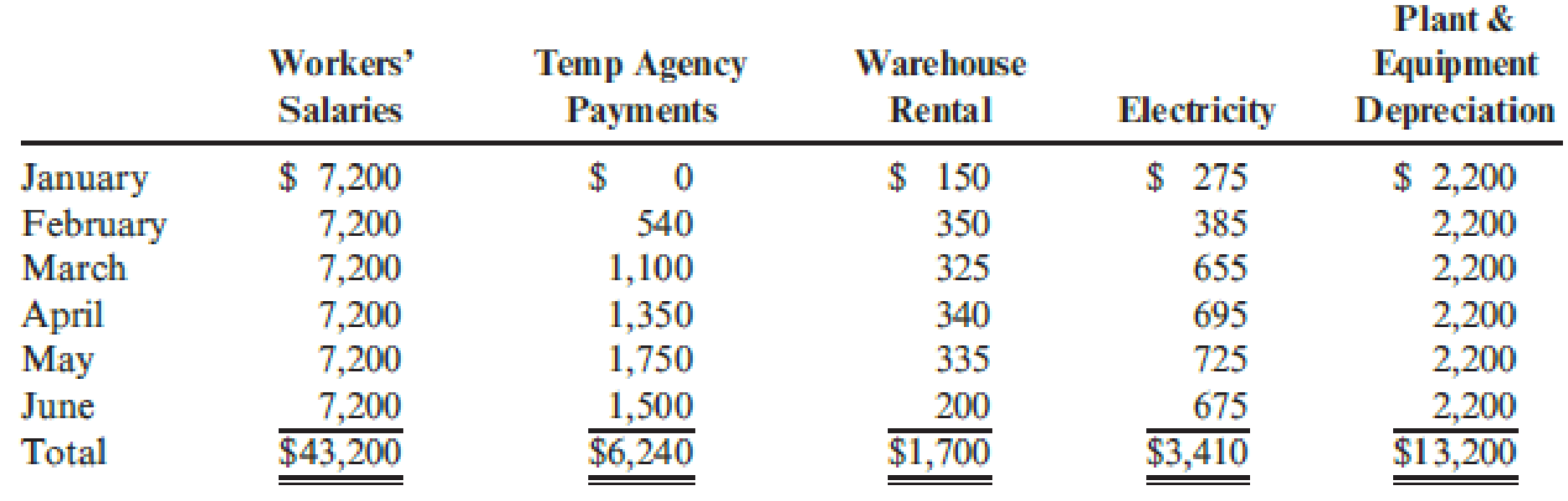

Darnell Poston, owner of Poston Manufacturing, Inc., wants to determine the cost behavior of labor and

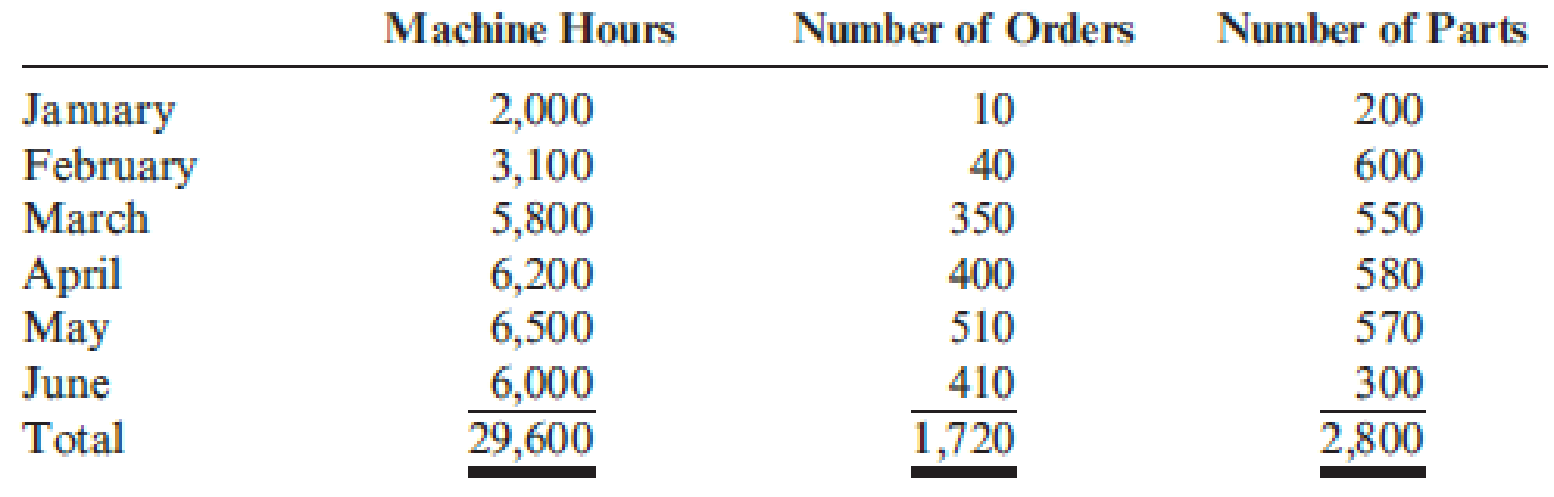

Information on number of machine hours, orders, and parts for the six-month period follows:

Required:

- 1. Calculate the monthly average account balance for each account. Calculate the average monthly amount for each of the three drivers.

- 2. Calculate fixed monthly cost and the variable rates for temp agency payments, warehouse rent, and electricity. Express the results in the form of an equation for total cost.

- 3. In July, Darnell predicts there will be 420 orders, 250 parts, and 5,900 machine hours. What is the total labor and overhead cost for July?

- 4. What if Darnell buys a new machine in July for $24,000? The machine is expected to last 10 years and will have no salvage value at the end of that time. What part of the cost equation will be affected? How? What is the new expected cost in July?

1.

Calculate the monthly average account balance for each account. Calculate the average monthly amount for each of the three drivers.

Explanation of Solution

Cost estimation: Cost estimation is the process of ascertaining the behavior of particular cost.

Calculate monthly average account balance for each account.

| Account | Workings | Amount |

| Average workers' salaries | ($43,200 ÷ 6) | $7,200 |

| Average temp agency payment | ($6,240 ÷ 6) | $1,040 |

| Average warehouse rental | ($1,700 ÷ 6) | $283 |

| Average electricity | ($3,410 ÷ 6) | $568 |

| Average depreciation | ($13,200 ÷ 6) | $2,200 |

Table (1)

Calculate the average monthly amount for each of the three drivers.

| Account | Workings | Amount |

| Average machine hours | ($29,600 ÷ 6) | $4,933 |

| Average number of orders | ($1,720÷ 6) | $287 |

| Average number of parts | ($2,800 ÷ 6) | $467 |

Table (2)

2.

Calculate fixed monthly cost and the variable rates for temp agency payments, warehouse rent, and electricity. Express the results in the form of an equation for total cost.

Explanation of Solution

Calculate monthly fixed cost.

Calculate variable rate for temp agency.

Calculate variable rate for warehouse rental.

Calculate variable rate for electricity.

Monthly cost equation is

3.

Calculate the total labor and overhead cost for July.

Explanation of Solution

Calculate the total labor and overhead cost for July.

4.

State whether, Person D buys a new machine in July for $24,000, if the machine is expected to last 10 years and will have no salvage value at the end of that time. And identify the part of the cost equation will be affected, and identify the new expected cost in July.

Explanation of Solution

Calculate new machine depreciation per month.

Calculate new total cost for July month.

Want to see more full solutions like this?

Chapter 3 Solutions

Cornerstones of Cost Management

- Ownership and profit distribution in a sole proprietorship are generally seen on its balance sheet, respectively, as: a. A personal capital account and dividends b. Common stock and dividends c. Common stock and withdrawals d. A personal capital account and withdrawalsarrow_forwardIf the contribution margin ratio for Vera Company is 28%, sales were $1,135,000, and fixed costs were $297,420, what was the income from operations? Right Answerarrow_forwardabc general accountingarrow_forward

- During FY 2020, Dorchester Company plans to sell Widgets for $14 a unit. Current variable costs are $6 a unit and fixed costs are expected to total $146,000. Use this information to determine the dollar value of sales for Dorchester to break even. (Round to the nearest whole dollar.)arrow_forwardWhat is the pension expense for 2023?arrow_forwardNimbus Financial Services expects its accountants to work 30,000 direct labor hours per year. The company's estimated total indirect costs are $275,000. The direct labor rate is $80 per hour. The company uses direct labor hours as the allocation base for indirect costs. If Nimbus performs a job requiring 25 hours of direct labor, what is the total job cost? Answerarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning