_forwardWhat are the two most common receivables ratios, and what do these ratios tell a stakeholder about the company?arrow_forward

- Which of the following ratios is used to measure a firms profitability? a. Liabilities Ă· Equity c. Sales Ă· Assets b. Assets Ă· Equity d. Net Income Ă· Net Salesarrow_forwardGive examples of Profitability Ratios from a company's financial statement, and how such profitability ratios are computed, and interpreted. As many Profitability ratios as possible.arrow_forwardCalculate the following ratios based on the balance sheet, income statement and cash flow prepared in question ROE Return on Capital Employed (post-tax) Net Profit Margin EBITDA Margin Effective Tax Rate Operating Cost Ratio Gross Profit Margin Total Asset Turnover Ratio Fixed Asset Turnover Ratio Receivables Turnover Ratio Leverage Ratio [Avg. Total Assets / Avg. Total Equity] FCF / EBITDA Interest Coverage Ratio Debt Service Coverage Ratio Basic EPS (Assume Face Value of each share is INR 10) Debt : Equity Ratio Income Statement (INR Cr) Units Mar/14 Saleable Units 4,570 Revenues Gross Revenues INR Cr 2,116 Less: Environment Cess INR Cr 5 Net Revenues INR Cr 2,121 Growth (%) -1.9% Expenses O&M Expenses (% of Project Costs) INR Cr 146 YoY Escalation 5.72% EBITDA INR Cr 1,974 Margin (%) 93.1% Book Depreciation INR Cr 439 Interest Expenses INR…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License