Concept explainers

Variable-Costing and Absorption-Costing Income

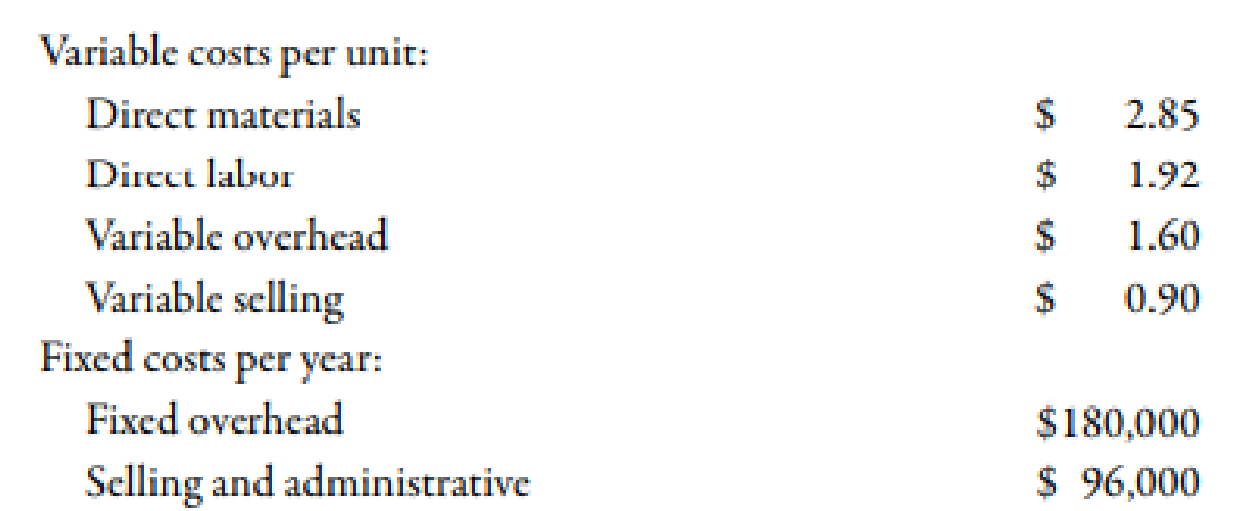

Borques Company produces and sells wooden pallets that are used for moving and stacking materials. The operating costs for the past year were as follows:

During the year, Borques produced 200,000 wooden pallets and sold 204,300 at $9 each. Borques had 8,200 pallets in beginning finished goods inventory; costs have not changed from last year to this year. An actual costing system is used for product costing.

Required:

- 1. What is the per-unit inventory cost that is acceptable for reporting on Borques’s balance sheet at the end of the year ? How many units are in ending inventory? What is the total cost of ending inventory?

- 2. Calculate absorption-costing operating income.

- 3. CONCEPTUAL CONNECTION What would the per-unit inventory cost be under variable costing? Does this differ from the unit cost computed in Requirement 1? Why?

- 4. Calculate variable-costing operating income.

- 5. Suppose that Borques Company had sold 196,700 pallets during the year. What would absorption-costing operating income have been? Variable-costing operating income?

1.

Calculate per unit cost of inventory. Also, calculate the units of ending inventory and total cost of ending inventory.

Explanation of Solution

Cost:

Cost can be defined as the cash and cash equivalent which is incurred against the products or its related services which will benefit the organization in the future. There are two types of costs that are fixed and variable costs.

Calculation of per unit cost of inventory:

| Particulars |

Amount ($) |

| Direct material | 2.85 |

| Direct labor | 1.92 |

| Variable overhead | 1.60 |

| Fixed overhead1 | 0.90 |

| Total | 7.27 |

Table (1)

Therefore, per unit cost of inventory is $7.27.

Use the following formula to calculate the units of ending inventory.

Substitute 8,200 units for opening finished goods, and 200,000 units for manufactured goods and 204,300 units for closing finished goods in the above formula.

Therefore, a unit of ending inventory is 3,900 units.

Use the following formula to calculate the cost of ending inventory.

Substitute $7.27 for per-unit inventory cost and 3,900 units for units of ending inventory in the above formula.

Therefore, the cost of ending inventory is $28,353.

Working Note:

1. Calculation of fixed overhead:

2.

Compute the operating income with the help of absorption costing.

Explanation of Solution

Calculation of operating income:

| Particulars |

Amount ($) |

| Sales1 | 1,838,700 |

| Less: cost of goods sold2 | 1,485,261 |

| Gross margin | 353,439 |

| Less: Selling and administrative expenses | 279,870 |

| Operating income | 73,569 |

Table (2)

Working Note:

1. Calculation of sales:

2. Calculation of cost of goods sold:

3.

Calculate per unit cost of inventory with the help of variable costing. Also, identify the difference in the amount in part 1.

Explanation of Solution

Calculation of per unit cost of inventory with the help of variable costing:

| Particulars |

Amount ($) |

| Direct material | 2.85 |

| Direct labor | 1.92 |

| Variable overhead | 1.60 |

| Total | 6.37 |

Table (3)

Therefore, per unit cost of inventory with the help of variable costing is $6.37.

The difference between per unit cost of inventory occurs because the absorption costing includes the amount of both variable and fixed costing. On the contrary, variable costing does not include the amount of fixed costing. That is why under absorption costing the value of per unit of ending inventory is higher as compared to the variable costing.

4.

Compute the operating income with the help of variable costing.

Explanation of Solution

Calculation of operating income:

| Particulars |

Amount ($) |

| Sales1 | 1,838,700 |

| Less: cost of goods sold2 | 1,485,261 |

| Selling and administrative expenses3 | 183,870 |

| Contribution margin | 353,439 |

| Less: Fixed overhead | 180,000 |

| Fixed Selling and administrative expenses | 96,000 |

| Operating income | 77,439 |

Table (4)

Working Note:

1. Calculation of sales:

2. Calculation of cost of goods sold:

2. Calculation of selling and administrative expenses:

5.

Compute the operating income with the help absorption costing and variable costing:

Explanation of Solution

Calculation of operating income with the help of absorption costing:

| Particulars |

Amount ($) |

| Sales1 | 1,770,300 |

| Less: cost of goods sold2 | 1,430,009 |

| Gross margin | 340,291 |

| Less: Selling and administrative expenses | 273,030 |

| Operating income | 67,261 |

Table (5)

Therefore, the amount of operating income under absorption costing is $67,261.

Calculation of operating income with the help of variable costing:

| Particulars |

Amount ($) |

| Sales1 | 1,770,300 |

| Less: cost of goods sold3 | 1,252,979 |

| Selling and administrative expenses4 | 177,030 |

| Contribution margin | 340,291 |

| Less: Fixed overhead | 180,000 |

| Fixed Selling and administrative expenses | 96,000 |

| Operating income | 64,291 |

Table (6)

Therefore, the amount of operating income under variable costing is $64,291.

Working Note:

1. Calculation of sales:

2. Calculation of cost of goods sold under absorption costing:

3. Calculation of cost of goods sold under variable costing:

4. Calculation of selling and administrative expenses:

Want to see more full solutions like this?

Chapter 3 Solutions

Cengagenowv2, 1 Term Printed Access Card For Mowen/hansen/heitger?s Managerial Accounting: The Cornerstone Of Business Decision-making, 7th

- The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $520,000; Office salaries, $104,000; Federal income taxes withheld, $156,000; State income taxes withheld, $35,000; Social security taxes withheld, $38,688; Medicare taxes withheld, $9,048; Medical insurance premiums, $12,500; Life insurance premiums, $9,500; Union dues deducted, $6,500; and Salaries subject to unemployment taxes, $61,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%. 1. & 2. Using the above information, complete the below table and prepare the journal entries to record accrued payroll, including employee deductions, and cash payment of the net payroll (salaries payable) for July. 3. Using the above information, complete the below table. 4. Record the accrued employer payroll taxes and other related employment expenses and the cash payment of all liabilities…arrow_forwardAt the beginning of the year, Vanguard Systems, Inc. determined that estimated overhead costs would be $720,000, while actual overhead costs for the year totaled $770,000. Furthermore, it was determined that the estimated allocation basis would be 75,000 direct labor hours, while direct laborers actually worked 78,000 hours. What was the dollar amount of underallocated or overallocated manufacturing overhead?arrow_forwardWhat are impaired assets and its pros and cons?arrow_forward

- Ming Chen started a business and had the following transactions in June. a. Owner invested $60,000 cash in the company along with $15,000 of equipment. b. The company paid $2,000 cash for rent of office space for the month. c. The company purchased $18,000 of additional equipment on credit (payment due within 30 days). d. The company completed work for a client and immediately collected $1,600 cash. e. The company completed work for a client and sent a bill for $7,300 to be received within 30 days. f. The company purchased additional equipment for $5,000 cash. g. The company paid an assistant $2,400 cash as wages for the month. h. The company collected $4,500 cash as a partial payment for the amount owed by the client in transaction e. i. The company paid $18,000 cash to settle the liability created in transaction c. j. The owner withdrew $1,500 cash from the company for personal use.arrow_forwardNeed answer the financial accounting question not use aiarrow_forwardGet correct answer the general accounting questionarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College