Concept explainers

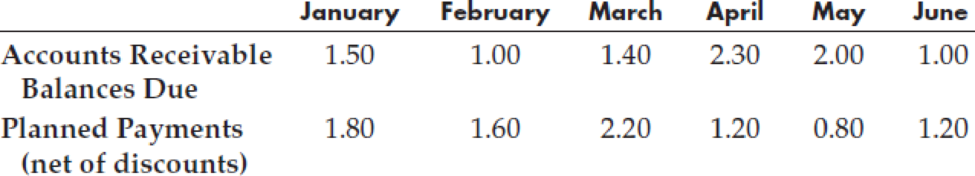

The CFO for Eagle Beach Wear and Gift Shop is in the process of planning for the company’s cash flows for the next 6 months. The following table summarizes the expected accounts receivables and planned payments for each of these months (in $100,000s).

The company currently has a beginning cash balance of $40,000 and desires to maintain a balance of at least $25,000 in cash at the end of each month. To accomplish this, the company has a number of ways of obtaining short-term funds:

- 1. Delay Payments. In any month, the company’s suppliers permit it to delay any or all payments for 1 month. However, for this consideration, the company forfeits a 2% discount that normally applies when payments are made on time. (Loss of this 2% discount is, in effect, a financing cost.)

- 2. Borrow Against Accounts Receivables. In any month, the company’s bank will loan it up to 75% of the accounts receivable balances due that month. These loans must be repaid in the following month and incur an interest charge of 1.5%

- 3. Short-Term Loan. At the beginning of January, the company’s bank will also give it a 6-month loan to be repaid in a lump sum at the end of June. Interest on this loan is 1% per month and is payable at the end of each month.

Assume the company earns 0.5% interest each month on cash held at the beginning of the month.

Create a spreadsheet model the company can use to determine the least costly cash management plan (i.e., minimal net financing costs) for this 6-month period. What is the optimal solution?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Spreadsheet Modeling & Decision Analysis: A Practical Introduction to Business Analytics (MindTap Course List)

- Based on your Course Project (Organizing a diversity, equity, and inclusion (DEI) awareness month celebration) Explain what uncertainty outcome would be best suited to manage risks effectively for the project you chose. Remember, choosing an outcome as it relates to uncertainty is dependent on different variables, such as the industry, environment, culture, and so forth. (Use Table 2-10. Checking Outcomes - Uncertainty Performance Domain to review the different outcomes.)arrow_forwardWhy is Program management more involved than project management as it requires oversee multiple related projects to achieve strategic objectives?arrow_forwardwhy not? What did you learn this semester? Anything you think should be added or changed as far as the curriculumarrow_forward

- Define what is an Executive officer and give reference with your answer. What are the roles and responsibilities of an Executive Officer and give one reference with your answer. Describe the qualifications needed to become an Executive officer and give one reference with your answer.arrow_forwardIdentify and explain the legal and regulatory frameworks governing companies in your jurisdiction. Provide examples of compliance and non-compliance cases, assessing their outcomes. Suggest best practices for ensuring compliance.arrow_forwardDid you enjoy the class? Why or why not? What did you learn this semester? Anything you think should be added or changed as far as the curriculum?arrow_forward

- Name the key stakeholders in the Himachal Fertilizer Corporation Part A case. Consider the stakeholder map in the lecture material. Which stakeholders would be the most important under your default lens?arrow_forwardimagine you have the sole marketing rights to a new herbal shampoo that you developed from local herbs and plants that are indigenous to your country. This shampoo can stop hair loss and promote hair growth for those who have suffered hair loss. You have branded it Nasure® Shampoo, and given your limited capital, you plan to sell your product exclusively over the Internet and support it by advertising and infomercials on late-night television. You have also planned some social media marketing, plus you are also hoping to obtain free publicity in men's fashion magazines. You plan to sell the product in a 400-gram bottle for $599 plus $9.99 shipping and handling. This price is considered premium to that of competing products, but you justify this based on the unique properties of the shampooarrow_forwardDoes NFL rules such as the changes in kickoff formation and the banning of the hip drop tackle improve player safety in the NFL?arrow_forward

- Has the current concussion protocol in the NFL been enough to improve player safety in the NFL?arrow_forwardDescribe how the increase of injuries such as concussions and broken bones are why the rules for NFL football have changed for decades.arrow_forwardWhat is the importance of player safety and updated safety rules in the NFL?arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,