Concept explainers

Work in process account data for two months; cost of production reports

Pittsburgh Aluminum Company uses a

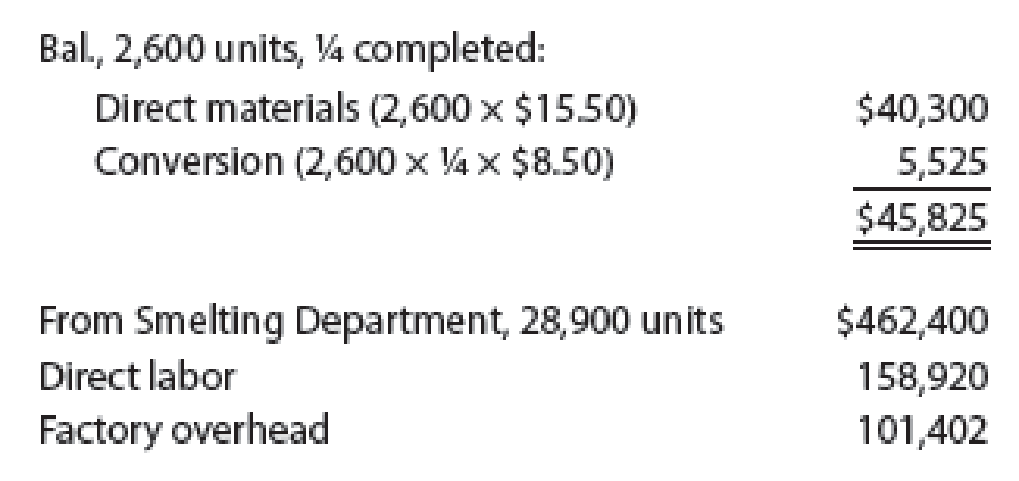

During September, 2,600 units in process on September 1 were completed, and of the 28,900 units entering the department, all were completed except 2,900 units that were 4⁄5 completed.

Charges to Work in Process—Rolling for October were as follows:

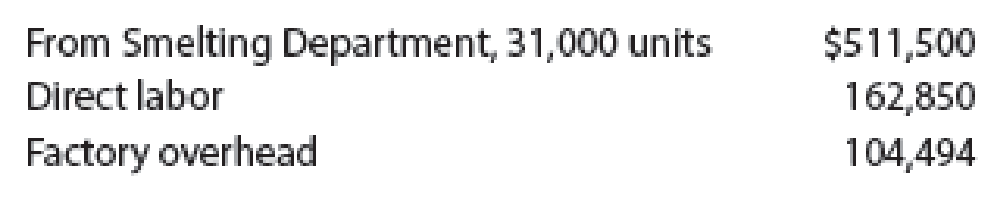

During October, the units in process at the beginning of the month were completed, and of the 31,000 units entering the department, all were completed except 2,000 units that were 2⁄5 completed.

Instructions

- 1. Enter the balance as of September 1 in a four-column account for Work in Process—Rolling. Record the debits and the credits in the account for September. Construct a cost of production report and present computations for determining (A) equivalent units of production for materials and conversion, (B) costs per equivalent unit, (C) cost of goods finished, differentiating between units started in the prior period and units started and finished in September, and (D) work in process inventory.

- 2. Provide the same information for October by recording the October transactions in the four-column work in process account. Construct a cost of production report, and present the October computations (A through D) listed in part (1).

- 3. Comment on the change in costs per equivalent unit for August through October for direct materials and conversion cost.

(1)

Prepare the four-column account for work in process inventory balancerolling departmentfrom September to October of Company PA.

Explanation of Solution

Process costs

It is a method of cost accounting, which is used where the production is continuous, and the product needs various processes to complete. This method is used to ascertain the cost of the product at each process or stage of production.

Equivalents units for production

The activity of a processing department in terms of fully completed units is known as equivalent units. It includes the completed units of direct materials and conversion cost of beginning work in process, units completed and transferred out, and ending work in process.

Production cot report

A production cost report is a comprehensive report prepared for each department separately at the end of a particular period, which represents the physical flow and cost flow of product for the concerned department.

Prepare the four column account for work in process inventory balance rolling department from September to October of Company PA as shown below:

| Work in Process - Rolling | |||||

| Date | Item | Debit | Credit | Balance | |

| Debit | Credit | ||||

| Sept 1 | Balance, 2,600 units | $45,825 | |||

| Sept 30 | Smelting department | $462,400 | $508,225 | ||

| Sept 30 | Direct labor | $158,920 | $667,145 | ||

| Sept 30 | Factory overhead | $101,402 | $768,547 | ||

| Sept 30 | Finished goods | $702,195 | $66,352 | ||

| Sept 30 | Balance, 2,900 units | $66,352 | |||

| Oct 31 | Smelting department | $511,500 | $577,852 | ||

| Oct 31 | Direct labor | $162,850 | $740,702 | ||

| Oct 31 | Factory overhead | $104,494 | $845,196 | ||

| Oct 31 | Finished goods | $805,156 | $40,040 | ||

| Oct 31 | Balance, 2,000 units | $40,040 | |||

Table (1)

Hence, Work in process inventory ending balance for the month of September is $66,352 and for the month of October is $40,040.

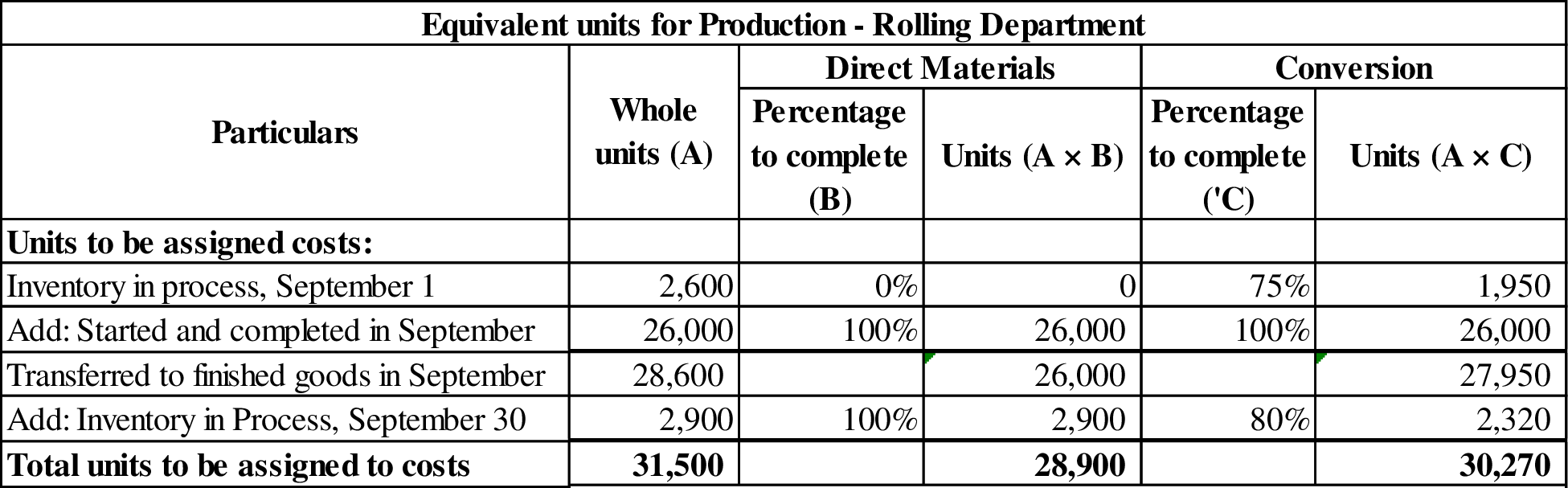

(1) (A)

Prepare the equivalents units for production of direct materials and conversion cost of Company PA.

Explanation of Solution

Prepare the equivalent units for production of direct materials and conversion cost of Company PA as shown below:

Figure (1)

Working notes:

Calculate opening work in process inventory for conversion percentage to complete as shown below:

Calculate units started and completed in September as shown below:

Calculate ending work in process inventory units as shown below:

Total units to be assigned to costs is calculated by adding opening work in process inventory, units started and completed and ending work in process inventory.

Therefore, direct material equivalent units for production is 28,900 units and conversion cost equivalent units for production is 30,270 units.

(1)(B)

Prepare the cost per equivalent unit for direct material and conversion cost of Company PA.

Explanation of Solution

Calculate the cost per equivalent unit for direct material and conversion cost of Company PA as shown below:

Working note:

Calculate conversion cost for the month of September of Company PA as shown below:

Equivalent cost per unit for direct materials is calculated by dividing direct material cost by equivalent units for direct materials. Equivalent cost per unit for conversion cost is calculated by dividing conversion cost by equivalent units for conversion.

Therefore, equivalent cost per unit for direct material is $16.00 per unit and for conversion cost is $8.60 per unit.

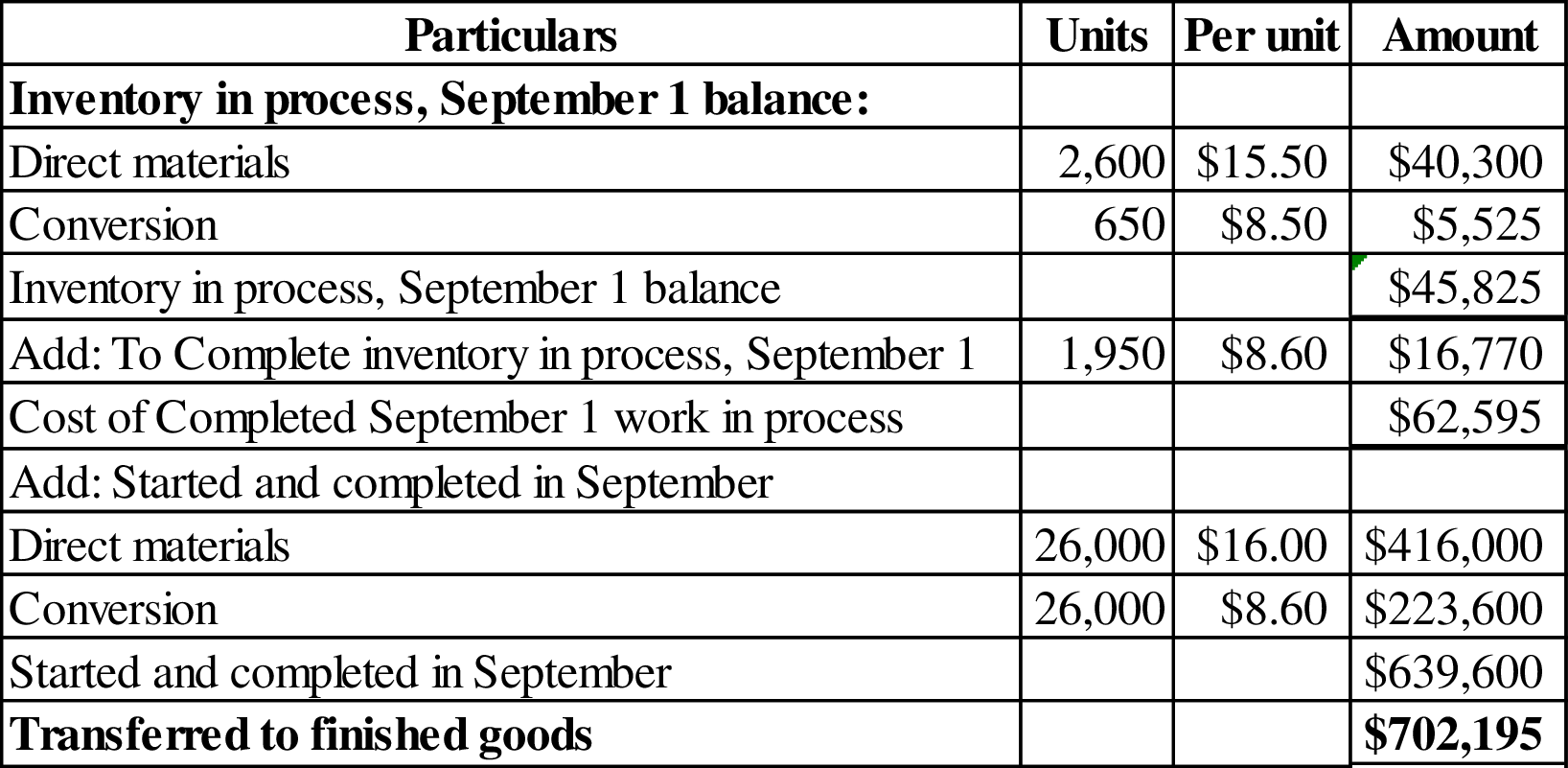

(1) (C)

Prepare the cost of goods finished, between units stared in the prior period and units started and finished in September of Company PA.

Explanation of Solution

Prepare the cost of goods finished, between units stared in the prior period and units started and finished in September of Company PA as shown below:

Figure (2)

Costs transferred to finished goods is calculated by adding opening inventory in September balance, to complete opening work in process inventory in September, andcost of units started and completed in September.

Hence, cost of completed work in process inventory in September 1 is $62,595, cost for started and completed in September is $639,600, and transferred to finished goods is $702,195.

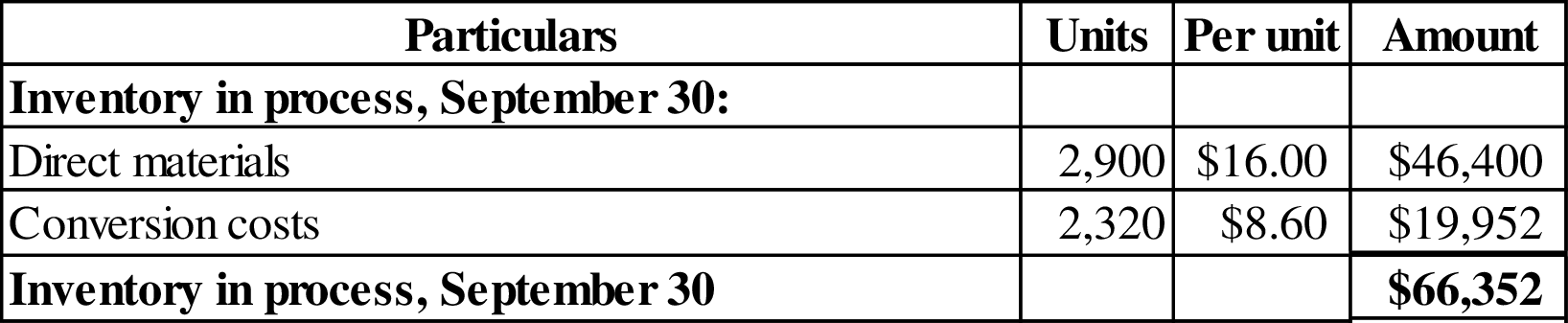

(1)(D)

Prepare the ending work in process inventory cost of the month September for the Company PA.

Explanation of Solution

Prepare the ending work in process inventory cost of the month September for the Company PA as shown below:

Figure (3)

Ending work in process inventory cost is calculated by adding ending direct material cost and ending conversion costs.

Hence, ending work in process inventory cost for the month of September is $66,352.

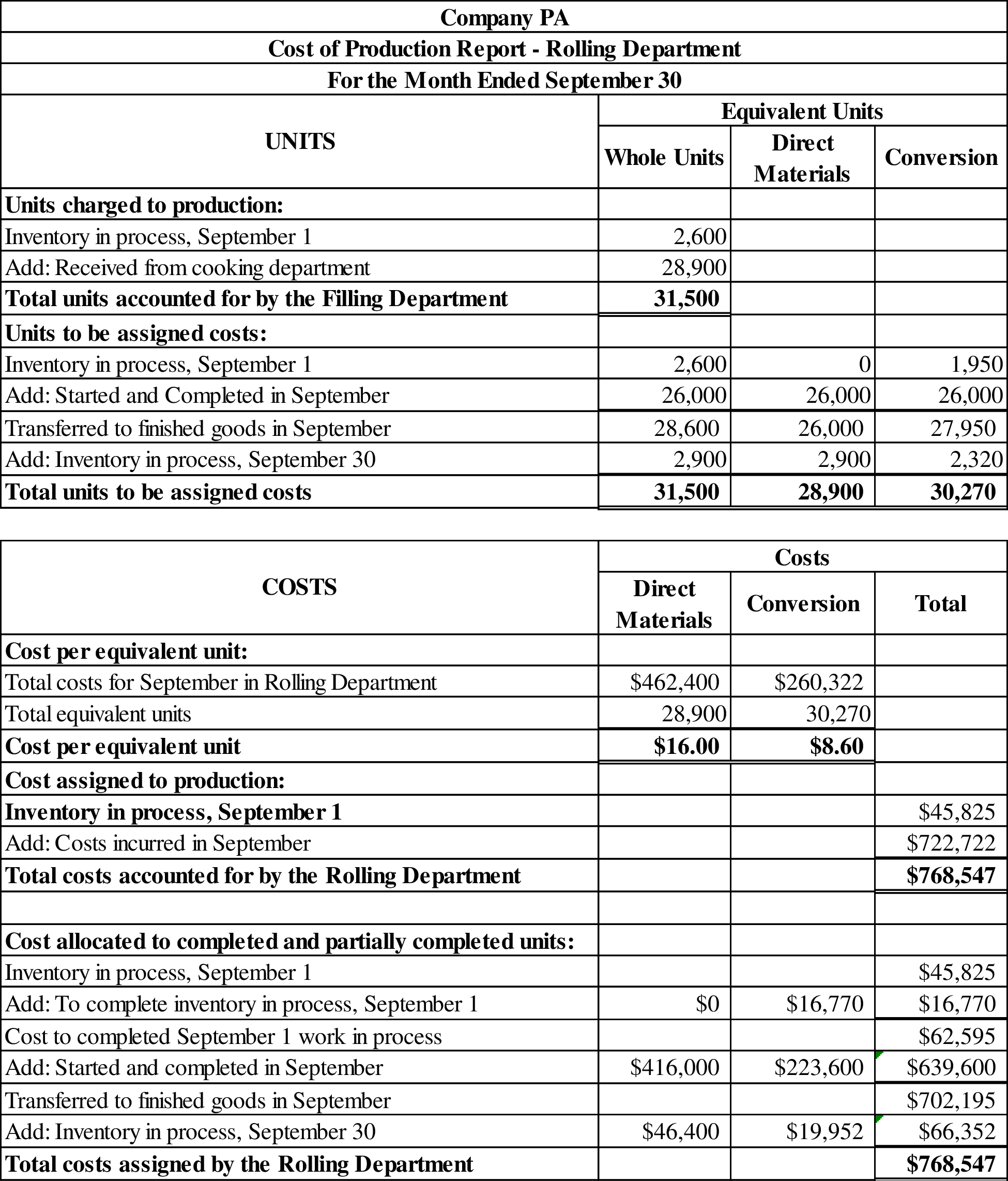

Prepare the production cost report of rolling department for the month of September of Company PA.

Explanation of Solution

Prepare the production cost report of rolling department for the month of September for Company PA as shown below:

Figure (4)

Therefore, cost of production report for rolling department during the month of September for Company PA is $768,547.

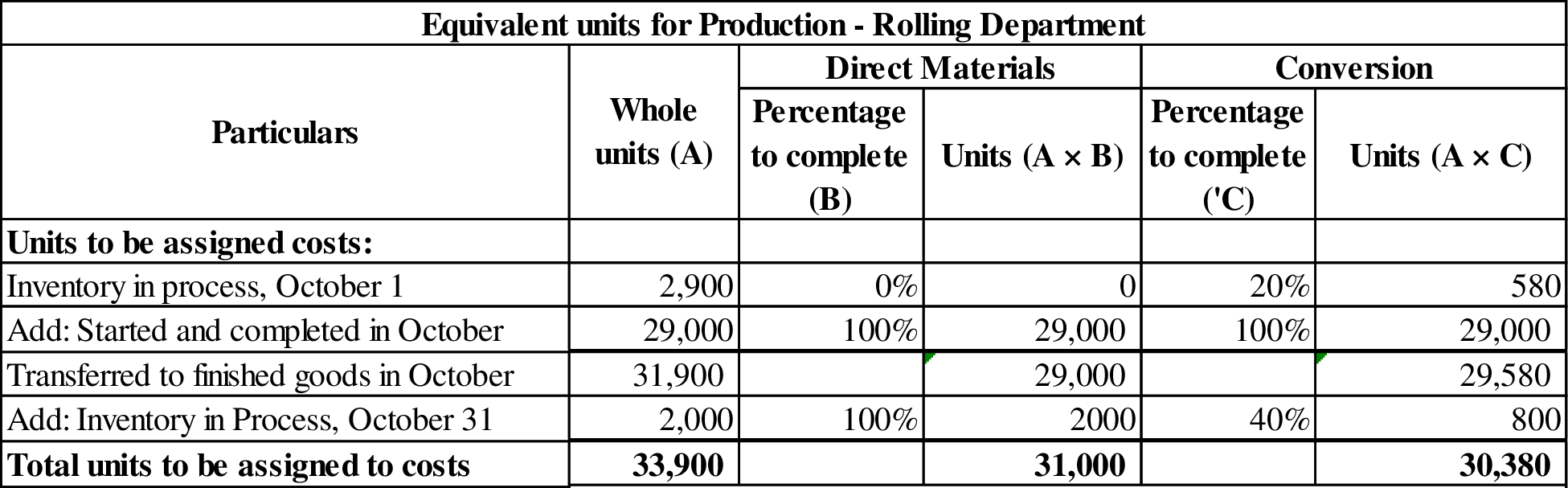

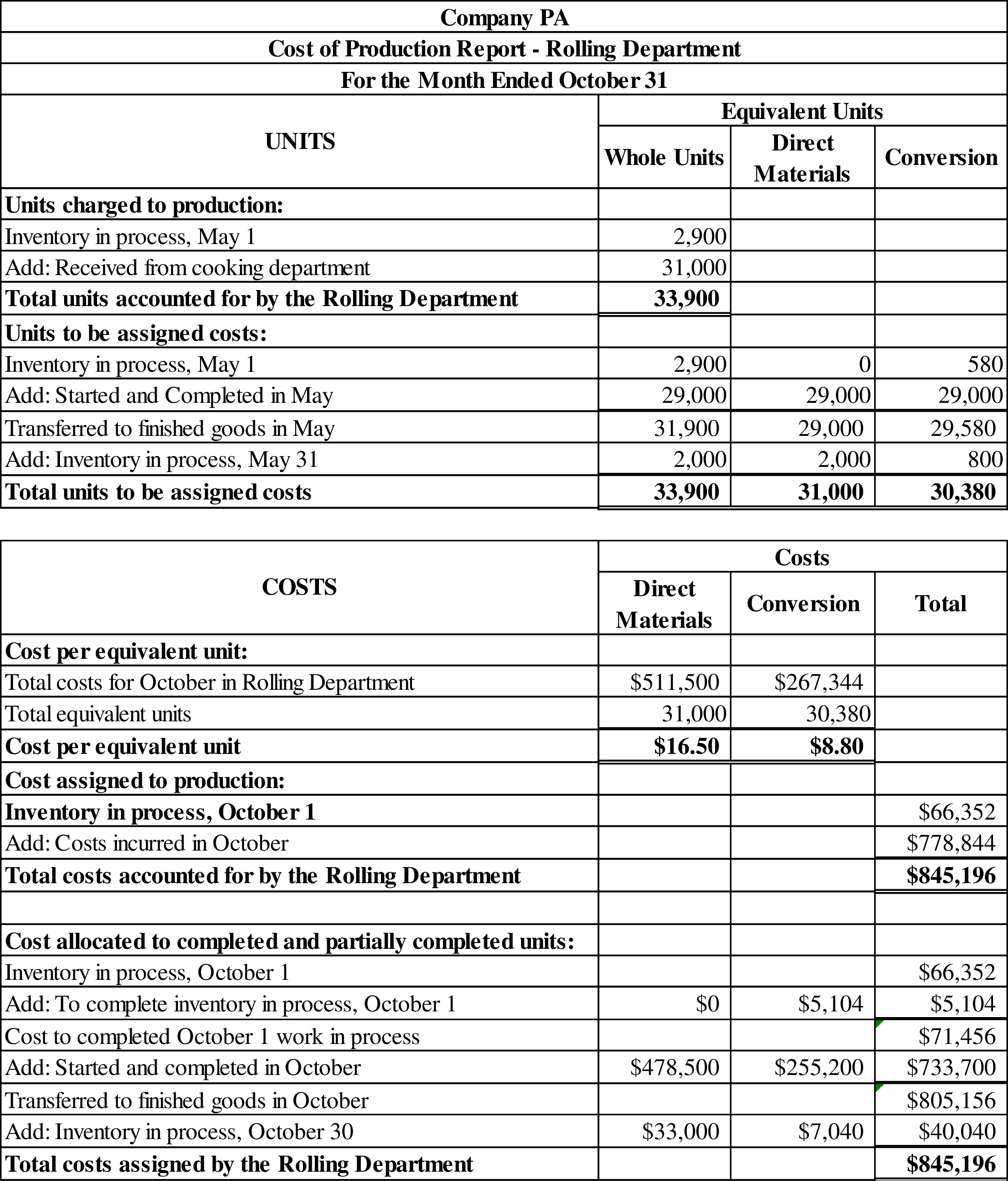

(2) (A)

Prepare the equivalents units for production of direct materials and conversion cost during the month of October for Company PA.

Explanation of Solution

Prepare the equivalents units for production of direct materials and conversion cost during the month of October for Company PA as shown below:

Figure (5)

Working notes:

Calculate opening work in process inventory for conversion percentage to complete as shown below:

Calculate units started and completed in October as shown below:

Calculate ending work in process inventory units as shown below:

Total units to be assigned to costs is calculated by adding opening work in process inventory, units started and completed and ending work in process inventory.

Therefore, direct material equivalent units for production is 31,000 units and conversion cost equivalent units for production is 30,380 units.

(2) (B)

Prepare the cost per equivalent unit for direct material and conversion cost during the month of Octoberfor Company PA.

Explanation of Solution

Calculate the cost per equivalent unit for direct material and conversion cost during the month of October for Company PA as shown below:

Working note:

Calculate conversion cost for the month of September of Company PA as shown below:

Equivalent cost per unit for direct materials is calculated by dividing direct material cost by equivalent units for direct materials. Equivalent cost per unit for conversion cost is calculated by dividing conversion cost by equivalent units for conversion.

Therefore, equivalent cost per unit for direct material is $16.50 per unit and for conversion cost is $8.80 per unit.

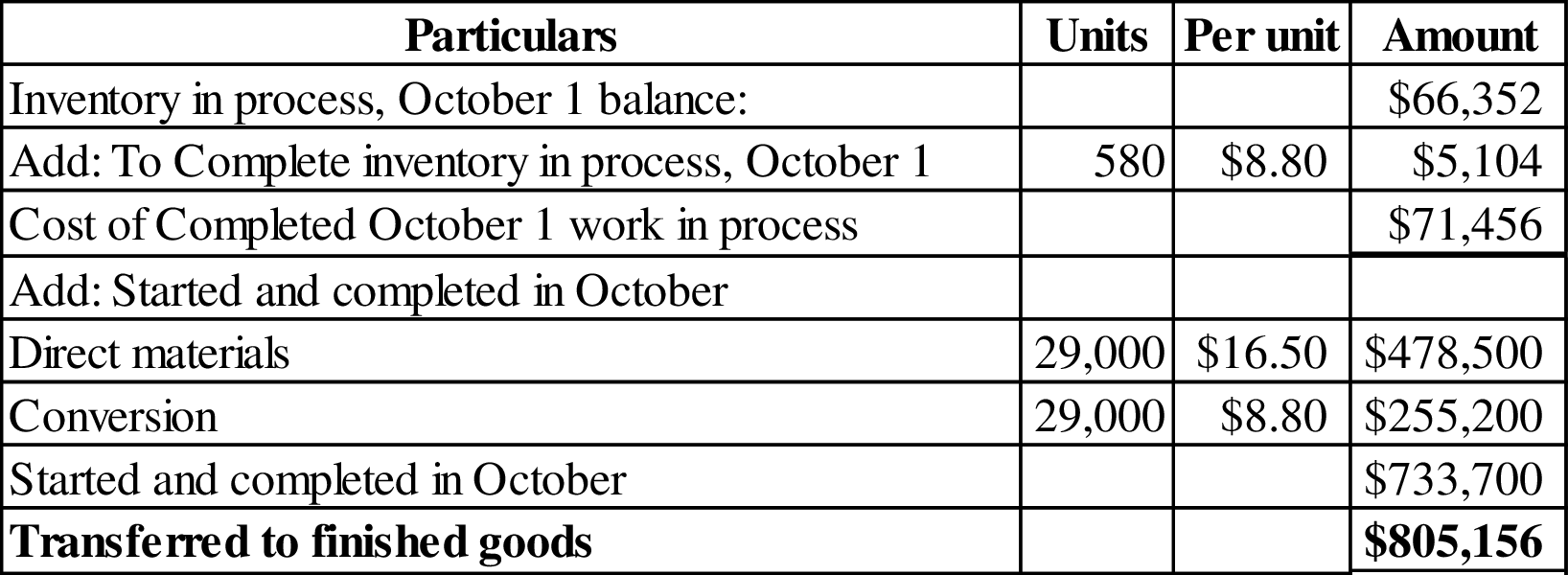

(2) (C)

Prepare the cost of goods finished, between units stared in the prior period and units started and finished in October of Company PA.

Explanation of Solution

Prepare the cost of goods finished, between units stared in the prior period and units started and finished in October of Company PA as shown below:

Figure (6)

Costs transferred to finished goods is calculated by adding opening inventory in September balance, to complete opening work in process inventory in September, and cost of units started and completed in September.

Hence, cost of completed work in process inventory in October 1 is $71,456, cost for started and completed in October is $733,700, and transferred to finished goods is $805,156.

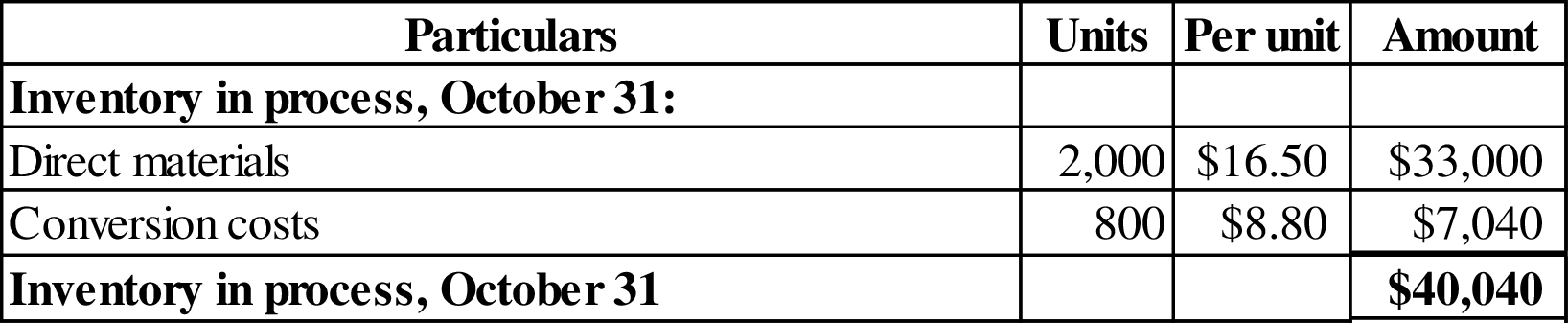

(2) (D)

Prepare the ending work in process inventory cost of the month October for the Company PA.

Explanation of Solution

Prepare the ending work in process inventory cost of the month October for the Company PA as shown below:

Figure (7)

Ending work in process inventory cost is calculated by adding ending direct material cost and ending conversion costs.

Hence, ending work in process inventory cost for the month of October is $40,040.

Prepare the production cost report of rolling department for the month of October of Company PA.

Explanation of Solution

Prepare the production cost report of rolling department for the month of October of Company PA as shown below:

Figure (8)

Therefore, cost of production report for Rolling department during the month of October for Company PA is $845,196.

(3)

Mention the change in cost per equivalent unit for August through October for direct materials and conversion costs.

Explanation of Solution

The cost per equivalent unit for direct material in August is $15.50 per unit, in September is $16.00 per unit, and in October is $16.50 per unit. Constantly direct material cost per unit is increased from August to October. Likewise, the cost per equivalent unit for conversion cost in August is $8.50 per unit, in September is $8.60 per unit, and in October$8.80 per unit. Constantly conversion cost per unit is increased from August to October. The Company PA scrutinizes for their underlying reasons, and any required remedial actions would be taken.

Want to see more full solutions like this?

Chapter 3 Solutions

Managerial Accounting

- Assuming that all sales were made on accountarrow_forwardThe amount of cash collected from customers during 2019 was?arrow_forwardDanbury Processing combines corn husks and methanol. After joint manufacturing costs of $4,200 have been incurred, the mixture separates into two products, cellulose fiber and methyl esters. At the split-off point, cellulose fiber can be sold for $8,300, and the methyl esters can be sold for $12,700. The cellulose fiber can be further processed at a cost of $9,100 to make biodegradable packaging, which could be sold for $21,500. The methyl esters can be further processed at a cost of $7,800 to make biodiesel, which could be sold for $18,900. What is the net increase (decrease) in operating income from biodegradable packaging? helparrow_forward

- I need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardDanbury Processing combines corn husks and methanol. After joint manufacturing costs of $4,200 have been incurred, the mixture separates into two products, cellulose fiber and methyl esters. At the split-off point, cellulose fiber can be sold for $8,300, and the methyl esters can be sold for $12,700. The cellulose fiber can be further processed at a cost of $9,100 to make biodegradable packaging, which could be sold for $21,500. The methyl esters can be further processed at a cost of $7,800 to make biodiesel, which could be sold for $18,900. What is the net increase (decrease) in operating income from biodegradable packaging?arrow_forwardCan you explain the process for solving this financial accounting question accurately?arrow_forward

- Financial accountingarrow_forwardGolden Star Cafe had a 12% return on a $60,000 investment in new dining furniture. The investment resulted in increased sales and an increase in income that was 3% of the increase in sales. What was the increase in sales? Accurate answerarrow_forwardI am looking for help with this financial accounting question using proper accounting standards.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning