Loose Leaf for Corporate Finance Format: Loose-leaf

12th Edition

ISBN: 9781260139716

Author: Ross

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 4QAP

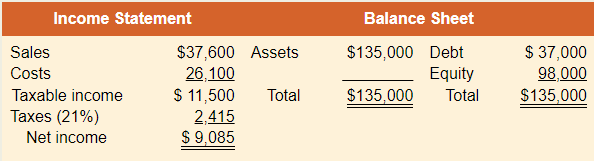

EFN The most recent financial statements for Bello, Inc., are shown here:

Assets and costs are proportional to sales; debt and equity are not. A dividend of $2,700 was paid, and the company wishes to maintain a constant payout ratio. Next year’s sales are projected to be $42,112. What external financing is needed?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the difference between a contra asset account and a liability?i need help.

What is the significance of a company’s price-to-earnings (P/E) ratio? i need answer.

What is the significance of a company’s price-to-earnings (P/E) ratio?

Chapter 3 Solutions

Loose Leaf for Corporate Finance Format: Loose-leaf

Ch. 3 - Financial Ratio Analysis A financial ratio by...Ch. 3 - Industry-Specific Ratios So-called same-store...Ch. 3 - Sales Forecast Why do you think most long-term...Ch. 3 - Sustainable Growth In the chapter, we used...Ch. 3 - EFN and Growth Rate Broslofski Co. maintains a...Ch. 3 - Common-Size Financials One tool of financial...Ch. 3 - Asset Utilization and EFN One of the implicit...Ch. 3 - Comparing ROE and ROA Both ROA and ROE measure...Ch. 3 - Ratio Analysis Consider the ratio EBITD/Assets....Ch. 3 - Return on Investment A ratio that is becoming more...

Ch. 3 - Use the following information to answer the next...Ch. 3 - Prob. 12CQCh. 3 - Use the following information to answer the next...Ch. 3 - Use the following information to answer the next...Ch. 3 - Use the following information to answer the next...Ch. 3 - DuPont Identity If Muenster, Inc., has an equity...Ch. 3 - Equity Multiplier and Return on Equity Synovec...Ch. 3 - Prob. 3QAPCh. 3 - EFN The most recent financial statements for...Ch. 3 - Prob. 5QAPCh. 3 - Sustainable Growth If the Moran Corp. has an ROE...Ch. 3 - Prob. 7QAPCh. 3 - Prob. 8QAPCh. 3 - Prob. 9QAPCh. 3 - Prob. 10QAPCh. 3 - Prob. 11QAPCh. 3 - Prob. 12QAPCh. 3 - External Funds Needed The Optical Scam Company has...Ch. 3 - Days' Sales in Receivables A company has net...Ch. 3 - Prob. 15QAPCh. 3 - Prob. 16QAPCh. 3 - Prob. 17QAPCh. 3 - Prob. 19QAPCh. 3 - Prob. 20QAPCh. 3 - Calculating EFN The most recent financial...Ch. 3 - Prob. 22QAPCh. 3 - Prob. 23QAPCh. 3 - Prob. 26QAPCh. 3 - Prob. 27QAPCh. 3 - Prob. 28QAPCh. 3 - Prob. 29QAPCh. 3 - Prob. 30QAPCh. 3 - Calculate all of the ratios listed in the industry...Ch. 3 - Prob. 2MCCh. 3 - Prob. 3MCCh. 3 - Prob. 4MCCh. 3 - Prob. 5MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License