AUDITING-TEXT (LOOSELEAF)

11th Edition

ISBN: 9781337619462

Author: JOHNSTONE

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 35RQSC

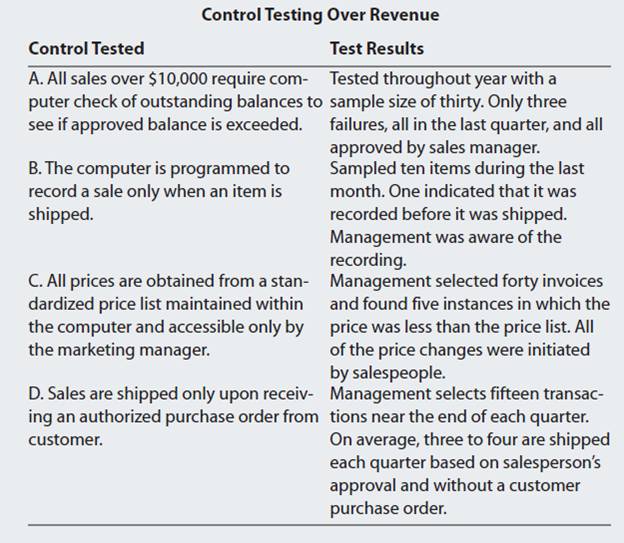

Assume that management is gathering evidence as part of its process for assessing the effectiveness of internal control over financial reporting. The company is a manufacturer of high-dollar specialized Control Tested machines used in the medical profession. The following table identifies important controls that management is testing regarding accounts related to revenue recognition,

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

need help this questions

provide correct answer

hello tutor please help me

Chapter 3 Solutions

AUDITING-TEXT (LOOSELEAF)

Ch. 3 - Prob. 1CYBKCh. 3 - Prob. 2CYBKCh. 3 - Which of the following are affected by the quality...Ch. 3 - Prob. 4CYBKCh. 3 - Prob. 5CYBKCh. 3 - Prob. 6CYBKCh. 3 - What are the components of internal control per...Ch. 3 - Prob. 8CYBKCh. 3 - Prob. 9CYBKCh. 3 - The control environment is seen as the foundation...

Ch. 3 - Prob. 11CYBKCh. 3 - Which one of the following components of internal...Ch. 3 - Prob. 13CYBKCh. 3 - Prob. 14CYBKCh. 3 - Prob. 15CYBKCh. 3 - Prob. 16CYBKCh. 3 - Prob. 17CYBKCh. 3 - Prob. 18CYBKCh. 3 - Prob. 19CYBKCh. 3 - Prob. 20CYBKCh. 3 - Prob. 21CYBKCh. 3 - Prob. 22CYBKCh. 3 - Prob. 23CYBKCh. 3 - Prob. 24CYBKCh. 3 - Prob. 25CYBKCh. 3 - Prob. 26CYBKCh. 3 - Prob. 27CYBKCh. 3 - Prob. 28CYBKCh. 3 - Prob. 29CYBKCh. 3 - Prob. 30CYBKCh. 3 - Prob. 31CYBKCh. 3 - Prob. 32CYBKCh. 3 - Prob. 33CYBKCh. 3 - Prob. 34CYBKCh. 3 - Prob. 35CYBKCh. 3 - Prob. 36CYBKCh. 3 - Prob. 37CYBKCh. 3 - Prob. 38CYBKCh. 3 - Prob. 39CYBKCh. 3 - Prob. 40CYBKCh. 3 - Prob. 1RQSCCh. 3 - Prob. 2RQSCCh. 3 - Prob. 3RQSCCh. 3 - Prob. 4RQSCCh. 3 - Distinguish between entity-wide and transaction...Ch. 3 - Refer to Exhibit 3.2. List the principles...Ch. 3 - Prob. 7RQSCCh. 3 - Prob. 8RQSCCh. 3 - Prob. 9RQSCCh. 3 - Prob. 10RQSCCh. 3 - Refer to Exhibit 3.3. For each risk assessment...Ch. 3 - Prob. 12RQSCCh. 3 - Prob. 13RQSCCh. 3 - Prob. 14RQSCCh. 3 - Prob. 15RQSCCh. 3 - Prob. 16RQSCCh. 3 - Prob. 17RQSCCh. 3 - Prob. 18RQSCCh. 3 - Authorization of transactions is a key control in...Ch. 3 - Prob. 20RQSCCh. 3 - Prob. 21RQSCCh. 3 - Prob. 22RQSCCh. 3 - Prob. 23RQSCCh. 3 - Prob. 24RQSCCh. 3 - Prob. 25RQSCCh. 3 - Prob. 26RQSCCh. 3 - Prob. 27RQSCCh. 3 - Prob. 28RQSCCh. 3 - Refer to Exhibit 3.9. What are the important...Ch. 3 - Refer to Exhibit 3.10 and Exhibit 3.11. Describe...Ch. 3 - Prob. 31RQSCCh. 3 - Prob. 32RQSCCh. 3 - Prob. 33RQSCCh. 3 - Prob. 34RQSCCh. 3 - Assume that management is gathering evidence as...Ch. 3 - Prob. 36RQSCCh. 3 - Prob. 37RQSCCh. 3 - Prob. 38RQSCCh. 3 - Prob. 39RQSCCh. 3 - Prob. 40RQSCCh. 3 - Prob. 39FFCh. 3 - Diamond Foods, Inc. (LO 8, 9) In February 2012,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Internal Control Components; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=D8SSaqpE6L8;License: Standard Youtube License