Classified

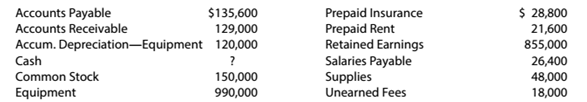

Pounds-Away Services Co. offers personal weight reduction consulting services to individuals. On November 30, 20Y9, the balances of selected accounts of Pounds-Away Services Co. are as follows:

Prepare a classified balance sheet that includes the correct balance for Cash.

Trending nowThis is a popular solution!

Chapter 3 Solutions

Survey of Accounting (Accounting I)

Additional Business Textbook Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Essentials of MIS (13th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

- If cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit Revenue need helparrow_forwardDennis Green and Peter Olinto are equal partners in Foxy Partnership. Peter is an active general partner. Dennis is a limited partner and is not involved in the operations of the business. Foxy Partnership's Year 2 financial statements are provided in the exhibits. Using the information provided, enter the appropriate amounts to be reported on page 1 of Foxy Partnership's income tax return in the table below. Enter all amounts as positive whole values. If a response is zero, enter a zero (0). A B 1 Gross receipts or sales 2 Cost of goods sold 3 Salaries and wages 4 Guaranteed payments to partners 5 Repairs and maintenance 6 Bad debts 7 Rent 8 Depreciation 9 Other deductions 10 Ordinary business income (loss)arrow_forwardDennis Green and Peter Olinto are equal partners in Foxy PartneDennis Green and Peter Olinto are equal partners in Foxy Partnership. Peter is an active general partner. Dennis is a limited partner and is not involved in the operations of the business. Foxy Partnership's Year 2 financial statements are provided in the exhibits. Using the information provided, enter the appropriate amounts to be reported on page 1 of Foxy Partnership's income tax return in the table below. Enter all amounts as positive whole values. If a response is zero, enter a zero (0). 2. Cost of goods sold 3. Salaries and wages 4. Guaranteed payments to partners 5. Repairs and maintenance 6. Bad debts 7. Rent 8. Depreciation 9. Other deductions 10. Ordinary business income (loss)arrow_forward

- If a business pays off a loan, which of the following will occur?A. Assets and liabilities increaseB. Assets and liabilities decreaseC. Only liabilities increaseD. Equity decreasesarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementneedarrow_forwardNo chatgpt! Which financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementarrow_forward

- Which financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings StatementNo Aiarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementarrow_forwardWhich account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentcorrectarrow_forward

- Which account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentcorrect solutuarrow_forwardWhich account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentneedarrow_forwardWhich account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentarrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning