PAYROLL ACCT.,2019 ED.(LL)-TEXT

19th Edition

ISBN: 9781337619783

Author: BIEG

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 6PB

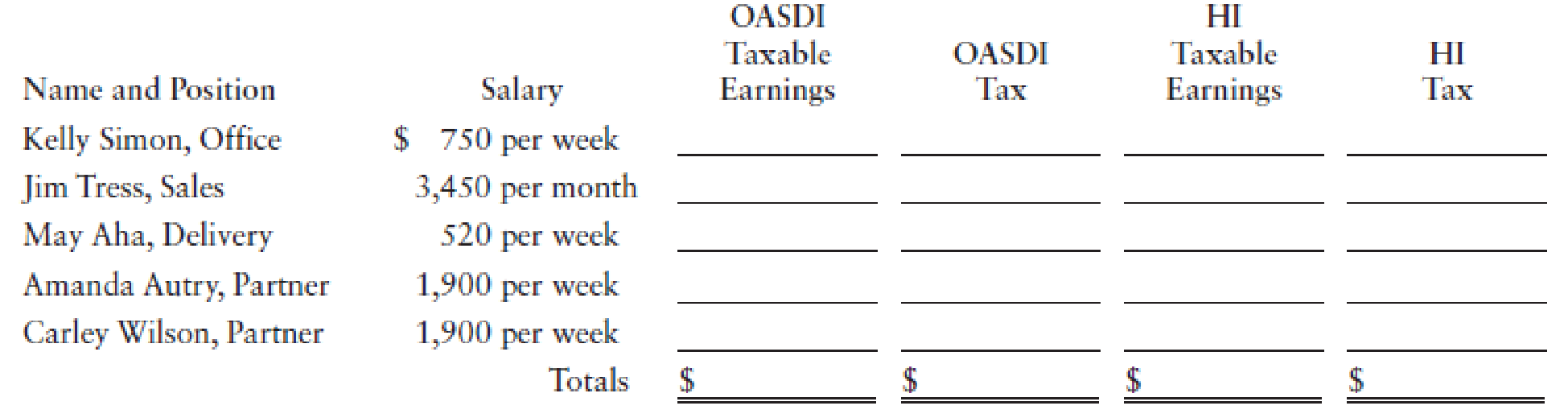

Amanda Autry and Carley Wilson are partners in A & W Gift Shop, which employs the individuals listed below. Paychecks are distributed every Friday to all employees. Based on the information given, compute the amounts listed below for a weekly payroll period.

Employer’s OASDI Tax $ ________

Employer’s HI Tax $ ________

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

I need assistance with this financial accounting question using appropriate principles.

Please help me solve this financial accounting problem with the correct financial process.

Can you explain the process for solving this financial accounting problem using valid standards?

Chapter 3 Solutions

PAYROLL ACCT.,2019 ED.(LL)-TEXT

Ch. 3 - Which of the following are covered by FICA...Ch. 3 - Prob. 2SSQCh. 3 - Prob. 3SSQCh. 3 - Lori Kinmark works as a jeweler for a local...Ch. 3 - _____1. Johnson Industries, a semiweekly...Ch. 3 - _____1. Employees FICA tax rates A. Severance pay...Ch. 3 - For social security purposes, what conditions must...Ch. 3 - Prob. 2QRCh. 3 - Prob. 3QRCh. 3 - Prob. 4QR

Ch. 3 - What are an employers responsibilities for FICA...Ch. 3 - Prob. 6QRCh. 3 - Prob. 7QRCh. 3 - Prob. 8QRCh. 3 - Prob. 9QRCh. 3 - Prob. 10QRCh. 3 - Prob. 11QRCh. 3 - Prob. 12QRCh. 3 - Prob. 13QRCh. 3 - Prob. 14QRCh. 3 - Prob. 15QRCh. 3 - During the year, employee Sean Matthews earned...Ch. 3 - In order to improve the cash flow of the company,...Ch. 3 - Prob. 3QDCh. 3 - Prob. 4QDCh. 3 - The biweekly taxable wages for the employees of...Ch. 3 - During 2019, Rachael Parkins, president of...Ch. 3 - Prob. 3PACh. 3 - Ken Gorman is a maitre d at Carmel Dinner Club. On...Ch. 3 - In 20-- the annual salaries paid each of the...Ch. 3 - Audrey Martin and Beth James are partners in the...Ch. 3 - Prob. 7PACh. 3 - Ralph Henwood was paid a salary of 64,600 during...Ch. 3 - Empty Fields Company pays its salaried employees...Ch. 3 - The monthly and hourly wage schedule for the...Ch. 3 - Prob. 11PACh. 3 - Prob. 12PACh. 3 - Prob. 13PACh. 3 - During the third calendar quarter of 20--, Bayview...Ch. 3 - Prob. 15PACh. 3 - Prob. 16PACh. 3 - Prob. 17PACh. 3 - Prob. 1PBCh. 3 - During 2019, Matti Conner, president of Maggert...Ch. 3 - Prob. 3PBCh. 3 - Moisa Evans is a maitre d at Red Rock Club. On...Ch. 3 - In 20-- the annual salaries paid each of the...Ch. 3 - Amanda Autry and Carley Wilson are partners in A ...Ch. 3 - Prob. 7PBCh. 3 - George Parker was paid a salary of 74,700 during...Ch. 3 - Prob. 9PBCh. 3 - The monthly and hourly wage schedule for the...Ch. 3 - Prob. 11PBCh. 3 - Prob. 12PBCh. 3 - Prob. 13PBCh. 3 - During the third calendar quarter of 20--, the...Ch. 3 - Prob. 15PBCh. 3 - Prob. 16PBCh. 3 - Prob. 17PBCh. 3 - Your assistant has just completed a rough draft of...Ch. 3 - Prob. 2CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forwardI am trying to find the accurate solution to this financial accounting problem with appropriate explanations.arrow_forward

- I need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forwardI need help with this financial accounting problem using proper accounting guidelines.arrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardWhen incorporating his sole proprietorship, Joe transfers all of its assets and liabilities. Included in the $30,000 of liabilities assumed by the corporation is $500 that relates to a personal expenditure. Under these circumstances, the entire $30,000 will be treated as boot. / Provide explanation please a. True b. Falsearrow_forward

- In determining whether § 357(c) applies, assess whether the liabilities involved exceed the bases of all assets a shareholder transfers to the corporation./ Provide explanation please. a. True b. Falsearrow_forwardI will unhelpful if wrong.arrow_forwardplease don't solve using wrong values i will mark as unhelpful.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes; Author: Whats Up Dude;https://www.youtube.com/watch?v=fzK3KDDYCQw;License: Standard Youtube License