Problem 3-4A Interpreting unadjusted and adjusted trial balances, and preparing financial statements P1 P2 P3 P4 P5 P6

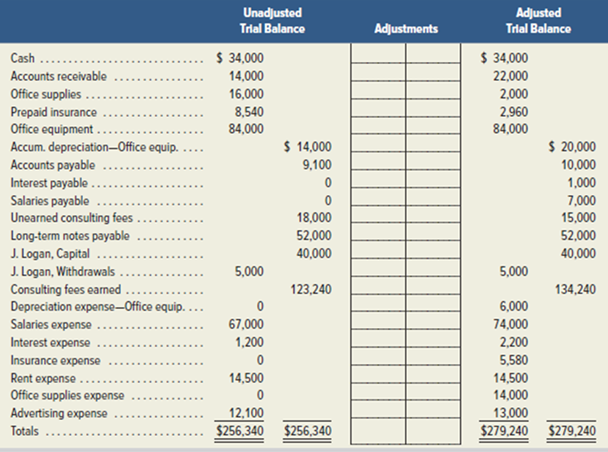

A six-column table for JK.L Company follows. The first two columns contain the unadjusted

Required

Analysis Component

1. Analyze the differences between the unadjusted and adjusted trial balances to determine the eight adjustments that likely were made. Show the results of yow analysis by inserting these adjustment amounts in the table’s two middle columns. Label each adjustment with a letter a through h and provide a short description of each. Preparation Component

2.

Use the information in the adjusted trial balance to prepare the company’s (a) income statement and its statement of owner’s equity for the ye ended July 31 [Note. 3. Logan, Capital at July 31 of the prior year was $40,000, and the cwrent-year withdrawals were $5,000] and (b) the

Check (2) Net income. $4,960: Total assets. $124,960

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Connect Access Card For Fundamental Accounting Principles

- Which of the following is a current liability? (a) Notes Payable (due in 2 years) (b) Bonds Payable (c) Unearned Revenue (d) Equipmentarrow_forwardCompute the cash conversion cycle for both year ??arrow_forwardGross profit percentage on sales 30%What amount of inventory was lost in the fire?arrow_forward

- Compute the cash conversion cycle for both year ?? General accountingarrow_forwardPinhead Manufacturers Inc. has estimated total factory overhead costs of $147,000 and 12,800 direct labor hours for the current fiscal year. If job number 218 incurred 3,400 direct labor hours, the work-in-process account will be debited and factory overhead will be credited for $____?arrow_forwardwhat amount and direction during that same period?. General Account..arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,