Concept explainers

Cost of production report

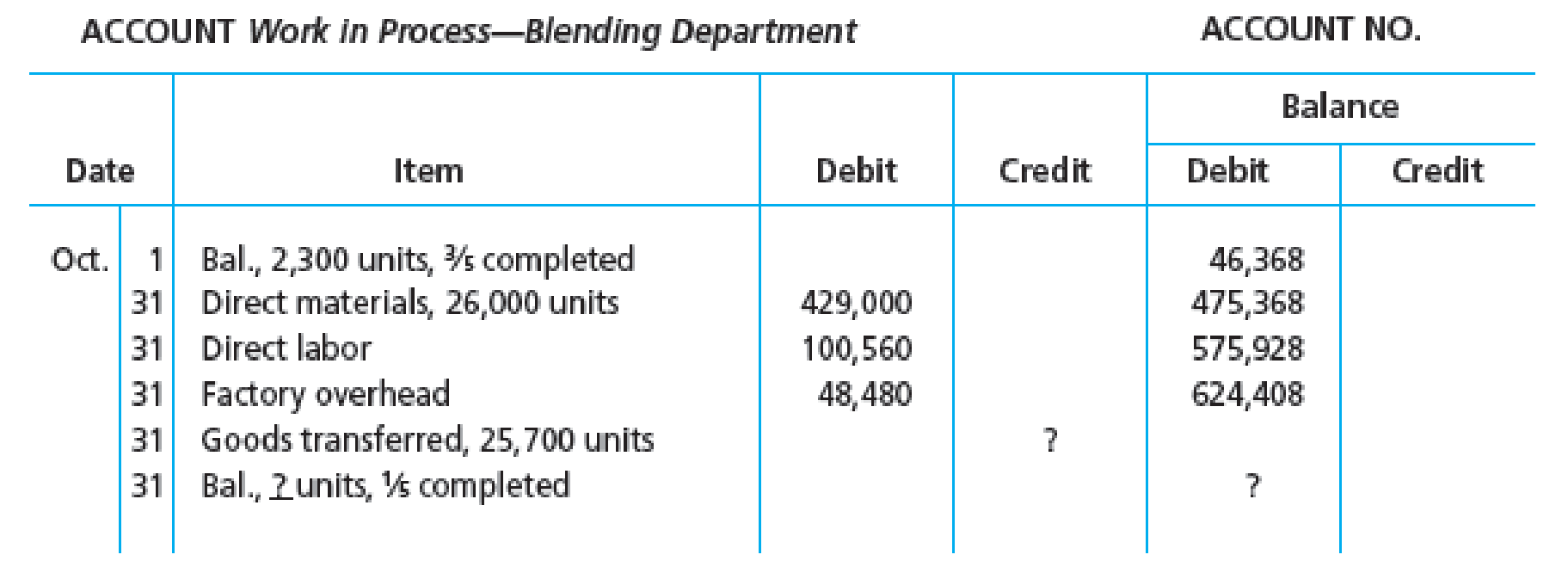

Bavarian Chocolate Company processes chocolate into candy bars. The process begins by placing direct materials (raw chocolate, milk, and sugar) into the Blending Department. All materials are placed into production at the beginning of the blending process. After blending, the milk chocolate is then transferred to the Molding Department, where the milk chocolate is formed into candy bars. The following is a partial work in process account of the Blending Department at October 31:

Instructions

- 1. Prepare a cost of production report, and identify the missing amounts for Work in Process—Blending Department.

- 2. Assuming that the October 1 work in process inventory includes direct materials of $38,295, determine the increase or decrease in the cost per equivalent unit for direct materials and conversion between September and October.

(1)

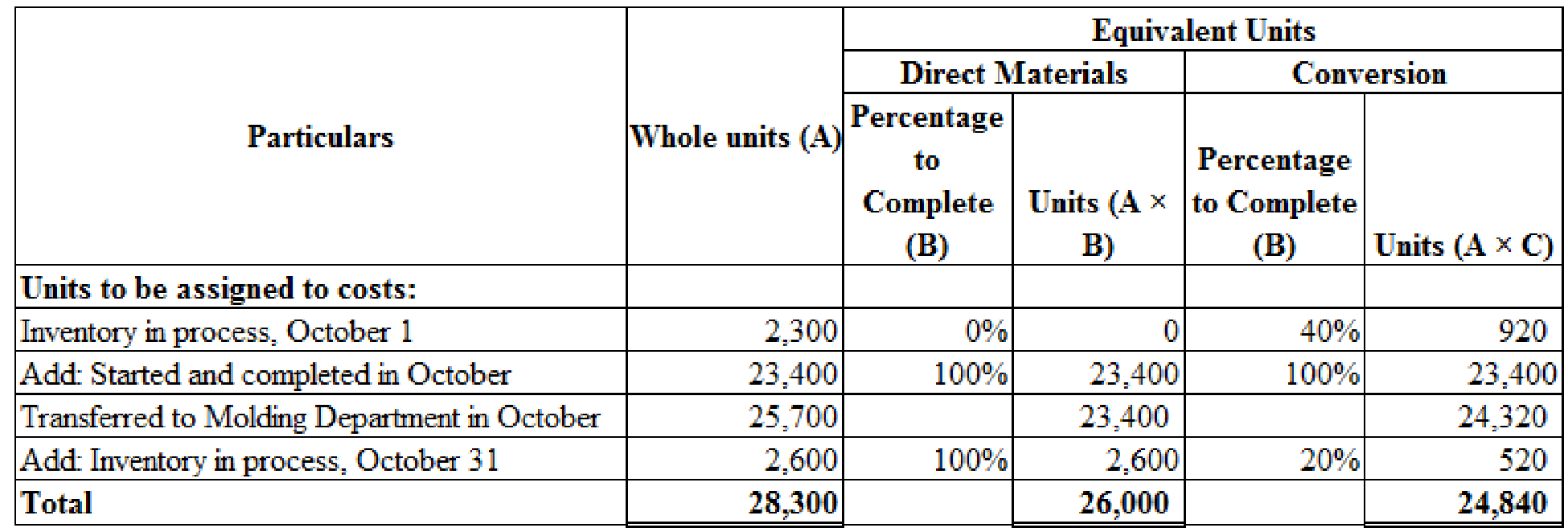

Calculate the equivalents units for production of direct materials and conversion costs for the month of October for Company BC.

Explanation of Solution

Process costs

It is a method of cost accounting, which is used where the production is continuous, and the product needs various processes to complete. This method is used to ascertain the cost of the product at each process or stage of production.

Equivalents units for production

The activity of a processing department in terms of fully completed units is known as equivalent units. It includes the completed units of direct materials and conversion cost of beginning work in process, units completed and transferred out, and ending work in process.

Production cost report

A production cost report is a comprehensive report prepared for each department separately at the end of a particular period, which represents the physical flow and cost flow of product for the concerned department.

Calculate the equivalents units for production of direct materials and conversion costs for the month of October for Company BC as shown below:

Figure (1)

Working notes:

Calculate opening work in process inventory for conversion costs as shown below:

Calculate units started and completed in October as shown below:

Calculate whole ending work in process inventory in October as shown below:

Calculate ending work in process inventory for conversion costs as shown below:

Equivalent units for production is calculated by adding units of opening work in process inventory, transferred to finished goods in october, and units for ending work in process inventory. Therefore, an equivalents unit for production for direct materials is 26,000 units and equivalent units for production for conversion costs is 24,840 units.

Therefore, the Company BC production cost for blending department during the period of October is $624,408.

(b)

Calculate the increase or decrease in the cost per equivalent per unit for direct materials and conversion cost between September and October when, work in process inventory as on October 1 includes $38,295 of direct materials.

Explanation of Solution

Calculate change in cost per equivalent unit for direct material and conversion cost during the month of October as shown below:

| Particulars | Per unit |

| Cost per unit for October month | $16.50 |

| Less: Cost per unit for September month | $16.65 |

| Decrease in direct material per unit | ($0.15) |

Table (2)

| Particulars | Per unit |

| Cost per unit for October month | $6.00 |

| Less: Cost per unit for September month | $5.85 |

| Increase in conversion cost per unit | $0.15 |

Table (3)

Working notes:

Calculate direct materials and conversion cost equivalent cost per unit for September as shown below:

Calculate total conversion costs for the month of September as shown below:

Calculate conversion cost units for the month of September as shown below:

Want to see more full solutions like this?

Chapter 3 Solutions

Managerial Accounting

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardCan you demonstrate the accurate method for solving this General accounting question?arrow_forward

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning