Concept explainers

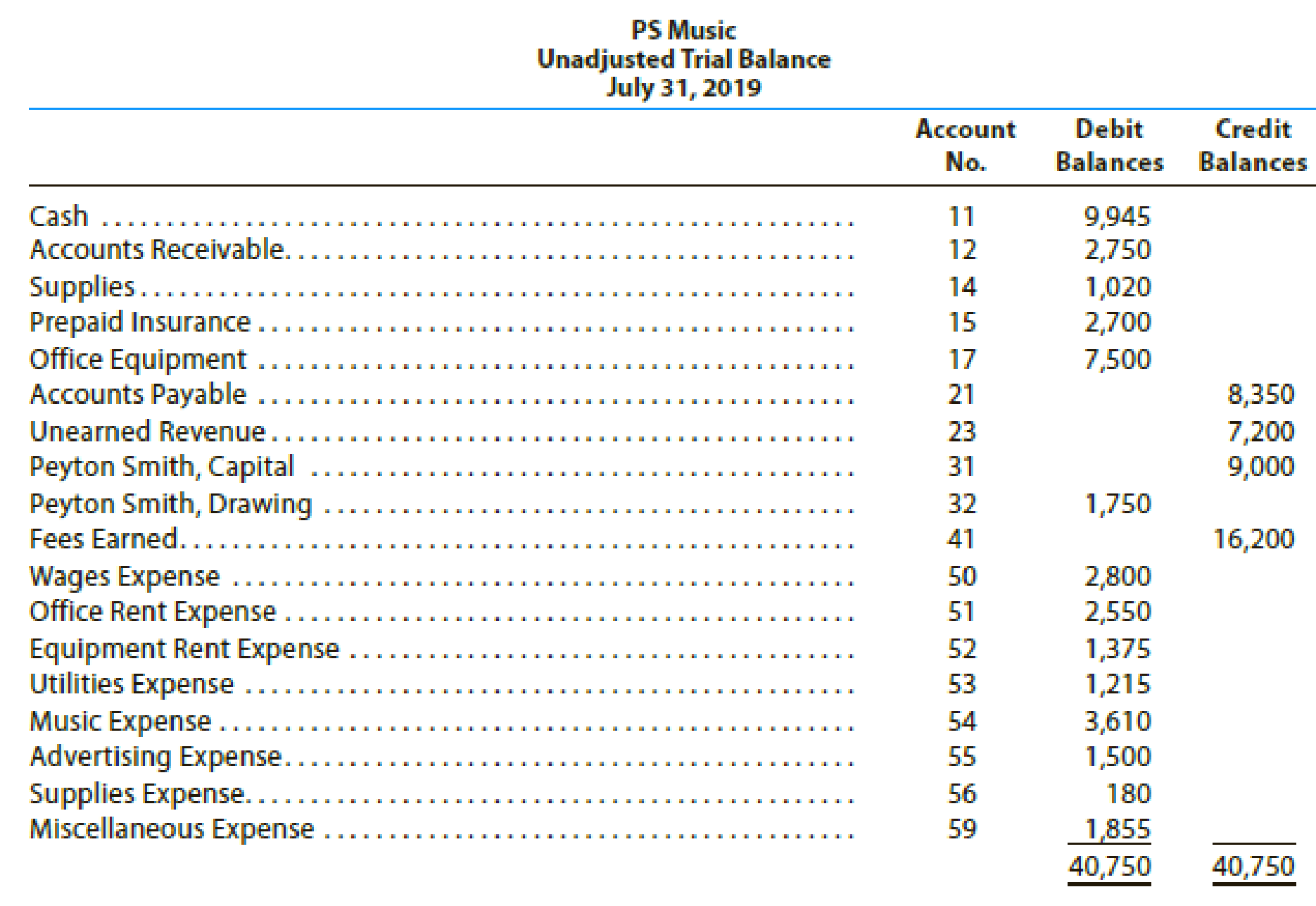

The unadjusted

The data needed to determine adjustments are as follows:

- • During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3 transaction at the end of Chapter 2.

- • Supplies on hand at July 31, $275.

- • The balance of the prepaid insurance account relates to the July 1 transaction in Chapter 2.

- •

Depreciation of the office equipment is $50. - • The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3 transaction in Chapter 2.

- • Accrued wages as of July 31 were $140.

Instructions

- 1. Prepare adjusting

journal entries. You will need the following additional accounts:

18

22 Wages Payable

57 Insurance Expense

58 Depreciation Expense

- 2.

Post the adjusting entries , inserting balances in the accounts affected. - 3. Prepare an adjusted trial balance.

(1)

Prepare adjusting entries in the books of Company PS at the end of the July 31, 2019.

Answer to Problem 1COP

Adjusting entries: Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. All adjusting entries affect at least one income statement account (revenue or expense), and one balance sheet account (asset or liability).

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and owners’ equities.

- Credit, all increase in liabilities, revenues, and owners’ equities, all decrease in assets, expenses.

T-account: T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

Adjusted trial balance: Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Adjusting entries

| Journal Page 18 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2019 | Accounts receivable | 12 | 1,400 | ||

| July | 31 | Fees earned (Working note 1) | 41 | 1,400 | |

| (To record the fees earned at the end of July) | |||||

| 31 | Supplies expense (Working note 2) | 56 | 745 | ||

| Supplies | 14 | 745 | |||

| (To record supplies expense incurred at the end of the July) | |||||

| 31 | Insurance expense (Working note 3) | 57 | 225 | ||

| Prepaid insurance | 15 | 225 | |||

| (To record insurance expense incurred at the end of the July) | |||||

| 31 | Depreciation expense | 58 | 50 | ||

| Accumulated depreciation-Office equipment | 18 | 50 | |||

| (To record depreciation expense incurred at the end of the July) | |||||

| 31 | Unearned revenue (Working note 4) | 23 | 3,600 | ||

| Fees earned | 41 | 3,600 | |||

| (To record the service performed to the customer at the end of the July) | |||||

| 31 | Wages expense | 50 | 140 | ||

| Wages payable | 22 | 140 | |||

| (To record wages expense incurred at the end of the July) | |||||

Table (1)

Explanation of Solution

Working note 1: Calculate the value of accrued fees during the July

Hence, fees earned during the July are $1,400.

Working note 2: Calculate the value of supplies expense

Hence, supplies expense during the July is $745.

Working note 3: Calculate the value of insurance expense

Hence, insurance expense during the July is $745.

Working note 4: Calculate the value of unearned fees at the end of the July

Hence, unearned fees at the end of the July are $3,600.

(2)

Post the adjusting entries to the ledger in the books of Company PS.

Explanation of Solution

Post the adjusting entries to the ledger account as follows:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 3,920 | |||

| 1 | 1 | 5,000 | 8,920 | ||||

| 1 | 1 | 1,750 | 7,170 | ||||

| 1 | 1 | 2,700 | 4,470 | ||||

| 2 | 1 | 1,000 | 5,470 | ||||

| 3 | 1 | 7,200 | 12,670 | ||||

| 3 | 1 | 250 | 12,420 | ||||

| 4 | 1 | 900 | 11,520 | ||||

| 8 | 1 | 200 | 11,320 | ||||

| 11 | 1 | 1,000 | 12,320 | ||||

| 13 | 1 | 700 | 11,620 | ||||

| 14 | 1 | 1,200 | 10,420 | ||||

| 16 | 2 | 2,000 | 12,420 | ||||

| 21 | 2 | 620 | 11,800 | ||||

| 22 | 2 | 800 | 11,000 | ||||

| 23 | 2 | 750 | 11,750 | ||||

| 27 | 2 | 915 | 10,835 | ||||

| 28 | 2 | 1,200 | 9,635 | ||||

| 29 | 2 | 540 | 9,095 | ||||

| 30 | 2 | 500 | 9,595 | ||||

| 31 | 2 | 3,000 | 12,595 | ||||

| 31 | 2 | 1,400 | 11,195 | ||||

| 31 | 2 | 1,250 | 9,945 | ||||

Table (2)

| Account: Accounts Receivable Account no. 12 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 1,000 | |||

| 2 | 1 | 1,000 | |||||

| 23 | 2 | 1,750 | 1,750 | ||||

| 30 | 2 | 1,000 | 2,750 | ||||

| 31 | Adjusting | 3 | 1,400 | 4,150 | |||

Table (3)

| Account: Supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 170 | |||

| 18 | 850 | 1,020 | |||||

| 31 | Adjusting | 745 | 275 | ||||

Table (4)

| Account: Prepaid Insurance Account no. 15 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | 1 | 2,700 | 2,700 | |||

| 31 | Adjusting | 3 | 225 | 2,475 | |||

Table (5)

| Account: Office equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 5 | 1 | 7,500 | 7,500 | |||

Table (6)

| Account: Accumulated Depreciation Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 31 | Adjusting | 3 | 50 | 50 | ||

Table (7)

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 250 | |||

| 3 | 1 | 250 | |||||

| 5 | 1 | 7,500 | 7,500 | ||||

| 18 | 2 | 850 | 8,350 | ||||

Table (8)

| Account: Wages Payable Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 31 | Adjusting | 3 | 140 | 140 | ||

Table (9)

| Account: Unearned revenue Account no. 23 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | 1 | 7,200 | 7,200 | |||

| 31 | Adjusting | 3 | 3,600 | 3,600 | |||

Table (10)

| Account: P’s capital Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 4,000 | |||

| 1 | 1 | 5,000 | 9,000 | ||||

Table (11)

| Account: P’s drawings Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 500 | |||

| 31 | 2 | 1,250 | 1,750 | ||||

Table (12)

| Account: Fees earned Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 6,200 | |||

| 11 | 1 | 1,000 | 7,200 | ||||

| 16 | 2 | 2,000 | 9,200 | ||||

| 23 | 2 | 2,500 | 11,700 | ||||

| 30 | 2 | 1,500 | 13,200 | ||||

| 31 | 2 | 3,000 | 16,200 | ||||

| 31 | Adjusting | 3 | 1,400 | 17,600 | |||

| 31 | Adjusting | 3 | 3,600 | 21,200 | |||

Table (13)

| Account: Wages expense Account no. 50 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 400 | |||

| 14 | 1 | 1,200 | 1,600 | ||||

| 28 | 2 | 1,200 | 2,800 | ||||

| 31 | Adjusting | 3 | 140 | 2,940 | |||

Table (14)

| Account: Office rent expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 800 | |||

| 1 | 1 | 1,750 | 2,550 | ||||

Table (15)

| Account: Equipment rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 675 | |||

| 13 | 1 | 700 | 1,375 | ||||

Table (16)

| Account: Utilities expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 300 | |||

| 27 | 2 | 915 | 1,215 | ||||

Table (17)

| Account: Music expense Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 1,590 | |||

| 21 | 2 | 620 | 2,210 | ||||

| 31 | 2 | 1,400 | 3,610 | ||||

Table (18)

| Account: Advertising expense Account no. 55 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 500 | |||

| 8 | 1 | 200 | 700 | ||||

| 22 | 2 | 800 | 1,500 | ||||

Table (19)

| Account: Supplies expense Account no. 56 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 180 | |||

| 31 | Adjusting | 3 | 745 | 925 | |||

Table (20)

| Account: Insurance expense Account no. 57 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 31 | Adjusting | 3 | 225 | 225 | ||

Table (21)

| Account: Depreciation expense Account no. 58 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 31 | Adjusting | 3 | 50 | 50 | ||

Table (22)

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| July | 1 | Balance | ✓ | 415 | |||

| 4 | 900 | 1,315 | |||||

| 29 | 540 | 1,855 | |||||

Table (23)

(3)

Prepare an adjusted trial balance of Company PS at July 31, 2019.

Explanation of Solution

Prepare an adjusted trial balance of Company PS at July 31, 2019 as follows:

| Company PS | |||

| Adjusted Trial Balance | |||

| July 31, 2019 | |||

| Particulars | AccountNo. | Debit $ | Credit $ |

| Cash | 11 | 9,945 | |

| Accounts receivable | 12 | 4,150 | |

| Supplies | 14 | 275 | |

| Prepaid insurance | 15 | 2,475 | |

| Office equipment | 17 | 7,500 | |

| Accumulated depreciation-Equipment | 18 | 50 | |

| Accounts payable | 21 | 8,350 | |

| Wages payable | 22 | 140 | |

| Unearned revenue | 23 | 3,600 | |

| P's capital | 31 | 9,000 | |

| P's drawings | 32 | 1750 | |

| Fees earned | 41 | 21,200 | |

| Wages expense | 50 | 2,940 | |

| Office rent expense | 51 | 2,550 | |

| Equipment rent expense | 52 | 1,375 | |

| Utilities expense | 53 | 1,215 | |

| Music expense | 54 | 3,610 | |

| Advertising expense | 55 | 1,500 | |

| Supplies expense | 56 | 925 | |

| Insurance expense | 57 | 225 | |

| Depreciation expense | 58 | 50 | |

| Miscellaneous expense | 59 | 1,855 | |

| 42,340 | 42,340 | ||

Table (24)

The debit column and credit column of the adjusted trial balance are agreed, both having the balance of $42,340.

Want to see more full solutions like this?

Chapter 3 Solutions

FINANCIAL ACCOUNTING

- I need help with this General accounting question using the proper accounting approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forward

- I am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forwardI am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forwardEcho Tone Technologies reports annual sales of $90,000, and it expects sales to increase to $135,000 next year. The company has a degree of operating leverage (DOL) of 4.2. By what percentage should net income increase? A. 70% B. 189% C. 150% D. 210%arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNo chatgpt Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College