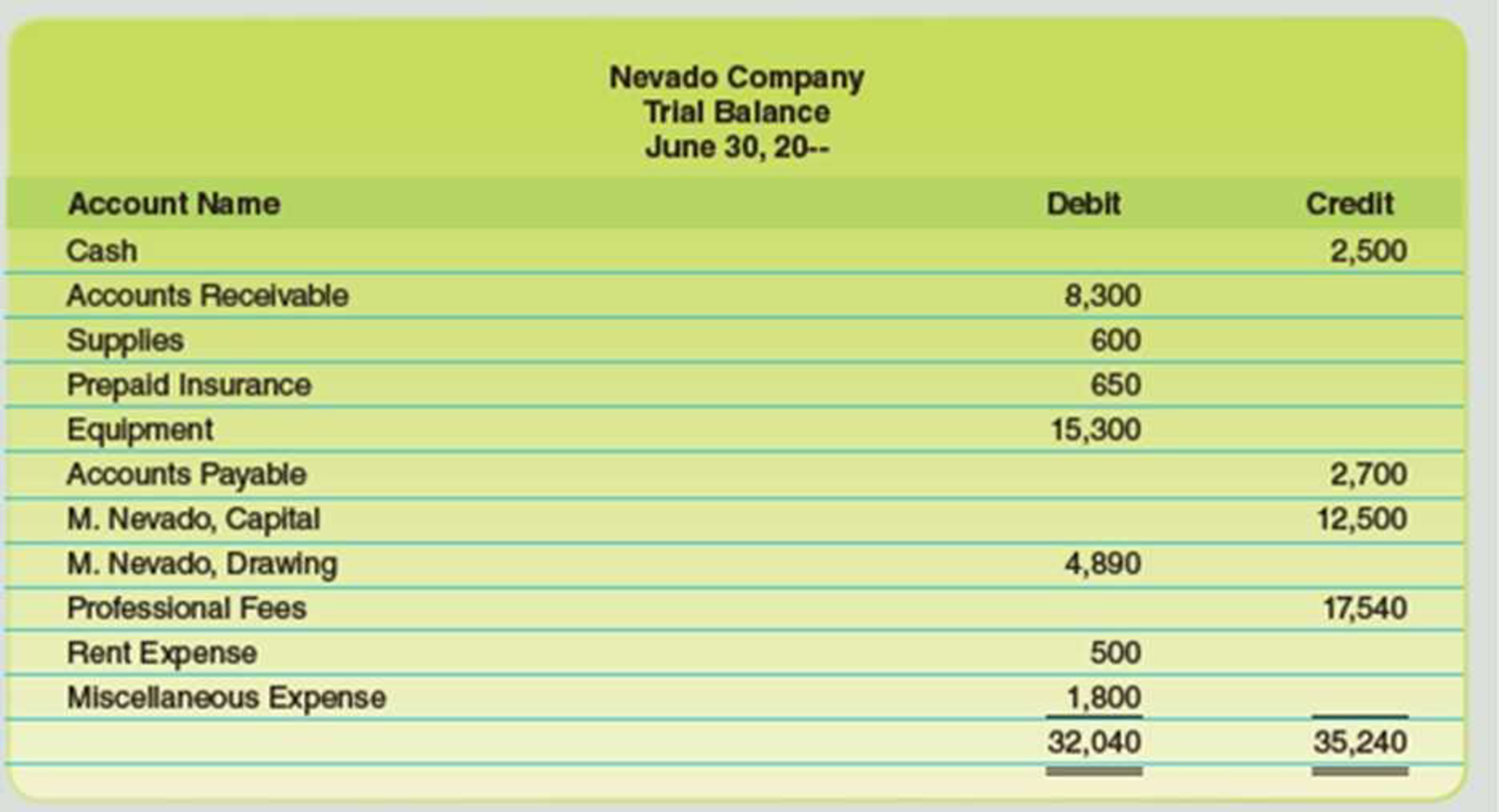

The bookkeeper for Nevado Company has prepared the following

The bookkeeper has asked for your help. In examining the company’s journal and ledger, you discover the following errors. Use this information to construct a corrected trial balance.

- a. The debits to the Cash account total $8,000, and the credits total $3,300.

- b. A $500 payment to a creditor was entered in the journal correctly but was not posted to the Accounts Payable account.

- c. The first two numbers in the balance of the

Accounts Receivable account were transposed when the balance was copied from the ledger to the trial balance. - d. The $1,500 amount withdrawn by the owner for personal use was debited to Miscellaneous Expense by mistake—it was correctly credited to Cash.

Trending nowThis is a popular solution!

Chapter 3 Solutions

College Accounting

Additional Business Textbook Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Fundamentals of Management (10th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Financial Accounting, Student Value Edition (5th Edition)

- Hito’s Auto Spa has $95,000 of fixed costs and variable costs equal to 65% of sales. How much total sales are required to achieve a net income of $160,000? Helparrow_forwardOslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses $22,400 12,800 Contribution margin 9,600 Fixed expenses 7,968 Net operating income $1,632 What is the degree of operating leverage?arrow_forwardTech Solutions, Inc. is looking to achieve a net income of 18 percent of sales. Here’s the firm’s profile: Unit sales price is $12; variable cost per unit is $7; total fixed costs are $50,000. What is the level of sales in units required to achieve a net income of 18 percent of sales?arrow_forward

- For its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows: Pretax accounting income Permanent difference $300,000 (15,000) 285,000 Temporary difference-depreciation (20,000) Taxable income $265,000 Tringali's tax rate is 40%. What should Tringali report as its deferred income tax liability as of the end of its first year of operations?arrow_forwardWhat was Regal Enterprises' average collection period?arrow_forward???arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College