Financial Accounting

3rd Edition

ISBN: 9780078025549

Author: J. David Spiceland, Wayne M Thomas, Don Herrmann

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3.4BE

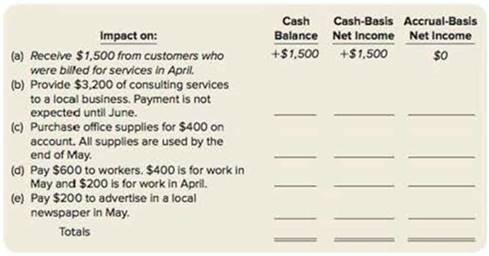

Analyze the impact of transactions on the balance of cash, cash-basis net income and accrual-basis net income (LO3–1, 3–2)

Consider the following set of transactions occurring during the month of May for Bison Consulting Company. For each transaction, indicate the impact on (1) the balance of cash, (2) cash-basis net income, and (3) accrual-basis net income for May. The first answer is provided as an example.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need the correct answer to this financial accounting problem using the standard accounting approach.

I need the correct answer to this general accounting problem using the standard accounting approach.

I need the correct answer to this general accounting problem using the standard accounting approach.

Chapter 3 Solutions

Financial Accounting

Ch. 3 - Prob. 1RQCh. 3 - 2.Discuss the major principle that describes...Ch. 3 - 3.Samantha is a first-year accounting student. She...Ch. 3 - 4.Describe when revenues and expenses are...Ch. 3 - Rip Side of Question 7 5.Executive Lawn provides...Ch. 3 - Prob. 6RQCh. 3 - Prob. 7RQCh. 3 - Consider the information in Question 7. Using...Ch. 3 - Prob. 9RQCh. 3 - There are two basic types of adjusting...

Ch. 3 - 11.Provide an example of a prepaid expense. The...Ch. 3 - Provide an example of a deferred revenue. The...Ch. 3 - 13.Provide an example of an accrued expense. The...Ch. 3 - Provide an example of an accrued revenue. The...Ch. 3 - Sequoya Printing purchases office supplies for 75...Ch. 3 - Jackson Rental receives its September utility bill...Ch. 3 - 17.Global Printing publishes several types of...Ch. 3 - At the end of May, Robertson Corporation has...Ch. 3 - Prob. 19RQCh. 3 - Prob. 20RQCh. 3 - Prob. 21RQCh. 3 - Prob. 22RQCh. 3 - Prob. 23RQCh. 3 - Prob. 24RQCh. 3 - Describe the debits and credits for the three...Ch. 3 - In its first four years of operations, Chance...Ch. 3 - Prob. 27RQCh. 3 - Prob. 28RQCh. 3 - Determine revenues to be recognized (LO31) Below...Ch. 3 - Prob. 3.2BECh. 3 - Prob. 3.3BECh. 3 - Analyze the impact of transactions on the balance...Ch. 3 - Prob. 3.5BECh. 3 - At the beginning of May, Golden Gopher Company...Ch. 3 - Record the adjusting entry for prepaid rent (LO33)...Ch. 3 - Prob. 3.8BECh. 3 - Prob. 3.9BECh. 3 - Prob. 3.10BECh. 3 - Prob. 3.11BECh. 3 - Prob. 3.12BECh. 3 - Prob. 3.13BECh. 3 - Prob. 3.14BECh. 3 - Prob. 3.15BECh. 3 - Prob. 3.16BECh. 3 - Prob. 3.17BECh. 3 - Prob. 3.18BECh. 3 - Prob. 3.19BECh. 3 - Prob. 3.20BECh. 3 - Consider the following situations: 1.American...Ch. 3 - Consider the following situations: 1.American...Ch. 3 - Refer to the situations discussed in E31....Ch. 3 - Differentiate cash-basis expenses from...Ch. 3 - Prob. 3.5ECh. 3 - Listed below are all the steps in the accounting...Ch. 3 - Prob. 3.7ECh. 3 - Prob. 3.8ECh. 3 - Prob. 3.9ECh. 3 - Prob. 3.10ECh. 3 - Prob. 3.11ECh. 3 - Prob. 3.12ECh. 3 - Prob. 3.13ECh. 3 - Prob. 3.14ECh. 3 - Prob. 3.15ECh. 3 - Prob. 3.16ECh. 3 - Prob. 3.17ECh. 3 - Prob. 3.18ECh. 3 - Prob. 3.19ECh. 3 - Prob. 3.20ECh. 3 - Consider the following transactions. Required: For...Ch. 3 - Prob. 3.2APCh. 3 - Prob. 3.3APCh. 3 - Prob. 3.4APCh. 3 - Prob. 3.5APCh. 3 - The year-end financial statements of Rattlers Tax...Ch. 3 - Prob. 3.7APCh. 3 - Prob. 3.8APCh. 3 - Consider the following transactions. Required: For...Ch. 3 - Prob. 3.2BPCh. 3 - Prob. 3.3BPCh. 3 - Prob. 3.4BPCh. 3 - Prob. 3.5BPCh. 3 - FIGHTING ILLINI Income Statement Service revenue...Ch. 3 - Prob. 3.7BPCh. 3 - Prob. 3.8BPCh. 3 - Prob. 3.1APCPCh. 3 - Prob. 3.2APFACh. 3 - Prob. 3.3APFACh. 3 - Prob. 3.4APCACh. 3 - Prob. 3.5APECh. 3 - Prob. 3.7APWC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with this general accounting question using standard accounting techniques.arrow_forwardWhat markup percentage is the company usingarrow_forwardAn asset owned by Crescent Manufacturing has a book value of $36,000 on June 30, Year 5. The asset has been depreciated at an annual rate of $8,000 using the straight-line method. Assuming the asset is sold on June 30, Year 5 for $39,500, how should the company record the transaction? a. Neither a gain nor a loss is recognized on this type of transaction. b. A gain on sale of $3,500. c. A gain on sale of $5,000. d. A loss on sale of $3,500. e. A loss on sale of $5,000.arrow_forward

- Can you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License