1.

Journalize the given transactions.

1.

Explanation of Solution

Journalize the given transactions:

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

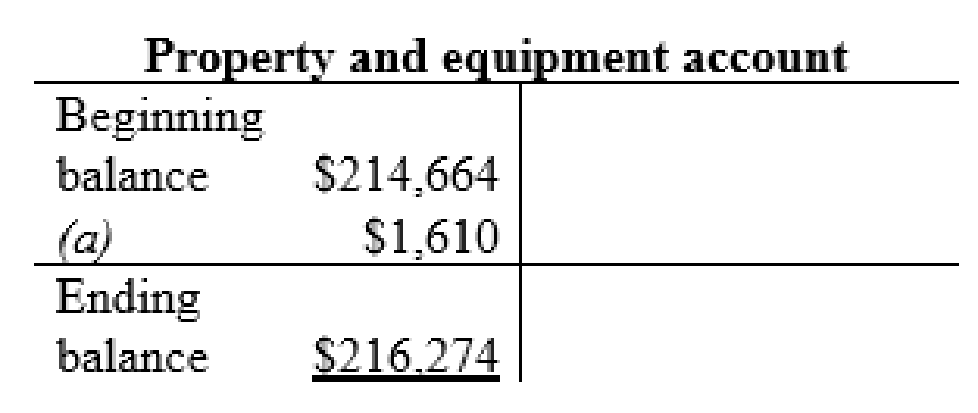

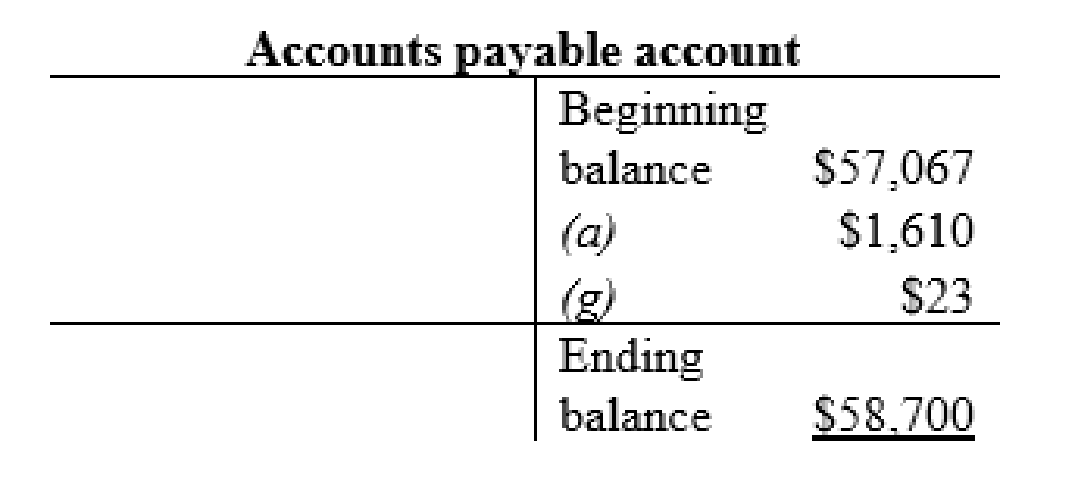

| a | Property and equipment (+A) | $1,610 | |

| Long-term notes payable (+L) | $1,610 | ||

| (To record the long-term notes payable) | |||

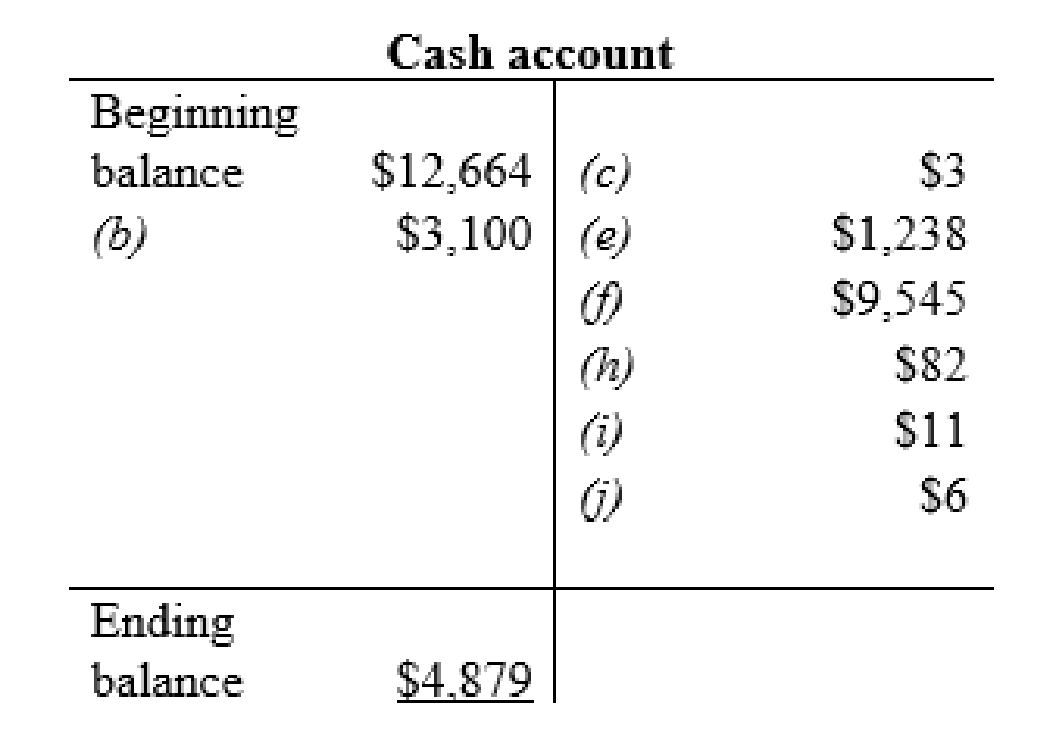

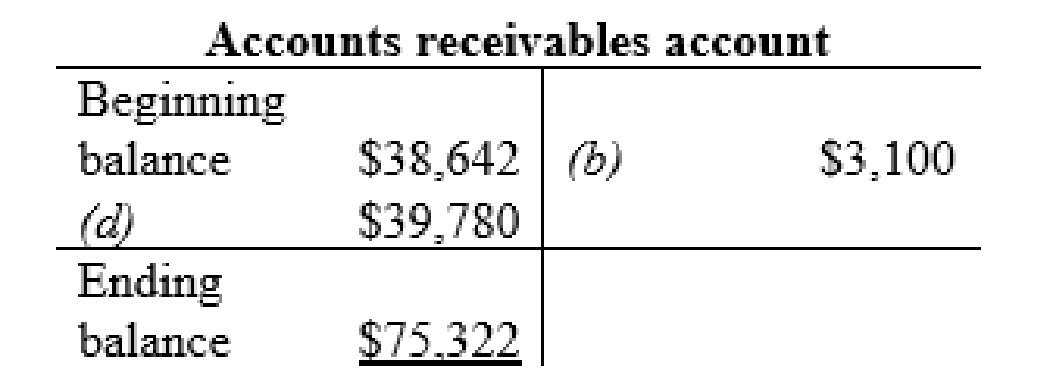

| b | Cash (+A) | $3,100 | |

| $3,100 | |||

| (To record the receivables collected) | |||

| c | Utilities expense (+E) (-SE) | $3 | |

| Cash (-A) | $3 | ||

| (To record the expenses paid) | |||

| d | Accounts receivable (+A) | $39,780 | |

| Sales Revenue (+SE, +R) | $39,780 | ||

| (To record the expenses paid) | |||

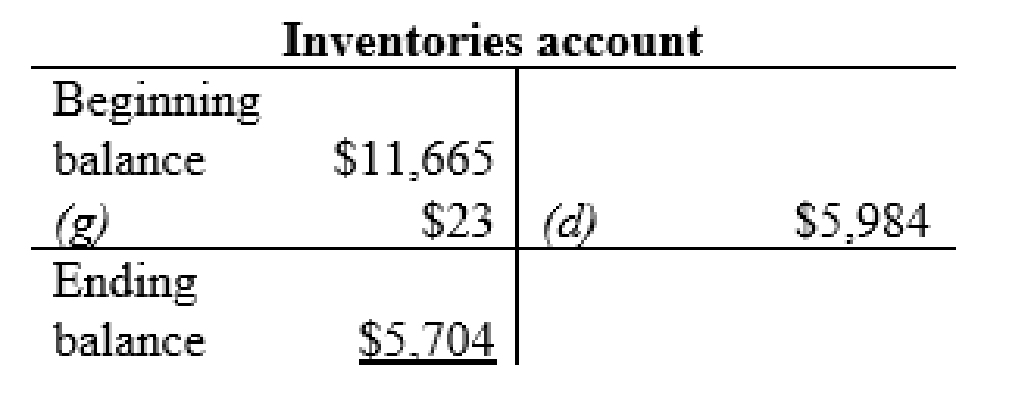

| Cost of Sales (+E) (-SE) | $5,984 | ||

| Inventory (-A) | $5,984 | ||

| (To record the cost involved in sales) | |||

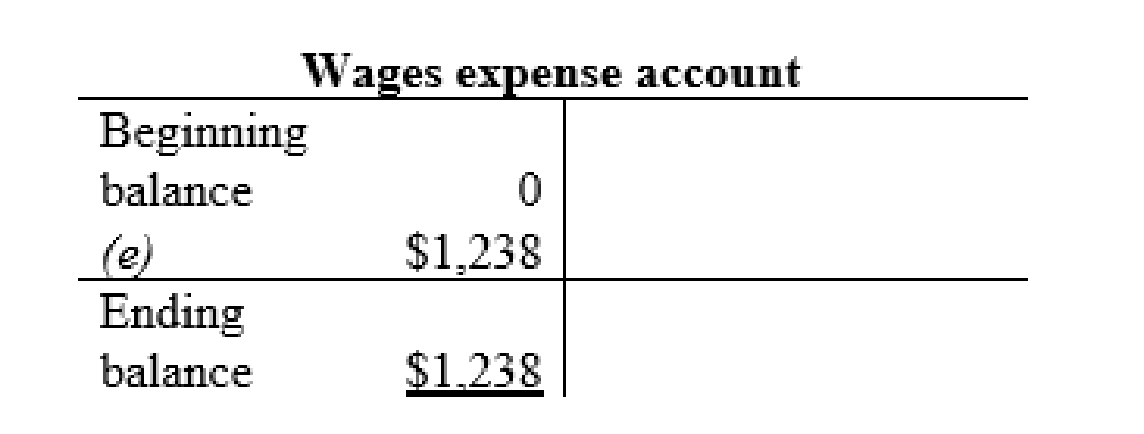

| e | Wages (+E) (-SE) | $1,238 | |

| Cash (-A) | $1,238 | ||

| (To record the wages paid) | |||

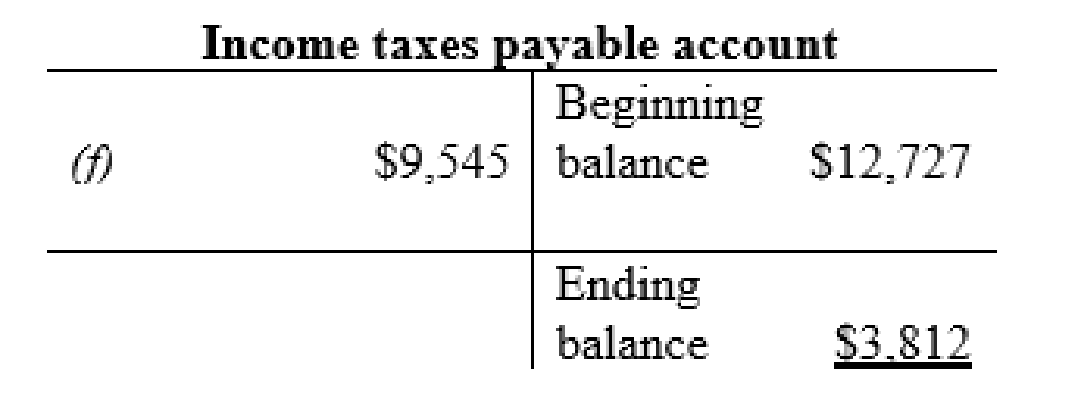

| f | Income tax payable (-L) | $9,545 | |

| Cash (-A) | $9,545 | ||

| (To record the income taxes paid) | |||

| g | Inventory (+A) | $23 | |

| Accounts payable (+L) | $23 | ||

| (To record the inventory purchased on account) | |||

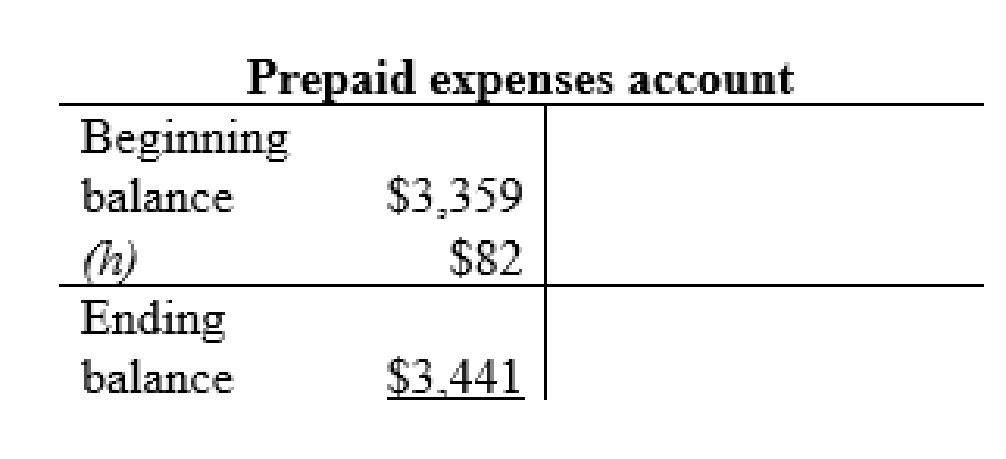

| h | Prepaid expenses (+A) | $82 | |

| Cash (-A) | $82 | ||

| (To record the expenses paid in advance) | |||

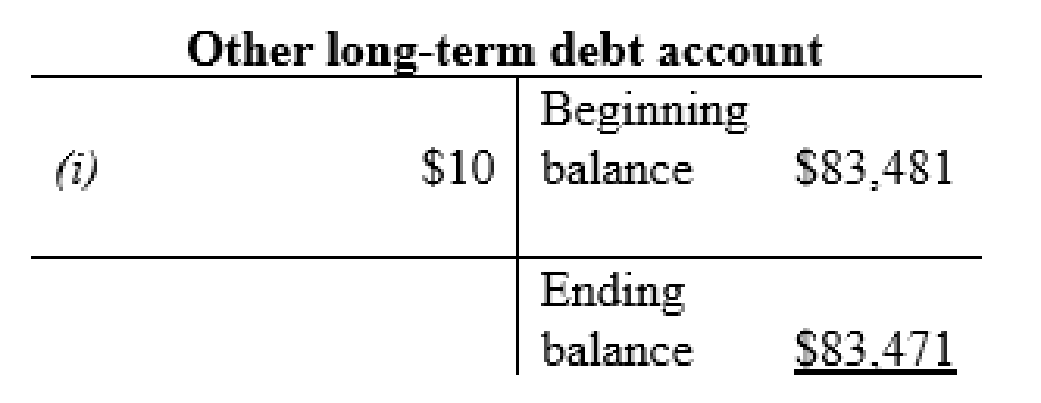

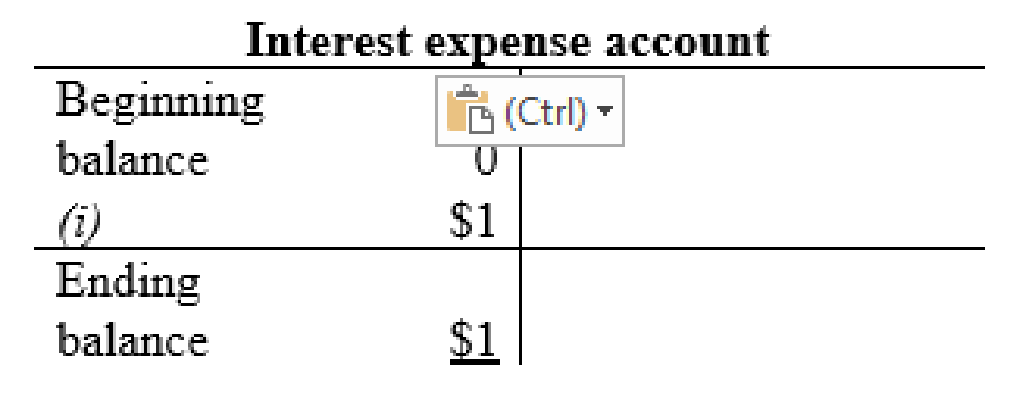

| i | Other long-term debt (-L) | $10 | |

| Interest expense | $1 | ||

| Cash (-A) | $11 | ||

| (To record the debt paid off) | |||

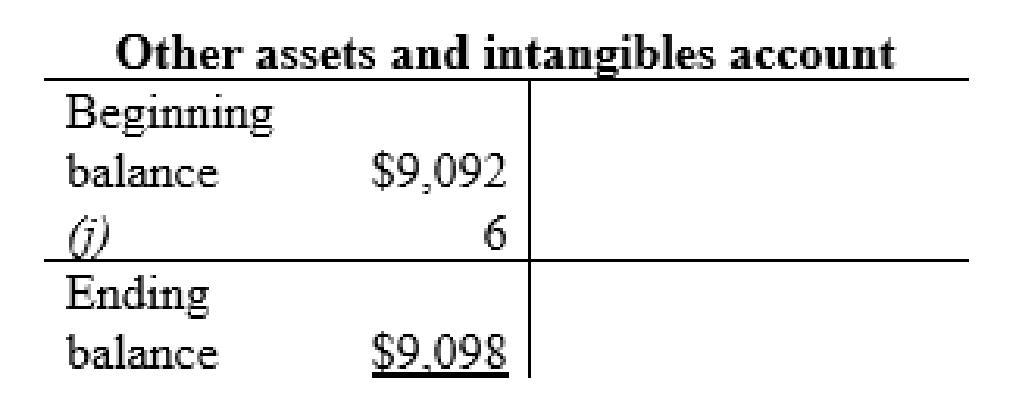

| j | Other assets and intangibles (+A) | $6 | |

| Cash (-A) | $6 | ||

| (To record the purchase of other assets and intangibles) | |||

Table (1)

2

Prepare the T- account and enter the transaction into their respective accounts for calculating the ending balance.

2

Explanation of Solution

Prepare the T-accounts:

Cash account:

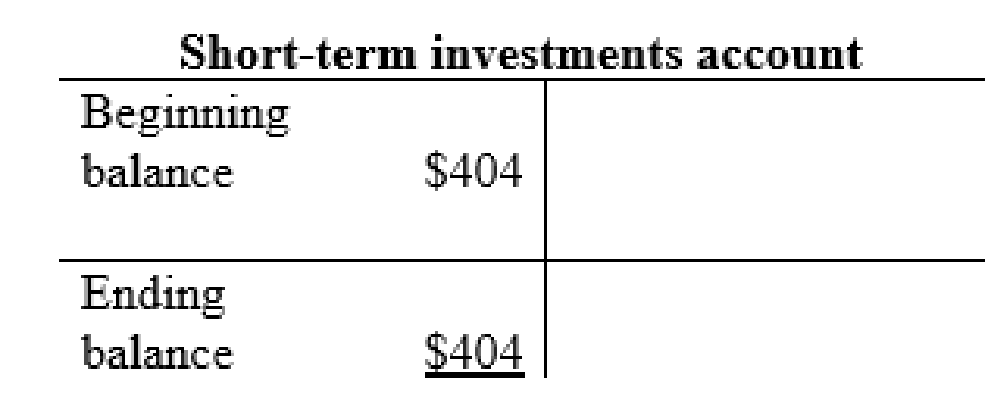

Short-term investments account:

Accounts receivables account:

Inventories account:

Prepaid expenses account:

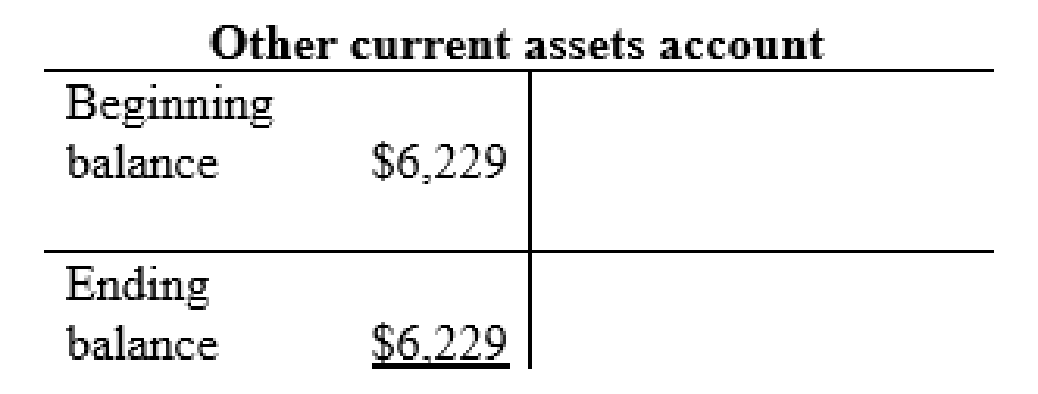

Other current assets account:

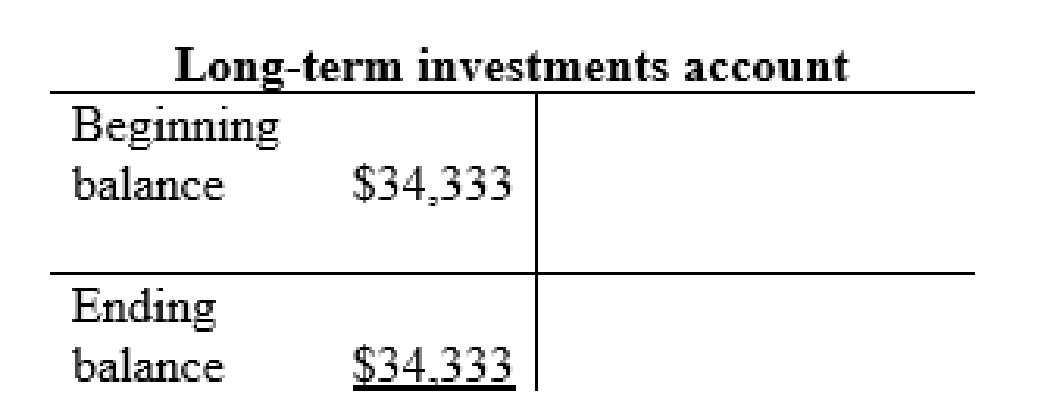

Long-term investments account:

Other assets and intangibles account:

Property and equipment account:

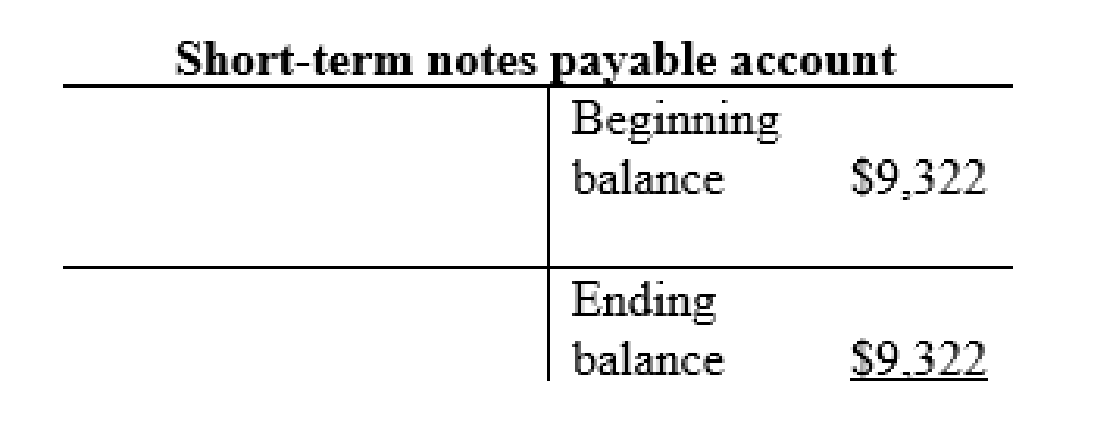

Short-term notes payable account:

Accounts payable account:

Income taxes payable account:

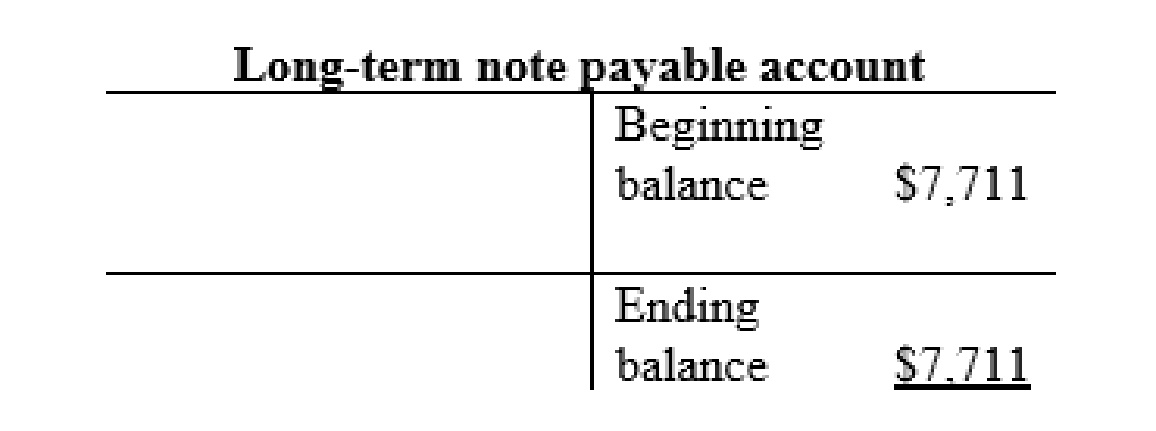

Long-term note payable account:

Other long-term debt account:

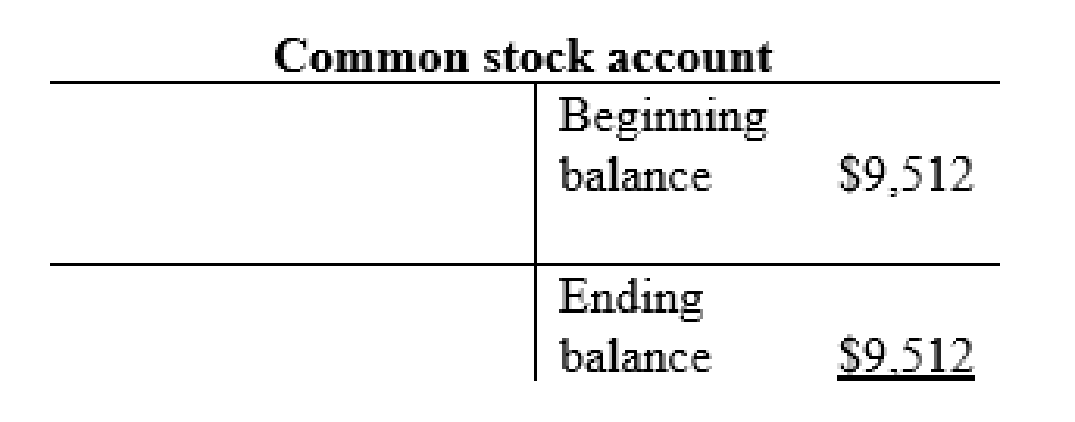

Common stock account:

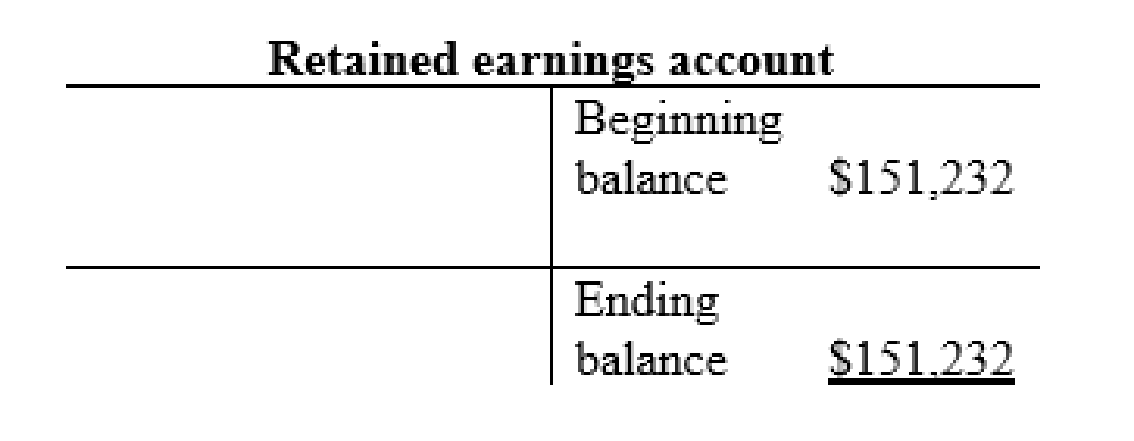

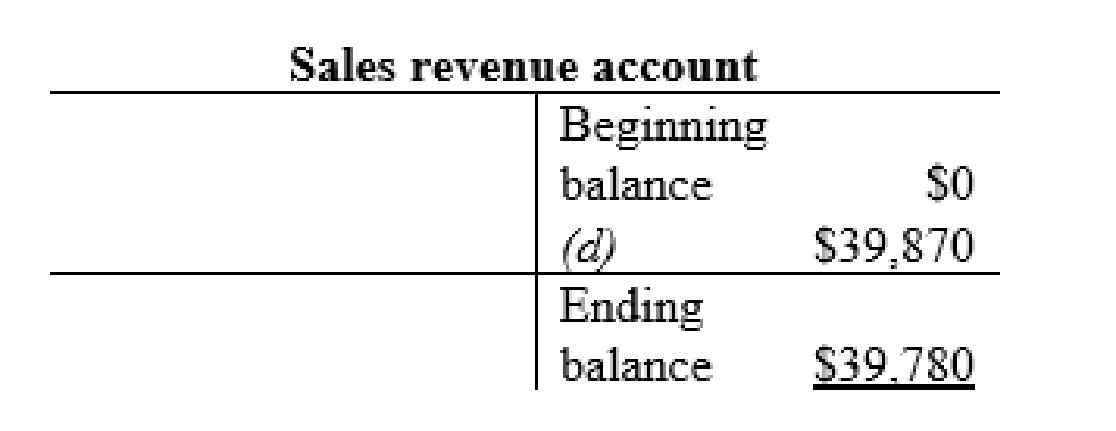

Sales revenue account:

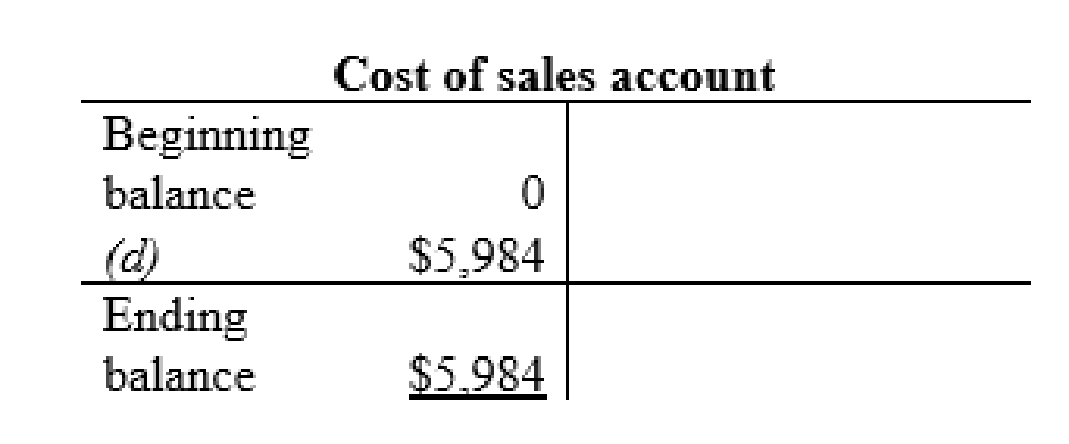

Cost of sales account:

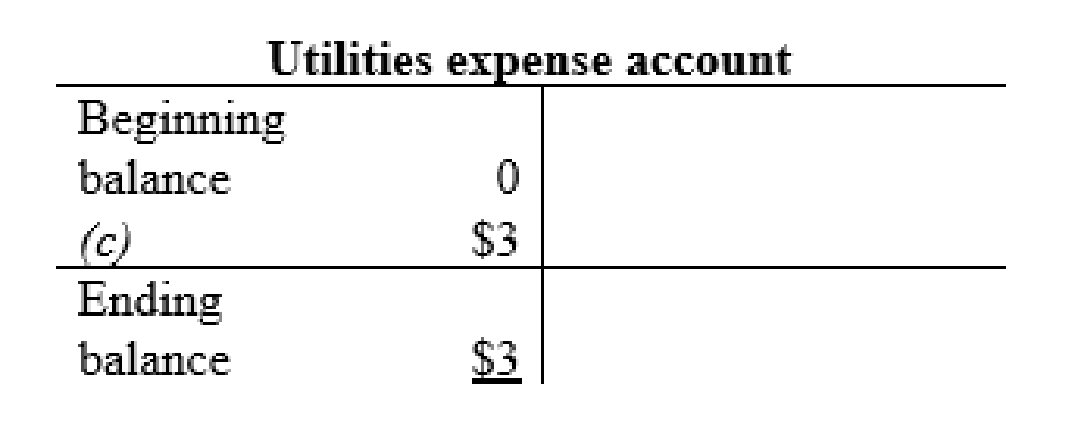

Utilities expense account:

Interest expense account:

Wage expense account:

Thus, the t-accounts are prepared and the ending balances are calculated.

3.

Prepare an income statement for the month of January.

3.

Explanation of Solution

Prepare an income statement:

| Corporation EM | ||

| Income statement | ||

| For the month ended 31st January | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues: | ||

| Sales revenue | 39,780 | |

| Expenses: | ||

| Cost of sales | 5,984 | |

| Wage expense | 1,238 | |

| Utilities expense | 3 | |

| Total costs and expenses | 7,225 | |

| Operating income | 32,555 | |

| Less: Other expense | ||

| Interest expense | 1 | |

| Net Income | $32,554 | |

Table (2)

Hence, the net income of Company E is $32,554.

4.

Compute the net profit margin ratio and based on the result give suggestion to the company.

4.

Explanation of Solution

Compute the net profit margin ratio:

Hence, the net profit margin ratio is 0.82.

- By evaluating the net profit margin ratio, the company has earned $0.82 in net income for every $ 1 in the sales revenue.

- To know the better result about the company, net profit margin ratio should be calculated to identify the way in which the management is generating its revenue and controlling the various expenses.

Want to see more full solutions like this?

Chapter 3 Solutions

FINANCIAL ACCOUNTING (LL)-W/CONNECT

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education