Concept explainers

Variable-Costing and Absorption-Costing Income

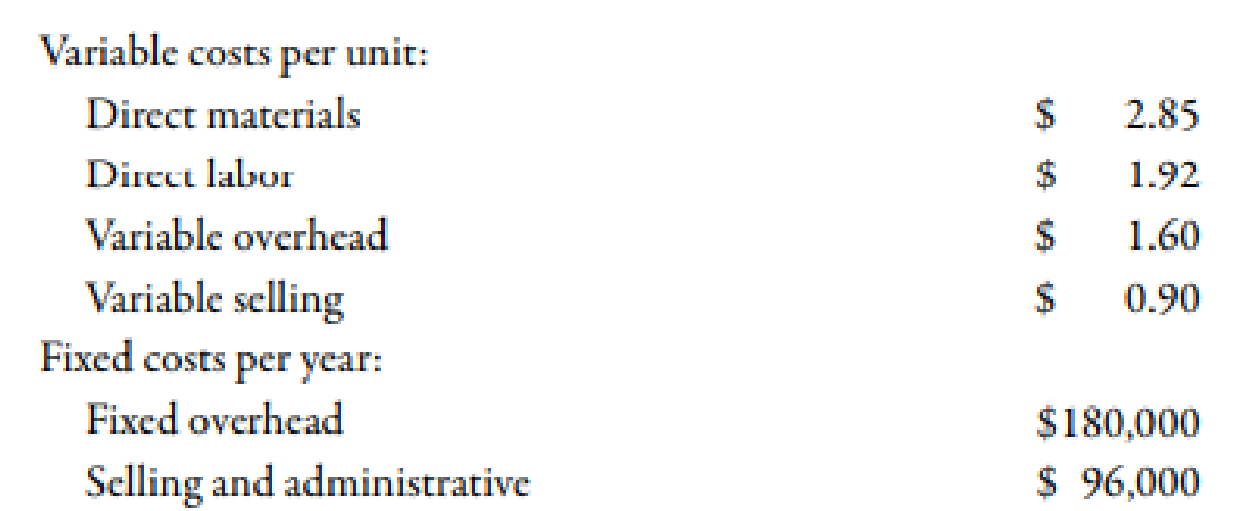

Borques Company produces and sells wooden pallets that are used for moving and stacking materials. The operating costs for the past year were as follows:

During the year, Borques produced 200,000 wooden pallets and sold 204,300 at $9 each. Borques had 8,200 pallets in beginning finished goods inventory; costs have not changed from last year to this year. An actual costing system is used for product costing.

Required:

- 1. What is the per-unit inventory cost that is acceptable for reporting on Borques’s

balance sheet at the end of the year ? How many units are in ending inventory? What is the total cost of ending inventory? - 2. Calculate absorption-costing operating income.

- 3. CONCEPTUAL CONNECTION What would the per-unit inventory cost be under variable costing? Does this differ from the unit cost computed in Requirement 1? Why?

- 4. Calculate variable-costing operating income.

- 5. Suppose that Borques Company had sold 196,700 pallets during the year. What would absorption-costing operating income have been? Variable-costing operating income?

1.

Calculate per unit cost of inventory. Also, calculate the units of ending inventory and total cost of ending inventory.

Explanation of Solution

Cost:

Cost can be defined as the cash and cash equivalent which is incurred against the products or its related services which will benefit the organization in the future. There are two types of costs that are fixed and variable costs.

Calculation of per unit cost of inventory:

| Particulars |

Amount ($) |

| Direct material | 2.85 |

| Direct labor | 1.92 |

| Variable overhead | 1.60 |

| Fixed overhead1 | 0.90 |

| Total | 7.27 |

Table (1)

Therefore, per unit cost of inventory is $7.27.

Use the following formula to calculate the units of ending inventory.

Substitute 8,200 units for opening finished goods, and 200,000 units for manufactured goods and 204,300 units for closing finished goods in the above formula.

Therefore, a unit of ending inventory is 3,900 units.

Use the following formula to calculate the cost of ending inventory.

Substitute $7.27 for per-unit inventory cost and 3,900 units for units of ending inventory in the above formula.

Therefore, the cost of ending inventory is $28,353.

Working Note:

1. Calculation of fixed overhead:

2.

Compute the operating income with the help of absorption costing.

Explanation of Solution

Calculation of operating income:

| Particulars |

Amount ($) |

| Sales1 | 1,838,700 |

| Less: cost of goods sold2 | 1,485,261 |

| Gross margin | 353,439 |

| Less: Selling and administrative expenses | 279,870 |

| Operating income | 73,569 |

Table (2)

Working Note:

1. Calculation of sales:

2. Calculation of cost of goods sold:

3.

Calculate per unit cost of inventory with the help of variable costing. Also, identify the difference in the amount in part 1.

Explanation of Solution

Calculation of per unit cost of inventory with the help of variable costing:

| Particulars |

Amount ($) |

| Direct material | 2.85 |

| Direct labor | 1.92 |

| Variable overhead | 1.60 |

| Total | 6.37 |

Table (3)

Therefore, per unit cost of inventory with the help of variable costing is $6.37.

The difference between per unit cost of inventory occurs because the absorption costing includes the amount of both variable and fixed costing. On the contrary, variable costing does not include the amount of fixed costing. That is why under absorption costing the value of per unit of ending inventory is higher as compared to the variable costing.

4.

Compute the operating income with the help of variable costing.

Explanation of Solution

Calculation of operating income:

| Particulars |

Amount ($) |

| Sales1 | 1,838,700 |

| Less: cost of goods sold2 | 1,485,261 |

| Selling and administrative expenses3 | 183,870 |

| Contribution margin | 353,439 |

| Less: Fixed overhead | 180,000 |

| Fixed Selling and administrative expenses | 96,000 |

| Operating income | 77,439 |

Table (4)

Working Note:

1. Calculation of sales:

2. Calculation of cost of goods sold:

2. Calculation of selling and administrative expenses:

5.

Compute the operating income with the help absorption costing and variable costing:

Explanation of Solution

Calculation of operating income with the help of absorption costing:

| Particulars |

Amount ($) |

| Sales1 | 1,770,300 |

| Less: cost of goods sold2 | 1,430,009 |

| Gross margin | 340,291 |

| Less: Selling and administrative expenses | 273,030 |

| Operating income | 67,261 |

Table (5)

Therefore, the amount of operating income under absorption costing is $67,261.

Calculation of operating income with the help of variable costing:

| Particulars |

Amount ($) |

| Sales1 | 1,770,300 |

| Less: cost of goods sold3 | 1,252,979 |

| Selling and administrative expenses4 | 177,030 |

| Contribution margin | 340,291 |

| Less: Fixed overhead | 180,000 |

| Fixed Selling and administrative expenses | 96,000 |

| Operating income | 64,291 |

Table (6)

Therefore, the amount of operating income under variable costing is $64,291.

Working Note:

1. Calculation of sales:

2. Calculation of cost of goods sold under absorption costing:

3. Calculation of cost of goods sold under variable costing:

4. Calculation of selling and administrative expenses:

Want to see more full solutions like this?

Chapter 3 Solutions

Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, Loose-Leaf Version, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

- Suppose you take out a five-year car loan for $14000, paying an annual interest rate of 4%. You make monthly payments of $258 for this loan. Complete the table below as you pay off the loan. Months Amount still owed 4% Interest on amount still owed (Remember to divide by 12 for monthly interest) Amount of monthly payment that goes toward paying off the loan (after paying interest) 0 14000 1 2 3 + LO 5 6 7 8 9 10 10 11 12 What is the total amount paid in interest over this first year of the loan?arrow_forwardSuppose you take out a five-year car loan for $12000, paying an annual interest rate of 3%. You make monthly payments of $216 for this loan. mocars Getting started (month 0): Here is how the process works. When you buy the car, right at month 0, you owe the full $12000. Applying the 3% interest to this (3% is "3 per $100" or "0.03 per $1"), you would owe 0.03*$12000 = $360 for the year. Since this is a monthly loan, we divide this by 12 to find the interest payment of $30 for the month. You pay $216 for the month, so $30 of your payment goes toward interest (and is never seen again...), and (216-30) = $186 pays down your loan. (Month 1): You just paid down $186 off your loan, so you now owe $11814 for the car. Using a similar process, you would owe 0.03* $11814 = $354.42 for the year, so (dividing by 12), you owe $29.54 in interest for the month. This means that of your $216 monthly payment, $29.54 goes toward interest and $186.46 pays down your loan. The values from above are included…arrow_forwardSuppose you have an investment account that earns an annual 9% interest rate, compounded monthly. It took $500 to open the account, so your opening balance is $500. You choose to make fixed monthly payments of $230 to the account each month. Complete the table below to track your savings growth. Months Amount in account (Principal) 9% Interest gained (Remember to divide by 12 for monthly interest) Monthly Payment 1 2 3 $500 $230 $230 $230 $230 + $230 $230 10 6 $230 $230 8 9 $230 $230 10 $230 11 $230 12 What is the total amount gained in interest over this first year of this investment plan?arrow_forward

- Hii expert please given correct answer general Accounting questionarrow_forwardOn 1st May, 2024 you are engaged to audit the financial statement of Giant Pharmacy for the period ending 30th December 2023. The Pharmacy is located at Mgeni Nani at the outskirts of Mtoni Kijichi in Dar es Salaam City. Materiality is judged to be TZS. 200,000/=. During the audit you found that all tests produced clean results. As a matter of procedures you drafted an audit report with an unmodified opinion to be signed by the engagement partner. The audit partner reviewed your file in October, 2024 and concluded that your audit complied with all requirements of the international standards on auditing and that; sufficient appropriate audit evidence was in the file to support a clean audit opinion. Subsequently, an audit report with an unmodified opinion was issued on 1st November, 2024. On 18th January 2025, you receive a letter from Dr. Fatma Shemweta, the Executive Director of the pharmacy informing you that their cashier who has just absconded has been arrested in Kigoma with TZS.…arrow_forwardNonearrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College