Concept explainers

You may refer to the opening story of Tony and Suzie and their decision to start Great Adventures in AP 1–1. More of their story and the first set of transactions for the company in July are presented in AP 2–1 and repeated here.

| July 1 | Sell $10,000 of common stock to Suzie. |

| 1 | Sell $10,000 of common stock to Tony. |

| 1 | Purchase a one-year insurance policy for $4,800 ($400 per month) to cover injuries to participants during outdoor clinics. |

| 2 | Pay legal fees of $1,500 associated with incorporation. |

| 4 | Purchase office supplies of $1,800 on account. |

| 7 | Pay for advertising of $300 to a local newspaper for an upcoming mountain biking clinic to be held on July 15. Attendees will be charged $50 the day of the clinic. |

| 8 | Purchase 10 mountain bikes, paying $12,000 cash. |

| 15 | On the day of the clinic, Great Adventures receives cash of $2,000 from 40 bikers. Tony conducts the mountain biking clinic. |

| 22 | Because of the success of the first mountain biking clinic, Tony holds another mountain biking clinic and the company receives $2,300. |

| 24 | Pay for advertising of $700 to a local radio station for a kayaking clinic to be held on August 10. Attendees can pay $100 in advance or $150 on the day of the clinic. |

| 30 | Great Adventures receives cash of $4,000 in advance from 40 kayakers for the upcoming kayak clinic. |

The following transactions occur over the remainder of the year.

| Aug. 1 | Great Adventures obtains a $30,000 low-interest loan for the company from the city council, which has recently passed an initiative encouraging business development related to outdoor activities. The loan is due in three years, and 6% annual interest is due each year on July 31. |

| Aug. 4 | The company purchases 14 kayaks, paying $28,000 cash. |

| Aug. 10 | Twenty additional kayakers pay $3,000 ($150 each), in addition to the $4,000 that was paid in advance on July 30, on the day of the clinic. Tony conducts the first kayak clinic. |

| Aug. 17 | Tony conducts a second kayak clinic, and the company receives $10,500 cash. |

| Aug. 24 | Office supplies of $1,800 purchased on July 4 are paid in full. |

| Sep. 1 | To provide better storage of mountain bikes and kayaks when not in use, the company rents a storage shed, purchasing a one-year rental policy for $2,400 ($200 per month). |

| Sep. 21 | Tony conducts a rock-climbing clinic. The company receives $13,200 cash. |

| Oct. 17 | Tony conducts an orienteering clinic. Participants practice how to understand a topographical map, read an altimeter, use a compass, and orient through heavily |

| Dec. 1 | Tony decides to hold the company’s first adventure race on December 15. Four-person teams will race from checkpoint to checkpoint using a combination of mountain biking, kayaking, orienteering, trail running, and rock-climbing skills. The first team in each category to complete all checkpoints in order wins. The entry fee for each team is $500. |

| Dec. 5 | To help organize and promote the race, Tony hires his college roommate, Victor. Victor will be paid $50 in salary for each team that competes in the race. His salary will be paid after the race. |

| Dec. 8 | The company pays $1,200 to purchase a permit from a state park where the race will be held. The amount is recorded as a miscellaneous expense. |

| Dec. 12 | The company purchases racing supplies for $2,800 on account due in 30 days. Supplies include trophies for the top-finishing teams in each category, promotional shirts, snack foods and drinks for participants, and field markers to prepare the racecourse. |

| Dec. 15 | The company receives $20,000 cash from a total of forty teams, and the race is held. |

| Dec. 16 | The company pays Victor’s salary of $2,000. |

| Dec. 31 | The company pays a dividend of $4,000 ($2,000 to Tony and $2,000 to Suzie). |

| Dec. 31 | Using his personal money, Tony purchases a diamond ring for $4,500. Tony surprises Suzie by proposing that they get married. Suzie accepts and they get married! |

The following information relates to year-end

a.

b. Six months’ worth of insurance has expired.

c. Four months’ worth of rent has expired.

d. Of the $1,800 of office supplies purchased on July 4, $300 remains.

e. Interest expense on the $30,000 loan obtained from the city council on August 1 should be recorded.

f. Of the $2,800 of racing supplies purchased on December 12, $200 remains.

g. Suzie calculates that the company owes $14,000 in income taxes.

Required:

1. Record transactions from July 1 through December 31.

2. Record adjusting entries as of December 31, 2018.

3. Post transactions from July 1 through December 31 and adjusting entries on December 31 to T-accounts.

4. Prepare an adjusted

5. For the period July 1 to December 31, 2018, prepare an income statement and statement of stockholders’ equity. Prepare a classified

6. Record closing entries as of December 31, 2018.

7. Post closing entries to T-accounts.

8. Prepare a post-closing trial balance as of December 31, 2018.

Requirement – 1

To record: The journal entries for given transactions from July 1 to December 31.

Explanation of Solution

Journal:

Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

The journal entries for given transactions of Company G are as follows:

| Date | Account Title and Explanation | PostRef. | Debit($) | Credit($) |

| 2018 | Cash | 10,000 | ||

| July 1 | Common stock | 10,000 | ||

| (To record the issuance of common stock in cash to Company S) | ||||

| 2018 | Cash | 10,000 | ||

| July, 2 | Common stock | 10,000 | ||

| (To record the issuance of common stock in cash to Company T) | ||||

| 2018 | Prepaid insurance | 4,800 | ||

| July 1 | Cash | 4,800 | ||

| (To record the purchase of one year insurance policy in cash) | ||||

| 2018 | Legal fees expense | 1,500 | ||

| July, 2 | Cash | 1,500 | ||

| (To record the payment of legal fees) | ||||

| 2018 | Supplies (office) | 1,800 | ||

| July, 4 | Accounts payable | 1,800 | ||

| (To record purchase of office supplies on account) | ||||

| 2018 | Advertising expense | 300 | ||

| July, 7 | Cash | 300 | ||

| (To record payment of advertising expense) | ||||

| 2018 | Equipment (Bikes) | 12,000 | ||

| July, 7 | Cash | 12,000 | ||

| (To record the purchase of mountain bike) | ||||

| 2018 | Cash | 2,000 | ||

| July, 15 | Service revenue (Clinic) | 2,000 | ||

| ( To record the cash received for service revenue) | ||||

| 2018 | Cash | 2,300 | ||

| July, 22 | Service revenue (Clinic) | 2,300 | ||

| ( To record the cash received for service revenue) | ||||

| 2018 | Advertising expense | 700 | ||

| July, 22 | Cash | 700 | ||

| (To record the payment of advertising expense in cash) | ||||

| 2018 | Cash | 4,000 | ||

| July, 30 | Deferred revenue | 4,000 | ||

| (To record advance cash received from customer) | ||||

| 2018 | Cash | 30,000 | ||

| August, 1 | Notes payable | 30,000 | ||

| (To record loan received from city council) | ||||

| 2018 | Equipment (Kayaks) | 28,000 | ||

| August, 4 | Cash | 28,000 | ||

| (To record the purchase of equipment in cash) | ||||

| 2018 | Cash | 3,000 | ||

| August, 10 | Deferred revenue | 4,000 | ||

| Service revenue | 7,000 | |||

| (To record the cash received from service revenue and recognized service revenue) | ||||

| 2018 | Cash | 10,500 | ||

| August, 17 | Service revenue | 10,500 | ||

| (To record cash received from service revenue) | ||||

| 2018 | Accounts payable | 1,800 | ||

| August, 24 | Cash | 1,800 | ||

| ( To record payment of cash to creditors) | ||||

| 2018 | Prepaid rent | 2,400 | ||

| September 1 | Cash | 2,400 | ||

| (To record the payment of one year advance rent) | ||||

| 2018 | Cash | 13,200 | ||

| September 21 | Service revenue (Clinic) | 13,200 | ||

| (To record the cash received from customer) | ||||

| 2018 | Cash | 17,900 | ||

| October 17 | Service revenue (Clinic) | 17,900 | ||

| (To record the cash received from customer) | ||||

| 2018 | Miscellaneous expense | 1,200 | ||

| December 8 | Cash | 1,200 | ||

| (To record the payment of miscellaneous expense) | ||||

| 2018 | Supplies (Racing) | 2,800 | ||

| December 12 | Accounts payable | 2,800 | ||

| (To record purchase of supplies on account) | ||||

| 2018 | Cash | 20,000 | ||

| December 15 | Service revenue (Racing) | 20,000 | ||

| (To record cash received from service revenue) | ||||

| 2018 | Salaries expense | 2,000 | ||

| December 16 | Cash | 2,000 | ||

| (To record the supplies expense incurred) | ||||

| 2018 | Dividend | 4,000 | ||

| December 31 | Cash | 4,000 | ||

| (To record the payment of cash dividends) |

Table (1)

Requirement – 2

To record: The adjusting journal entries on December 31.

Explanation of Solution

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. The purpose of adjusting entries is to adjust the revenue, and the expenses during the period in which they actually occurs.

The adjusting journal entries for given transactions of Company G are as follows:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| 2018 | Depreciation expense | 8,000 | ||

| December 31 | Accumulated depreciation | 8,000 | ||

| (To record depreciation expense incurred at the end of the accounting year) | ||||

| 2018 | Insurance expense | 2,400 | ||

| December 31 | Prepaid insurance | 2,400 | ||

| (To record the insurance expense incurred at the end of the accounting period) | ||||

| 2018 | Rent expense | 800 | ||

| December 31 | Prepaid rent | 800 | ||

| (To record the rent expense incurred at the end of the accounting year) | ||||

| 2018 | Supplies expense (Office) | 1,500 | ||

| December 31 | Supplies | 1,500 | ||

| (To record supplies expense incurred at the end of the accounting year) | ||||

| 2018 | Interest expense | 750 | ||

| December 31 | Interest payable | 750 | ||

| (To record interest expense incurred at the end of the accounting year) | ||||

| 2018 | Supplies expense (Racing) | 2,600 | ||

| December 31 | Supplies | 2,600 | ||

| (To record supplies expense incurred at the end of the accounting year) | ||||

| 2018 | Income tax expense | 14,000 | ||

| December 31 | Income tax payable | 14,000 | ||

| (To record the income tax expense incurred at the end of the accounting year) |

Table (2)

Requirement – 3

To post: The Transactions to T-accounts of Company G.

Explanation of Solution

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

T-accounts for above transactions are as follows:

| Cash | |

| 10,000 | 4,800 |

| 10,000 | 1,500 |

| 2,000 | 300 |

| 2,300 | 12,000 |

| 4,000 | 700 |

| 30,000 | 28,000 |

| 3,000 | 1,800 |

| 10,500 | 2,400 |

| 13,200 | 1,200 |

| 17,900 | 2,000 |

| 20,000 | 4,000 |

| 64,200 | |

| Prepaid Insurance | |

| 4,800 | 2,400 |

| 2,400 | |

| Supplies (Racing) | |

| 2,800 | 2,600 |

| 200 | |

| Prepaid Rent | |

| 2,400 | 800 |

| 1,600 | |

| Supplies (Office) | |

| 1,800 | 1,500 |

| 300 | |

| Equipment (Bikes) | |

| 12,000 | |

| 12,000 | |

| Equipment (Kayaks) | |

| 28,000 | |

| 28,000 | |

| Accumulated Depreciation | |

| 8,000 | |

| 8,000 | |

| Accounts Payable | |

| 1800 | 1,800 |

| 2,800 | |

| 2,800 | |

| Deferred Revenue | |

| 4,000 | 4,000 |

| 0 | |

| Interest Payable | |

| 750 | |

| 750 | |

| Income Tax Payable | |

| 14,000 | |

| 14,000 | |

| Notes Payable | |

| 30,000 | |

| 30,000 | |

| Common Stock | |

| 10,000 | |

| 10,000 | |

| 20,000 | |

| Dividends | |

| 4,000 | |

| 4,000 | |

| Service Revenue (Clinic) | |

| 2,000 | |

| 2,300 | |

| 7,000 | |

| 10,500 | |

| 13,200 | |

| 17,900 | |

| 52,900 | |

| Service Revenue (Racing) | |

| 20,000 | |

| 20,000 | |

| Legal Fees Expense | |

| 1,500 | |

| 1,500 | |

| Advertising Expense | |

| 300 | |

| 700 | |

| 1,000 | |

| Rent Expense | |

| 800 | |

| 800 | |

| Salaries Expense | |

| 2,000 | |

| 2,000 | |

| Depreciation Expense | |

| 8,000 | |

| 8,000 | |

| Insurance Expense | |

| 2,400 | |

| 2,400 | |

| Supplies Expense (Office) | |

| 1,500 | |

| 1,500 | |

| Supplies Expense (Racing) | |

| 2,600 | |

| 2,600 | |

| Interest Expense | |

| 750 | |

| 750 | |

| Income Tax Expense | |

| 14,000 | |

| 14,000 | |

| Miscellaneous Expense | |

| 1,200 | |

| 1,200 | |

Requirement – 4

To prepare: The adjusted trial balance of Company G.

Explanation of Solution

Adjusted trial balance:

Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Adjusted trial balance of Company G is as follows:

| Company G | ||

| Adjusted Trial Balance | ||

| December 31, 2018 | ||

| Accounts | Debit ($) | Credit ($) |

| Cash | 64,200 | |

| Prepaid Insurance | 2,400 | |

| Prepaid Rent | 1,600 | |

| Supplies (Office) | 300 | |

| Supplies (Racing) | 200 | |

| Equipment (Bikes) | 12,000 | |

| Equipment (Kayaks) | 28,000 | |

| Accumulated Depreciation | $8,000 | |

| Accounts Payable | 2,800 | |

| Income Tax Payable | 14,000 | |

| Interest Payable | 750 | |

| Notes Payable | 30,000 | |

| Common Stock | 20,000 | |

| Dividends | 4,000 | |

| Service Revenue (Clinic) | 52,900 | |

| Service Revenue (Racing) | 20,000 | |

| Advertising Expense | 1,000 | |

| Depreciation Expense | 8,000 | |

| Income Tax Expense | 14,000 | |

| Insurance Expense | 2,400 | |

| Interest Expense | 750 | |

| Legal Fees Expense | 1,500 | |

| Miscellaneous Expense | 1,200 | |

| Rent Expense | 800 | |

| Salaries Expense | 2,000 | |

| Supplies Expense (Office) | 1,500 | |

| Supplies Expense (Racing) | 2,600 | |

| Totals | 148,450 | 148,450 |

Table (3)

Requirement –5

To prepare: The income statement and classified balance sheet of Company G.

Explanation of Solution

Income statement:

This is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

Statement of stockholders’ equity:

This statement reports the beginning stockholder’s equity and all the changes, which led to ending stockholder’s’ equity. Additional capital, net income from income statement is added to and drawings are deducted from beginning stockholder’s equity to arrive at the result of closing balance of stockholders’ equity.

Classified balance sheet:

This is the financial statement of a company which shows the grouping of similar assets and liabilities under subheadings.

Income statement:

Income statement of Company G is as follows:

| Company G | ||

| Income Statement | ||

| For the year ended December 31, 2018 | ||

| ($) | ($) | |

| Revenues: | ||

| Service revenue (clinic) | 52,900 | |

| Service revenue (racing) | 20,000 | |

| Total revenues | 72,900 | |

| Expenses: | ||

| Advertising expense | 1,000 | |

| Depreciation expense | 8,000 | |

| Income tax expense | 14,000 | |

| Insurance expense | 2,400 | |

| Interest expense | 750 | |

| Legal fees expense | 1,500 | |

| Miscellaneous expense | 1,200 | |

| Rent expense | 800 | |

| Salaries expense | 2,000 | |

| Supplies expense (office) | 1,500 | |

| Supplies expense (racing) | 2,600 | |

| Total expenses | 35,750 | |

| Net income | 37,150 | |

Table (4)

Therefore, the net income of Company G is $37,150.

Statement of stockholder’s equity:

The statement of stockholder’s equity of Company G for the year ended December 31, 2018 is as follows:

| Company G | |||

| Statement of Stockholders’ Equity | |||

| For the period ended December 31, 2018 | |||

| Common stock ($) | Retained earnings ($) | Total stockholders' equity ($) | |

| Balance at July 1 | $0 | $0 | $0 |

| Issuance of common stock | 20,000 | 20,000 | |

| Add: Net income for 2018 | 37,150 | 37,150 | |

| Less: Dividends | -4,000 | -4,000 | |

| Balance at December 31 | $20,000 | $33,150 | $53,150 |

Table (5)

Therefore, the total stockholder’s equity of Company G for the year ended December 31, 2018 is $53,150.

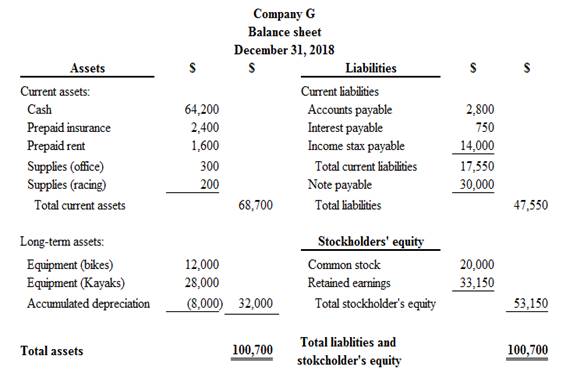

Classified balance sheet:

Classified balance sheet of Company G is as follows:

Figure (1)

Therefore, the total assets of Company G are $100,700, and the total liabilities and stockholders’ equity are $100,700.

Requirement – 6

To record: The necessary closing entries of Company G.

Explanation of Solution

Closing entries:

Closing entries are those journal entries, which are passed to transfer the final balances of temporary accounts, (all revenues account, all expenses account and dividend) to the retained earnings. Closing entries produce a zero balance in each temporary account.

Closing entries of Company G is as follows:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| 2018 | Service revenue (Clinic) | 52,900 | ||

| December 31 | Service revenue (Racing) | 20,000 | ||

| Retained earnings | 72,900 | |||

| (To close all revenue account) | ||||

| 2018 | Retained earnings | 37,750 | ||

| December 31 | Advertising expense | 1,000 | ||

| Depreciation expense | 8,000 | |||

| Income tax expense | 14,000 | |||

| Insurance expense | 2,400 | |||

| Interest expense | 750 | |||

| Legal fees expense | 1,500 | |||

| Miscellaneous expense | 1,200 | |||

| Rent expense | 800 | |||

| Salaries expense | 2,000 | |||

| Supplies expense (office) | 1,500 | |||

| Supplies expense (Racing) | 2,600 | |||

| (To close all the expenses account) | ||||

| 2018 | Retained earnings | 4,000 | ||

| December 31 | Dividends | 4,000 | ||

| (To close the dividends account) | ||||

Table (6)

Requirement – 7

To post: The closing entries to the T-accounts.

Explanation of Solution

| Service Revenue (Clinic) | |

| 2,000 | |

| 2,300 | |

| 7,000 | |

| 10,500 | |

| 13,200 | |

| 52,900 | 17,900 |

| 0 | |

| Service Revenue (Racing) | |

| 20,000 | 20,000 |

| 0 | |

| Legal Fees Expense | |

| 1,500 | 1,500 |

| 0 | |

| Advertising Expense | |

| 300 | |

| 700 | 1,000 |

| 0 | |

| Rent Expense | |

| 800 | 800 |

| 0 | |

| Salaries Expense | |

| 2,000 | 2,000 |

| 0 | |

| Depreciation Expense | |

| 8,000 | 8,000 |

| 0 | |

| Insurance Expense | |

| 2,400 | 2,400 |

| 0 | |

| Supplies Expense (Office) | |

| 1,500 | 1,500 |

| 0 | |

| Supplies Expense (Racing) | |

| 2,600 | 2,600 |

| 0 | |

| Interest Expense | |

| 750 | 0 |

| 750 | |

| Income Tax Expense | |

| 14,000 | 14,000 |

| 0 | |

| Miscellaneous Expense | |

| 1,200 | 1,200 |

| 0 | |

| Dividends | |

| 4,000 | 4,000 |

| 0 | |

| Retained Earnings | |

| 35,750 | 72,900 |

| 4,000 | |

| 33,150 | |

Requirement – 8

To prepare: A post-closing trial balance of Company G.

Explanation of Solution

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Post-closing trial balance of Company G is as follows:

| Company G | ||

| Post-closing Trial Balance | ||

| For the year ended December 31, 2018 | ||

| Accounts | Debit ($) | Credit ($) |

| Cash | $64,200 | |

| Prepaid Insurance | 2,400 | |

| Prepaid Rent | 1,600 | |

| Supplies (Office) | 300 | |

| Supplies (Racing) | 200 | |

| Equipment (Bikes) | 12,000 | |

| Equipment (Kayaks) | 28,000 | |

| Accumulated Depreciation | $8,000 | |

| Accounts Payable | 2,800 | |

| Income Tax Payable | 14,000 | |

| Interest Payable | 750 | |

| Notes Payable | 30,000 | |

| Common Stock | 20,000 | |

| Retained Earnings | 33,150 | |

| Total | $108,700 | $108,700 |

Table (7)

Therefore, the total of debit, and credit columns of post-closing trial balance is $108,700 and agree.

Want to see more full solutions like this?

Chapter 3 Solutions

FINANCIAL ACCOUNTINGLL W/CONNECT >IC<

- Which of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivableno aiarrow_forwardWhich of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivablearrow_forwardWhat does a ledger account represent? A) A detailed record of all business transactionsB) A summary of trial balancesC) An individual record for each accountD) The final balance of a financial statement Need help!arrow_forward

- What is the primary purpose of accounting? A) To generate tax revenueB) To record, summarize, and report financial transactionsC) To determine the market value of assetsD) To manage payrollarrow_forwardWhat are the three main financial statements in accounting?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education