1.

Calculate the regular earnings for the weekly payroll ended December 13, 2019.

1.

Explanation of Solution

Calculate the regular earnings for the weekly payroll ended December 13, 2019.

Step 1: Calculate the annual salary of Employee LR, Employee RB and Employee GL.

| Employee | Monthly salary (A) | Annual salary (A×12months) |

| Employee JR | $7,280 per month | $87,360.00 |

| Employee OJ | $5,265 per month | $63,180.00 |

| Employee MK | $3,400 per month | $40,800.00 |

Table (1)

Step 2: Calculate the regular earnings of each employees.

| Employee | Annual salary (A) | Regular Weekly earnings |

| Employee WH | $99,840.00 | $1,920.00 |

| Employee PB | $96,200.00 | $1,850.00 |

| Employee JR | $87,360.00 | $1,680.00 |

| Employee OJ | $63,180.00 | $1,215.00 |

| Employee MK | $40,800.00 | $784.62 |

| Total | $387,380.00 | $7,449.62 |

Table (2)

Thus, the total regular earnings for the weekly payroll ended December 13, 2019 is $7,449.62

2.

Calculate the overtime earnings if any applicable to any employee.

2.

Explanation of Solution

Calculate the overtime earnings for Employee GL.

| Employee | Weekly earnings (A) | Regular hourly rate (B) |

Overtime hourly rate (C) |

Overtime earnings (D) |

| Employee MK | $784.62 | $19.62 | $29.42 | $176.54 |

Table (3)

Thus, the overtime earnings for Employee GL is $176.54.

3.

Calculate the total regular, overtime earnings and bonus.

3.

Explanation of Solution

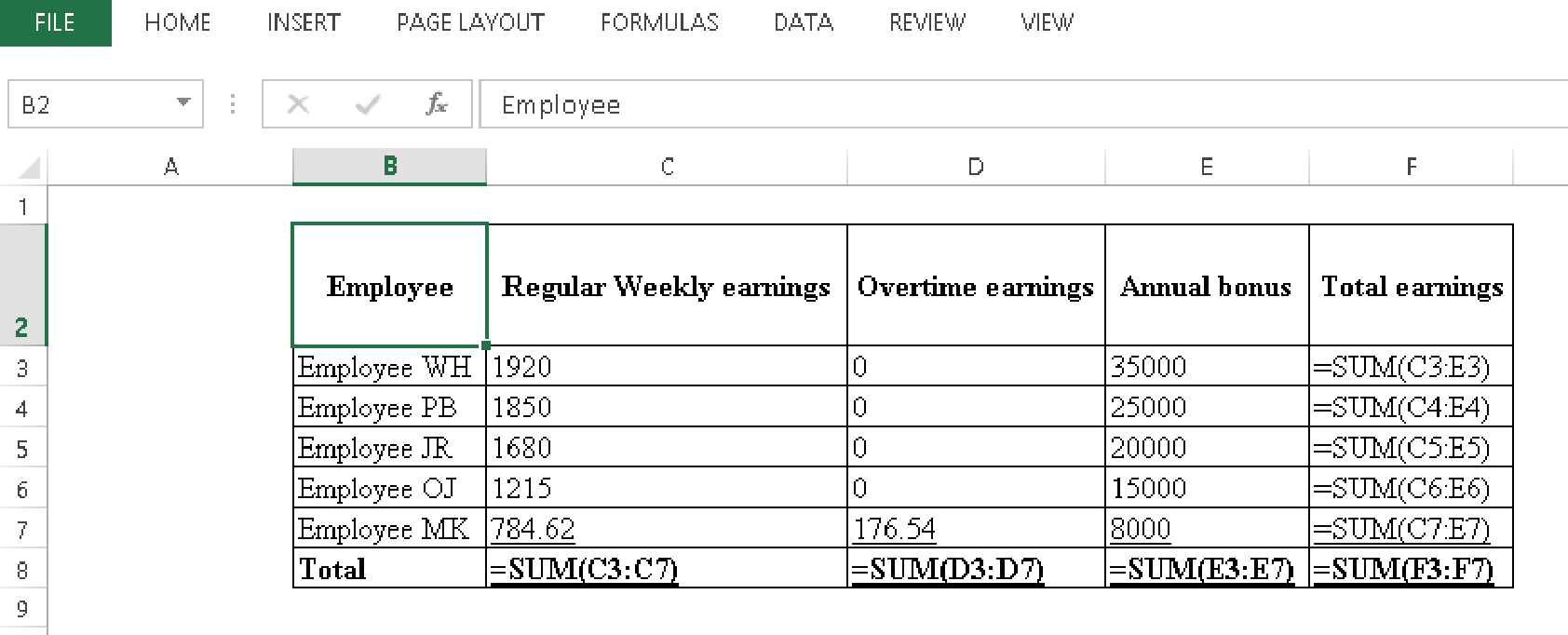

Calculate the total regular, overtime earnings and bonus.

| Employee | Regular Weekly earnings | Overtime earnings | Annual bonus | Total earnings |

| Employee WH | $1,920.00 | $0.00 | $35,000 | $36,920.00 |

| Employee PB | $1,850.00 | $0.00 | $25,000 | $26,850.00 |

| Employee JR | $1,680.00 | $0.00 | $20,000 | $21,680.00 |

| Employee OJ | $1,215.00 | $0.00 | $15,000 | $16,215.00 |

| Employee MK | $784.62 | $176.54 | $8,000 | $8,961.16 |

| Total | $7,449.62 | $176.54 | $103,000 | $110,626.16 |

Table (4)

Calculation for total regular, overtime earnings and bonus is as follows.

Table (5)

4 and 5.

Calculate the FICA taxable wages for this period and FICA taxes to be withheld for this period.

4 and 5.

Explanation of Solution

Calculate the FICA taxable wages for this period and FICA taxes to be withheld for this period.

| Cumulative earnings as of Last Pay Period | FICA Taxable Wages This Pay Period | FICA Taxes to be Withheld | Employees | ||

| OASDI (A) | HI (B) | OASDI | HI | ||

| $94,080.00 | $36,920.00 | $36,920.00 | $2,289.04 | $535.34 | Employee WH |

| $90,650.00 | $26,850.00 | $26,850.00 | $1,664.70 | $389.33 | Employee PB |

| $82,332.00 | $21,680.00 | $21,680.00 | $1,344.16 | $314.36 | Employee JR |

| $59,535.00 | $16,215.00 | $16,215.00 | $1,005.33 | $235.12 | Employee OJ |

| $38,446.38 | $8,961.16 | $8,961.16 | $555.59 | $129.94 | Employee MK |

| $110,626.16 | $110,626.16 | $6,858.82 | $1,604.08 | Totals | |

Table (6)

Step 3: Calculate the employer’s portion of the FICA taxes for the week ended.

Calculate the OASDI taxes.

Calculate the HI taxes.

Calculate the total FICA taxes.

Want to see more full solutions like this?

Chapter 3 Solutions

PAYROLL ACCT.,2019 ED.(LL)-TEXT

- Can you solve this general accounting problem using accurate calculation methods?arrow_forwardBlackwell Retail Corporation has experienced significant growth in the past fiscal year, with gross sales totaling $2,750,000. However, the company's records show that customers returned merchandise worth $175,000, and they provided a 4% early payment discount on $1,400,000 of their sales after accounting for returns. As the newly appointed financial analyst, your manager has asked you to calculate the net sales figure that should appear on the income statement for accurate financial reporting and investor communication. What is Blackwell Retail Corporation's net sales for the fiscal year?arrow_forwardFinancial Accountingarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning