Concept explainers

What Do You Think?

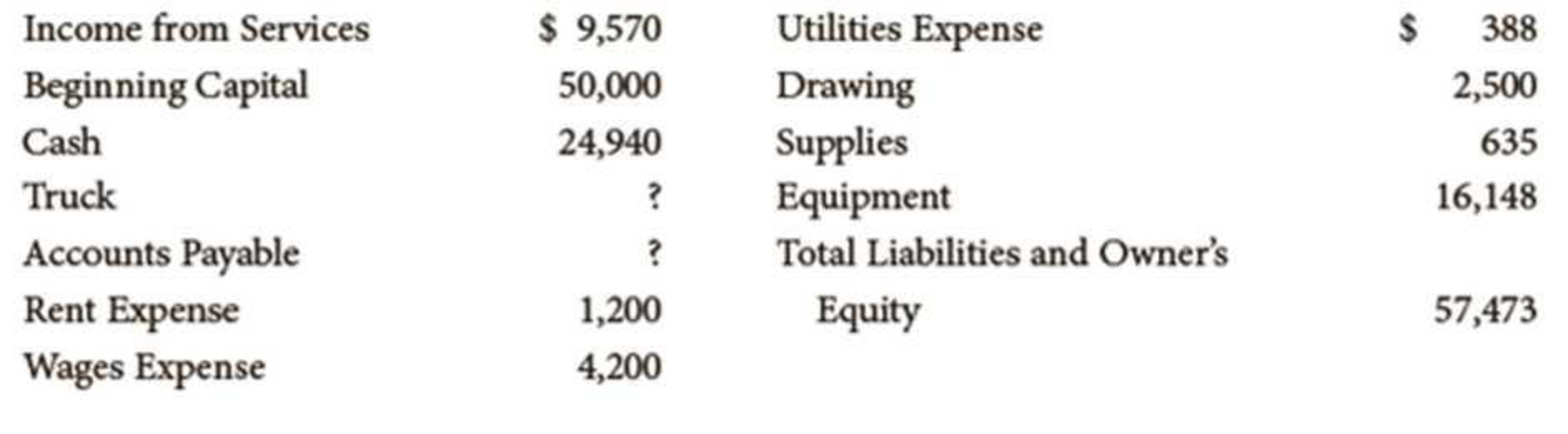

You work as an accounting clerk. You have received the following information supplied by a client, S. Winston, from the client’s bank statement, the client’s tax returns, and a variety of other July documents. The client wants you to prepare an income statement, a statement of owner’s equity, and a

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Bundle: College Accounting: A Career Approach (with QuickBooks Online), Loose-leaf Version,13th + CengageNOWV2, 1 term (6 months) Printed Access

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Essentials of MIS (13th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- During the year, Kiner Company made an entry to write off a $9,000 uncollectible account. Before this entry was made, the balance in accounts receivable was $315,000 and the balance in the allowance account was $27,000. The net realizable value of accounts receivable after the write-off entry was: A. $200,000. B. $184,000. C. $176,000. D. $288,000.arrow_forwardGENERAL ACCOUNTING 5.1arrow_forwardThe gross profit margin is?arrow_forward

- What is the amount of the gross profitarrow_forwardNeed help with this question solution general accountingarrow_forwardSales for Strength Corp are $725,000, cost of goods sold are $543,000, and interest expenses are $23,000. What is the gross profit margin? A. 25.1% B. 24.3% C. 25.8% D. 21.9% E. 23.2% Accurate answerarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College