Concept explainers

Journalizing and posting adjustments to the four-column accounts and preparing an adjusted

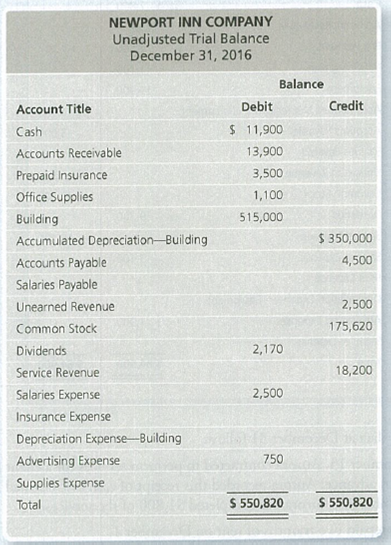

The unadjusted trial balance of Newport Inn Company at December 31, 2016, and the data needed for the adjustments follow.

Adjustment data at December 31 follow:

a. As of December 31, Newport had $600 of Prepaid Insurance remaining.

b. At the end of the month, Newport had $700 of office supplies remaining.

c.

d. Newport pays its employees weekly on Friday. Its employees earn $1,500 for a five-day workweek. December 31 falls on Wednesday this year.

e. On November 20, Newport contracted to perform services for a client receiving $2,500 in advance. Newport recorded this receipt of cash as Unearned Revenue.

As of December 31, Newport has $1,500 still unearned.

Requirements

1. Journalize the

2. Using the unadjusted trial balance, open the accounts (use a four-column ledger) with the unadjusted balances.

3. Prepare the adjusted trial balance.

4. Assuming the adjusted trial balance has total debits equal to total credits, does this mean that the adjusting entries have been recorded correctly? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

- Solve Question. General accountingarrow_forwardFinancial accountingarrow_forwardHatfield Corporation, which has only one product, has provided the following data concerning its most recent month of operations: Selling price $158 Units in beginning inventory 100 Units produced 1,720 Units sold 920 Units in ending inventory 900 Variable costs per unit: Direct materials $59 Direct labor $37 Variable manufacturing overhead $6 Variable selling and administrative $9 Fixed costs: Fixed manufacturing overhead $15,480 Fixed selling and administrative $17,480 What is the total period cost for the month under the variable costing? A- $32,960 B- $25,760 C- $41,240 D- $15,480arrow_forward

- Hamilton Biotech has a profit margin of 8% and an equity multiplier of 2.8. Its sales are $150 million, and it has total assets of $60 million. What is Hamilton Biotech's Return on Equity (ROE)? Round your answer to two decimal places.arrow_forwardMAX's Auto Repair, a proprietorship, started the year with total assets of $72,000 and total liabilities of $48,500. During the year, the business recorded $120,600 in repair revenues, $65,400 in expenses, and MAX Grant, the owner, withdrew $12,500. MAX’s capital balance at the end of the year?arrow_forwardWhat is equity at the end of the year is?arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub