Principles of Accounting: Chapters 1-13

12th Edition

ISBN: 9781133593102

Author: Belverd E., Jr, Ph.d. Needles, Marian, Ph.D. Powers, Susan V. Crosson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

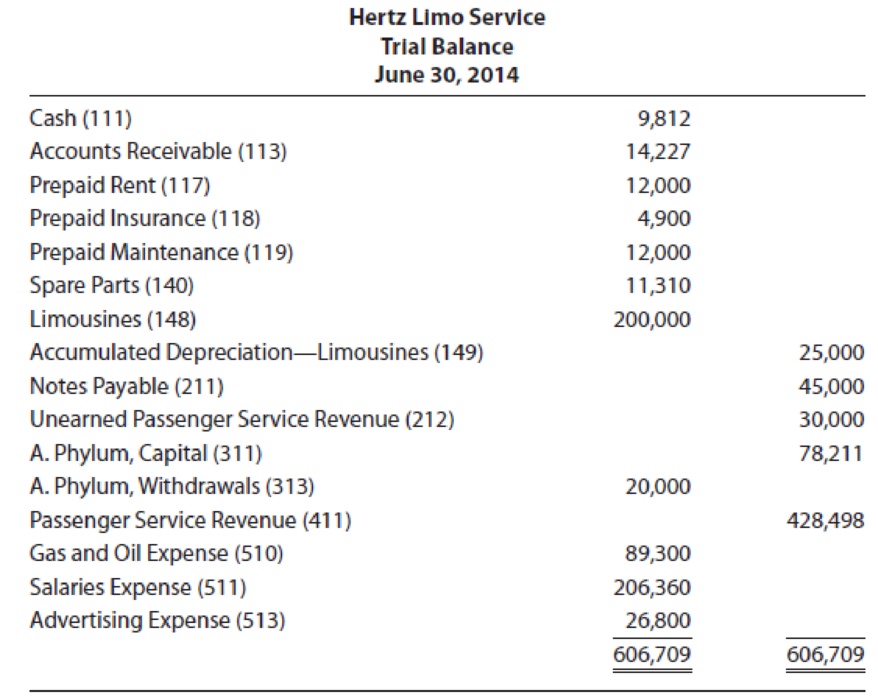

Chapter 3, Problem 4P

Hertz Limo Service was organized to provide limousine service between the airport and various suburban locations. It has just completed its second year of business. Its

The following information is also available:

- a. To obtain space at the airport, Hertz paid two years’ rent in advance when it began the business.

- b. An examination of insurance policies reveals that $2,800 expired during the year.

- c. To provide regular maintenance for the vehicles, Hertz deposited $12,000 with a local garage. An examination of maintenance invoices reveals charges of $10,944 against the deposit.

- d. An inventory of spare parts shows $1,902 on hand.

- e. Hertz depreciates all of its limousines at the rate of 12.5 percent per year. No limousines were purchased during the year. (Round answer to the nearest dollar.)

- f. A payment of $1,500 for one full year’s interest on notes payable is now due.

- g. Unearned Passenger Service Revenue on June 30 includes $17,815 for tickets that employers purchased for use by their executives but which have not yet been redeemed.

REQUIRED

- 1. Determine the

adjusting entries and enter them in the general journal (Page 14). - 2. Open ledger accounts for the accounts in the trial balance plus the following: Interest Payable (213); Rent Expense (514); Insurance Expense (515); Spare Parts Expense (516);

Depreciation Expense—Limousines (517); Maintenance Expense (518); and Interest Expense (519). Record the balances shown in the trial balance. - 3.

Post the adjusting entries from the general journal to the ledger accounts, showing proper references. - 4. Prepare an adjusted trial balance, an income statement, a statement of owner’s equity, and a

balance sheet . The owner made no investments during the period. - 5. ACCOUNTING CONNECTION ▶ What effect do the adjusting entries have on the income statement?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Delta Industries has an operating leverage of 3.8. If the company's sales

increase by 10%, by approximately how much should its net operating

income increase?

a) 10.0%

b) 26.3%

c) 38.0%

d) 3.8%

During its first year, Maple Ltd. reported a $25 per-unit profit under

absorption costing but would have reported $12,000 less profit under

variable costing. Suppose production exceeded sales by 400 units, and an

average contribution margin of 60% was maintained.

a) What is the fixed cost per unit?

b) What is the sales price per unit?

c) What is the variable cost per unit?

d) What is the unit sales volume if total profit under absorption costing

was $250,000?

A firm has a market value equal to its book value. The

firm has excess cash of $1,000, other assets of $6,500,

and equity of $7,500. The firm has 750 shares of stock

outstanding. The firm has decided to spend half of its

excess cash on a share repurchase program. How many

shares will be outstanding after the repurchase is

completed?

Chapter 3 Solutions

Principles of Accounting: Chapters 1-13

Ch. 3 - Prob. 1DQCh. 3 - Will the carrying value of a long-term asset...Ch. 3 - If, at the end of the accounting period, you were...Ch. 3 - Prob. 4DQCh. 3 - Prob. 5DQCh. 3 - Prob. 6DQCh. 3 - Match the concepts of accrual accounting that...Ch. 3 - The Prepaid Insurance account began the year with...Ch. 3 - The Supplies account began the year with a balance...Ch. 3 - Prob. 4SE

Ch. 3 - Prob. 5SECh. 3 - During the month of August, deposits in the amount...Ch. 3 - Prob. 7SECh. 3 - Malesherbes Companys adjusted trial balance on...Ch. 3 - Prob. 9SECh. 3 - Prob. 10SECh. 3 - Carlos Companys accountant makes the assumptions...Ch. 3 - Four conditions must be met before revenue should...Ch. 3 - Prob. 3EACh. 3 - Prob. 4EACh. 3 - Prob. 5EACh. 3 - Prob. 6EACh. 3 - Prob. 7EACh. 3 - Prob. 8EACh. 3 - Prepare year-end adjusting entries for each of the...Ch. 3 - Prob. 10EACh. 3 - Prob. 11EACh. 3 - Wipro Companys income statement included the...Ch. 3 - At the end of the first three months of operation,...Ch. 3 - On November 30, the end of the current fiscal...Ch. 3 - Kinokawa Consultants Companys trial balance on...Ch. 3 - Hertz Limo Service was organized to provide...Ch. 3 - At the end of its fiscal year, Berwyn Cleaners...Ch. 3 - Brave Advisors Services trial balance on December...Ch. 3 - Prob. 7PCh. 3 - Prob. 8PCh. 3 - Prob. 9APCh. 3 - On March 31, the end of the current fiscal year,...Ch. 3 - Lee Technology Corporations trial balance on...Ch. 3 - Prob. 12APCh. 3 - Prob. 13APCh. 3 - Scoop Consulting Services trial balance on...Ch. 3 - Prob. 15APCh. 3 - Prob. 16APCh. 3 - Never Flake Company provided a rust-prevention...Ch. 3 - Prob. 2CCh. 3 - Prob. 3CCh. 3 - Prob. 4CCh. 3 - Prob. 5CCh. 3 - Prob. 6C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nelson Corp. paid $620 in dividends and $750 in interest this past year. Common stock increased by $300, and retained earnings decreased by $150. Required: Compute Nelson Corp.'s net income for the year. a) $470 b) $620 c) $750 d) $560 e) $300arrow_forwardProvide correct answer with accounting questionarrow_forwardCan you help me with accounting questionsarrow_forward

- Convex Incorporated sells 50 million shares of stock in an SEO, with a market price of $10 per share. The underwriter charges 65% of the gross proceeds as a fee. How much money was raised in the sale?arrow_forwardDo fast answer of this general accounting questionarrow_forwardHello teacher give me answer step by step calculationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY