Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

15th Edition

ISBN: 9780134476315

Author: Chad J. Zutter, Scott B. Smart

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 3.24P

Learning Goal 6

P3-24 Financial statement analysis The financial statements of Zach Industries for the year ended December 31, 2019, follow.

Zach Industries Income Statement for the Year Ended December 31 2019

| Sales revenue | $160,000 |

| Less: Cost of goods sold | 106,000 |

| Gross profits | $ 54,000 |

| Less: Operating expenses | |

| Selling expense | $ 16,000 |

| General and administrative expenses | 10,000 |

| Lease expense | 1,000 |

| 10,000 | |

| Total operating expense | $37,000 |

| Operating profits | $ 17,000 |

| Less: Interest expense | 6,100 |

| Net profits before taxes | $10,900 |

| Less: Taxes | 4,360 |

| Net profits after taxes | $ 6,540 |

Zach Industries

| Assets | |

| Cash | $ 500 |

| Marketable securities | 1,000 |

| Accounts receivable | 25,000 |

| Inventories | 45,500 |

| Total current assets | $72,000 |

| Land | $ 26,000 |

| Buildings and equipment | 90,000 |

| Less: Accumulated depreciation | 38,000 |

| Net fixed assets | $78,000 |

| Total assets | $150,000 |

| Liabilities and Stockholders’ Equity | |

| Accounts payable | $ 22,000 |

| Notes payable | 47,000 |

| Total current liabilities | $ 69,000 |

| Long-term debt | 22,950 |

| Common stock | 31,500 |

| 26,550 | |

| Total liabilities and stockholders’ equity | $150,000 |

| The firm’s 3,000 outstanding shares of common stock closed 2019 at a price of $25 per share. | |

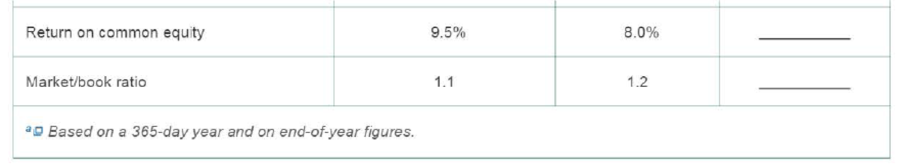

- a. Use the preceding financial statements to complete the following table. Assume that the industry averages given in the table are applicable for both 2018 and 2019.

- b. Analyze Zach Industries’ financial condition as it is related to (1) liquidity, (2) activity, (3) debt, (4) profitability, and (5) market. Summarize the company's overall financial condition.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

LOGIC COMPANYComparative Income StatementFor Years Ended December 31, 2019 and 2020

2020

2019

Gross sales

$

19,000

$

15,000

Sales returns and allowances

1,000

100

Net sales

$

18,000

$

14,900

Cost of merchandise (goods) sold

12,000

9,000

Gross profit

$

6,000

$

5,900

Operating expenses:

Depreciation

$

700

$

600

Selling and administrative

2,200

2,000

Research

550

500

Miscellaneous

360

300

Total operating expenses

$

3,810

$

3,400

Income before interest and taxes

$

2,190

$

2,500

Interest expense

560

500

Income before taxes

$

1,630

$

2,000

Provision for taxes

640

800

Net income

$

990

$

1,200

LOGIC COMPANYComparative Balance SheetDecember 31, 2019 and 2020

2020

2019

Assets

Current assets:

Cash

$

12,000

$

9,000

Accounts receivable

16,500

12,500

Merchandise inventory

8,500

14,000

Prepaid expenses

24,000

10,000

Total current assets

$

61,000

$

45,500

Plant and…

Answer the whole page

Very important please be correct thank you

Chapter 3 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Ch. 3.1 - Prob. 3.1RQCh. 3.1 - Describe the purpose of each of the four major...Ch. 3.1 - Prob. 3.3RQCh. 3.1 - Prob. 3.4RQCh. 3.2 - With regard to financial ratio analysis, how do...Ch. 3.2 - What is the difference between cross-sectional and...Ch. 3.2 - Prob. 3.7RQCh. 3.2 - Prob. 3.8RQCh. 3.3 - Under what circumstances would the current ratio...Ch. 3.3 - In Table 3.5, most of the specific firms listed...

Ch. 3.4 - To assess the firms average collection period and...Ch. 3.5 - What is financial leverage?Ch. 3.5 - What ratio measures the firms degree of...Ch. 3.6 - What three ratios of profitability appear on a...Ch. 3.6 - Prob. 3.15RQCh. 3.6 - Prob. 3.16RQCh. 3.7 - What do the price/earnings (P/E) ratio and the...Ch. 3.8 - Financial ratio analysis is often divided into...Ch. 3.8 - Prob. 3.19RQCh. 3.8 - What three areas of analysis are combined in the...Ch. 3 - For the quarter ended January 28, 2017, Kroger...Ch. 3 - Learning Goals 3, 4, 5 ST3-1 Ratio formulas and...Ch. 3 - Prob. 3.2STPCh. 3 - Prob. 3.1WUECh. 3 - Learning Goal 1 E3-2 Explain why the income...Ch. 3 - Prob. 3.3WUECh. 3 - Learning Goal 3 E3-4 Bluestone Metals Inc. is a...Ch. 3 - Learning Goal 6 E3-5 If we know that a firm has a...Ch. 3 - Financial statement account identification Mark...Ch. 3 - Learning Goal 1 P3-2 1ncome statement preparation...Ch. 3 - Prob. 3.3PCh. 3 - Learning Goal 1 P3-4 Calculation of EPS and...Ch. 3 - Prob. 3.5PCh. 3 - Prob. 3.6PCh. 3 - Learning Goals 1 P3-7 Initial sale price of common...Ch. 3 - Prob. 3.8PCh. 3 - Learning Goal 1 P3-9 Changes In stockholders...Ch. 3 - Learning Goals 2, 3, 4, 5 P3-10 Ratio comparisons...Ch. 3 - Learning Goal 3 P3-11 Liquidity management Bauman...Ch. 3 - Prob. 3.12PCh. 3 - Inventory management Three companies that compete...Ch. 3 - Accounts receivable management The table below...Ch. 3 - Prob. 3.15PCh. 3 - Learning Goal 4 P3-16 Debt analysis Springfield...Ch. 3 - Prob. 3.17PCh. 3 - Learning Goals 2, 3, 4 P3-18 Using Tables 3.1,...Ch. 3 - Learning Goals 5 P3-19 Common-size statement...Ch. 3 - The relationship between financial leverage and...Ch. 3 - Learning Goal 4 P3-21 Analysis of debt ratios...Ch. 3 - Learning Goal 6 P3-22 Ratio proficiency McDougal...Ch. 3 - Learning Goal 6 P3-23 Cross-sectional ratio...Ch. 3 - Learning Goal 6 P3-24 Financial statement analysis...Ch. 3 - Learning Goals 6 P3- 25 Integrative: Complete...Ch. 3 - Learning Goal 6 P3-26 DuPont system of analysis...Ch. 3 - Learning Goal 6 P3-27 Complete ratio analysis,...Ch. 3 - Spreadsheet Exercise The income statement and...

Additional Business Textbook Solutions

Find more solutions based on key concepts

The price of a one year call option on ET stock. Introduction: A binomial model portrays the development of irr...

Corporate Finance

Explain what is meant by the statement “The use of current liabilities as opposed to long-term debt subjects th...

Foundations Of Finance

Preference for current ratio and quick ratio. Introduction: Current ratio explains the liquidity position of a ...

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Define investors’ expected rate of return.

Foundations of Finance (9th Edition) (Pearson Series in Finance)

The meaning of straddle. Introduction: Option is a contract to purchase a financial asset from one party and se...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Problem 13-02A (Video) The comparative statements of Cullumber Company are presented here: Cullumber CompanyIncome StatementsFor the Years Ended December 31 2020 2019 Net sales $1,891,640 $1,751,600 Cost of goods sold 1,059,640 1,007,100 Gross profit 832,000 744,500 Selling and administrative expenses 501,100 480,100 Income from operations 330,900 264,400 Other expenses and losses Interest expense 23,700 21,700 Income before income taxes 307,200 242,700 Income tax expense 93,700 74,700 Net income $213,500 $168,000 Cullumber CompanyBalance SheetsDecember 31 Assets 2020 2019 Current assets Cash $60,100 $64,200 Debt investments (short-term) 74,000 50,000 Accounts receivable 118,900 103,900 Inventory 127,700 117,200 Total current assets 380,700 335,300 Plant assets (net)…arrow_forwardWould you please help me with thisarrow_forwardc. Calculate the profitability ratio which includes gross profit margin, operating profit margin, net profit margin, and NOPAT marginarrow_forward

- HIC GROUP OF Companies COMPARATIVE INCOME STATEMENT For years ended 3rd December 2019 2020 Revenue and gains Sales revenue 495,500 496,738.75 Interest revenue 278,500 279,196.25 Investment Income 71,700 71,879.25 Other revenue 101,500 101,753.75 Total revenue and gains 947,200 949,968 Expenses and losses Cost of good sold 450,000 447,750 Selling&administrative 185,000 184,075 Computer (operating) 42,500 42,288 Depreciation 50,000…arrow_forwardHIC GROUP OF Companies COMPARATIVE INCOME STATEMENT For years ended 3rd December 2019 2020 Revenue and gains Sales revenue 495,500 496,738.75 Interest revenue 278,500 279,196.25 Investment Income 71,700 71,879.25 Other revenue 101,500 101,753.75 Total revenue and gains 947,200 949,968 Expenses and losses Cost of good sold 450,000 447,750 Selling&administrative 185,000 184,075 Computer (operating) 42,500 42,288…arrow_forwardOperating data for Joshua Corporation are presented below. 2020 2019 Sales revenue $745,000 $595,000 Cost of goods sold 459,665 384,965 Selling expenses 114,730 67,235 Administrative expenses 55,130 48,790arrow_forward

- interpret and analyze the ratiosarrow_forwardPa help po salamatarrow_forwardAtlantic Corporation reported the following financial statements: E (Click the icon to view the financial statements.) The company has 2,200 shares of common stock outstanding. What is Atlantic's earnings per share? (Round the earnings per share to two decimal places, X.XX. O A. $1.90 Financial Statements O B. $3.58 OC. $2.49 O D. 3.19 times Atlantic Corporation Comparative Balance Sheet December 31, 2019 and 2018 2019 2018 Assets Current Assets: Cash and Cash Equivalents 2,052 $ 1,655 Accounts Receivable 1,951 1,731 Merchandise Inventory 1,342 1,094 1,615 1,817 Prepaid Expenses Total Current Assets 6,960 6,297 18,240 16,174 Other Assets 2$ 25,200 $ 22,471 Total Assets Liabilities Current Liabilities 24 7.087 $ 8,158 4,698 3,844 Long-term Liabilities Total Liabilities 11,785 12,002 Stockholders' Equity Common Stock, no par 7,015 4,169 6,400 6,300 Retained Earnings Click to select your an Total Stockholders' Equity 13,415 10,469 24 25,200 $ 22,471 Clear Al All parts showing Total…arrow_forward

- LOGIC COMPANY Comparative Income Statement For Years Ended December 31, 2019 and 2020 2020 2019 Gross sales $20,600 $16,200 Sales returns and allowances 800 100 Net sales $19,800 11,600 $ 8,200 $16,100 8,600 $ 7,500 Cost of merchandise (goods) sold Gross profit Operating expenses: Depreciation Selling and administrative Research Miscellaneous Total operating expenses Income before interest and taxes Interest expense 860 680 3,400 2,800 710 580 520 380 sa $5,490 $ 2,710 $ 4,440 $ 3,060 720 580 Income before taxes $ 1,990 $2,480 992 Provision for taxes 796 Net income $ 1,194 $ 1,488 LOGIC COMPANY Comparative Balance Sheet December 31, 2019 and 2020 2020 2019 Assets Current assets: Cash Accounts receivable Merchandise inventory Prepaid expenses Total current assets Plant and equipment: Building (net) $12,800 17,300 9,300 24,800 $64, 200 $ 48, 700 $ 9,800 13,300 14,800 10,800 $15,300 14,300 $11, 800 9,800 Land acer Σ %24 %24arrow_forwardHow much was the profit of the companyarrow_forwardModule pute Net Operating Profit after Tax Refer to the balance sheet information below for Home Depot. Feb. 3, 2019 Jan. 28, 2018 $35,891 $34,794 1,511 3,056 $37,402 $37,850 $14,177 $13,640 24,822 22,974 $38,999 $36,614 Operating assets Nonoperating assets Total assets $ millions Operating liabilities Nonoperating liabilities Total liabilities Net sales Operating expense before tax Net operating profit before tax (NOPBT) Other expense Income before tax Tax expense Net income Assume a statutory tax rate of 22%. a. Compute NOPAT for the year ended Feb. 3, 2019 using the formula: NOPAT = Net income + NNE Net income NNE NOPAT $ 9,453 $ $ $91,973 78,772 13,201 828 12,373 2,920 $9,453 7,361 * $ 16814 b. Compute NOPAT for the year ended Feb. 3, 2019 using the formula: NOPAT = NOPBT - Tax on operating profit NOPBT Tax on operating profit 7,361 * $ 10,296.78 x $ NOPAT -2936arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License