Concept explainers

Journalizing and posting adjustments to the T-accounts and preparing an adjusted

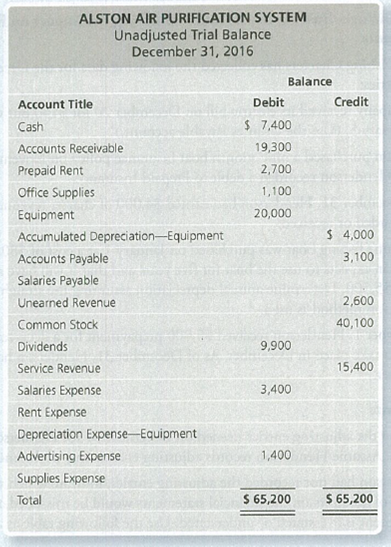

The unadjusted trial balance of Alston Air Purification System at December 31, 2016, and the data needed for the adjustments follow.

Adjustment data at December 31 follow:

a. On December 15, Alston contracted to perform services for a client receiving $2,600 in advance. Alston recorded this receipt of cash as Unearned Revenue. As of December 31, Alston has completed $1,200 of the services.

b. Alston prepaid two months of rent on December 1.

c. Alston used $650 of office supplies during the month.

d.

e. Alston received a bill for December's online advertising, $600. Alston will not pay the bill until January. (Use Accounts Payable.)

f. Alston pays its employees weekly on Monday for the previous week’s wages. Its employees earn $5,500 for a five-day workweek. December 31 falls on Wednesday this year.

g. On October 1, Alston agreed to provide a four-month air system check (beginning October 1) for a customer for $2,800. Alston has completed the system check every month, but payment has not yet been received and no entries have been made.

Requirements

1. Journalize the

2. Using the unadjusted trial balance, open the T-accounts with the unadjusted balances.

3. Prepare the adjusted trial balance.

4. How will Alston Air Purification System use the adjusted trial balance?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

- Hendrix Corporation uses a periodic inventory system. For 2022, its beginning inventory was $85,300, purchases of inventory were $372,000, and inventory at the end of the period was $98,750. What was the amount of Hendrix's cost of goods sold for 2022?arrow_forwardWhat is your capital gain rate?arrow_forwardDeacon Corporation has provided the following financial data from its balance sheet and income statement: Year 2 Year 1 Total assets $1,298,000 $1,232,000 Total liabilities $610,000 $462,100 Total stockholders' equity $734,400 $892,000 Net operating income (income before interest and taxes) $69,903 Interest expense $35,000 The company's debt-to-equity ratio at the end of Year 2 is: a. 0.68 b. 0.63 c. 0.52 d. 0.83arrow_forward

- What is the total contribution margin?arrow_forwardcost accountingarrow_forwardQuestion-Accounting: During its first year of operations, Gautam Company paid $12,385 for direct materials and $10,600 for production workers' wages. Lease payments and utilities on the production facilities amounted to $9,600 while general, selling, and administrative expenses totaled $3,900. The company produced 6,650 units and sold 4,100 units at a price of $7.40 a unit. What is the amount of gross margin for the first year? Need helparrow_forward

- Assume 550 units were worked on during a period in which a total of 500 good units were completed. Normal spoilage consisted of 30 units; abnormal spoilage, 20 units. Total production costs were $2,200. The company accounts for abnormal spoilage separately on the income statement as loss due to abnormal spoilage. Normal spoilage is not accounted for separately. What is the cost of the good units produced?arrow_forwardhi expert provide correct answer of this General accountingarrow_forwardQuestion-Accounting: During its first year of operations, Gautam Company paid $12,385 for direct materials and $10,600 for production workers' wages. Lease payments and utilities on the production facilities amounted to $9,600 while general, selling, and administrative expenses totaled $3,900. The company produced 6,650 units and sold 4,100 units at a price of $7.40 a unit. What is the amount of gross margin for the first year?arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning - Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College