Principles of Accounting: Chapters 1-13

12th Edition

ISBN: 9781133593102

Author: Belverd E., Jr, Ph.d. Needles, Marian, Ph.D. Powers, Susan V. Crosson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 10AP

On March 31, the end of the current fiscal year, the following information is available to assist Zun Cleaning Company’s accountants in making

- a. Zun’s Supplies account shows a beginning balance of $5,962. Purchases during the year were $10,294. The end-of-year inventory reveals supplies on hand of $3,105.

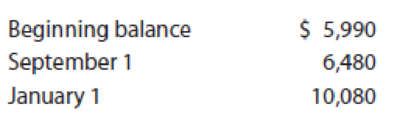

- b. The Prepaid Insurance account shows the following on March 31:

The beginning balance represents the unexpired portion of a one-year policy purchased in January of the previous year. The September 1 entry represents a new oneyear policy, and the January 1 entry represents additional coverage in the form of a three-year policy.

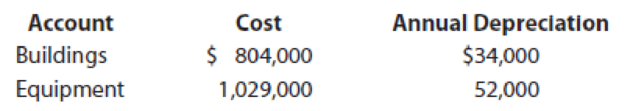

- c. The following table contains the cost and annual

depreciation for buildings and equipment, all of which Zun purchased before the current year:

- d. On December 1, the company completed negotiations with a client and accepted an advance of $32,000 for services to be performed monthly for a year. The $32,000 was credited to Unearned Services Revenue. (Round to the nearest dollar.)

- e. The company calculated that, as of March 31, it had earned $9,200 on a $17,000 contract that would be completed and billed in January.

- f. Among the liabilities of the company is a note payable in the amount of $600,000. On March 31, the accrued interest on this note amounted to $17,470.

- g. On Saturday, April 3, the company, which is on a six-day workweek, will pay its regular employees their weekly wages of $22,000. (Round to the nearest dollar.)

- h. On March 31, the company completed negotiations and signed a contract to provide services to a new client at an annual rate of $19,000, beginning April 1.

REQUIRED

- 1. Prepare adjusting entries for each item listed above.

- 2. CONCEPT ▶ Explain how the conditions for revenue recognition are applied to transactions e and h.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Assume that none of the fixed overhead can be avoided. However, if the robots are purchased from Tienh Inc., Crane can use the

released productive resources to generate additional income of $375,000. (Enter negative amounts using either a negative sign

preceding the number e.g. -45 or parentheses e.g. (45).)

Direct materials

Direct labor

Variable overhead

1A

Fixed overhead

Opportunity cost

Purchase price

Totals

Make

A

Buy

$

SA

Net Income

Increase

(Decrease)

$

Based on the above assumptions, indicate whether the offer should be accepted or rejected?

The offer

The following is a list of balances relating to Phiri Properties Ltd during 2024.

The company maintains a memorandum debtors and creditors ledger in which the individual account of customers and suppliers are maintained.

These were as follows:

Debit balance in debtors account 01/01/2024

66,300

Credit balance in creditors account 01/01/2024

50,600

Sunday credit balance on debtors ledger

Goods purchased on credit

724

257,919

Goods sold on credit

Cash received from debtors

Cash paid to suppliers

Discount received

Discount allowed

Cash purchases

Cash sales

Bad Debts written off

Interest on overdue account of customers

323,614

299,149

210,522

2,663

2,930

3,627

5,922

3,651

277

Returns outwards 2,926

Return inwards 2,805

Accounts settled by contra between debtors and creditors ledgers 1,106

Credit balances in debtors ledgers 31/12/2024. 815

Debit balances in creditors ledger 31/12/2024.698

Required:

Prepare the debtors control account as at 31/12/2024.

Prepare the creditors control account…

Soln

Chapter 3 Solutions

Principles of Accounting: Chapters 1-13

Ch. 3 - Prob. 1DQCh. 3 - Will the carrying value of a long-term asset...Ch. 3 - If, at the end of the accounting period, you were...Ch. 3 - Prob. 4DQCh. 3 - Prob. 5DQCh. 3 - Prob. 6DQCh. 3 - Match the concepts of accrual accounting that...Ch. 3 - The Prepaid Insurance account began the year with...Ch. 3 - The Supplies account began the year with a balance...Ch. 3 - Prob. 4SE

Ch. 3 - Prob. 5SECh. 3 - During the month of August, deposits in the amount...Ch. 3 - Prob. 7SECh. 3 - Malesherbes Companys adjusted trial balance on...Ch. 3 - Prob. 9SECh. 3 - Prob. 10SECh. 3 - Carlos Companys accountant makes the assumptions...Ch. 3 - Four conditions must be met before revenue should...Ch. 3 - Prob. 3EACh. 3 - Prob. 4EACh. 3 - Prob. 5EACh. 3 - Prob. 6EACh. 3 - Prob. 7EACh. 3 - Prob. 8EACh. 3 - Prepare year-end adjusting entries for each of the...Ch. 3 - Prob. 10EACh. 3 - Prob. 11EACh. 3 - Wipro Companys income statement included the...Ch. 3 - At the end of the first three months of operation,...Ch. 3 - On November 30, the end of the current fiscal...Ch. 3 - Kinokawa Consultants Companys trial balance on...Ch. 3 - Hertz Limo Service was organized to provide...Ch. 3 - At the end of its fiscal year, Berwyn Cleaners...Ch. 3 - Brave Advisors Services trial balance on December...Ch. 3 - Prob. 7PCh. 3 - Prob. 8PCh. 3 - Prob. 9APCh. 3 - On March 31, the end of the current fiscal year,...Ch. 3 - Lee Technology Corporations trial balance on...Ch. 3 - Prob. 12APCh. 3 - Prob. 13APCh. 3 - Scoop Consulting Services trial balance on...Ch. 3 - Prob. 15APCh. 3 - Prob. 16APCh. 3 - Never Flake Company provided a rust-prevention...Ch. 3 - Prob. 2CCh. 3 - Prob. 3CCh. 3 - Prob. 4CCh. 3 - Prob. 5CCh. 3 - Prob. 6C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- incoporate the accounting conceptual frameworksarrow_forwarda) Define research methodology in the context of accounting theory and discuss the importance of selecting appropriate research methodology. Evaluate the strengths and limitations of quantitative and qualitative approaches in accounting research. b) Assess the role of modern accounting theories in guiding research in accounting. Discuss how contemporary theories, such as stakeholder theory, legitimacy theory, and behavioral accounting theory, shape research questions, hypotheses formulation, and empirical analysis. Question 4 Critically analyse the role of financial reporting in investment decision-making, emphasizing the qualitative characteristics that enhance the usefulness of financial statements. Discuss how financial reporting influences both investor confidence and regulatory decisions, using relevant examples.arrow_forwardFastarrow_forward

- CODE 14 On August 1, 2010, Cheryl Newsome established Titus Realty, which completed the following transactions during the month: a. Cheryl Newsome transferred cash from a personal bank account to an account to be used for the business in exchange for capital stock, $25,000. b. Paid rent on office and equipment for the month, $2,750. c. Purchased supplies on account, $950. d. Paid creditor on account, $400. c. Earned sales commissions, receiving cash, $18,100. f. Paid automobile expenses (including rental charge) for month, $1,000, and miscel- laneous expenses, $600. g. Paid office salaries, $2,150. h. Determined that the cost of supplies used was $575. i. Paid dividends, $2,000. REQUIREMENTS: 1. Determine increase - decrease of each account and new balance 2. Prepare 3 F.S: Income statement; Retained Earnings Statement; Balance Sheet Scanned with CamScannerarrow_forwardAssume that TDW Corporation (calendar-year-end) has 2024 taxable income of $952,000 for purposes of computing the §179 expense. The company acquired the following assets during 2024: (Use MACRS Table 1, Table 2, Table 3, Table 4, and Table 5.) Asset Machinery Computer equipment Furniture Total Placed in Service September 12 February 10 April 2 Basis $ 2,270,250 263,325 880,425 $ 3,414,000 b. What is the maximum total depreciation, including §179 expense, that TDW may deduct in 2024 on the assets it placed in service in 2024, assuming no bonus depreciation? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Maximum total depreciation deduction (including §179 expense)arrow_forwardEvergreen Corporation (calendar-year-end) acquired the following assets during the current year: (Use MACRS Table 1 and Table 2.) Date Placed in Asset Machinery Service October 25 Original Basis $ 120,000 Computer equipment February 3 47,500 Used delivery truck* August 17 Furniture April 22 60,500 212,500 The delivery truck is not a luxury automobile. Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. b. What is the allowable depreciation on Evergreen's property in the current year if Evergreen does not elect out of bonus depreciation and elects out of §179 expense?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY