EBK COLLEGE ACCOUNTING: A CAREER APPROA

13th Edition

ISBN: 9781337516525

Author: Scott

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3A

What Do You Think?

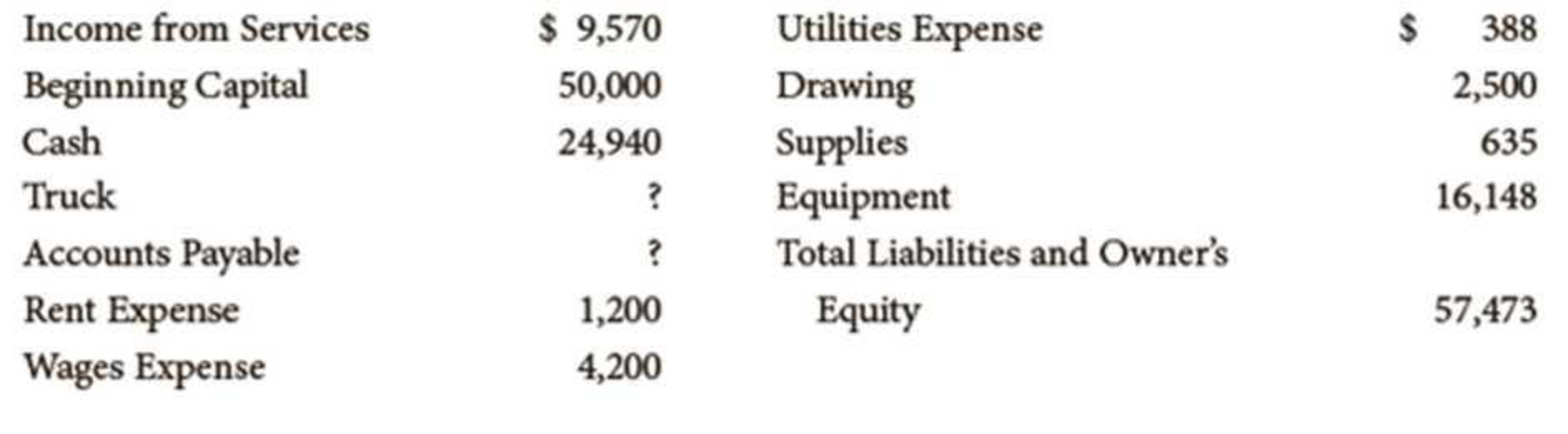

You work as an accounting clerk. You have received the following information supplied by a client, S. Winston, from the client’s bank statement, the client’s tax returns, and a variety of other July documents. The client wants you to prepare an income statement, a statement of owner’s equity, and a

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

GENERAL ACCOUNTING

Answer this Question

Expert provide answers

Chapter 3 Solutions

EBK COLLEGE ACCOUNTING: A CAREER APPROA

Ch. 3 - A __________ is a book in which business...Ch. 3 - Transferring information from the journal to the...Ch. 3 - For a journal entry to be complete, it must...Ch. 3 - The __________ is used to determine where the...Ch. 3 - Prob. 5QYCh. 3 - A 250 payment for salaries expense was incorrectly...Ch. 3 - Prob. 1DQCh. 3 - How does the journal differ from the ledger?Ch. 3 - What is the purpose of providing a ledger account...Ch. 3 - List by account classification the order of the...

Ch. 3 - Arrange the following steps in the posting process...Ch. 3 - Prob. 6DQCh. 3 - Prob. 7DQCh. 3 - In the following two-column journal, the capital...Ch. 3 - Decor Services completed the following...Ch. 3 - Montoya Tutoring Service completed the following...Ch. 3 - Prob. 4ECh. 3 - Arrange the following steps in the posting process...Ch. 3 - The bookkeeper for Nevado Company has prepared the...Ch. 3 - Determine the effect of the following errors on a...Ch. 3 - Journalize correcting entries for each of the...Ch. 3 - The chart of accounts of the Barnes School is...Ch. 3 - Laras Landscaping Service has the following chart...Ch. 3 - Following is the chart of accounts of Sanchez...Ch. 3 - The chart of accounts of Ethan Academy is shown...Ch. 3 - Leanders Landscaping Service maintains the...Ch. 3 - Following is the chart of accounts of Smith...Ch. 3 - Why Does It Matter? ECOTOUR EXPEDITIONS, INC.,...Ch. 3 - What Would You Say? You are the new bookkeeper for...Ch. 3 - What Do You Think? You work as an accounting...Ch. 3 - What Would You Do?

You are responsible for...Ch. 3 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- XYZ Ltd has a balanced day of 31 December. On 1 January 2XX3, it had an opening inventory balance of $24,000. XYZ Ltd purchased $35,600 worth of goods for resale. On 31 December 2XX3, the closing inventory balance was $13,550. During the year, XYZ Ltd had sales of $51,000. What is the Cost of Goods Sold for XYZ Ltd for the period ending 31 December 2XX3?arrow_forwardOne of Anfa Company's activity cost pools is inspecting, with an estimated overhead (OH) of $155,000. It produces throw rugs (820 inspections) and area 'rugs (1,180 inspections). How much $$ OH should be assigned to throw rugs inspections? A) $35,000 B) $50,000 C) $63,550 D) $100,000 answer?arrow_forwardOne of Anfa Company's activity cost pools is inspecting, with an estimated overhead (OH) of $155,000. It produces throw rugs (820 inspections) and area 'rugs (1,180 inspections). How much $$ OH should be assigned to throw rugs inspections? A) $35,000 B) $50,000 C) $63,550 D) $100,000arrow_forward

- Kennedy Inc has $23,800 of ending finished goods inventory as of Dec. 31, 2013. If beginning finished goods inventory was $16,300 and COGS was $72,000, how much would Kennedy report for cost of goods manufactured.Answer this question.arrow_forwardA company purchased a property for $100,000. The property included a building, a parking lot and land. The building was appraised at $66,500; the land at $49,500 and the parking lot at $18,900. The value of the land that will be included in the accounting record is? Round your answer to nearest $.arrow_forwardPredetermined overhead rate must have been?arrow_forward

- Kennedy Inc has $23,800 of ending finished goods inventory as of Dec. 31, 2013. If beginning finished goods inventory was $16,300 and COGS was $72,000, how much would Kennedy report for cost of goods manufactured.arrow_forward(16) FINANCIAL ACCOUNTING PRODUCT Y HAS FIXED COSTS OF 3,460,000 AND VARIABLE COSTS PER UNIT OF 250 DURING A TRADING YEAR. IT IS SOLD TO WHOLESALERS AT 325 PER UNIT. CALCULATE: (1) THE NUMBER OF UNITS THAT MUST BE SOLD IN ORDER TO BREAK EVEN. (II) THE LEVEL OF OUTPUT REQUIRED TO PROVIDE A PROFIT OF 475,000. (ROUND TO THE NEAREST WHOLE UNIT)arrow_forwardInformation is available for Betty DeRosearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License