COLLEGE ACCOUNTING W/ ACCESS >BI<

13th Edition

ISBN: 9780357531822

Author: Scott

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 7E

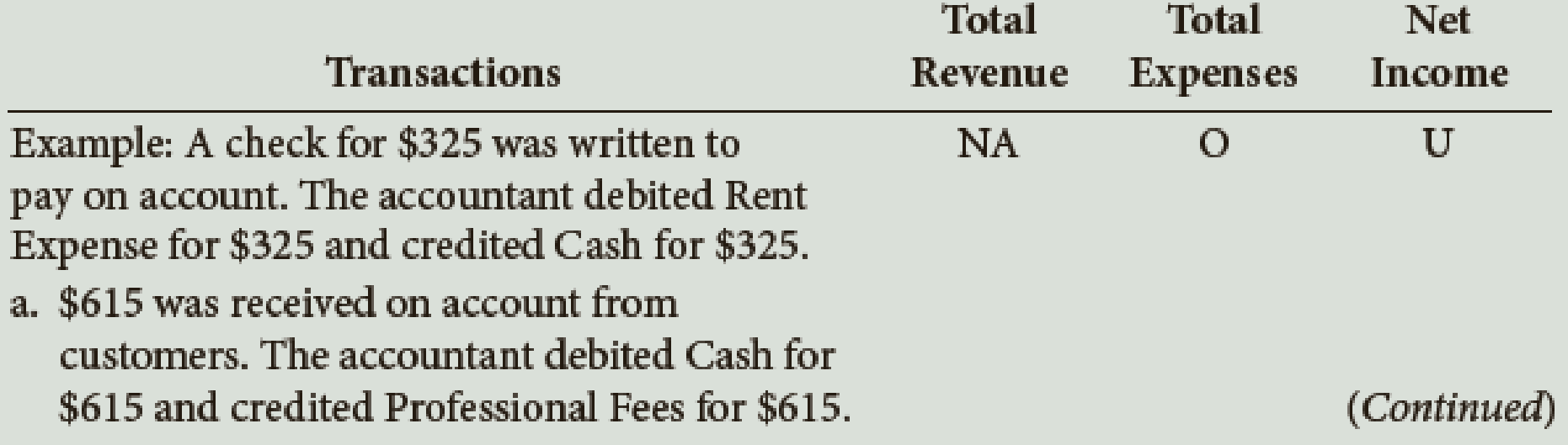

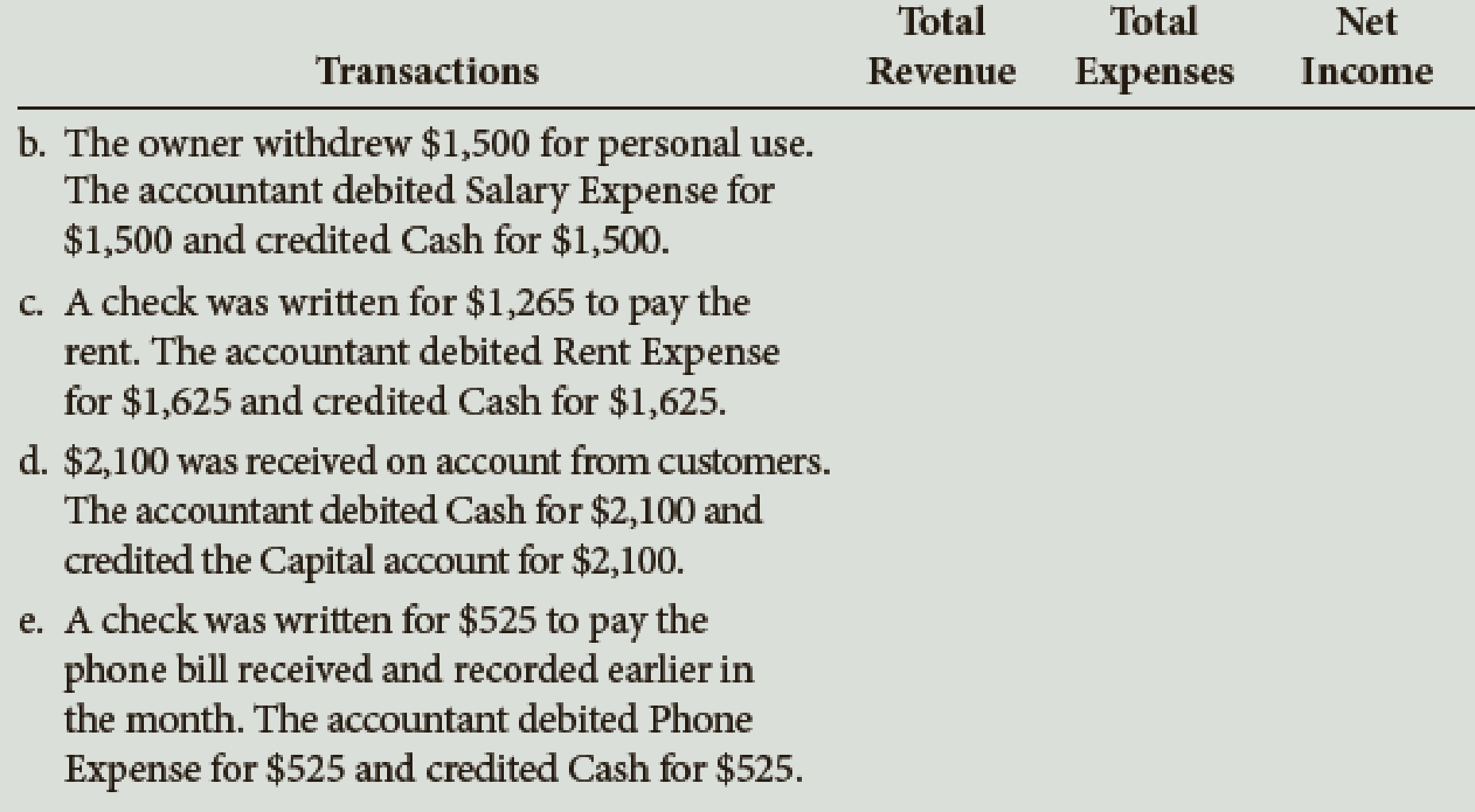

Determine the effect of the following errors on a company’s total revenue, total expenses, and net income. Indicate the effect by writing O for Overstated (too much), U for Understated (too little), or NA for Not Affected.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Financial accounting questions

General Accounting

Need help with this general accounting question

Chapter 3 Solutions

COLLEGE ACCOUNTING W/ ACCESS >BI<

Ch. 3 - A __________ is a book in which business...Ch. 3 - Transferring information from the journal to the...Ch. 3 - For a journal entry to be complete, it must...Ch. 3 - The __________ is used to determine where the...Ch. 3 - Prob. 5QYCh. 3 - A 250 payment for salaries expense was incorrectly...Ch. 3 - Prob. 1DQCh. 3 - How does the journal differ from the ledger?Ch. 3 - What is the purpose of providing a ledger account...Ch. 3 - List by account classification the order of the...

Ch. 3 - Arrange the following steps in the posting process...Ch. 3 - Prob. 6DQCh. 3 - Prob. 7DQCh. 3 - In the following two-column journal, the capital...Ch. 3 - Decor Services completed the following...Ch. 3 - Montoya Tutoring Service completed the following...Ch. 3 - Prob. 4ECh. 3 - Arrange the following steps in the posting process...Ch. 3 - The bookkeeper for Nevado Company has prepared the...Ch. 3 - Determine the effect of the following errors on a...Ch. 3 - Journalize correcting entries for each of the...Ch. 3 - The chart of accounts of the Barnes School is...Ch. 3 - Laras Landscaping Service has the following chart...Ch. 3 - Following is the chart of accounts of Sanchez...Ch. 3 - The chart of accounts of Ethan Academy is shown...Ch. 3 - Leanders Landscaping Service maintains the...Ch. 3 - Following is the chart of accounts of Smith...Ch. 3 - Why Does It Matter? ECOTOUR EXPEDITIONS, INC.,...Ch. 3 - What Would You Say? You are the new bookkeeper for...Ch. 3 - What Do You Think? You work as an accounting...Ch. 3 - What Would You Do?

You are responsible for...Ch. 3 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

Which of the following is a primary activity in the value chain?

purchasing

accounting

post-sales service

human...

Accounting Information Systems (14th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

10-10 What challenges do managers face in managing global teams? How should those challenges be handled?

Fundamentals of Management (10th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A customer has requested that Astral Manufacturing fill a special order for.... Please answer the general accounting questionarrow_forwardGood Times Restaurant estimates the following costs for next year: fixed costs $120,000, variable cost per meal $15. If they want to earn a profit of $90,000 and charge $35 per meal, calculate the required number of meals. No WRONG ANSWERarrow_forwardAnswer? ? Financial accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License