Concept explainers

Journalizing and posting adjustments to the four-column accounts and preparing an adjusted

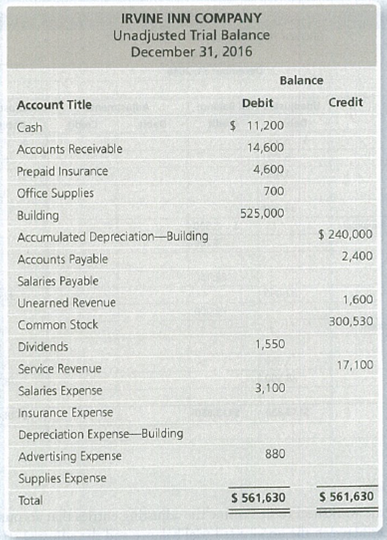

The unadjusted trial balance of Irvine Inn Company at December 31, 2016, and the data needed for the adjustments follow.

Adjustment data at December 31 follow:

a. As of December 31, Irvine Inn had $500 of Prepaid Insurance remaining.

b. At the end of the month, Irvine Inn had $400 of office supplies remaining.

c.

d. Irvine Inn pays its employees on Friday for the weekly salaries. Its employees earn $1,000 for a five-day workweek. December 31 falls on Wednesday this year.

e. On November 20, Irvine Inn contracted to perform services for a client receiving $ 1,600 in advance. Irvine In n recorded this receipt of cash as Unearned Revenue.

As of December 31, Irvine Inn has $1,100 still unearned.

Requirements

1. Journalize the

2. Using the unadjusted trial balance, open the accounts (use a four-column ledger) with the unadjusted balances.

3. Prepare the adjusted trial balance.

4. Assuming the adjusted trial balance has total debits equal to total credits, does this mean that the adjusting entries have been recorded correctly? Explain.

Trending nowThis is a popular solution!

Chapter 3 Solutions

Horngren's Financial & Managerial Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

- Give correct answer this financial accounting questionarrow_forwardSubject: general accounting questionarrow_forwardAman Equipment Corporation (AEC) paid $5,200 for direct materials and $9,800 for production workers' wages. Lease payments and utilities on the production facilities amounted to $8,200, while general, selling, and administrative expenses totaled $3,500. The company produced 6,000 units and sold 4,800 units at a price of $8.25 per unit. What was AEC's net income for the first year in operation?arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,