COST ACCOUNTING W/CONNECT

6th Edition

ISBN: 9781264022021

Author: LANEN

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 64P

Extensions of the CVP Model—Multiple Products

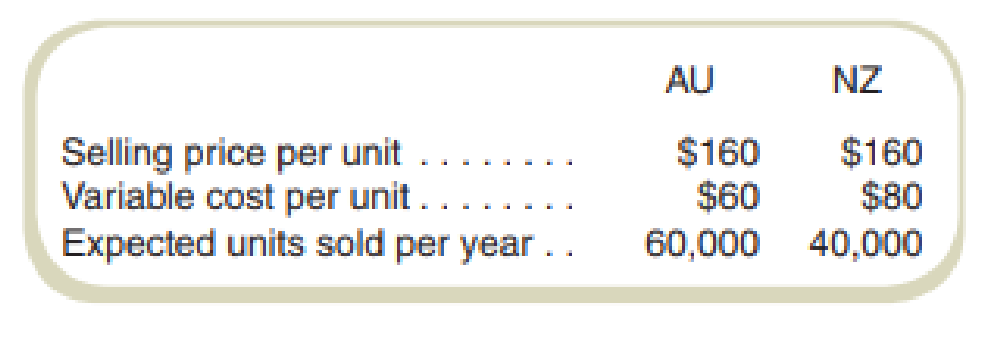

Sundial, Inc., produces two models of sunglasses: AU and NZ. The sunglasses have the following characteristics:

The total fixed costs per year for the company are $2,208,000.

Required

- a. What is the anticipated level of profits for the expected sales volumes?

- b. Assuming that the product mix is the same at the break-even point, compute the breakeven point.

- c. If the product sales mix were to change to four pairs of AU sunglasses for each pair of NZ sunglasses, what would be the new break-even volume for Sundial, Inc.?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Cariveh Co sells automotive supplies from 25 different locations in one country. Each branch has up to 30 staff working there, although most of the accounting systems are designed and implemented from the company's head office. All accounting systems, apart from petty cash, are computerised, with the internal audit department frequently advising and implementing controls within those systems.Cariveh has an internal audit department of six staff, all of whom have been employed at Cariveh for a minimum of five years and some for as long as 15 years. In the past, the chief internal auditor appoints staff within the internal audit department, although the chief executive officer (CEO) is responsible for appointing the chief internal auditor.The chief internal auditor reports directly to the finance director. The finance director also assists the chief internal auditor in deciding on the scope of work of the internal audit department.You are an audit manager in the internal audit department…

Jinkal Sports Co. sells a

product for $55 per unit. The

variable cost per unit is $28,

and monthly fixed costs are

$270,000.

How many units must be sold to

earn a target profit of $120,000?

return on equity (ROE)? account question

Chapter 3 Solutions

COST ACCOUNTING W/CONNECT

Ch. 3 - Write out the profit equation and describe each...Ch. 3 - What are the components of total costs in the...Ch. 3 - How does the total contribution margin differ from...Ch. 3 - Compare cost-volume-profit (CVP) analysis with...Ch. 3 - Fixed costs are often defined as fixed over the...Ch. 3 - Prob. 6RQCh. 3 - What is the margin of safety? Why is this...Ch. 3 - Prob. 8RQCh. 3 - Write out the equation for the target volume (in...Ch. 3 - How do income taxes affect the break-even...

Ch. 3 - Why is it common to assume a fixed sales mix...Ch. 3 - What are some important assumptions commonly made...Ch. 3 - Prob. 13CADQCh. 3 - Prob. 14CADQCh. 3 - The typical cost-volume-profit graph assumes that...Ch. 3 - The assumptions of CVP analysis are so simplistic...Ch. 3 - Prob. 17CADQCh. 3 - Consider a class in a business school where volume...Ch. 3 - Prob. 19CADQCh. 3 - Prob. 20CADQCh. 3 - Consider the Business Application,...Ch. 3 - Consider the Business Application,...Ch. 3 - Prob. 23CADQCh. 3 - Profit Equation Components Identify each of the...Ch. 3 - Profit Equation Components Identify the letter of...Ch. 3 - Basic Decision Analysis Using CVP Anus Amusement...Ch. 3 - Basic CVP Analysis The manager of Dukeys Shoe...Ch. 3 - CVP AnalysisEthical Issues Mark Ting desperately...Ch. 3 - Basic Decision Analysis Using CVP Derby Phones is...Ch. 3 - Prob. 30ECh. 3 - Basic Decision Analysis Using CVP Warner Clothing...Ch. 3 - Basic Decision Analysis Using CVP Refer to the...Ch. 3 - Prob. 33ECh. 3 - Prob. 34ECh. 3 - Analysis of Cost Structure Spring Companys cost...Ch. 3 - CVP and Margin of Safety Bristol Car Service...Ch. 3 - CVP and Margin of Safety Caseys Cases sells cell...Ch. 3 - Prob. 38ECh. 3 - Prob. 39ECh. 3 - Refer to the data for Derby Phones in Exercise...Ch. 3 - Refer to the data for Warner Clothing in Exercise...Ch. 3 - CVP with Income Taxes Hunter Sons sells a single...Ch. 3 - CVP with Income Taxes Hammerhead Charters runs...Ch. 3 - Prob. 44ECh. 3 - Prob. 45ECh. 3 - Prob. 46ECh. 3 - Prob. 47ECh. 3 - CVP Analysis and Price Changes Argentina Partners...Ch. 3 - Prob. 49PCh. 3 - CVP AnalysisMissing Data Breed Products has...Ch. 3 - Prob. 51PCh. 3 - Prob. 52PCh. 3 - CVP AnalysisSensitivity Analysis (spreadsheet...Ch. 3 - Prob. 54PCh. 3 - Prob. 55PCh. 3 - Extensions of the CVP ModelSemifixed (Step) Costs...Ch. 3 - Prob. 57PCh. 3 - Extensions of the CVP ModelTaxes Odd Wallow Drinks...Ch. 3 - Prob. 59PCh. 3 - Prob. 60PCh. 3 - Extensions of the CVP ModelTaxes Toys 4 Us sells...Ch. 3 - Extensions of the CVP AnalysisTaxes Eagle Company...Ch. 3 - Extensions of the CVP ModelMultiple Products...Ch. 3 - Extensions of the CVP ModelMultiple Products...Ch. 3 - Prob. 65PCh. 3 - Prob. 66PCh. 3 - Prob. 67PCh. 3 - Prob. 68PCh. 3 - Extensions of the CVP ModelMultiple Products and...Ch. 3 - Extensions of the CVP ModelTaxes With Graduated...Ch. 3 - Prob. 71PCh. 3 - Financial Modeling Three entrepreneurs were...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- its net income?arrow_forwardSilver Star Manufacturing has $20 million in sales, an ROE of 15%, and a total assets turnover of 5 times. Common equity on the firm's balance sheet is 30% of its total assets. What is its net income? Round the answer to the nearest cent.arrow_forwardHi expert please give me answer general accounting questionarrow_forward

- Horizon Consulting started the year with total assets of $80,000 and total liabilities of $30,000. During the year, the business recorded $65,000 in service revenues and $40,000 in expenses. Additionally, Horizon issued $12,000 in stock and paid $18,000 in dividends. By how much did stockholders' equity change from the beginning of the year to the end of the year?arrow_forwardх chat gpt - Sea Content Content × CengageNOW × Wallet X takesssignment/takeAssignmentMax.co?muckers&takeAssignment Session Loca agenow.com Instructions Labels and Amount Descriptions Income Statement Instructions A-One Travel Service is owned and operated by Kate Duffner. The revenues and expenses of A-One Travel Service Accounts (revenue and expense items) < Fees earned Office expense Miscellaneous expense Wages expense Required! $1,480,000 350,000 36,000 875,000 Prepare an income statement for the year ended August 31, 2016 Labels and Amount Descriptions Labels Expenses For the Year Ended August 31, 20Y6 Check My Work All work saved.arrow_forwardEvergreen Corp. began the year with stockholders' equity of $350,000. During the year, the company recorded revenues of $500,000 and expenses of $320,000. The company also paid dividends of $30,000. What was Evergreen Corp.'s stockholders' equity at the end of the year?arrow_forward

- Evergreen corp.'s stockholders' equity at the end of the yeararrow_forwardHarrison Corp. reported earnings per share (EPS) of $15 in 2022 and paid dividends of $4 per share. The current market price per share is $90, and the book value per share is $65. What is Harrison Corp.'s price- earnings ratio (P/E ratio)?arrow_forwardEverest Manufacturing produces and sells a single product. The company has provided its contribution format income statement for March: • Sales (4,500 units): $135,000 • Variable expenses: $58,500 • Contribution margin: $76,500 • Fixed expenses: $50,000 • Net operating income: $26,500 If the company sells 5,200 units, what is the total contribution margin?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License