FINANCIAL ACCOUNTING

15th Edition

ISBN: 9781337885928

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 6PB

At the end of August, the first month of operations, the following selected data were taken from the financial statements of Tucker Jacobs, an attorney:

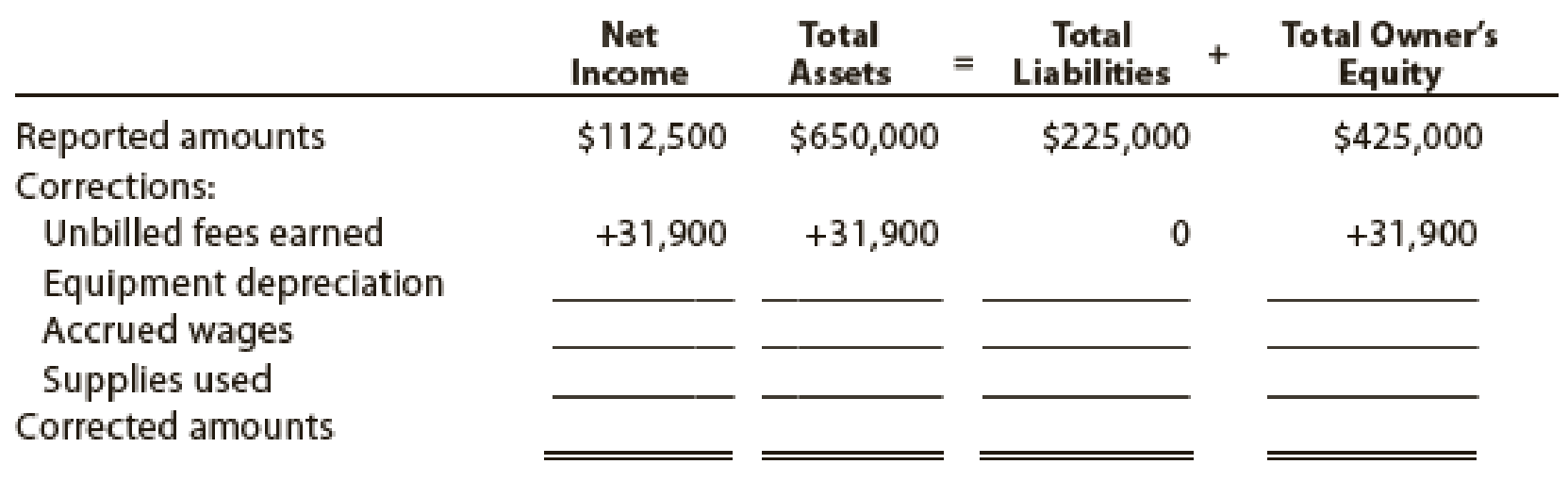

In preparing the financial statements, adjustments for the following data were overlooked:

- • Unbilled fees earned at August 31, $31,900.

- •

Depreciation of equipment for August, $7,500. - • Accrued wages at August 31, $5,200.

- • Supplies used during August, $3,000.

Instructions

- 1.

Journalize the entries to record the omitted adjustments. - 2. Determine the correct amount of net income for August and the total assets, liabilities, and owner’s equity at August 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The first adjustment is presented as an example.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the value of the ending inventory for the year?

Get correct answer with accounting

Please provide the solution to this financial accounting question with accurate financial calculations.

Chapter 3 Solutions

FINANCIAL ACCOUNTING

Ch. 3 - How are revenues and expenses reported on the...Ch. 3 - Is the matching concept related to (a) the cash...Ch. 3 - Why are adjusting entries needed at the end of an...Ch. 3 - What is the difference between adjusting entries...Ch. 3 - Identify the four different categories of...Ch. 3 - If the effect of the debit portion of an adjusting...Ch. 3 - Prob. 7DQCh. 3 - Does every adjusting entry affect net income for a...Ch. 3 - Prob. 9DQCh. 3 - Prob. 10DQ

Ch. 3 - Indicate with a Yes or No whether or not each of...Ch. 3 - Indicate with a Yes or No whether or not each of...Ch. 3 - Classify the following items as (1) prepaid...Ch. 3 - Classify the following items as (1) prepaid...Ch. 3 - At the end of the current year, 17,555 of fees...Ch. 3 - At the end of the current year, 23,570 of fees...Ch. 3 - Prospect Realty Co. pays weekly salaries of 27,600...Ch. 3 - We-Sell Realty Co. pays weekly salaries of 11,800...Ch. 3 - On June 1, 2019, Herbal Co. received 18,900 for...Ch. 3 - The balance in the unearned fees account, before...Ch. 3 - The prepaid insurance account had a beginning...Ch. 3 - The supplies account had a beginning balance of...Ch. 3 - The estimated amount of depreciation on equipment...Ch. 3 - Prob. 7PEBCh. 3 - For the year ending April 30, Urology Medical...Ch. 3 - For the year ending August 31, Mammalia Medical...Ch. 3 - For each of the following errors, considered...Ch. 3 - For each of the following errors, considered...Ch. 3 - Prob. 10PEACh. 3 - Prob. 10PEBCh. 3 - Classify the following items as (a) accrued...Ch. 3 - The following accounts were taken from the...Ch. 3 - At the end of the current year, 59,500 of fees...Ch. 3 - The adjusting entry for accrued fees was omitted...Ch. 3 - Garcia Realty Co. pays weekly salaries of 17,250...Ch. 3 - Prob. 6ECh. 3 - Accrued salaries owed to employees for October 30...Ch. 3 - Prob. 8ECh. 3 - The balance in the unearned fees account, before...Ch. 3 - At the end of January, the first month of the...Ch. 3 - The balance in the supplies account, before...Ch. 3 - The supplies and supplies expense accounts at...Ch. 3 - At August 31, the end of the first month of...Ch. 3 - The balance in the prepaid insurance account,...Ch. 3 - The prepaid insurance account had a balance of...Ch. 3 - The balance in the unearned fees account, before...Ch. 3 - Prob. 17ECh. 3 - The estimated amount of depreciation on equipment...Ch. 3 - The balance in the equipment account is 3,150,000,...Ch. 3 - In a recent balance sheet, Microsoft Corporation...Ch. 3 - For a recent period, the balance sheet for Costco...Ch. 3 - For a recent year, the balance sheet for The...Ch. 3 - The accountant for Healthy Life Company, a medical...Ch. 3 - If the net income for the current year had been...Ch. 3 - On December 31, a business estimates depreciation...Ch. 3 - The unadjusted and adjusted trial balances for...Ch. 3 - The accountant for Evas Laundry prepared the...Ch. 3 - Prob. 28ECh. 3 - Prob. 29ECh. 3 - Prob. 30ECh. 3 - On December 31, the following data were...Ch. 3 - Selected account balances before adjustment for...Ch. 3 - Milbank Repairs Service, an electronics repair...Ch. 3 - Good Note Company specializes in the repair of...Ch. 3 - Pitman Company is a small editorial services...Ch. 3 - At the end of April, the first month of...Ch. 3 - On May 31, the following data were accumulated to...Ch. 3 - Selected account balances before adjustment for...Ch. 3 - Crazy Mountain Outfitters Co., an outfitter store...Ch. 3 - The Signage Company specializes in the maintenance...Ch. 3 - Reece Financial Services Co., which specializes in...Ch. 3 - At the end of August, the first month of...Ch. 3 - The unadjusted trial balance that you prepared for...Ch. 3 - Chris P. Bacon is the chief accountant for CV...Ch. 3 - Daryl Kirby opened Squid Realty Co. on January 1,...Ch. 3 - Prob. 4CPCh. 3 - Several years ago, your brother opened Magna...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Yamamoto Corporation began the accounting period with $92,000 of merchandise, and the net cost of purchases was $318,000. A physical inventory showed $104,000 of merchandise unsold at the end of the period. The cost of goods sold by Yamamoto Corporation for the period is __.arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardGeneral accountingarrow_forward

- Please explain the solution to this financial accounting problem with accurate explanations.arrow_forwardPlease explain this financial accounting problem with accurate financial standards.arrow_forwardCan you demonstrate the accurate method for solving this financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY