Extensions of the CVP Analysis—Taxes

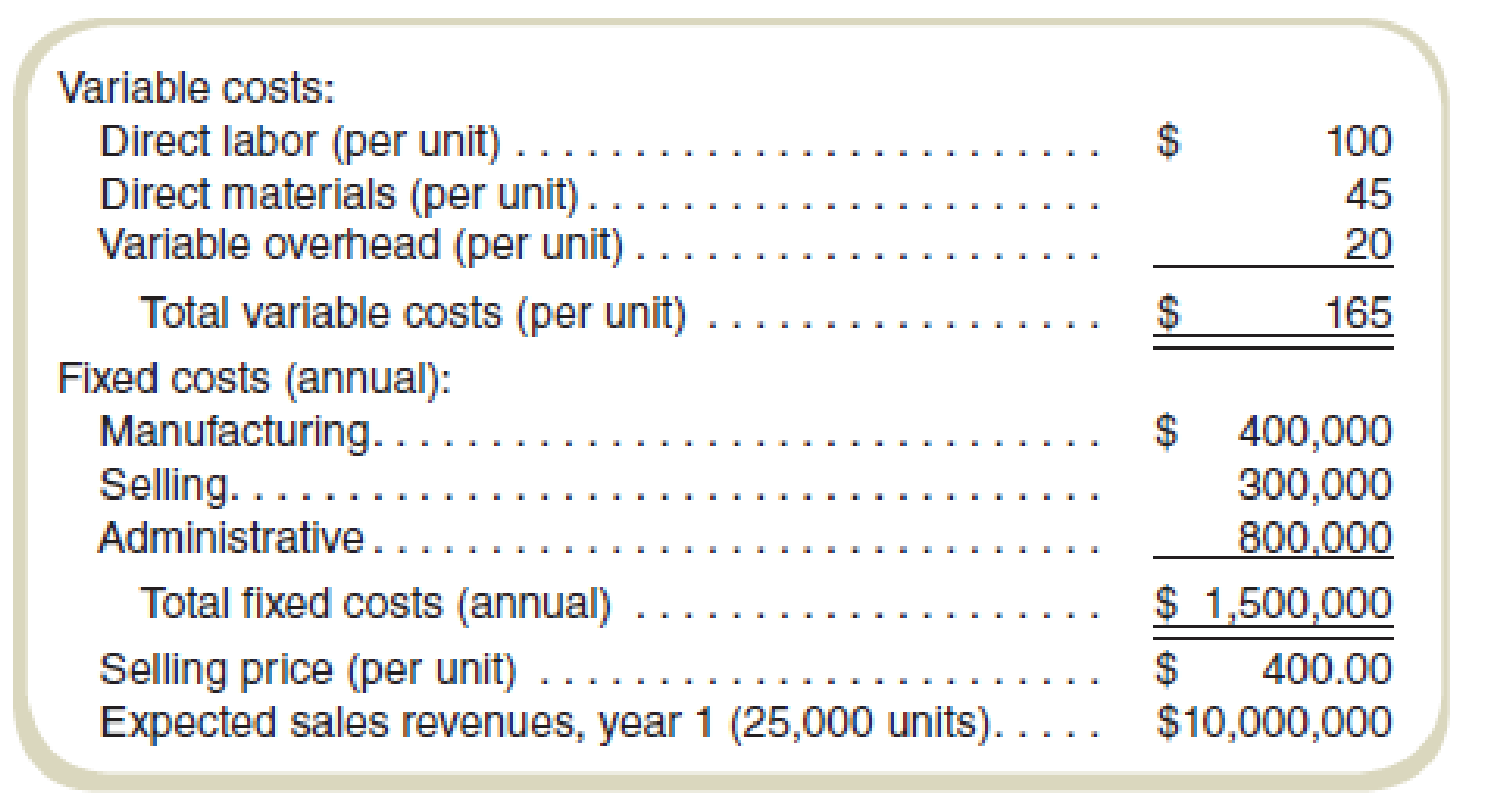

Eagle Company makes the MusicFinder, a sophisticated satellite radio. Eagle has experienced a steady growth in sales for the past five years. However, Ms. Luray, Eagle’s CEO, believes that to maintain the company’s present growth will require an aggressive advertising campaign next year. To prepare for the campaign, the company’s accountant, Mr. Bednarik, has prepared and presented to Ms. Luray the following data for the current year, year 1:

Eagle has an income tax rate of 35 percent.

Ms. Luray has set the sales target for year 2 at a level of $11,200,000 (or 28,000 radios).

Required

- a. What is the projected after-tax operating profit for year 1?

- b. What is the break-even point in units for year 1?

- c. Ms. Luray believes that to attain the sales target (28,000 radios) will require additional selling expenses of $300,000 for advertising in year 2, with all other costs remaining constant. What will be the after-tax operating profit for year 2 if the firm spends the additional $300,000?

- d. What will be the break-even point in sales dollars for year 2 if the firm spends the additional $300,000 for advertising?

- e. If the firm spends the additional $300,000 for advertising in year 2, what is the sales level in dollars required to equal the year 1 after-tax operating profit?

- f. At a sales level of 28,000 units, what is the maximum amount the firm can spend on advertising to earn an after-tax operating profit of $750,000?

a.

Calculate the projected after-tax operating profit for year 1.

Answer to Problem 62P

The projected after-tax operating profit for year 1 is $2,843,750.

Explanation of Solution

Target volume: the level of sales which need to be achieved during a particular period of time is termed as target volume.

Target profit: the amount of profit which needs to be achieved during a particular period of time on a particular level of sales is termed as target profit.

Total fixed costs and variable costs:

| Particulars | Amount |

| Variable cost (per unit): | |

| Direct labor | $100 |

| Direct material | $45 |

| Variable overhead | $20 |

| Total variable cost: | $165 |

| Fixed cost: | |

| Manufacturing | $400,000 |

| Selling | $300,000 |

| Administration | $800,000 |

| Total fixed costs (annual) | $1,500,000 |

| Selling price | $400 |

| Expected sales revenue, year 1 (25,000 units) | $10,000,000 |

Table: (1)

Compute the projected after-tax operating profit for year 1:

Compute the after-tax profit, when the tax rate is 35%:

Thus, the projected after-tax operating profit for year 1 is $2,843,750

Working note 1:

Compute the profit:

b.

Calculate the break-even point in units for year 1.

Answer to Problem 62P

The break-even point in units for year 1 is $6,383.

Explanation of Solution

Breakeven point (BEP): The breakeven point or BEP is that level of output at which the total revenue is equal to the total cost. The BEP means there are no operating income and no operating losses. The management keeps an eye on the breakeven point in order to avoid the operating losses in order to avoid losses.

Compute the break-even point in units for year 1:

Thus, the break-even point for the drones is 6,383 units.

Working note 2:

Compute the contribution margin:

c.

Calculate after-tax operating profit for year 2 if the firm spends the additional $300,000.

Answer to Problem 62P

After tax operating profit for year 2 will be $3,107,000,

Explanation of Solution

Target volume: the level of sales which need to be achieved during a particular period of time is termed as target volume.

Target profit: the amount of profit which needs to be achieved during a particular period of time on a particular level of sales is termed as target profit.

Compute the projected after-tax operating profit for year 1:

Compute the after-tax profit:

Thus, the projected after-tax operating profit for year 1 is $3,107,000.

Working note 3:

Compute the profit:

Working note 4:

Compute the revised fixed cost:

d.

Calculate the break-even point if the firm spends the additional $300,000 for advertising.

Answer to Problem 62P

If a firm spends the additional $300,000 for advertising, the break-even point will be $3,063,000.

Explanation of Solution

Breakeven point (BEP): The breakeven point or BEP is that level of output at which the total revenue is equal to the total cost. The BEP means there are no operating income and no operating losses. The management keeps an eye on the breakeven point in order to avoid the operating losses in order to avoid losses.

Compute the break-even point in sales dollar for year 1:

Thus, if a firm spends the additional $300,000 for advertising, the break-even point will be $3,063,000.

Working note 5:

Compute the break-even point in units for year 1:

Thus, the break-even point for the drones is 7,659 units.

e.

Calculate the dollar sales to maintain the year 1 after-tax operating profit if the firm spends the additional $300,000 for advertising.

Answer to Problem 62P

The dollar sales to maintain the year 1 after-tax operating profit if the firm spends the additional $300,000 for advertising is $10,510,638.

Explanation of Solution

Breakeven point (BEP): The breakeven point or BEP is that level of output at which the total revenue is equal to the total cost. The BEP means there are no operating income and no operating losses. The management keeps an eye on the breakeven point in order to avoid the operating losses in order to avoid losses.

Dollars sales to maintain the year 1 level of profit:

Working note 6:

Compute the dollar sales to maintain the year 1 after-tax operating profit if the firm spends the additional $300,000 for advertising:

f.

Calculate the maximum amount the firm can spend on advertising to earn the after-tax operating profit of $750,000 at a sales level of 28,000 units.

Answer to Problem 62P

The maximum amount the firm can spend on advertising to earn the after-tax operating profit of $750,000 at a sales level of 28,000 units is $4,226,154.

Explanation of Solution

Compute the the maximum amount the firm can spend on advertising to earn the after-tax operating profit of $750,000 at a sales level of 28,000 units is $4,226,154:

Thus, the maximum amount the firm can spend on advertising to earn the after-tax operating profit of $750,000 at a sales level of 28,000 units is $4,226,154.

Working note 7:

Compute the operating profit before tax:

Working note 8:

Compute the contribution margin in dollar sales:

Working note 9:

Compute the total fixed cost:

Working note 10:

Compute the maximum amount the firm can spend on advertising:

Total fixed cost other than advertising:

| Particulars | Amount |

| Fixed cost: | |

| Manufacturing | $400,000 |

| Administration | $800,000 |

| Total fixed costs (annual) | $1,200,000 |

Table: (7)

Want to see more full solutions like this?

Chapter 3 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Assume that a company is choosing between two alternatives-lease a piece of equipment for five years or buy a piece of equipment and sell it in five years. The costs associated with the two alternatives are summarized as follows: LeaseBuyPurchase cost of equipment $ 60,000Annual operating costs $ 6,000Immediate deposit$ 25,000 Annual lease payments$ 18,000 Salvage value (5 years from now) $ 8,000 If the company chooses the lease option, it will have to pay an immediate deposit of $25,000 to cover any future damages to the equipment. The deposit is refundable at the end of the lease term. The annual lease payments are made at the end of each year. Based on a net present value analysis with a discount rate of 24%, what is the financial advantage (disadvantage) of buying the equipment rather than leasing it? Multiple Choice $(8,687) S(4,877) $(7,857) S(7,367)arrow_forwardSheffield Corp. sells its product for $75 per unit. During 2016, it produced 70,000 units and sold 55000 units (there was no beginning inventory). Costs per unit are: direct materials $16, direct labor $15, and variable overhead $4. Fixed costs are: $910,000 manufacturing overhead, and $93,000 selling and administrative expenses. The per-unit manufacturing cost under absorption costing is__.arrow_forwardNeed help me this question general accountingarrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning