Concept explainers

At the end of August, the first month of operations, the following selected data were taken from the financial statements of Tucker jacobs, an attorney:

| Net income for August | $112,500 |

| Total assets at August 31 | 650,000 |

| Total liabilities at August 31 | 225,000 |

| Total stockholders’ equity at August 31 | 425,000 |

In preparing the financial statements, adjustments for the following data were overlooked:

- Unbilled fees earned at August 31, $31,900.

Depreciation of equipment for August, $7,500.- Accrued wages at August 31, $5,200.

- Supplies used during August, $3,000.

Instructions

1.

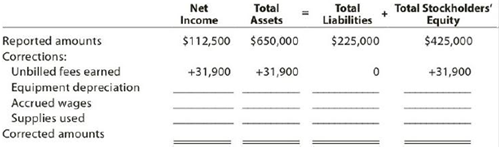

2. Determine the correct amount of net income for August and the total assets, liabilities, and stockholders’ equity at August 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The first adjustment is presented as an example.

Trending nowThis is a popular solution!

Chapter 3 Solutions

Bundle: Corporate Financial Accounting, Loose-leaf Version, 14th + LMS Integrated for CengageNOWv2, 1 term Printed Access Card

- Can you help me solve this general accounting problem with the correct methodology?arrow_forwardI need help with this financial accounting problem using proper accounting guidelines.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forward

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardWhen incorporating his sole proprietorship, Joe transfers all of its assets and liabilities. Included in the $30,000 of liabilities assumed by the corporation is $500 that relates to a personal expenditure. Under these circumstances, the entire $30,000 will be treated as boot. / Provide explanation please a. True b. Falsearrow_forwardIn determining whether § 357(c) applies, assess whether the liabilities involved exceed the bases of all assets a shareholder transfers to the corporation./ Provide explanation please. a. True b. Falsearrow_forward

- The ending inventory isarrow_forwardhelparrow_forwardBansai, age 66, retires and receives a $1,450 per month annuity from his employer's qualified pension plan. Bansai made $87,600 of after-tax contributions to the plan before retirement. Under the simplified method, Bansai's number of anticipated payments is 240. What is the amount includible in income in the first year of withdrawals assuming 12 monthly payments? A. $10,560 B. $12,540 C. $17,400 D. $8,220arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning