Concept explainers

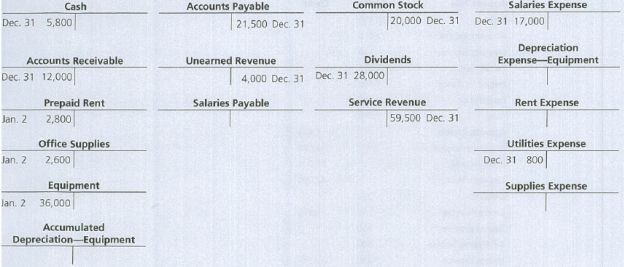

One year ago, Tyler Stasney founded Swift Classified Ads. Stasney remembers that you took an accounting course while in college and comes to you for advice. He wishes to know how much net income his business earned during the past year in order to decide whether to keep the company going. His accounting records consist of the T-accounts from his ledger, which were prepared by an accountant who moved to another city. The ledger at December 31 follows. The accounts have not been adjusted.

Stasney indicates that at year-end, customers owe the business $1,600 for accrued service revenue. These revenues have not been recorded. During the year, Swift Classified Ads collected $4,000 service revenue in advance from customers, but the business earned only $900 of that amount. Rent expense for the year was $2,400, and the business used up $1,700 of the supplies. Swift determines that

Help Swift Classified Ads compute its net income for the year. Advise Stasney whether to continue operating Swift Classified Ads.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

ACC 201/202 MYACCLAB E-TEXT ONLY >I<

- Can you help me with general accounting question?arrow_forwardProvide correct answer general accounting questionarrow_forwardAnti-Pandemic Pharma Co. Ltd. reports the following information in its income statement: Sales = $5,250,000. Costs = $2, 173,000. Other expenses = $187,400. Depreciation expense = $79,000. Interest expense= $53,555. Taxes = $76,000. Dividends = $69,000. $136,700 worth of new shares were also issued during the year and long-term debt worth $65,300 was redeemed. a) Compute the cash flow from assets b) Compute the net change in working capitalarrow_forward

- A retail company reports the following financial data: • Revenue: $1,200,000 • Expenses: $800,000 • Net income: $400,000 • Assets: $900,000 • Liabilities: $200,000 • Average equity: $700,000 What is the company's return on equity (ROE) in percentage terms, rounded to two decimal places?arrow_forwardEfford plc has the following equity capital at the year end. (Click here to view the financial data.) In addition, the company has 400,000 £1 8% preference shares in issue. The board of directors wishes to eliminate the company's reserves. It has decided to make an immediate 1-for-2 bonus issue of ordinary shares. Following the issue, an annual dividend will be paid to shareholders. What will be the required: 1. Transfer from revenue reserves to effect the bonus issue. £50,000 (Type an integer.) 2. Dividend per ordinary share. (Expressed as £ per share) £ 0.10 per share (Round to two decimal places as needed.) Data table £ Ordinary shares of £0.50 each 200,000 Share premium 50,000 General reserve 80,000 62,000 Retained profits 392.000arrow_forwardA technology company earns a profit of $8 per share. If the stock is currently selling for $96 per share, what is the current price/earnings (P/E) ratio? a) 6 b) 10 c) 12 d) 18arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub