Loose Leaf for Corporate Finance Format: Loose-leaf

12th Edition

ISBN: 9781260139716

Author: Ross

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 21QAP

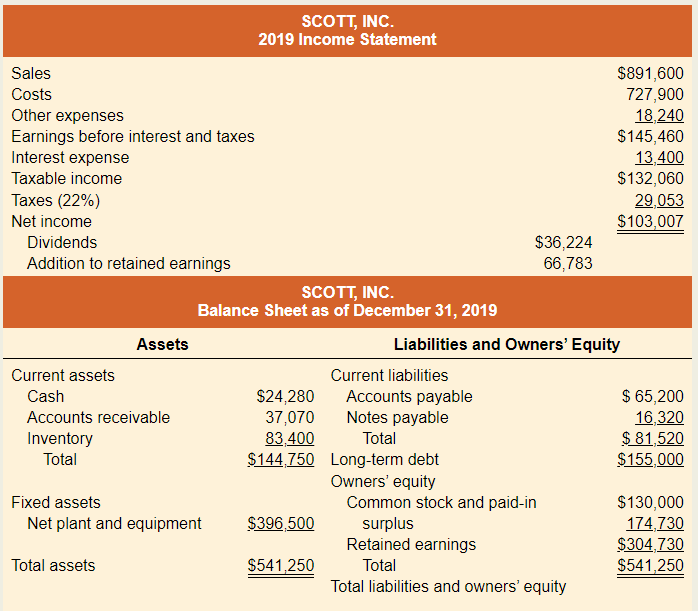

Calculating EFN The most recent financial statements for Scott, Inc., appear below. Sales for 2020 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the difference between a contra asset account and a liability?i need help.

What is the significance of a company’s price-to-earnings (P/E) ratio? i need answer.

What is the significance of a company’s price-to-earnings (P/E) ratio?

Chapter 3 Solutions

Loose Leaf for Corporate Finance Format: Loose-leaf

Ch. 3 - Financial Ratio Analysis A financial ratio by...Ch. 3 - Industry-Specific Ratios So-called same-store...Ch. 3 - Sales Forecast Why do you think most long-term...Ch. 3 - Sustainable Growth In the chapter, we used...Ch. 3 - EFN and Growth Rate Broslofski Co. maintains a...Ch. 3 - Common-Size Financials One tool of financial...Ch. 3 - Asset Utilization and EFN One of the implicit...Ch. 3 - Comparing ROE and ROA Both ROA and ROE measure...Ch. 3 - Ratio Analysis Consider the ratio EBITD/Assets....Ch. 3 - Return on Investment A ratio that is becoming more...

Ch. 3 - Use the following information to answer the next...Ch. 3 - Prob. 12CQCh. 3 - Use the following information to answer the next...Ch. 3 - Use the following information to answer the next...Ch. 3 - Use the following information to answer the next...Ch. 3 - DuPont Identity If Muenster, Inc., has an equity...Ch. 3 - Equity Multiplier and Return on Equity Synovec...Ch. 3 - Prob. 3QAPCh. 3 - EFN The most recent financial statements for...Ch. 3 - Prob. 5QAPCh. 3 - Sustainable Growth If the Moran Corp. has an ROE...Ch. 3 - Prob. 7QAPCh. 3 - Prob. 8QAPCh. 3 - Prob. 9QAPCh. 3 - Prob. 10QAPCh. 3 - Prob. 11QAPCh. 3 - Prob. 12QAPCh. 3 - External Funds Needed The Optical Scam Company has...Ch. 3 - Days' Sales in Receivables A company has net...Ch. 3 - Prob. 15QAPCh. 3 - Prob. 16QAPCh. 3 - Prob. 17QAPCh. 3 - Prob. 19QAPCh. 3 - Prob. 20QAPCh. 3 - Calculating EFN The most recent financial...Ch. 3 - Prob. 22QAPCh. 3 - Prob. 23QAPCh. 3 - Prob. 26QAPCh. 3 - Prob. 27QAPCh. 3 - Prob. 28QAPCh. 3 - Prob. 29QAPCh. 3 - Prob. 30QAPCh. 3 - Calculate all of the ratios listed in the industry...Ch. 3 - Prob. 2MCCh. 3 - Prob. 3MCCh. 3 - Prob. 4MCCh. 3 - Prob. 5MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License