Concept explainers

Variable and Fixed Costs, Cost Formula, High-Low Method

Li Ming Yuan and Tiffany Shaden are the department heads for the accounting department and human resources department, respectively, at a large textile firm in the southern United States. They have just returned from an executive meeting at which the necessity of cutting costs and gaining efficiency has been stressed. After talking with Tiffany and some of her staff members, as well as his own staff members, Li Ming discovered that there were a number of costs associated with the claims processing activity. These costs included the salaries of the two paralegals who worked full time on claims processing, the salary of the accountant who cut the checks, the cost of claims forms, checks, envelopes, and postage, and

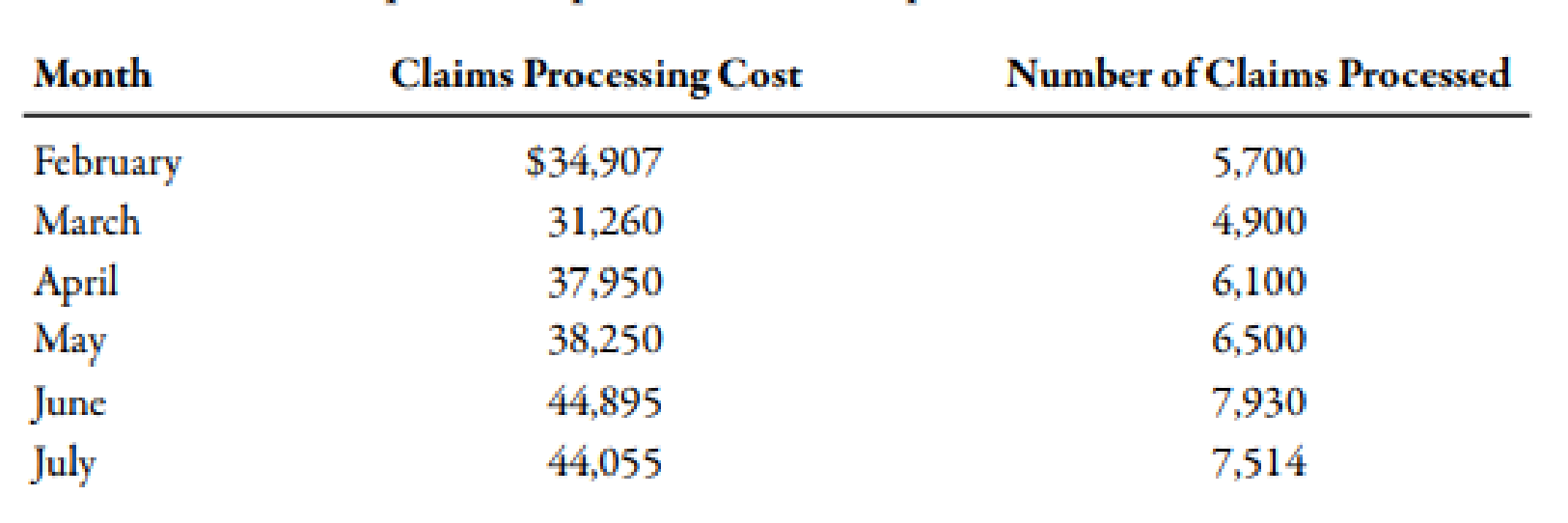

Li Ming was able to separate the costs of processing claims from the costs of running the departments of accounting and human resources. He gathered the data on claims

Required:

- 1. Classify the claims processing costs that Li Ming identified as variable and fixed.

- 2. What is the independent variable? The dependent variable?

- 3. Use the high-low method to find the fixed cost per month and the variable rate. What is the cost formula?

- 4. CONCEPTUAL CONNECTION Suppose that an outside company bids on the claims processing business. The bid price is $4.60 per claim. If Tiffany expects 75,600 claims next year, should she outsource the claims processing or continue to do it in-house?

Trending nowThis is a popular solution!

Chapter 3 Solutions

Managerial Accounting

- A new product Zico was recently introduced by Philadelphia Co., in order to complement its other products, Novo and Domo. The accountant used to allocate the indirect cost according to the units produced. With the recent addition of an expanded computer system, Sonata would like to investigate the possibility of implementing ABC. Before making a final decision, management has come to you for advice. You collected the following information regarding manufacturing overhead: Table (1) Mfg. Overhead Mfg. Overhead Allocation bases Costs $ 40,000 $ 45,000 $ 9,000 $ 21,000 Number of set-ups Set-up Ordering materials Handling materials Inspection Number of material orders Number of times material was handled Number of inspection hours $115,000 Table (2) Products Activity Zico Novo Domo Total Number of set-ups 5 20 55 Total Number of material orders 1 2 7 Total Number of times material was handled 1 17 Total Number of inspection hours Number of units produced 3 10 6,000 3,000 1,000 Required: 1.…arrow_forward. The firm You are employed by Maddie's Corp. an Accounting Firm based in Houston has recently been asked by a client, a medium-sized manufacturing company in California to provide advice and recommendations to improve the company's existing costing system. The CEO of the manufacturing company is keen to implement standard costing. Requirement: Draft a report for your client that: a. b. Outlines the purposes of standard costing Explains the operating mechanisms of the standard costing system The company is also looking to expand and wishes to understand the scope, structure and purpose of transfer pricing. Requirement: Draft a report for your client that: C. Explains how transfer pricing worksarrow_forwardQ.How might Decorative Doors, Inc., use the new cost information from its activity-based costing system to address the declining market share for interior doors?arrow_forward

- Mel Gibbeson has recently graduated from a business school and has joined the family business as anaccountant. At the first management meeting with production, marketing and sales, a great deal oftime was spent discussing the unit cost of products.Required: What kinds of decisions can managers make using the unit cost information?( explain briefly your answer) (use your own words to avoid plagirism)arrow_forwardThe management of Hartman Company is trying to determine the amount of each of two products to produce over the coming planning period. The following information concerns labor availability, labor utilization, and product profitability: a. Develop a linear programming model of the Hartman Company problem. Solve the model to determine the optimal production quantities of products 1 and 2. b. In computing the profit contribution per unit, management does not deduct labor costs because they are considered fixed for the upcoming planning period. However, suppose that overtime can be scheduled in some of the departments. Which departments would you recommend scheduling for overtime? How much would you be willing to pay per hour of overtime in each department? c. Suppose that 10, 6, and 8 hours of overtime may be scheduled in departments A, B, and C, respectively. The cost per hour of overtime is 18 in department A, 22.50 in department B, and 12 in department C. Formulate a linear programming model that can be used to determine the optimal production quantities if overtime is made available. What are the optimal production quantities, and what is the revised total contribution to profit? How much overtime do you recommend using in each department? What is the increase in the total contribution to profit if overtime is used?arrow_forwardCommunication Carol Creedence, the plant manager of the Clearwater Companys Revival plant, has prepared the following graph of the unit costs from the job cost reports for the plants highest volume product, Product CCR. Carol is concerned about the erratic and increasing cost of Product CCR and has asked for your help. Prepare a one-half page memo to Carol, interpreting this graph and requesting any additional information that might be needed to explain this situation.arrow_forward

- Evans, Inc., has a unit-based costing system. Evanss Miami plant produces 10 different electronic products. The demand for each product is about the same. Although they differ in complexity, each product uses about the same labor time and materials. The plant has used direct labor hours for years to assign overhead to products. To help design engineers understand the assumed cost relationships, the Cost Accounting Department developed the following cost equation. (The equation describes the relationship between total manufacturing costs and direct labor hours; the equation is supported by a coefficient of determination of 60 percent.) Y=5,000,000+30X,whereX=directlaborhours The variable rate of 30 is broken down as follows: Because of competitive pressures, product engineering was given the charge to redesign products to reduce the total cost of manufacturing. Using the above cost relationships, product engineering adopted the strategy of redesigning to reduce direct labor content. As each design was completed, an engineering change order was cut, triggering a series of events such as design approval, vendor selection, bill of materials update, redrawing of schematic, test runs, changes in setup procedures, development of new inspection procedures, and so on. After one year of design changes, the normal volume of direct labor was reduced from 250,000 hours to 200,000 hours, with the same number of products being produced. Although each product differs in its labor content, the redesign efforts reduced the labor content for all products. On average, the labor content per unit of product dropped from 1.25 hours per unit to one hour per unit. Fixed overhead, however, increased from 5,000,000 to 6,600,000 per year. Suppose that a consultant was hired to explain the increase in fixed overhead costs. The consultants study revealed that the 30 per hour rate captured the unit-level variable costs; however, the cost behavior of other activities was quite different. For example, setting up equipment is a step-fixed cost, where each step is 2,000 setup hours, costing 90,000. The study also revealed that the cost of receiving goods is a function of the number of different components. This activity has a variable cost of 2,000 per component type and a fixed cost that follows a step-cost pattern. The step is defined by 20 components with a cost of 50,000 per step. Assume also that the consultant indicated that the design adopted by the engineers increased the demand for setups from 20,000 setup hours to 40,000 setup hours and the number of different components from 100 to 250. The demand for other non-unit-level activities remained unchanged. The consultant also recommended that management take a look at a rejected design for its products. This rejected design increased direct labor content from 250,000 hours to 260,000 hours, decreased the demand for setups from 20,000 hours to 10,000 hours, and decreased the demand for purchasing from 100 component types to 75 component types, while the demand for all other activities remained unchanged. Required: 1. Using normal volume, compute the manufacturing cost per labor hour before the year of design changes. What is the cost per unit of an average product? 2. Using normal volume after the one year of design changes, compute the manufacturing cost per hour. What is the cost per unit of an average product? 3. Before considering the consultants study, what do you think is the most likely explanation for the failure of the design changes to reduce manufacturing costs? Now use the information from the consultants study to explain the increase in the average cost per unit of product. What changes would you suggest to improve Evanss efforts to reduce costs? 4. Explain why the consultant recommended a second look at a rejected design. Provide computational support. What does this tell you about the strategic importance of cost management?arrow_forwardCommunication The controller of New Wave Sounds Inc. prepared the following product profitability report for management, using activity-based costing methods for allocating both the factory overhead and the marketing expenses. As such, the controller has confidence in the accuracy of this report. In addition, the controller interviewed the vice president of marketing, who provided the following insight into the companys three products: The home theater speakers are an older product that is highly recognized in the marketplace. The wireless speakers are a new product that was just recently launched. The wireless headphones are a new technology that has no competition in the marketplace, and it is hoped that they will become an important future addition to the companys product portfolio. Initial indications are that the product is well received by customers. The controller believes that the manufacturing costs for all three products are in line with expectations. Based on the information provided: 1. Calculate the ratio of gross profit to sales and the ratio of operating income to sales for each product. 2. Write a brief (one-page) memo using the product profitability report and the calculations in (a) to make recommendations to management with respect to strategies for the three products.arrow_forwardVariable and Fixed Costs What follows are a number of resources that are used by a manufacturer of futons. Assume that the output measure or cost driver is the number of futons produced. All direct labor is paid on an hourly basis, and hours worked can be easily changed by management. All other factory workers are salaried. a. Power to operate a drill (to drill holes in the wooden frames of the futons) b. Cloth to cover the futon mattress c. Salary of the factory receptionist d. Cost of food and decorations for the annual Fourth of July party for all factory employees e. Fuel for a forklift used to move materials in a factory f. Depreciation on the factory g. Depreciation on a forklift used to move partially completed goods h. Wages paid to workers who assemble the futon frame i. Wages paid to workers who maintain the factory equipment j. Cloth rags used to wipe the excess stain off the wooden frames Required: Classify the resource costs as variable or fixed.arrow_forward

- Southward Company has implemented a JIT flexible manufacturing system. John Richins, controller of the company, has decided to reduce the accounting requirements given the expectation of lower inventories. For one thing, he has decided to treat direct labor cost as a part of overhead and to discontinue the detailed direct labor accounting of the past. The company has created two manufacturing cells, each capable of producing a family of products: the radiator cell and the water pump cell. The output of both cells is sold to a sister division and to customers who use the radiators and water pumps for repair activity. Product-level overhead costs outside the cells are assigned to each cell using appropriate drivers. Facility-level costs are allocated to each cell on the basis of square footage. The budgeted direct labor and overhead costs are as follows: The predetermined conversion cost rate is based on available production hours in each cell. The radiator cell has 45,000 hours available for production, and the water pump cell has 27,000 hours. Conversion costs are applied to the units produced by multiplying the conversion rate by the actual time required to produce the units. The radiator cell produced 81,000 units, taking 0.5 hour to produce one unit of product (on average). The water pump cell produced 90,000 units, taking 0.25 hour to produce one unit of product (on average). Other actual results for the year are as follows: All units produced were sold. Any conversion cost variance is closed to Cost of Goods Sold. Required: 1. Calculate the predetermined conversion cost rates for each cell. 2. Prepare journal entries using backflush accounting. Assume two trigger points, with completion of goods as the second trigger point. 3. Repeat Requirement 2, assuming that the second trigger point is the sale of the goods. 4. Explain why there is no need to have a work-in-process inventory account. 5. Two variants of backflush costing were presented in which each used two trigger points, with the second trigger point differing. Suppose that the only trigger point for recognizing manufacturing costs occurs when the goods are sold. How would the entries be listed here? When would this backflush variant be considered appropriate?arrow_forwardPlain Limited produces two standard products, White and Grey. You have recently been appointed as a management accountant along with a new marketing manager, who has several ideas about how to grow the company, including introducing new products with different designs. The company currently absorbs overheads on the basis of units produced, but they have read about a method based on activities undertaken, Activity Based Costing. They have asked you to help them to investigate this method and it’s implication for their business should they decide to implement it in the next accounting year. The current expected output for the existing products during the next year is White 15,000 and Grey 12,000 The company has also provided the following information about the current overhead costs of the business; Overhead activity. Annual costs Cost driver. Amount of activity White…arrow_forwardPlease answer it for each productarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning