a.

Analyze the effects that each of the given transactions will have on the following six components of the company’s financial statements for the month of June.

a.

Explanation of Solution

Income statement:

The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and

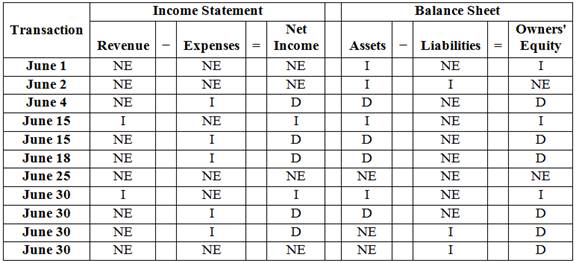

Analyze the effects that each of the given transactions will have on the following six components of the company’s financial statements for the month of June as follows:

Figure (1)

b.

Prepare journal entries for each transaction.

b.

Explanation of Solution

Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Prepare journal entries for each transaction as follows:

| Date | Account title and Explanation | Post ref. |

Debit (in $) | Credit (in $) |

| June 1 | Cash | 60,000 | ||

| Capital stock | 60,000 | |||

| (To record the issue of the capital stock) | ||||

| June 2 | Aircraft | 220,000 | ||

| Cash | 40,000 | |||

| Notes Payable | 180,000 | |||

| (To record the purchase of aircraft) | ||||

| June 4 | Rent expense | 2,500 | ||

| Cash | 2,500 | |||

| (To record the payment made for June rent) | ||||

| June 15 | 8,320 | |||

| Aerial photography revenue | 8,320 | |||

| (To record the services provided on account) | ||||

| June 15 | Salaries expense | 5,880 | ||

| Cash | 5,880 | |||

| (To record the salary expense paid) | ||||

| June 18 | Maintenance expense | 1,890 | ||

| Cash | 1,890 | |||

| (To record the maintenance expense paid) | ||||

| June 25 | Cash | 4,910 | ||

| Accounts receivable | 4,910 | |||

| (To record the cash collected from accounts receivable) | ||||

| June 30 | Accounts receivable | 16,450 | ||

| Aerial photography revenue | 16,450 | |||

| (To record the services provided on account) | ||||

| June 30 | Salaries expense | 6,000 | ||

| Cash | 6,000 | |||

| (To record the salary expense paid) | ||||

| June 30 | Fuel expense | 2,510 | ||

| Accounts payable | 2,510 | |||

| (To record the bill received for fuel used during June) | ||||

| June 30 | Dividends | 2,000 | ||

| Dividends Payable | 2,000 | |||

| (To record the payment due for the cash dividend declared) |

Table (1)

c.

Post each transaction to the appropriate ledger accounts.

c.

Explanation of Solution

T-account:

The condensed form of a ledger is referred to as T-account. The left-hand side of this account is known as debit, and the right hand side is known as credit.

Post each transaction to the appropriate ledger accounts as follows:

| Cash | |||||

| Date | Debit | Credit | Balance | ||

| Current Year | |||||

| June | 1 | 60,000 | 60,000 | ||

| 2 | 40,000 | 20,000 | |||

| 4 | 2,500 | 17,500 | |||

| 15 | 5,880 | 11,620 | |||

| 18 | 1,890 | 9,730 | |||

| 25 | 4,910 | 14,640 | |||

| 30 | 6,000 | 8,640 | |||

Table (2)

| Accounts Receivable | |||||

| Date | Debit | Credit | Balance | ||

| Current Year | |||||

| June | 15 | 8,320 | 8,320 | ||

| 25 | 4,910 | 3,410 | |||

| 30 | 16,450 | 1,9860 | |||

Table (3)

| Aircraft | |||||

| Date | Debit | Credit | Balance | ||

| Current Year | |||||

| June | 2 | 220,000 | 220,000 | ||

Table (4)

| Notes Payable | |||||

| Date | Debit | Credit | Balance | ||

| Current Year | |||||

| June | 2 | 180,000 | 180,000 | ||

Table (5)

| Accounts Payable | |||||

| Date | Debit | Credit | Balance | ||

| Current Year | |||||

| June | 30 | 2,510 | 2,510 | ||

Table (6)

| Dividends Payable | |||||

| Date | Debit | Credit | Balance | ||

| Current Year | |||||

| June | 30 | 2,000 | 2,000 | ||

Table (7)

| Capital Stock | |||||

| Date | Debit | Credit | Balance | ||

| Current Year | |||||

| June | 1 | 60,000 | 60,000 | ||

Table (8)

| Dividends | |||||

| Date | Debit | Credit | Balance | ||

| Current Year | |||||

| June | 30 | 2,000 | 2,000 | ||

Table (9)

| Aerial Photography Revenue | |||||

| Date | Debit | Credit | Balance | ||

| Current Year | |||||

| June | 15 | 8,320 | 8,320 | ||

| 30 | 16,450 | 24,770 | |||

Table (10)

| Maintenance Expense | |||||

| Date | Debit | Credit | Balance | ||

| Current Year | |||||

| June | 18 | 1,890 | 1,890 | ||

Table (11)

| Fuel Expense | |||||

| Date | Debit | Credit | Balance | ||

| Current Year | |||||

| June | 30 | 2,510 | 2,510 | ||

Table (12)

| Salaries Expense | |||||

| Date | Debit | Credit | Balance | ||

| Current Year | |||||

| June | 15 | 5,880 | 5,880 | ||

| 30 | 6,000 | 11,880 | |||

Table (13)

| Rent Expense | |||||

| Date | Debit | Credit | Balance | ||

| Current Year | |||||

| June | 4 | 2,500 | 2,500 | ||

Table (14)

d.

Prepare a

d.

Explanation of Solution

Trial balance:

Trial balance is a summary of all the ledger accounts balances presented in a tabular form with two column, debit and credit. It checks the mathematical accuracy of the

Prepare a trial balance dated June 31, current year as follows:

| Company A | ||

| Trial Balance | ||

| June 30, Current Year | ||

| Cash | $8,640 | |

| Accounts receivable | 19,860 | |

| Aircraft | 220,000 | |

| Notes payable | $180,000 | |

| Accounts payable | 2,510 | |

| Dividends payable | 2,000 | |

| Capital stock | 60,000 | |

| | 0 | |

| Dividends | 2,000 | |

| Aerial photography revenue | 24,770 | |

| Maintenance expense | 1,890 | |

| Fuel expense | 2,510 | |

| Salaries expense | 11,880 | |

| Rent expense | 2,500 | |

| $269,280 | $269,280 | |

Table (15)

e.

Compute total assets, total liabilities, and owners’ equity and explain whether these are the figures that the company will report in its June 30 balance sheet.

e.

Explanation of Solution

Assets:

These are the resources owned and controlled by business and used to produce benefits for the company. Assets are classified on the balance sheet as current assets, non-current assets, property, plant, and equipment, and intangible assets.

Liabilities:

The claims creditors have over assets or resources of a company are referred to as liabilities. These are the debt obligations owed by company to creditors. Liabilities are classified on the balance sheet as current liabilities and long-term liabilities.

Owners’ equity:

Owner’s equity refers to the right the owner possesses over the resources of the business. Revenues and the expenses are the components of the owner’s equity.

Net income:

The bottom line of income statement which is the result of excess of earnings from operations (revenues) over the costs incurred for earning revenues (expenses) is referred to as net income.

Compute total assets, total liabilities, and owners’ equity as follows:

| Total Assets: | ||

| Cash | $8,640 | |

| Accounts receivable | 19,860 | |

| Aircraft | 220,000 | |

| Total assets | $248,500 | |

| Total Liabilities: | ||

| Notes payable | $180,000 | |

| Accounts payable | 2,510 | |

| Dividends payable | 2,000 | |

| Total liabilities | $184,510 | |

| Total Owners' Equity: | ||

| Total assets − Total liabilities | $63,990 |

Table (16)

Explain whether these are the figures that the company will report in its June 30 balance sheet as follows:

No, these are not the figures that the company will report in its June 30 balance sheet. Adjustments will be made to the trial balance figures at the end, before preparing the financial statements of the company. The figures, after the adjustments are made, will be the figures that the company will report in its June 30 balance sheet.

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting

- Get correct answer with general accountingarrow_forwardPlato Ventures reports sales revenue of $285,000 and the cost of goods sold is $163,000. What is the gross profit for the period? A) $112,000 B) $98,000 C) $122,000 D) $148,000arrow_forwardWhat is the degree of operating leverage on these financial accounting question?arrow_forward

- What would be the reported book value of the trademark three years after purchase?arrow_forwardAnswerarrow_forwardDiscuss the accounting treatment for property and equipment impairment and the potential impact on the company's financial statements. What factors can trigger an impairment test? Answerarrow_forward

- Right Answerarrow_forwardWhat is the profit margin if the tax rate is 32 percent?arrow_forwardNova Flex Corp. had net fixed assets of $20,500 at the start of the year and $21,800 at the end. The company recorded $4,200 in depreciation and spent $9,000 on purchasing new fixed assets. How much in fixed assets did Nova Flex Corp. sell during the year?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education